ObamaCare Facts Archive

The facts below are our original “ObamaCare facts” page. These ObamaCare facts will give you a sense of how things used to be and what has changed.

See our up-to-date “ObamaCare” facts page here.

It is easy to forget that time when women paid more than men for health insurance, or when you could be denied coverage or charged more for being sick in the past, or when there were lifetime and annual limits, or when there was 44 million uninsured. These facts below help serve as a reminder.

• The Fact is, ObamaCare gives 47 million women access to preventive health services and makes it illegal to charge women different rates than men. Get more ObamaCare women’s health services facts.

• Up to 82% of nearly 16 million uninsured young U.S. adults will qualify for cost assistance or Medicaid through ObamaCare’s marketplaces.

• The number of young people who sign up for insurance will greatly impact the effectiveness of the program, as healthy young adults are the least likely to use costly health care services. Find out how ObamaCare affects young people.

• 1 in 2 Americans have a “pre-existing” condition that they could have been denied health insurance for. ObamaCare chipped away at pre-existing conditions until 2014, so pre-existing conditions are no longer a barrier to insurance coverage for anyone, including high-risk customers. This means you can no longer be denied coverage or treatment or be charged more due to your health status. Find out more about pre-existing conditions.

• 54 million Americans with private health insurance now have access to preventive services with no cost sharing because of the new minimum standards of ObamaCare.

• ObamaCare doesn’t ration health care. It protects consumers from the health care coverage and cost-based rationing that insurance companies have been doing for decades.

• ObamaCare reduces the growth in healthcare spending. The current $2.8 trillion U.S. healthcare system costs almost $9k a year for every man, woman, and child.

• The new law affects everyone differently. Find out: how will the Affordable Care Act affect me?

After you get done reading the ObamaCare facts, check out our detailed summary of ObamaCare to get the facts on how Obama’s health care reform really works: health care reform summary

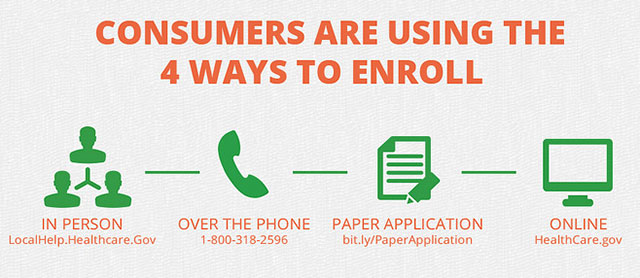

• You may have heard about the ObamaCare website glitches. The official healthcare.gov website had some technical issues at its launch, but those have been dealt with, and it is up and running well. Aside from the website, you can also sign up for the marketplace by mailing in an online application (read these instructions first), get in-person help, or call the 24/7 helpline (800) 318-2596. Learn more about other ways to sign up for health insurance.

UPDATE: The health insurance marketplaces are operational; over 8 million Americans had enrolled in marketplace plans after the first year’s open enrollment. 2017 has been a year of uncertainty, but as of September, all areas of the country have at least one insurer in the marketplace.

• When the ACA first began to be effective, some people in some states who bought insurance outside of the marketplace, due to technical issues with their states’ websites, despite qualifying for subsidies, could have retroactively signed up for a marketplace plan and received federal subsidies in 2014. Contact your insurance company for further details. ObamaCare subsidies.

• The Defund ObamaCare movement led to a Government Shutdown on October 1st, 2013 because the House Republicans refused to pass a budget unless it included repealing, removing, delaying, or defunding parts of the Affordable Care Act (such as the medical device tax and employer mandate). The shutdown lasted until October 18th. Get the facts on the Government shutdown and the repeal ObamaCare Movement.

• We’ve created a detailed ObamaCare Facts Health care reform timeline of every protection, benefit, and tax laid out by the Affordable Care Act from 2010 to 2022.

• ObamaCare is a hot-button political issue, and both sides of the aisle will try to persuade you to be for or against it. Get THE FACTS on ObamaCare and American Health Care Reform.

