File Taxes For ObamaCare

There are several reasons you may have to file taxes under ObamaCare (the Affordable Care Act). Learn how to file your ObamaCare taxes in 2019 and beyond.

This section includes tips on: how to make a Shared Responsibility Payment for not having coverage, how to report health coverage known as Minimum Essential Coverage, how to adjust and report Premium Tax Credits, how to report exemptions, and more.

UPDATE on 1040s: For 2019 forward there is no longer a 1040EZ or 1040A. Instead there is one 1040 and then different schedules. You may have to file different 1040 schedules if you are filing for an exemption, are taking medical deductions, or got tax credits. Learn more about the new 1040s.

UPDATE on the fee: The federal fee for not having health coverage has been reduced to zero starting in 2019. Moving forward only states with their own mandate will have a fee. Please remember to check the rules in your state. Any reference below to paying the fee now only applies to the 2014 – 2018 tax years or to states with their own mandate moving forward. To be clear, you must account for the fee for plans held during 2018 when you do your taxes by April 2019 in all states.

NOTE: We try to keep this page updated, but it was written back in 2015 and a few things have changed. Everything below should generally be correct and helpful, especially since the IRS updates their forms (and thus all links to the IRS should remain relevant each year), but do always double check and make sure you are using the official forms appropriate for this tax season!

TIP: Make sure you are filing 2018 forms when filing taxes by April 2019. If you are filing without tax assistance, take the time to verify the instructions and make sure you are using the correct tables for 2018 coverage (this can change based on which form you are filing). This is to say, keep an eye on the dates of forms and tables, it can get a little confusing.

Who Has to File Taxes for ObamaCare?

Everyone, who has to file taxes, must at least report if they had coverage on their 1040.

- If you, or a tax dependent, missed at least one full month of coverage last year, you’d need to file the Exemptions form.

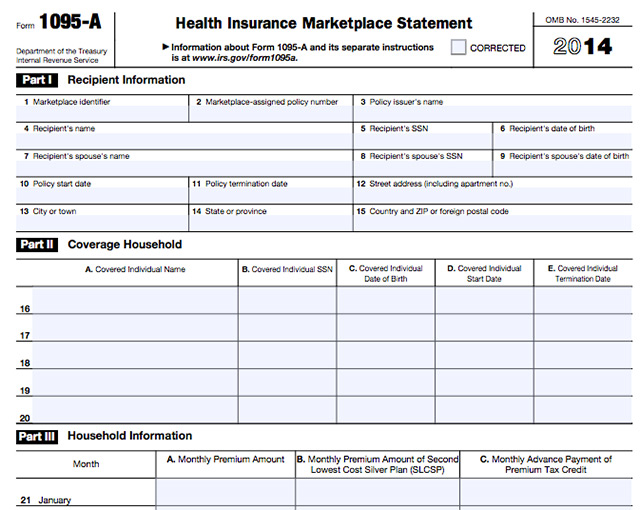

- If you, or a dependent, received Advanced Tax Credits you’d need to file a Premium Tax Credit form and will receive a helpful 1095-A form in the mail in regards to your coverage.

- If you, or a dependent, got a Marketplace plan but chose to receive your Tax Credits as a part of your year-end tax refund, you’d need to file a Premium Tax Credit form.

- If you, or a dependent, has Medicaid, Medicare, or another insurance type you’d only need to check the box on your 1040 that said you had health insurance.

