Healthcare Providers Are Concerned About Potential ACA Repeal

Healthcare providers across the nation are unsure of whether they will be able to survive an abrupt repeal of Obamacare without a comprehensive replacement.

Healthcare providers across the nation are unsure of whether they will be able to survive an abrupt repeal of Obamacare without a comprehensive replacement.

Trump has selected House Budget Committee Chairman and a six-term Georgia Representative Tom Price for Health Secretary. That means Price will lead the GOP charge to repeal and replace ObamaCare.

We explain why a nationwide non-profit public network should be included in any future healthcare reform plan that seeks to repeal and replace ObamaCare.

Health Insurance Cancellation Reform – Prohibition on Rescissions for Non-Payment in the Individual and Family Market. Below is a proposed solution to the problem of health insurance cancellations for non-payment. If your health plan has been dropped due to non-payment, please share your story here. The problem: Despite the fact that the ACA has done a lot to crack… Read More

Life insurance, unlike health insurance under ObamaCare, is not typically guaranteed issue. However, there are options for those with chronic illnesses.

College students have a number of health plan options including the Marketplace, Medicaid, school health plans, catastrophic plans, and their parents plan. Below we take a look at student health options under the Affordable Care Act (ObamaCare). FACT: A university health plan counts as Minimum Essential Coverage for ObamaCare if it’s fully insured or self insured. Aside… Read More

If a dependent has access to affordable employer sponsored coverage they can’t get ObamaCare’s cost assistance, but can qualify for Medicaid / CHIP.

Employers who reimburse employees for individual non-group health plans face a $100 a day or $36,500 per year, per employee excise tax. This rule applies to all employers, but the fine itself is only levied on those who have to comply with ObamaCare’s mandate (firms with 50 or more full-time equivalent employees).

Under the Affordable Care Act (ObamaCare) there many ways to get covered including the new Health Insurance Marketplace and new Medicaid options. Those aren’t your only options, but are the only options that qualify for cost assistance.

Only US citizens and legal residents can get Marketplace health insurance, but there are a number of other options for pregnant foreign citizens.

If you have two options for health insurance through two employers, you can take one and reject the other, or can take both and use one as a secondary plan.

If a child has been a citizen for more than 5 years, they may qualify for CHIP based on income. If a family member has access to the Marketplace they can join a family plan

If a spouse doesn’t have access to an employer plan and is turning 26 they can get a Marketplace plan based on household income.

Medicaid and CHIPP are free or low-cost health insurances that are offered to all adults under the poverty line in some states due to ObamaCare, but have limited eligibility in others. The fact that some states rejected expanding Medicaid means millions of hardworking low-income adults are left without coverage options.

Employers can use Health Reimbursement Arrangements (HRAs), Employer Payment Plans, and Flexible Spending Accounts (FSAs) to save money on healthcare. We take a look at healthcare arrangements to find out how they can benefits employers and employees alike. We will also look at how they affect employer and employee taxes and penalties. It’s important to understand… Read More

Generally you can only get cost assistance through ObamaCare’s Health Insurance Marketplace if you don’t have other coverage options.

If you have an employer sponsored plan that costs more than 9.56% of your household income for employee-only coverage, you can opt-out of employer coverage and use the Marketplace.

When you move to the US you become eligible for Marketplace coverage. Your access to cost assistance, including Medicaid, depends upon income and immigration status.

ObamaCare and Health Insurance for the Self-Employed The Affordable Care Act (ObamaCare) has some important implications for how the self-employed go about obtaining, maintaining, and paying for health coverage. If you’re self-employed, most of the healthcare provisions in the ACA apply to you. Let’s take a look at how you’re affected by ObamaCare, how you can reduce the cost of coverage, and how… Read More

If you miss the deadline then you have the following choices: Look into Special Enrollment, Pay the fee, get short term health insurance.

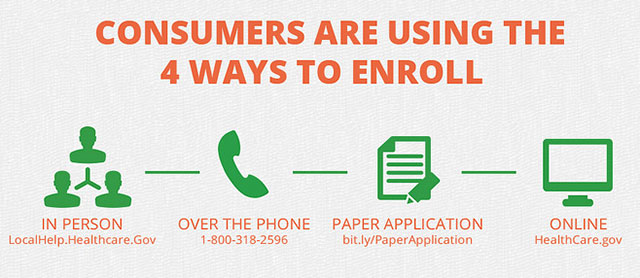

Everyone has to enroll in coverage and maintain it throughout the year if they can afford it, get an exemption, or pay a fee. You must enroll in coverage during open enrollment. If you miss your insurance type’s enrollment period you may have other options.

If you missed the health insurance February 15 deadline, health plan options include Special Enrollment, Medicaid, CHIP, and Short Term Health Insurance.

You won’t be eligible for Medicaid or Marketplace cost assistance if you are covered under a retiree health plan. Here are the rules if you have retiree coverage

When you turn 26 you’ll need to get your own health plan. As long as your parents don’t claim you as a dependent you may be eligible for cost assistance on the Marketplace or Medicaid if your state expanded.

If you have no job and no money you qualify for Medicaid in many states. In some states you may not have coverage options due to the “Medicaid Gap”.