Trump Executive Order on the ObamaCare Mandates (the Fees) Explained

Do I Still Need to Maintain Health Insurance or Pay a Fee Under Trump? Do I Need to Cover Full-Time Employees or Pay a Fee Under Trump?

We explain Trump’s executive order on ObamaCare’s individual mandate (the fee for not having insurance) and the employer mandate (the fee for not providing coverage to full-time employees).

A Summary of Trump’s Order and the Mandates

In words, regarding taxes filled in 2017 (for Tax Day 2017):

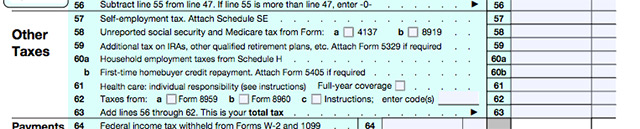

- For the individual mandate. If you didn’t have coverage, you can leave line 61 blank, not have your return rejected, and likely not owe the fee as “electronic and paper returns to be accepted for processing in instances where a taxpayer doesn’t indicate their coverage status.”

- For the employer mandate, “every regulation employers need to comply with still needs to be complied with until the IRS issues a statement or the law changes.”

TIP: The silent option only makes sense if you didn’t have coverage and would owe the fee. If you had coverage, got cost assistance, or qualify for an exemption, then you should follow the directions for line 61 and file the 8962 and 8965 forms respectively.

Silent Returns, Line 61, and IRS Advice

With the above in mind, the two main things to know about Trump’s rule and the individual mandate are:

- According to the IRS, you can leave line 61 blank, and thus not pay the fee, and the IRS will still accept your return.

- You should not, however, check 61, thus attesting to having coverage, if you did not have coverage. That is lying on an official tax document.

Keep in mind that “silent returns” (the term that describes leaving 61 blank and not paying the fee) may result in follow-up questions from the IRS.

In other words, not paying the fee won’t hold up your return, but it won’t ensure you don’t owe the fee down the line either (although the order also makes collecting the fee harder).

At the end of the day, the ACA is still the law of the land. The Trump order just took away some enforcement ability from the IRS.

IMPORTANT UPDATE 2019: The IRS accepted silent returns in 2017 (for 2016 plans), but was more stringent in 2018 (for 2017 plans) saying they would not accept electronically filed forms that did not address the health coverage requirement (see the official statement from the IRS here). It is likely they will still be stringent in 2019 (for 2018 plans). Then for 2019 plans there is no federal fee for not having coverage, and thus this whole thing will be a moot point. For the 2019 tax filing season for 2018 plans however, you should be aware that the IRS may reject “silent returns.”

TIP: If you plan to get cost assistance next year, you will very likely have to pay the fee.

TIP: The individual mandates fee is technically called the Individual Shared Responsibility Payment, and the fee for employers is the Employer Shared Responsibility Payment. They can both be abbreviated as SRP and often are in longer articles, where you can tell by context which of the two payments are under discussion.

How to Understand Trump’s Order

First off, Trump’s order did not eliminate any of the mandates or taxes; it just directed agencies to be more lenient.

That means, by the book, you still have to obtain and maintain coverage or an exemption or pay a fee (and deal with line 61 of your 1040), and employers still have to offer coverage to full-time employees.

The difference is, just like it was in 2014 where the IRS offered leniency for those who didn’t check line 61, the IRS will once again be accepting electronic and paper tax returns for the calendar year 2016 without line 61 filled in instead of rejecting them as they did for taxes filed in 2016.

The order pokes many holes in the IRS’s ability to enforce the law, and the result could be that the fee never gets collected even if it is technically owed.

The order instructs all the current administrations who have responsibility under the Affordable Care Act to “exercise all authority and discretion available to them to waive, defer, grant exemptions from, or delay the implementation of any provision or requirement of the [Patient Protection and Affordable Care Act] that would impose a fiscal burden on any State or a cost, fee, tax, penalty, or regulatory burden on” everyone, including insurers.”

You still have to follow the law. The ACA is the law, and thus you have to file taxes honestly. However, when it comes to line 61, you don’t have to check it. Leaving it blank will allow you to file your taxes without immediate penalty, but some day it may come back to bite you.

Remember that silence is not the same as a lie. I would not suggest attesting to having coverage if you did not, but the IRS is suggesting not checking box 61 and doing nothing is an option.

The IRS is supposed to avoid enforcing the fees and mandates to the best of its ability while still maintaining the law. They have conflicting directions, and whether or not a person will end up owing the fee, or how the fee will be collected is up in the air.

That means not complying with the fees is a gamble, but it is less of a gamble post-Trump than it was under Obama.

One can confirm this all on the IRS website. Here is an excerpt from the IRS’s update on the mandate:

Most taxpayers have qualifying health care coverage for all 12 months of the year and will check the “Full-year coverage” box on their return.

This year, the IRS put in place system changes that would reject tax returns during processing in instances where the taxpayer didn’t provide information related to health coverage.

However, the Jan. 20, 2017, executive order directed federal agencies to exercise authority and discretion available to them to reduce potential burden. Consistent with that, the IRS has decided to make changes that would continue to allow electronic and paper returns to be accepted for processing in instances where a taxpayer doesn’t indicate their coverage status.

However, legislative provisions of the ACA law are still in force until changed by the Congress, and taxpayers remain required to follow the law and pay what they may owe.