Click to See Full Table of Taxes for Individuals and Families

|

IF YOU… |

THEN YOU… |

|---|---|

| And everyone in your tax household had health coverage for the entire year | Will simply check the box on your Form 1040 that said you had health insurance. |

| Enrolled in health insurance through the Marketplace | Should receive a Form 1095-A Health Insurance Marketplace Statement from the Marketplace |

| Received a Form 1095-A, Health Insurance Marketplace Statement, showing you received the benefit of advance payments of the premium tax credit in 2014 | Must file a tax return in 2015 and reconcile the advance payments with the amount of the premium tax credit allowed on your return |

| Need to reconcile the advance payments of the credit with the credit allowed | Make the calculations using IRS Form 8962 Premium Tax Credit (PTC) |

| Must repay any excess advance payments of the premium tax credit | You must file Form 8962 and report the information on your 1040 (see Form 8962 instructions for details) |

| Are claiming the premium tax credit and did not benefit from advance payments of the premium tax credit | Must file a tax return and IRS Form 8962, Premium Tax Credit (PTC) |

| Did not receive a Form 1095-A, Healthcare Insurance Marketplace Statement, from the Marketplace | Should contact the state or federal Marketplace through which you enrolled |

| Are claiming an exemption from the requirement to have health coverage for anyone on your tax return | Will complete Form 8965, Health Coverage Exemptions, and submit it with your tax return |

| Still need to obtain a religious conscience exemption or a hardship exemption that can only be granted by the Marketplace | Should file an application with the Marketplace and follow the instructions below about how to report exemptions from the Marketplace on your tax return |

| Obtained an exemption from the Marketplace, and received your unique Exemption Certificate Number | Will enter the Exemption Certificate Number in Part I of Form 8965, Health Coverage Exemptions, and submit the form with your return |

| Applied for an exemption from the Marketplace, but do not currently have an Exemption Certificate Number | Will enter ‘PENDING’ in Part I of Form 8965 Health Coverage Exemptions, and submit the form with your return |

| Are claiming an exemption that can be granted only from the IRS | Will not need an Exemption Certificate Number, but will complete Parts II and III of Form 8965, Health Coverage Exemptions, and submit the form with your return |

| Are able to obtain the exemption from either the IRS or the Marketplace | Should obtain the exemption from the IRS by completing Part II and III of Form 8965, Health Coverage Exemptions, and attach this form to your federal tax return when you file |

| Are making a shared responsibility payment because you did not have health coverage or qualify for an exemption for any month in 2014 | Will enter the payment amount on line 61 of Form 1040 schedule 4. |

TIP: Line 61 where you check if you didn’t have health insurance and need to pay the fee is found on form 1040 schedule 4 starting in 2019.

Who Doesn’t Have to File Taxes for ObamaCare?

If you don’t have to file a tax return because your income is too low, then you are automatically exempt and don’t need to file forms related to the Affordable Care Act. Learn about the filing limit.

Even if you don’t have to file, you may want to file for many reasons. For example, if you had Marketplace coverage and then lost your source of income, you may be owed tax credits for the months you had coverage. This is true even if your year end income dropped below 100% of the Federal Poverty Level. You can also report exemptions due to income for months you did not have coverage on the Health Coverage Exemptions form found below.

All ObamaCare Related IRS Forms, Instructions, and Our Simplified Instructions

We have covered most of the tax filing requirements below in an easy to understand way. You can find all the official forms and instructions from the IRS, as well as, our simplified guides to each type of form related to ObamaCare below. For more details go to IRS.gov.

ObamaCare Facts Guides:

-

- ObamaCare Facts simplified guide to 1040 forms

- ObamaCare Facts simplified guide to 1095 forms

- Clarification on missing or incorrect 1095-A forms

- ObamaCare Facts simplified instructions for Form 8962, Premium Tax Credit (PTC)

- ObamaCare Facts simplified instructions for Form 8965, Health Coverage Exemptions

- ObamaCare Facts guide to Exemptions

- ObamaCare Facts guide to the Shared Responsibility Payment, including line-by-line calculations

-

- Second Lowest Cost Silver Plan (SLCSP) Tax Tool <- the one you need to verify your 1095-A or to correct an incorrect 1095-A (also contains Second Lowest Cost Bronze Plan Tax Tool)

-

- ObamaCare Facts guide to filing 8962 without a 1095-A form, correcting 1095-A forms, or filing 8965 without an ECN (if you are missing a form, read this)

Official IRS forms and Instructions:

- Form 1095-B and 1094-B Instructions (Draft)

- Form 1094-C, Transmittal of Employer-Provided Health Insurance Offer and Coverage Information Returns (Draft)

- Form 1095-C, Employer-Provided Health Insurance Offer and Coverage (Draft)

- Form 1095-C and 1094-C Instructions (Draft)

- Form 8965, Health Coverage Exemptions

- Form 8965, Health Coverage Exemptions Instructions

-

- Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return (file this if you still haven’t gotten a 1095-A, make sure to estimate at least 90% of your payment to avoid a penalty)

-

- Form 2210, Underpayment of Estimated Tax by Individuals, Estates, and Trusts (to request a waiver from owing back excess premium tax credits)

-

- For Self-employed Health Coverage Deductions, see worksheet from 1040 instructions

-

- Form 8941, Credit for Small Employer Health Insurance Premiums Instructions

- Publication 502 for Medical and Dental expenses (you need to attach a Schedule A to your 1040 to itemize deductions).

- For other Small Business Forms, see section on small business below

A Quick Look at the 1094 and 1095 Forms

TIP: From this point on the examples may use older documents or refer to past updates. All the basics are the same, but a few specifics are different year-to-year. Keep that in mind as you read. An update from 2016 might hold the answers you are looking for or offer insight, and given this, we have opted to leave them for now. In other words, things don’t change much each year, and thus everything below should be helpful, but keep an eye on the dates and check for more up-to-date versions of forms and instructions.

Individuals don’t have to fill out 1094 or 1095 forms. They are sent by whoever provided you coverage. They include months you had coverage and premium amounts, and are used to fill out 1040, 8962, and 8965 forms. If you got marketplace coverage in 2014, you’d have received a copy of a 1095-A form sent to you. The filing date for the Marketplace was January 31st, 2015, so most people got their 1095-A in the mail by February 2nd, 2015. However, some states reported delays due to last minute changes to the form. If you do not receive your 1095-A, call or visit your Marketplace to find out more information. If you haven’t filed yet, we suggest double checking the information on your form.

Other 1095 forms (1095-B and 1095-C) didn’t begin until 2016 due to transition relief for non-marketplace employers and insurers. If you didn’t get tax credits and don’t get a 1095, simply report your health coverage accurately on your 1040.

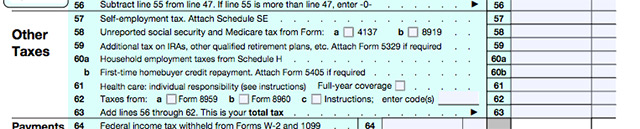

A Quick Look At Form 1040

Open up 1040 form (for 2014) and the 1040 instructions. Go to line 61 (use the command find function on your keyboard). This is where you report your coverage, or pay the Shared Responsibility Payment if you owe it. Many people will only have to fill out this one line reporting that they had coverage for the entire year. If you are only filling out this line, you can use a 1040-EZ form. (It’s line 38 on a Form 1040-A or line 11 Form 1040-EZ)

AGI (adjusted gross income) is on line 37. And while it doesn’t say so, Modified AGI or MAGI is typically the total on line 41.

If you got Premium Tax Credits, you’d Adjust Tax Credits using Form 8962 on line 46 and report your Net Premium Tax Credit amount from Form 8962 on line 69.

You’ll use line 25 for Health Savings Account deductions and line 29 for reporting for Self-employed Health Insurance deductions.

See our ObamaCare Facts simplified guide to 1040 forms for more information. Including information on Schedule A deductions.

A Quick Look at Form 8962

Open up Form 8962, Premium Tax Credit (PTC). This is the form you will need to report your household Modified AGI (MAGI), your Federal Poverty Level amount, your families health insurance premium, exemptions, and the cost assistance you received. See below for more details on this form, see our page on Form 8962 for simplified instructions.

Part 2 of Premium Tax Credit Form 8962.

