950,000 Enrolled In 2015 Special Enrollment

According to CMS nearly 950,000 Americans selected a plan through the HealthCare.gov via Special Enrollment between February 23 and June 30, 2015.

What Is Special Enrollment?

A Special Enrollment Period (SEP) is a time outside of open enrollment where people can get a Marketplace plan that is eligible for cost assistance and protects them from the fee. There are a number of qualifying life events that make people eligible for special enrollment including:

- Losing a plan

- Being determined ineligible for Medicaid / CHIP

- For 2015 only being confused about how the fee work during tax season

- And a number of other events like moving or having a baby. See full list of qualifying life events here.

What Special Enrollment Types Did People Use?

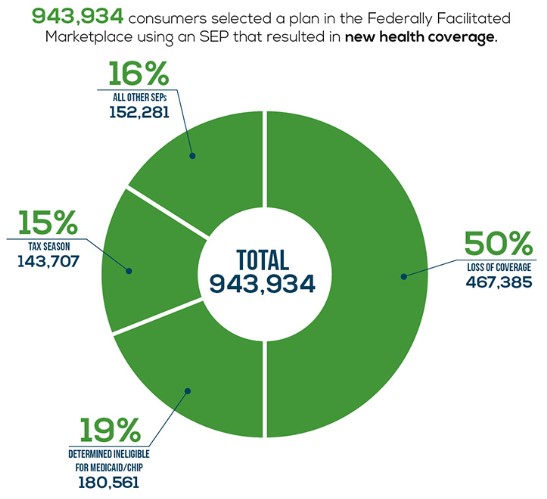

The breakdown of 2015 Special Enrollment numbers works like this:

- About 50% of these people lost other coverage and then switched to a Marketplace plan. So these aren’t newly insured.

- About 20% were determined ineligible for Medicaid / CHIP. These folks either lost Medicaid / CHIP or applied for Medicaid / CHIP during open enrollment but were denied after. Some may be newly insured.

- About 15% enrolled during tax season. In order to qualify you had to not have coverage so that is 143,707 newly insured.

- About 15% qualified via different life events. This is a mix of people switching plans, adding new family members, and enrolling for the first time.

The takeaway would be that not all SEP enrollments are newly insured, but some are. More importantly than lowering the uninsured rate SEP has ensured nearly a million Americans another chance at healthcare for 2015.

Note: all information below is taken directly from the CMS report on special enrollment 2015.

Table 1: Plan Selections by Type of SEP – February 23 to June 30, 2015, HealthCare.gov States

| Type of SEP | Count | Percent |

| Loss of Coverage | 467,385 | 50% |

| Determined Ineligible for Medicaid/CHIP | 180,561 | 19% |

| Tax Season[1] | 143,707 | 15% |

| All Other SEPs | 152,281 | 16% |

| Total | 943,934 | 100% |

| State | Loss of Coverage | Denial of Medicaid | Tax Season | All Other SEPs | Total |

