Trump Administration’s First Big ObamaCare Regulations: Summary

A Quick Summary of the Trump Administration’s New ObamaCare Rules: With Opinions

The Trump Administration regulation published by CMS on Thursday April 13th was a handout to insurers, a blow to many consumers, and may curb premium costs.

Below we do a quick summary, we are in the process of working on a full review.

Since this is a summary, and not the full review, I want to offer a mix of facts and opinions (because my moral duty compels me to let people know my opinions on this corporate handout which fixes no sticking points directly, aside addressing premium costs by allowing for narrower networks and more out-of-pocket costs, but will almost certainly increase the uninsured rate and insurer profits).

A Quick Summary of What the Trump Administration Regulations Do

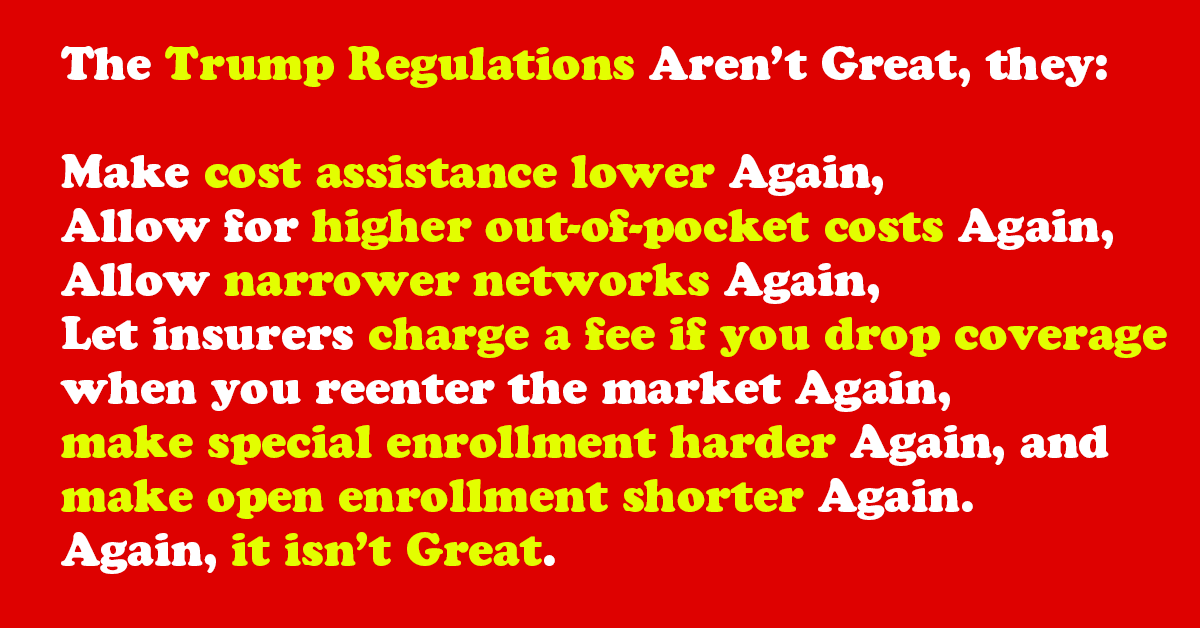

In summary, the regulations lower cost assistance by lowering the value of Silver Plans, allow for plans with higher out-of-pocket costs and narrower networks make special enrollment harder, and make open enrollment shorter.

On the plus side, it will likely lower costs a bit for those full-time employees with higher incomes and health coverage who will remain at their job (which, to be fair, is a good chunk of Americans).

In other words this helps insurers, employers, and high-income employees, but hurts the normal Joe who doesn’t have a steady full-time job with great benefits (or the Jane who wants to switch jobs or actually gets sick and then loses their job… as that is what happens and why employer coverage is a little sketchy in the first place).

See “the purpose of the safety net,” it isn’t welfare, it is to bounce the working class back up when the fall on hard times. The safety net is what is being trimmed away here (in favor of corporations and the wealthy).

About Trump’s April 13th Regulation

This regulation wasn’t unexpected, but the pro-business tone was a little shocking (although maybe it shouldn’t have been).

The regulation fixes zero sticking points, outside of maybe bringing costs down, and in many ways acts as a blatant handout for insurers.

It is an odd tactic to cave in to insurer demands instead of caving into the demands of people, but that is what has happened.

It shows that the Trump administration is willing to give in fully to industry when there is no vote to be had on a matter.

It isn’t that the regulations are fully bad or not sensible, it is that the whole document is just fulfilling the wish-list of insurers and tightening rules and lower cost assistance for the people.

The only good thing I can say about the entire 139 page document is that “it may reduce the cost of plans for employees and those who will obtaining and maintain coverage as a side effect.”