Quick Look at Form 8965 Health Coverage Exemptions

Form 8965 Health Coverage Exemptions allows you to claim hardships. Make sure to include the Electronic Confirmation Number (ECN) from the Marketplace, if needed, for that exemption. You’ll attach this form with your 1040 and use it to determine what you owe for the Shared Responsibility Payment. See the full list of exemptions and their numbers and requirements or see our simplified step-by-step guide to form 8965, Health Coverage Exemptions.

Quick Look at Instructions for Figuring your Shared Responsibility Payment

Page 5 of form 8965 instructions also provides a worksheet for calculating the Shared Responsibility Payment, as well as more details on how the payment works. See our guide to the Shared Responsibility Fee (including simplified instructions for calculating the fee).

How to Get Help Filing Taxes

Going to a local tax professional is probably your best bet for filing taxes. Establish a relationship and make sure to take advantage of discounts (they are always offered at tax time, especially this year due to the ACA). The more complicated your taxes, the more important it is to get help. There are so many odd deductions, especially for folks at lower income levels, that not getting help can end up costing you lost savings.

- You can also use the IRS Tax Help Line for help: (800) 829-1040

- If you make less than $60,000 a year, you can use the IRS’ Free File option.

- If you make less than $53,000 a year, you can use the IRS’ free Volunteer Income Tax Assistance program.

- The IRS’ Tax Counseling for the Elderly program is free for those 60 and over.

- Enroll America will offer no-cost local help using Intuit TurboTax.

- You can use any major tax assistance software.

Or if you can ask ObamaCare Facts (us) any questions you have.

Quick Facts for Filing Taxes For ObamaCare

Here are some quick facts on filing taxes under the Affordable Care Act:

- Taxes must be filed by the IRS tax filing deadline: Wednesday, April 15th, 2015; Wednesday, April 15th, 2015; Tuesday, April 18 for 2016; and Tuesday, April 18 for 2017.

- If you used the Marketplace or missed a full month of coverage in any year, you’d need to file forms related to ObamaCare in addition to reporting coverage status on your 1040.

- Important forms are 1040 (your main tax form), Form 8962, Premium Tax Credit (PTC), Form 8965 Health Coverage Exemptions, and Form 1095-A reporting your Marketplace coverage.

- When filing taxes, you’ll be paying the fee at the previous year’s rate, and you’d base cost assistance on the Federal Poverty Guidelines.

- Cost assistance, the fee, and exemptions are based on Modified Adjusted Gross Income (MAGI). Modified Adjusted Gross Income is Adjusted Gross Income (AGI) as found on your 1040, plus any foreign earned income and tax-exempt interest you receive during the taxable year.

- MAGI is often referred to as household income. For the ACA, household income is your families Modified Adjusted Gross Income and includes the incomes of all of your dependents who are required to file tax returns. For example, if your dependent is 18-26 years old and covered under your families insurance, then their income is included in your MAGI.

- If you have to file taxes, you’ll have to report the status of your health coverage for the entire year and any cost assistance you may have received during the year. If you aren’t required to file, you may choose to take advantage of refunds and assistance programs.

- If you didn’t take the full Premium Tax Credit in advance, or you made less than you projected and didn’t adjust your info in the marketplace, you can deduct the remaining amount on your Federal Income Taxes using Form 8962, Premium Tax Credit (PTC).

- If you went without minimum essential coverage for more than 4 months in 2014 or 3 months in 2015 and beyond, you’d have to make a Shared Responsibly Payment for each month you, or a household member you claim as a dependent went without coverage or an exemption. The fee is 1/12th of the annual fee up to the family max or a percentage of your household income which is capped at the national average of a Bronze plan. See Individual mandate for detailed information on the fee and requirement.

- You’ll get a 1095-A, 1094-B, 1095-B, or 1095-C form from your insurer about your coverage. If you had more than one source of coverage, you’d get multiple forms. You will use these forms to report minimum essential coverage. You’d also use that form to help fill out Form 8962, Premium Tax Credit (PTC).

