Save American Workers Act Facts

The Save American Workers Act changes the definition of full-time workers so fewer employers have to comply with ObamaCare’s employer mandate. Let’s take a look at the legislation, why it was passed in the House, why it won’t pass the Presidents desk, what effects it has, data on part-time hours and job loss, and some alternatives to the Save American Workers Act.

The Save American Workers Act sounds good on paper, but unfortunately the specific fix in the law doesn’t actually save American workers. Instead it is projected to create loopholes, increase the deficit, and lead to even more employers cutting Full-time jobs. That being said reforming the Employer Mandate shouldn’t be taken off the table, if approached in a smart way. See our suggestions for alternative fixes as well as examples below.What is the Save American Workers Act?

The Save American Workers Act, a US bill to amend the Affordable Care Act, seeks to ensure that employers don’t cut back part-time hours of workers past the 30 hour mark that the ACA defines as full-time work hours. Under the current rules if an employee works the equivalent of 30 hours or more a week per month them and their dependents must be offered coverage (not their spouse).

Also, if a firm has at least 50 full-time equivalent employees (found by adding full-time employees plus all part-time hours worked by part-time employees divided 120) that firm must provide coverage. If coverage doesn’t meet affordability and minimum-value guidelines, and at least one employee get’s cost assistance on the Marketplace, the employer could end up owing a Employer Shared Responsibility Payment.

Under the Save American workers act only those with 40 or more hours would be considered full-time and part-time hours would be divided by 174 to determine full-time equivalents (which roughly translates to 40 hours a week). This would mean fewer businesses would have to comply with the law and less workers would have to be insured. It would also theoretically disincentivize employers from cutting back hours. However, studies show it would actually have the opposite effect as employers are more likely to cut a full-time workers hours from 40 to say 38 under the Workers Act, then they are from 40 to 27 under the current law.

History of the Save American Workers Act

The Save American Workers Act H.R.2575 was first proposed by Rep. Todd C. Young on June 28th, 2013. It was struck down when it was tried to pass as the Save American Workers Act of 2014. It has again be proposed as the Save American Workers Act of 2015 H.R.30 and then voted on in the house on January 6th, 2015. It passed in the house, however isn’t expected to become part of the law.

Obama to Veto Save American Workers Act

Although the Act passed in House, the Obama Administration said in a Statement of Administration Policy, “While the Administration welcomes ideas to improve the law, H.R. 30 would shift costs to taxpayers, put workers’ hours at risk, and disrupt health insurance coverage. If the President were presented with H.R. 30, he would veto it.”

The reasoning gave is pretty much the same reason we will give for the negative impacts of the law below. Not out of biased, but rather because the negative impacts are facts and based on the Congressional Budget Office report on the Save American Workers Act.

Why Amend the Affordable Care Act’s Employer Mandate?

Over the past few years we have heard increased reports of businesses cutting full-time hours back to part-time to avoid having to offer them health benefits. under the law full-time hours is 30, and 27 is considered a safe harbor. Therefore workers who get their hours cut back tend to get 27 or less hours a week.

Cutting back hours won’t help a firm avoid the mandate in most cases, as the calculations for full-time equivalents take into account average part-time hours worked (Part-time hours divided by 120, then each 30 counts as one, plus all full-time workers).

Also in many cases this helps both the employer and employee, as the new law also provides generous subsidies for lower income Americans without access to work based coverage. That coverage ends up being much cheaper than what employers can offer, even after employer contributions (no citation, this is found by searching for group plans and assuming a 50% employer contribution and comparing that to marketplace coverage in a given region).