Processing silent returns means that taxpayer returns are not systemically rejected by the IRS at the time of filing, allowing the returns to be processed and minimizing the burden on taxpayers, including those expecting a refund. When the IRS has questions about a tax return, taxpayers may receive follow-up questions and correspondence at a future date, after the filing process is completed. This is similar to how we handled this in previous years, and this reflects the normal IRS post-filing compliance procedures that we follow.

Trump’s Executive Order and its Effects on ObamaCare’s Individual Mandate

For the Individual Mandate:

- Since the individual mandate went live in 2014 has always been the duty of the filer to check line 61 and attest they had coverage.

- The first year, 2014 silent returns were processed. In 2015 and 2016 silent returns were rejected.

- For taxes filed for 2017, it seems silent returns will be accepted again. This will be the case moving forward unless the IRS says differently or the law changes.

- If you got cost assistance or employer coverage, checking line 61 and filing accordingly is a must. Thus, there is no good loophole for you.

- If you did not get coverage, but want to take the lifeline Trump offered, then you may stay silent. Do not, however, attest that you had coverage if you didn’t. You would be lying on an official tax document which is a bad idea.

- The only thing I can suggest as a non-expert citizen is “following the directions on your 1040.” That means taking the exemptions on form 8965 are fair game, staying silent is fair game, but lying on line 61 is not advised.

TIP: The IRS has previously said that it wouldn’t garnish wages or go after a person’s property for not paying the SRP. Now Trump’s executive order has made it even more difficult for the IRS to collect the SRP or to concretely verify an individuals’ health insurance status. With that in mind, the IRS can withhold cost assistance moving forward, so if you plan to get assistance next year, get right with the tax code this year. Learn more a the Motley Fool – Trump’s Executive Order on Obamacare Leads to a Big Tax Change and Forbes – IRS Softens On Obamacare Reporting Requirements After Trump Executive Order.

Trump’s Executive Order and its Effects on the ACA Employer Mandate

Every regulation an employer needs to comply with should be complied with. There has been no official word from the IRS as far as we can tell.

We will update this section if and when there are more guidelines for employers.

Pam

I’m a little confused. I currently have the ACA but want to change to another insurance that isn’t part of Obamacare. As long as I don’t have a lapse in my insurance coverage, I would assume I have insurance. I wouldn’t have to pay the penalty as long as I had insurance coverage. Please help me to understand.

I do receive a subsidy, so how much of that will I have to pay back once I opt out.

ObamaCareFacts.comThe Author

I would call healthcare.gov and have them guide you.

You can’t just switch insurance plans mid-year, to effectively switch you need a reason like “starting new job.” There is more than one thing that can get mucked up here and more than one factor at play. In short, your question isn’t simple to answer and would depend on your specific plans. Given this, you should first and foremost start with guidance from HealthCare.gov.

John

Is there an exemption for people who weren’t covered because the Medicaid people wrongfully denied them coverage for which they were eligible?

ObamaCareFacts.comThe Author

Yes, there are a few different ways to get exempted from the fee based on being denied Medicaid. In all cases you have to contact HealthCare.Gov and they will likely want to see proof of the denial.

L. Brown

I’m feeling like I just got hosed twice, once by the Government, and again by my tax preparer who did NOT inform me that I could aver on Line 61! If I said nothing, I would not be facing handing over $985 to the Infernal Revenuers due to not complying with the Unaffordable Care Act.

I am depressed…. why is is MY responsibility to bail out hospitals for the bills of those who go to hospitals and then fail to pay their bills? I never signed up for that. When does someone bail ME out? I work, I pay my bills, yet, I cannot afford health care insurance, and I damn sure can’t afford to pay nearly a grand in penalties for not having it.

The inequity of this reverberates even more when I realize that the so-called dreamers get their health care whenever they want it… and I was born here!

CONCERN PERSON WHAT THIS COUNTRY HAS BECOME AND YOU CALL AMERICA LAND OF THE FREE.

THIS IS UNCONSTITUTIONAL TO HAVE AN PERSON THAT DOES NOT WANT HEALTH CARE COVERAGE TO GIVE THEM A PENALTY AND THE AMOUNT EACH YEAR YOU DO NOT HAVE COVERAGE IS OUTRAGEOUS. IF THERE WAS A PENALTY TO BE PAID IT SHOULD HAVE BEEN NOT MORE THAN A $100.00. IT SHOULD BE A PERSON RIGHT TO CHOOSE IF THEY WANT HEALTH CARE. IF THEY GET ILL WITHOUT COVERAGE AND HAVE BE HOSPITALIZED AND DO NOT PAID. THEN THEIR SHOULD BE A PENALTY. SO IT SHOULD NOTBE CALLED OBAMACARE IT SHOULD BE OBAMA LAW!

MEK

My husband is getting laid off and we’ve paid for employer coverage at work. Now it seems when applying on the exchange all of his income prior is counted and that pitiful unemployment check as our projected yearly income. The estimates are mind boggling for what money we will have for a few months compared to being forced to buy a policy with money we don’t have and is unusable. What a crock of shhh this whole act is.

ObamaCareFacts.comThe Author

That is true, the ACA counts income made in a year. That for me is one of the sticking points of the ACA. Although we hardly hear anyone calling for robust assistance without a limit based on annual income (perhaps we should start discussing this).