- In 2015, not all providers were required to provide you 1094-B, 1095-B (multiple and other insurer coverage), or 1094-C, 1095-C (employer coverage) forms according to the IRS. 1095-A (marketplace coverage) forms were sent after January 31st, 2014 if you had a Marketplace plan in 2014.

- Notice 2013-45 provided transition relief for 2014 from the section 6055 reporting requirements for health coverage providers. Accordingly, the reporting requirements did not apply for 2014. However, coverage providers were encouraged to provide information returns for coverage provided in 2014, which were due to be filed and furnished in early 2015. Returns filed voluntarily will have no impact on the tax liability of the health coverage provider or the individuals affected. For more information about voluntary filing in 2015, see IRS.gov.

- If you didn’t get your 1095, or got the wrong one, and need to calculate the second lowest cost silver plan, you can use this tool. (You can use the lowest cost bronze plan tool on that page for affordability exemptions.)

- If you had an exemption for any months, you might need an Electronic Confirmation Number (ECN) provided by the Health Insurance Marketplace HealthCare.Gov.

- Some exemptions require proof and others don’t. The one’s that require proof take time. Apply for exemptions early, or you’ll risk having to delay filing your taxes.

- Some exemptions apply to a short window of time, usually 3 months, while others apply to the full calendar year.

- You can’t go to jail for not paying the fee. The IRS cannot enforce the Individual Shared Responsibility Provision with jail time, liens, or any other typical method of collection. They can, however, withhold your Federal Income Tax refund.

- If your income is below the minimum threshold for filing a tax return ($10,150 for an individual or $20,300 for a couple) or the lowest cost coverage offered to you would cost more than 8% of MAGI for self-only coverage, you are exempt from the fee for not having coverage. You may still qualify for marketplace cost assistance or Medicaid.

- Try using a Health Savings Account HSA to bring down your MAGI for maximum savings on qualifying high deductible plans. If you do, you’ll need to file form 8889.

- The first time people paid the “ObamaCare tax” for not having insurance was 2015 after open enrollment closed. Those who went without coverage in 2014 ended up owing the fee for 2014 and 2015 because minimum essential coverage can only be obtained during open enrollment (which ended Feb 15 in 2015) unless you qualified for a special enrollment. On that note, the largest decrease in uninsured was expected to be during 2016 open enrollment which ended January 31st, 2016 and US uninsured rates dropped to record lows.

- Small businesses can use the SHOP to obtain coverage and tax credits for employees. Some larger businesses can use the SHOP for coverage too.

- Larger businesses and higher earning employees may also have to pay the increased Medicare Part A tax. Then there is also the 3.8% net investment income tax many high earners will face. Generally, large employers and higher earning individuals will be responsible for additional taxes and, thus, will need to report them. See our ObamaCare taxes page for a full list of taxes on high earners with a taxable income of $200,000 individual / $250,000 family.

Reporting Health Coverage to the IRS

Everyone who has to file taxes will have to, at the very least, report about the status of their health coverage throughout the year on their Federal Income Taxes. This will be reported on Form 1040, line 61 (or Form 1040A, line 38; or Form 1040EZ, line 11). Only Minimum Essential Coverage counts as health coverage under the ACA.

If you had marketplace coverage, you’d get a 1095-A form after January 31st. This will show you the months you had coverage. If you didn’t have coverage for every month, you’d need to complete the Shared Responsibility Payment Worksheet or exemptions worksheets.

How to Report Other ObamaCare Forms

Whether you had health coverage all year, went without health insurance for at least one full month, need to adjust income for Premium Tax Credits, or need to confirm an exemption, you’ll need to attach the correct form(s) to your 1040. Employers will also need to file tax forms if they qualified for tax credits through the marketplace, or were required to insure their employees.

See sections below for breakdowns of each form you might need to attach to your 1040.

The IRS suggests that filing your taxes electronically is the easiest way to file a complete and accurate tax return. Electronic Filing Options include free Volunteer Assistance, IRS Free File, commercial software and professional assistance.