| AK | 1,010 | 523 | 436 | 720 | 2,689 |

| AL | 10,150 | 2,556 | 3,542 | 2,872 | 19,120 |

| AR | 3,500 | 1,379 | 860 | 1,023 | 6,762 |

| AZ | 11,860 | 5,770 | 2,734 | 4,236 | 24,600 |

| DE | 1,593 | 907 | 279 | 485 | 3,264 |

| FL | 78,611 | 24,188 | 30,064 | 27,965 | 160,828 |

| GA | 25,665 | 10,392 | 10,869 | 8,655 | 55,581 |

| IA | 3,478 | 1,989 | 618 | 958 | 7,043 |

| IL | 20,093 | 10,260 | 4,108 | 5,906 | 40,367 |

| IN | 9,097 | 4,681 | 1,995 | 2,555 | 18,328 |

| KS | 6,366 | 1,630 | 1,182 | 1,857 | 11,035 |

| LA | 10,265 | 2,117 | 4,359 | 2,883 | 19,624 |

| ME | 3,772 | 1,654 | 850 | 1,187 | 7,463 |

| MI | 16,358 | 7,976 | 3,703 | 4,584 | 32,621 |

| MO | 13,243 | 5,443 | 3,909 | 3,933 | 26,528 |

| MS | 5,276 | 1,833 | 2,932 | 1,425 | 11,466 |

| MT | 2,536 | 564 | 635 | 944 | 4,679 |

| NC | 27,230 | 8,510 | 10,187 | 9,591 | 55,518 |

| ND | 1,382 | 641 | 278 | 561 | 2,862 |

| NE | 4,005 | 1,846 | 945 | 1,251 | 8,047 |

| NH | 3,290 | 1,023 | 702 | 679 | 5,694 |

| NJ | 13,923 | 7,319 | 2,866 | 4,915 | 29,023 |

| NM | 2,422 | 1,949 | 458 | 929 | 5,758 |

| NV | 4,383 | 3,251 | 1,471 | 1,898 | 11,003 |

| OH | 15,992 | 5,701 | 2,747 | 3,682 | 28,122 |

| OK | 8,285 | 3,199 | 1,905 | 3,469 | 16,858 |

| OR | 7,224 | 1,258 | 1,481 | 1,852 | 11,815 |

| PA | 24,310 | 9,758 | 3,924 | 5,959 | 43,951 |

| SC | 11,398 | 3,070 | 4,782 | 3,549 | 22,799 |

| SD | 1,305 | 385 | 297 | 412 | 2,399 |

| TN | 15,171 | 3,350 | 4,422 | 4,003 | 26,946 |

| TX | 59,384 | 25,359 | 24,396 | 22,618 | 131,757 |

| UT | 8,321 | 5,991 | 1,868 | 3,615 | 19,795 |

| VA | 19,512 | 6,649 | 5,031 | 6,696 | 37,888 |

| WI | 13,394 | 6,108 | 2,161 | 3,356 | 25,019 |

| WV | 2,110 | 936 | 397 | 491 | 3,934 |

| WY | 1,471 | 396 | 314 | 567 | 2,748 |

| Total | 467,385 | 180,561 | 143,707 | 152,281 | 943,934 |

How to Qualify For Special Enrollment

The following qualifying life events qualify you for special enrollment. You can get more information here.

- Lose other health coverage: you or your family lose coverage that qualifies as minimum essential coverage (MEC) during the benefit year, including, but not limited to, most employer-sponsored coverage and Medicaid. If you or your family are enrolled in individual coverage or group health plan coverage that ended during the year or you lose Medicaid pregnancy-related coverage or Medicaid coverage for medically-needy, you may also qualify for this special enrollment period.

- Gain or become a dependent: you gain or become a dependent through marriage, birth, adoption, placement for adoption, placement in foster care, or due to a child support or other court order.

- Gain citizenship, national, or lawfully present status: you gain status as a citizen, national, or lawfully present individual.

- Experience a Marketplace enrollment error: you weren’t enrolled in a plan or were enrolled in the wrong plan because of misinformation, misrepresentation, misconduct, or inaction of someone working in an official capacity to help you enroll.

- Being determined ineligible for Medicaid/CHIP: you applied for Medicaid/the Children’s Health Insurance Program coverage during the Marketplace Open Enrollment Period or after qualifying for a special enrollment period and your state Medicaid/CHIP agency determined you weren’t eligible.

- Experience a plan contract violation: you adequately demonstrate to the Marketplace that your Marketplace health plan has substantially violated a material provision of its contract.

- Become newly eligible or ineligible for help paying for your coverage: you or your family are enrolled in coverage and are determined newly eligible or ineligible for advance payments of the premium tax credit (APTC) or have a change in eligibility for cost-sharing reductions (CSRs).

- Experience changes to employer-sponsored coverage and become newly eligible for help paying for your coverage: you’re now eligible for advance payments of the premium tax credit (APTC) because you’re no longer eligible for employer-sponsored coverage, your coverage is discontinued, or your coverage is no longer considered minimum essential coverage (MEC).

- Live in a state that hasn’t expanded Medicaid and become newly eligible for help paying for your coverage: you live in a state that hasn’t expanded Medicaid and you weren’t eligible for Medicaid or advance payments of the premium tax credit (APTC) when you first applied because your income was too low, but due to a change in household income, you’re now eligible for APTC.

- Gain access to new health plans because of a permanent move: you permanently move to a new area and have new Marketplace health plan choices.

- Gain or maintain status as an American Indian or Alaska Native: you gain or maintain status as a member of a federally recognized tribe or Alaska Native Claims Settlement Act (ANCSA) Corporation shareholders.

- Experience an exceptional circumstance: you demonstrate to the Marketplace that you’ve experienced an exceptional circumstance that prevented you from enrolling in coverage, like a serious medical condition or natural disaster.

- Experience domestic abuse/violence or spousal abandonment: you’re a victim or survivor of domestic abuse/violence or spousal abandonment and want to enroll in your own health plan separate from your abuser or abandoner.

Patrick

I signed up for the family plans for health care, dental, and vision with my employer. They incorrectly left off one of my eligible children (15 years old) from the dental plan. He is signed up for the health care and vision plan. Even though I’m already paying for the full family coverage for all of these plans, they are refusing to add him to the list without a life qualifying event. Is this legal for them to do? They are blaming IRS rules as to why they cannot change it. Why does the IRS care if I’m already paying for full family coverage and he is not covered by any other plan?

Debbie

My son turns 26 and loses his father’s coverage 3/21/16. What date should he apply for obamacare?

ObamaCareFacts.comThe Author

Always apply 30 days before you lose coverage. If you enroll early you’ll ensure the new plan start when the old one ends.

To clarify enroll means choose your plan and sign a contract, the start date of the contract is different than “enrolling”. and signing up for the Marketplace is different than enrolling and a start date.

So you sign up and then enroll 30 days before, for coverage that will start when the old plan ends (or close to it). This helps avoid gaps in coverage.

Often a young person will qualify for CHIP, and they can start the process of applying for CHIP early too.