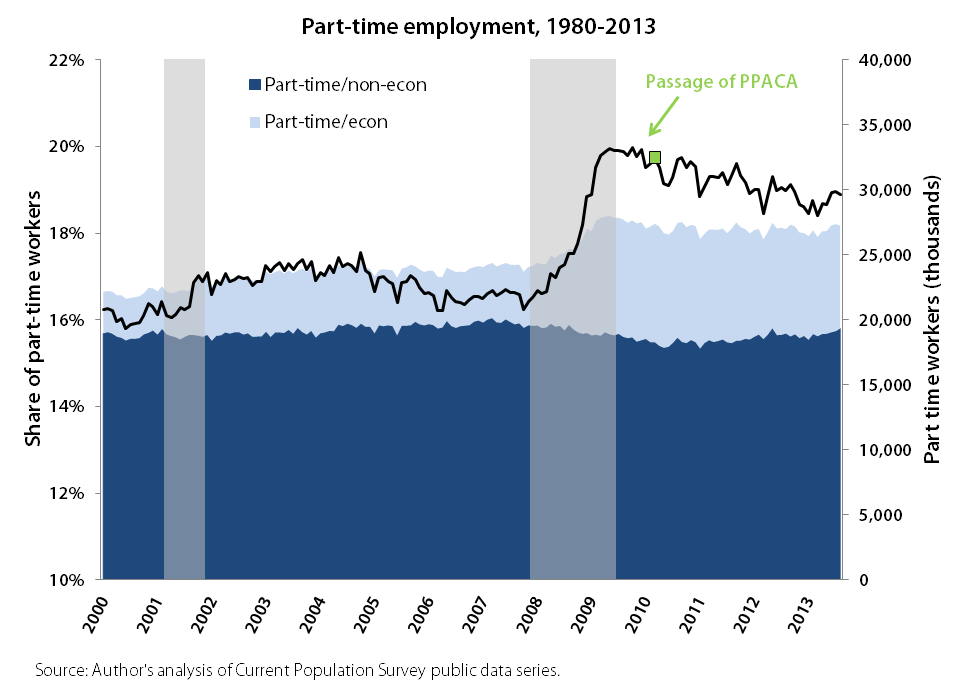

In general everyone agrees a law shouldn’t incentivize employer giving less hours or cutting back hours. However, although we know some people are having their hours cut back, there has actually been no data showing that this is happening in average to the country. In fact data shows full-time employment rising, involuntary part-time work falling, and voluntary part-time work rising. The opposite of the claims.

This chart from epi.org shows “the proof” that part-time hours have actually increased under the ACA. However since only 1 million jobs are in question and we are bouncing back from a recession, the numbers alone don’t dismiss the the problems associated with the Employer Mandate.

Negative Impacts of the Save American Workers Act

We know that the Obama Administration will Veto the law. So we have to ask ourselves why. The answer is based in a January 7th, 2015 report from the Congressional Budget Office that shows the Act will increase uninsured by 500,000, put more on the Marketplace, Medicaid, and CHIP, less on employer based coverage, create loopholes for employers, and increase the deficit $45.7 billion over the 2015 to 2024 period.

The CBO Report on Save American Workers Act

The CBO, Congressional Budget Office, is a non-partisan federal agency that provides budget and economic information. They don’t make suggestions on policy, they are a “just-the-facts” sort of agency. Thus their work is often requested and used by both sides when debating legislation.

The report mirrors the White House’s statements. Simply put the CBO says the Save American Workers Act will:

- Reduce the number of people receiving employment-based coverage—by about 1 million people;

- Increase the number of people obtaining coverage through Medicaid, the Children’s Health Insurance Program (CHIP), or health insurance exchanges—by between 500,000 and 1 million people; and

- Increase the number of uninsured—by less than 500,000 people.

In short, yes, Republicans oddly tried to pass a law that would give more people subsidies, result in less insured, and increase the deficit? This is because changing full-time status to 40 hours plus a week creates a lot of helpful loopholes for businesses, despite the potential burdens it puts on employees and the Government.

FACT: Before the ACA, except for setting 40 hours a week as the line beyond which overtime must be paid to eligible employees, U.S. laws haven’t strictly defined full-time work.

The Act Could Actually Increase Part-Time Hours, Furthering the Problem it’s Trying to Solve

Since we would calculate part-time hours in a more lax way, it would be easier for companies to maintain a full workforce, but yet provide coverage to many less workers. For example employers could keep employees at a save 38 hours a week or reduce all workers to below 40 to maintain a large work force yet not provide coverage. So while this would mean more hours for folks, it would mean less employer based coverage and more costs shifted onto the Federal Government.