How to Report Minimum Essential Coverage

When you file your taxes, you report whether or not you had coverage each month on line 61 of a standard 1040. For 2014 ONLY this was based on “the honor system” if you got non-marketplace coverage (due to transition relief discussed earlier on this page). If you had coverage in 2014, you answered “yes;” if you didn’t, you answered “no” and calculated your fee. When you file your taxes for 2015 and beyond, you report minimum essential coverage on your 1040 where it says “full year coverage” (still line 61 for 2017).

Keep in mind if you got Marketplace coverage the Marketplace backs this up. If you got coverage outside the Marketplace or through an employer, this is all verifiable in the case of an audit. You have the option of skipping this question as well, by marking neither “yes” or “no” and your return will still be processed, but you will still owe any back tax credits or fees you are responsible for under the law. You must sign your tax return under “penalties of perjury,” so, the best answer is the honest one.

If the answer is “yes,” then you used zero as the amount. If the answer is “no,” then you need additional forms. While this is still based on “the honor system,” all insurers and employers are required to furnish 1095 forms which show your coverage months, so it’s much more verifiable.

You’ll report coverage as shown on your 1095-A, 1095-B, or 1095-C form sent by your insurance provider. It will show what months you had coverage and how much assistance you received (Advanced PTC). If you had multiple insurance sources, you may get more than one form. This will help you to figure out if you owe money for any months that you went without coverage.

Deferred 10 on95 Forms For 2014

Please note that some requirements were deferred from 2014 to 2015, meaning they didn’t apply until taxes were filed for 2016. This includes the requirement for employers and providers to send 1095-B or 1095-C forms showing minimum essential coverage. However, if you received Advanced Premium Tax Credits, you should have gotten a 1095-A form. You can’t complete the Premium Tax Credit without it. As an individual or family, you’ll still need to report the status of your health coverage, but especially if you got Marketplace cost assistance. See IRS transition relief for 2014.

How to File Taxes for Not Having Coverage

If you didn’t obtain and maintain minimum essential coverage for each month, you’d need to make a Shared Responsibility Payment for each month you or a household member went without coverage, unless you obtained an exemption. Everyone got a short coverage gap of 4 months in 2014 and 3 months in years after that.

If you had Minimum Essential Coverage throughout the year, you could check the box on line 61 of your 1040 (or Form 1040A, line 38; or Form 1040EZ, line 11).

If you didn’t, then you’d need to follow the instructions on page 50 of the 1040 instructions for an overview and see page 5 of the exemptions instructions for a more detailed breakdown. This involves calculating which fees you must pay and calculating tax credits on form 8962 if applicable. We suggest using our simplified instructions for calculating the fee if you will do it by hand or just want to learn more about how the fee works.

For 2014, the annual fee was $95 per adult and $47.50 per child (up to $285 for a family) or 1% of your household income that was above the tax return filing threshold for your filing status, whichever was greater. While the fee adjusts annually, so you’ll want to use these numbers for calculating the fee for filing taxes for 2016.

- The Shared Responsibility Payment is 1/12 of the above amount, per household member, for each month they went without coverage for. The Flat Dollar Amount Worksheet is included in the exemptions instructions.

- For the percentage payment, you pay 1/12 of the percentage per month, per household member, not multiple instances of the percentage.

- The part where you divide the fee by 12 comes in further down the calculations worksheet, so don’t be scared by seeing large numbers earlier on if you fill the worksheet out by hand.

- You couldn’t owe more than $285 in 2014 if you paid the flat amount.

- If you pay the percentage: The total penalty for the taxable year cannot exceed the national average of the annual premiums for a bronze level health insurance plan offered through the Health Insurance Marketplaces. In 2014, the annual national average premium for a bronze level health plan available through the Marketplace was $2,448 per individual ($204 per month per individual), but $12,240 for a family with five or more members ($1,020 per month for a family with five or more members). See Rev. Proc. 2014-46.