That truism is important, and can’t be understated, but it is the only redeeming quality.

Key Provisions in the Regulation

With the above said, here are some of the key things the new regulations do:

NOTE: I am using Huffington Post’s review of the New Trump Administration Regulations as a basis until our team has time to summarize the full regulations. With that in mind, I’ve checked each of the points below against the regulations and rephrased portions to offer a different perspective.

- The open enrollment period is cut in half. Enrollment for 2018 coverage will now run from Nov. 1 to Dec. 15, 2017, instead of ending Jan. 31, 2018. This means that consumers have a much smaller window to buy plans in, and it forces everyone to have an extra month of coverage (many wait until January and thus in the past their coverage started in February or March).

- Guaranteed coverage is being chipped away. Insurance companies will be allowed to refuse to sell policies to consumers who fail to make EVERY SINGLE ONE of their premium payments this year (so even if you get dropped due to a mistake, if you don’t correct it, you can be denied coverage). Obama’s rules didn’t allow insurers to demand that money be paid back before enrolling people in coverage for the following year. The Trump rules permit, but don’t require, insurers to collect unpaid premiums.

- People who need to obtain coverage after the open enrollment period will have to prove it. Certain life changes ― such as getting married, having a child or moving ― give consumers the opportunity to buy plans at any point during the year. Under Obama, these people merely had to attest to their new circumstances; Trump will require documentation. Insurers complained that people used these “special enrollment periods” to get coverage only when they needed medical care. With that in mind, not everyone who moves, gets married, or is in-between jobs is trying to cheat the system. So many innocents will be taken down by this provision and will thus face the fee noted in the last section when they try to reenter the market the following year. This will likely keep the young and healthy out of the market, as now life is even more complicated and difficult.

- Insurers will be allowed to sell skimpier plans (but not Junk insurance). The Affordable Care Act defines four “metal” levels of coverage ― bronze, silver, gold and platinum ― that offer increasingly more generous coverage that, in general, comes with increasingly higher premiums. Each metal level must cover a certain percentage of a typical person’s medical expenses. For instance, a silver plan has to cover at least 70 percent. Obama allowed plans to vary within their metal level by 2 percentage points in either direction. Trump will give them more leeway. A silver plan could cover between 66 percent and 72 percent of medical costs. This has a side effect of potentially lowering the value of the tax credit subsidies for premiums, because they’re based in part on the cost of the second-cheapest silver plan in each geographic area. If that benchmark silver plan covers only 66 percent of medical expenses, it will have a lower price, and that lower price will lead to smaller subsidies for all policies in that locale. In other words, less subsidies will be given in general (because the Second Lowest Cost Silver plan will likely have a lower cost), and those without cost assistance may benefit slightly. The real winner here is Trump who will be able to act like he brought costs down (when really he would have just shifted the burden off the government and onto poor people with a little trick).

- Insurers will be allowed to include fewer “essential community providers” in their networks. Narrow network plans are a key way for insurers to keep costs down by excluding the most expensive providers. Obama required them to include at least 30 percent of area health providers that care for “medically underserved” and poor patients. Trump will reduce that threshold to 20 percent and leave it to states or private accrediting entities to determine whether an insurance policy has enough providers in its network. The idea of solving the healthcare crisis by offering more narrow networks is literally the Federal government rationing care in a for-profit system.

Most of the above does not directly benefit the majority of people, but may indirectly benefit those with higher incomes if it can truly lower premiums.

I am very sure there are other pros and cons in the regulations, but this should tide readers over until we can do a full review! Feel free to ask questions and comment below. See: DEPARTMENT OF HEALTH AND HUMAN SERVICES 45 CFR Parts 147, 155, and 156 [CMS-9929-F] RIN 0938-AT14 Patient Protection and Affordable Care Act; Market Stabilization.

Paula F. Glick

This system penalizes the elderly who have paid into the system all of there lives but are suddenly “dumped” from their previous plans. e.g., The George Washington University no longer has plans for supplemental medical care and prescription plans for their retirees. Until May 31, 2017. The retired employees could purchase the same coverage that was offered to present employees with a special rate for those that were covered under Medicare. This is no longer the case. The retired employees were forced to go to a company , OneExchange and shop for both Medicare supplemental care and prescription coverage. The choices under prescription coverage were so poor that many employees must try to purchase drugs from Canadian pharmacies. These drugs are essential for continued health for these retirees. The costs of the coverage and the drugs are rising but the income is fixed or declining. Is this how America should treat its elderly?

Peter Nguyen

There always conflict between political parties on policies, so even happened with ObamaCare. Don’t know who got benefit from that institute and even people don’t know is it removed to make lending companies more power or for the betterment of people. Just hope for the best!! In-house financing like medloft, carecaredit are the good alternate to save money over treatment.