For lower earning employees this would be good as the new subsidies would pad their health insurance while their checks would be bigger, but it would allow businesses a big loophole to sort of back out of the employer mandate’s Shared Responsibility. This would overtime mean more and more federal spending and less full-time jobs in general. At 30 hours, a business has to make a very hard choice between a part-time workforce and providing benefits.

Positive Impacts of the Save American Workers Act

Employees who had worked just over the 30 hour mark or just under the 40 hour mark below the law did have their hours cut back in some instances. This is only expected to increase moving forward come 2016 when all large employers have to comply with the mandate. The Save American Workers Act would:

- Make it so employers could give low earning employees more hours, but not stick them with unaffordable health options. (There aren’t many options for affordable health insurance for minimum wage worker beyond Marketplace subsidies and Medicaid, even the 50% contribution does little to make family plans affordable on minimum or low wage)

- Make it so employers just over the 50 full-time equivalent mark wouldn’t have to provide coverage (by calculating part-time hours differently it makes it easier to avoid the requirement). The smaller the business, the less likely it is they can provide coverage and still run a profitable business. Profit margins can be very slim for smaller firms.

- Generally, it decreases the burden of providing coverage for employers (although it shifts it to the Government, with a fall-off of about 500,000 by 2024 who simply don’t get any coverage). The financial burden is one thing, but the decrease in uninsured is a big sticking point for an amendment to the law. Alternatives to the Save American Workers Act and fixes for the mandate should ideally include, if nothing less, the covering of more Americans and less loopholes for businesses.

Opinion: We at ObamaCareFacts see the employer mandate as one of the bigger issues with the law. In fact we have consistently listed the mandate as an area of the ACA that needs work. While the Save American Workers Act takes things to the extreme with 40 hours being full-time (this incentivizes some bad behavior seen above), that doesn’t mean the Act isn’t with out it’s merits and reform to the mandate isn’t without it’s merits as well. Let’s take a look at what we think is wrong with the law and some alternatives that could address the unfair aspects of the law.

What is Wrong with the Employer Mandate?

Low wage workers and employers with low profits per employee (especially smaller employers like franchise owners) struggle the most under the law. In some cases, the better option is to not provide coverage and have employees shop on the Marketplace or to cut back worker hours. The fact that law incentivizes part-time work and leads to less affordable coverage for families is the problem. Let’s look at an example of how the law does this in practice.

Example Jim and BurgerChain:

Jim makes $7.50 (a real minimum wage in 2015… no really) working at a fictional franchise “Burger Chain” in Arizona. He works 40 hours a week, and makes $300 a week gross. Jim’s employer, Joe-the-employer, didn’t cut back his hours due to the mandate, and instead increased the menu price by an average of $0.50 per item at his 10 franchise locations which employees 10 full-time equivalents, and 5 full-time workers, each.

Jim now gets offered health insurance. That coverage can’t cost Jim more than $28.50 a week. That’s not too bad, but it’s not as cheap as his free or low cost coverage he could get if he shopped on the Marketplace or got Medicaid (Jim qualifies for Medicaid making an annual Gross $15,600).

Jim has 3 kids and a wife. Their total household income is ($30,000). Their employer doesn’t know this, so Burger Chain has to offer Jim affordable coverage based on his income and then pay 50% of the costs. So they offer plans that cost $50 a week they pay $25.00 and the employee pays $25.00. That is $100.00 a month for coverage and just under 9.5% of any employee-only income for employee-only coverage (since an employee can’t make less than minimum wage, and employer coverage can’t cost more than employee household income the employer bases costs on employee income as a safe harbor).

Although Jim has affordable coverage, his 3 kids and wife don’t get an employer contribution. So the result is their plans cost about $20 a week average. That is $80 a month x 4. That’s $320 a month, plus Jim’s $100. That’s $400 a month which is $4,800 a year out-of-pocket. That’s about 20% of their families gross income.