- The fee increases each year.

Check out these basic examples of the payment calculation and the federal tax filing requirement thresholds. For more detailed examples, see the Individual Shared Responsibility Provision final regulations.

How to Make Shared Responsibility Payment

You will do the calculations from the 8965 worksheet to figure out what you owe for each month and report that on line 61 of your 1040 (or Form 1040A, line 38; or Form 1040EZ, line 11).

To fill out the Shared Responsibility Payment Worksheet, you’ll need to look at your 1095-A, 1095-B, or 1095-C form sent by your insurance provider for any months you had coverage and Form 8965 Health Coverage Exemptions. You’ll then calculate the months you, or a household member didn’t have coverage, or an exemption, and pay a fee based on your Modified Adjusted Gross Income that is above the filing threshold. The total amount from the worksheet is reported on your 1040.

See detailed, line-by-line, instructions for filing out the Shared Responsibility Payment Worksheet.

How to File Taxes for ObamaCare Exemption

To report most exemptions on your taxes, you must first apply for an exemption through the Marketplace. After you have been granted an exemption, the Marketplace will mail you a notice of the exemption eligibility result. If you’re granted an exemption, the Marketplace notice will include your unique Exemption Certificate Number (ECN). Not all exemptions require approval.

You’ll simply report the ECN on your Form 8965 Health Coverage Exemptions along with any exemptions which don’t require an ECN.

Minimum Filing Threshold for 2014 Tax Returns

When preparing 2014 tax returns, you wouldn’t have been required to file if you make under these amounts. You also wouldn’t have owed the fee. You use Gross Income and filing status to determine your filing threshold amount. See Tax Filing Thresholds for more details.

2014 Federal Tax Filing Requirement Thresholds

| Filing Status | Age | Must File a Return If Gross Income Exceeds |

|---|---|---|

| Single | Under 65 | $10,150 |

| 65 or older | $11,700 | |

| Head of Household | Under 65 | $13,050 |

| 65 or older | $14,600 | |

| Married Filing Jointly | Under 65 (both spouses) | $20,300 |

| 65 or older (one spouse) | $21,500 | |

| 65 or older (both spouses) | $22,700 | |

| Married Filing Separately | Any age | $3,950 |

| Qualifying Widow(er) with Dependent Children | Under 65 | $16,350 |

| 65 or older | $17,550 |

Get the official IRS guidelines for preparing your 2014 tax returns or the quick IRS sheet on calculating payments for the ACA.

How to File Taxes for the Premium Tax Credit

If you received Advanced Premium Tax Credits, either in part or in whole, or if you plan to claim the Premium Tax Credit, you must file a federal income tax return. Specifically, you’ll need to file Form 8962, Premium Tax Credit (PTC).

We provide a detailed tutorial for filling out the Premium Tax Credit form. The form, of course, includes directions which are fairly easy to follow if you know what everything means, but potentially a little confusing and time-consuming.

NOTE: The following Advanced Tax Credit Repayment limit table from form 8692 is updated for 2018 coverage (accounted for on taxes filed in 2019).

| Income % of FPL | Filing Status: Single |

Filing Status: All Other |

|---|---|---|

| Less than 200% FPL | $300 | $600 |

| At least 200% FPL but less than 300% |

$775 | $1,550 |

| At least 300% FPL but less than 400% |

$1,300 | $2,600 |

| More than 400% FPL | Full Amount Received | Full Amount Received |

| If your year-end income exceeds 400% FPL, you will have to return the total amount of Advanced Premium Tax Credits you received. If you make too little to qualify for subsidies (less 100% FPL), then you should owe NOTHING (per the directions of form 8962 from which this table comes). That being said, if you know you are going to price out of cost assistance, make sure to update your Marketplace account. You might become eligible for a free or low-cost Medicaid plan if your state expanded Medicaid. | ||

TIP: See federal poverty level for more details. Make sure to refer to the current 8962 form for calculations each year at tax time (you can always use last year’s numbers for a general estimate).