• Before ObamaCare’s first open enrollment period, 15% of Americans were uninsured – this is a little less than 50 million men, women, and children.

• Before the ACA, about 38 million Americans had inadequate health insurance.

• Studies have shown that anywhere from 20,000 to 44,000 Americans died each year from lack of health insurance.

• Given the above, before the Affordable Care Act, nearly one-third of Americans faced each day without the security of knowing that affordable medical care was available to them and their families.

• An April 2014 Gallup poll showed the uninsured rate dropped to 13.4%, the lowest in decades, during the open enrollment in the health insurance marketplaces. Under Trump, that rate edged upward. See US Uninsured Rate Edges Up.

• The primary reasons for Americans being uninsured are cost and job loss.

• Both the individual mandate and the health insurance marketplace only affect uninsured Americans.

• For the 85% of Americans with health coverage, almost all of ObamaCare’s changes are already in place.

• 7 million Americans were projected to purchase private insurance on the marketplace in 2014; in the end, more than 8 million people enrolled in a marketplace plan in 2014.

• 74,424,652 individuals were enrolled in Medicaid and CHIP in June 2017. See: June 2017 Medicaid and CHIP Enrollment Data Highlights.

• The number of uninsured people has dropped since the Affordable Care Act was signed into law.

• The Congressional Budget Office projected that 12 million more non-elderly people would become insured due the ACA.

• The 101.5 million already enrolled in government health programs like Medicaid, Medicare, and CHIP won’t need to use the marketplace.

• The 170.9 million are already covered by employer insurance and won’t need to use the marketplace.

• In 2010, 19.5% percent of uninsured were employed, and 14.7% maintained full-time employment for the entire year.

• In 2010, only 53.8% of private sector firms offered health insurance.

• Poor working families were, and still are the most likely to be uninsured.

• In 2013, the average annual total cost of employer-sponsored family coverage was $16,351, and the share of the premium paid by workers was 29%. Between 2003 and 2013, premiums had increased by 80%.

• The “employer mandate” means larger employers had until 2016 to insure their full-time employees and their families or pay a per-employee fee. Learn more about the Employer Mandate.

• Today, all small businesses with less than 25 full-time equivalent employees get better benefits, big tax breaks, and better buying power if they provide employee health insurance via the SHOP (part of their state’s Health Insurance Marketplace). Learn more about ObamaCare and small business.

• Under the Affordable Care Act tens of millions of people got health coverage through the marketplaces, through Medicaid and CHIP, and outside of the marketplace through private providers.

• A May, 2014 Gallup poll shows, under ObamaCare (the Affordable Care Act), the uninsured rate is the lowest it’s been since 2008 when Gallup started polling the uninsured rate. Data from HHS on the uninsured in 2007 shows that this could be the lowest uninsured rate since before 1998. The uninsured rate for U.S. adults in April was 13.4%, down from 15.0% in March.

• States that moved forward with Medicaid expansion and established marketplaces saw the biggest reduction in the number of uninsured under the ACA; states that rejected both saw the smallest reduction. Learn more about how ObamaCare affects uninsured rates.

• Do you want more facts about uninsured Americans? Learn more about uninsured Americans from the Kaiser Family Foundation (one of the best resources on health care reform) and how ObamaCare helps.

• Most Americans had to obtain qualifying health insurance that started by May 1st, 2014, get an exemption, or pay a fee for every month they were without insurance. The fee is paid on your federal income tax return. This fee is commonly referred to as an Individual Mandate and is part of the Shared Responsibility Provision. Learn more about the ObamaCare Individual Mandate.

• According to the CBO: mostly due to exemptions, almost 90% of the 30 plus million Americans without insurance will not pay the penalty for not having insurance in 2016.

• Most Americans will have the option of staying on their current healthcare plans. No one who is currently unable to afford health insurance, or who has access to a subsidized plan (including seniors), will be forced to go without healthcare. That’s an ObamaCare fact.