20% is arguably unaffordable for families who still need to do things like live in a house and eat. Forget saving for college for the three kids, survival is hard when you pay 20% of your gross income. If they didn’t have another income source bringing in $15,000 a year, the cost of coverage through the employer would be 40% total gross income. That means, in sort, Jim would be better off working part-time.

Under the Affordable Care Act Jim as a low wage worker with a large family is better off working part-time. He get’s free healthcare for him and his family due to lower income (in state’s that expanded Medicaid only), or low cost healthcare with a Marketplace plan.

Joe-the-employer is in a similar boat. He pays $100 per employee a month, 5 per store, plus 10 franchises = $1,200 per employee, $6,000 a location, and $60,000 total. Joe-the-employer has to make an extra $60,000 by increasing menu items since he can’t very well lower wages past the minimum. Joe only makes $1 for every $1 he pays his employees, so he doesn’t have much wiggle room aside from increasing prices. Also, Joe-the-employer makes $60,000 in profit after overhead, without upping the menu prices providing health benefits would eat his entire profit.

Under the Save American Workers Act Jim can work more hours, and still qualify for Federal cost assistance. That is good for Jim. The employer doesn’t have to spring for health coverage, that is good for the employer. But the tax payer picks up the tab, that isn’t so hot for the country.

Employer Mandate Loopholes

In the above scenario, Joe-the-employer can simply not provide coverage to some of his workers and pay less. He doesn’t pay the fee for the first 30 workers under the mandate, if he insures no-one. Since he only has 50 full-time employees he would pay $2,000 x 20 = $40,000. Then his employees can use the Marketplace. In other words, the employer essentially pays a tax as their Shared Responsibility to provide health coverage to all Americans under the ACA’s SharedResponsibility Provision instead of offering coverage. There is nothing wrong with this.

Joe-the-employer can also cut back all his employees to part-time and hire more workers. This is the avenue some employers have chosen which has led to the claim that ObamaCare leads to more part-time jobs. While this is a valid move, it’s not as admirable as paying the above fee.

Alternatives to the Save American Works Act (Opinions)

When looking at how to fix the mandate we simply have to look at the problems.

1) Employers should never be incentivized to provide less hours.

2) Low wage employees struggle to afford employer-sponsored coverage. This is especially true for families. Dependent coverage MUST be addressed.

3) Complex regulations and strict rules mean lower earning smaller employers, with smaller profit margins, could take a really hard hit from not understanding how to comply with the mandate. Large businesses have experts to help ensure they comply.

Given these three points a better fix would involve taking into account the profit margin per employee of a company and employee wages. Based on that Federal subsidies should be given to the employee to better be able to afford coverage. That subsidy should be based on family income and should be extended to the entire family (since employer contributions don’t extend to the family). Also the small business tax credit should extend to employers with 50-100 FTE, if they have low profit margins (margins of less than the cost of providing coverage roughly).

Currently subsidies for employers are based on size and average annual wages, and don’t extend to businesses with between 50-100 FTE. This fix would of course increase the budget, but would eliminate the incentive to cut back part-time hours and provide a smoother environment for smaller large businesses to grow and thrive in.

Larger employers, like Walmart, would still have to comply with the mandate. Also smaller employers with large profits would have to comply with the mandate. However Joe-the-employer who

Higher earning employees wouldn’t get cost assistance for them or their families, lower wage workers would.

Loopholes for this fix would include employer cutting back profits to take advantage of subsidies, this would either be done by lowering prices, paying higher wages, or reinvesting in their company. All much more attractive loopholes.

The increased costs could be paid by adding a small tax to businesses with high profits, higher earning employees, and providers of group health plans to Share the Responsibility of providing affordable health coverage to more Americans.

Of course we aren’t policy experts, just people who write about the law everyday. Still it seems we all (you included) have an opportunity to address the mandate and family affordability glitch and thus, we hope America will come up with a solution that helps those who struggle and helps to further decrease the uninsured rate.