If you choose to get it now (Advanced Premium Tax Credits): When you file your tax return, you will subtract the total advance payments you received during the year from the actual Premium Tax Credit calculated on your tax return. If the Premium Tax Credit computed on the return is more than the advance payments made on your behalf during the year, the difference will increase your refund or lower the amount of tax you owe. If the advance credit payments are more than your actual Premium Tax Credit, the difference will increase the amount you owe and result in either a smaller refund or a balance due. This is an attractive, but risky move. Owing money at the end of the year for something you already had stings a bit. Of course, tax credits are based on income, so if it was calculated correctly upfront, you’d only owe significant amounts of money if you increase your household income.

If you choose to get it later (Premium Tax Credit): You will claim the full amount of your actual Premium Tax Credit when you file your tax return. This will either increase your refund or lower your balance due. This is the safer move. As attractive as an up-front credit is, saving money on taxes is a lot more exciting then owing back payments.

Learn more from the IRS.

Either way, it’ll be important to adjust tax credits each year, both on your taxes and through the marketplace, to ensure you get the assistance you deserve, not more or less. Keep in mind H&R Block is an accounting service that will most likely see a giant boom in businesses under the ACA.

Adjusting for Other ObamaCare Subsidies

If you got Cost-Sharing Reduction (CSR) subsidies or Medicaid, but your income increased, and as a result, disqualified you from part of the assistance or the full amount, you will have to report this on your taxes. Unlike Premium Tax Credits, Medicaid and Cost-sharing Reduction subsidies do not have to be paid back. This may be an advantage for those whose yearly incomes vary slightly, but are consistently on the edge of the Cost-Sharing Reduction subsidy income thresholds, especially if the full Premium Tax Credit offered is NOT taken in advance. See our Federal Poverty Level page to see where your income falls.

For most people, however, it is still important to report changes to income and family status to the Marketplace, so that changes to your Advanced Premium Tax Credits can be made when they happen.

Reporting ObamaCare for Small Businesses

Most businesses will simply defer tax filing duties to their accountant. Small businesses who received a tax credit for health insurance and will be filing themselves should go to IRS.gov for detailed filing information.

Tax credits for small businesses are available retroactively since 2010, although some restrictions apply. So, if you didn’t claim your tax credits in past years, you can still claim them.

To claim the tax credit for Small Business health insurance premiums, you’ll need to use a Form 8941 to calculate the credit. For detailed information on filling out this form, see the Instructions for Form 8941. If you are a tax-exempt organization, include the amount on line 44f of the Form 990-T. You must file the Form 990-T to claim the credit, even if you don’t ordinarily do so.

If your business is eligible for the SHOP, you can claim your tax credit there, but you’ll still need to fill out Form 8941.

If you are a small business, include the tax credit amount as part of the general business credit on your income tax return.

Reporting ObamaCare Taxes for High Earners

Anyone in a higher tax bracket should know that there are other taxes which apply to them. Like with businesses, most folks in higher tax brackets will have the help of an accountant. Please see our section on ObamaCare taxes to learn about taxes that may affect you, like the new Medicare tax on investment income.

Don’t forget, large businesses who are required to provide coverage must report coverage status of employees and must make an Employer Responsibility Payment. The amount of the payment depends upon whether the employee used Marketplace cost assistance or not. See employer mandate for more details.

Other ObamaCare Tax Return Forms

See our complete list of Obamacare-related forms closer to the top of this page. Here you can find other less common forms related to healthcare and the ACA.

Other Tax Form Examples Regarding the ACA in 2014 will be added below:

Form 1040A, U.S. Individual Income Tax Return

Form 1040NR, U.S. Nonresident Alien Income Tax Return

We will provide screen shots, additional forms, and further advice as we learn more related to the ACA and taxes. When in doubt we suggest referring to HealthCare.Gov, the IRS.Gov, or a local accountant.

Learn more about filing taxes for 2014 from Forbes.