• If you like your doctor, and your health insurance provider includes your doctor in your network, you can keep your doctor. Nothing in the ACA prevents you from keeping your doctor, although you may have to pick a network that your doctor participates in. Learn more about ObamaCare and doctors.

• If you don’t have coverage, you can use your state’s Health Insurance Marketplace to buy a private insurance plan. Many Americans will qualify for lower costs on monthly premiums and out-of-pocket costs through the marketplace. Please note that if you have access to employer-based insurance, you cannot get cost assistance through the marketplace.

• Your State’s Health Insurance Marketplace Opened Oct 1st, 2013. Insurance companies compete to be your healthcare provider via your State’s Health Insurance Marketplace, which is sometimes called a Health Insurance Exchange.

• Americans earning below 400% of the Federal Poverty Level may be eligible for cost assistance on the marketplace.

• Read our complete guide to the health insurance exchange marketplaces and find out how you can get reduced premiums and lower out-of-pocket costs for copays, coinsurance, and deductibles.

• According to a 2013 HHS report, 6 in 10 Americans without health insurance could have gotten health insurance for under $100 through their State’s Health Insurance Marketplace.

According to the June 2014 report, 69% of individuals who selected Marketplace plans with tax credits in the Federally Facilitated Marketplace (FFM), HealthCare.gov, had premiums of $100 or less after tax credits. Another 46% had premiums of $50 or less after tax credits.

Many low-income Americans will have an option for free health insurance when applying through the marketplace.

• Should I buy insurance through the health insurance marketplace? Your options for obtaining coverage are changing. For some of us, buying private insurance through the health insurance marketplace will be our best option; for others, buying health insurance through a private broker will be the smarter move. Find out which option is right for you and your family. ObamaCare and health insurance plans.

• HealthCare.gov is the official site on the Affordable Care Act and the Health Insurance Marketplace. Ready to sign up for health insurance? Find your state’s health insurance marketplace now.

• Any insurance plan that starts after 2014 must follow new health insurance rules and include Ten Essential Benefits. All health plans sold through the health insurance marketplace adhere to these rules.

• Policies issued before 2010 (“grandfathered” health plans) don’t have to adhere to all the new rights and protections offered by the Affordable Care Act.

• ObamaCare takes measures to prevent all types of discrimination in regards to your right to health care. Insurance companies can no longer use factors such as pre-existing conditions, health status, claims history, duration of coverage, gender, occupation, and small employer size org industry to increase health insurance premiums.

• The only factors that can affect premiums of new insurance plans starting in 2014 are your income, age, tobacco use, family size, geography and the type of plan you buy. This applies to all plans sold through your State’s health insurance marketplace.

• The amount of out-of-pocket costs your health plan covers can affect your rates. Plans that cover more out-of-pocket costs like deductibles, coinsurance, and copayments also have higher premiums.

• Starting in 2015, in some states, smokers could expect to pay up to 50% more than non-smokers for the same health plans. Subsidies are given before being charged a “tobacco surcharge,” meaning that smokers could find affordable insurance to be unaffordable. Get the facts on ObamaCare and smokers.

• According to the CDC, 75% of all healthcare expenditures go toward treating chronic diseases, many of which are preventable.

• Chronic diseases cause 7 in 10 deaths each year in the United States.

• The Affordable Care Act includes a major focus on wellness; this includes funding for programs that educate the public on health and wellness and new rules for employer wellness programs.

• Employers can use the SHOP marketplace or Small Business Health Options Program, a part of the health insurance exchange, to purchase affordable coverage for their workers. This saves employers up to 50% of low to moderate earning workers’ premiums in the form of tax credits.

• Did your health insurance premium go up? The fact is, ObamaCare enacted some consumer protections, including a rate review provision. Under this review insurance companies have to justify rate hikes above 10% to your State and post details online immediately. Nonetheless, many Americans are still seeing their premiums rise at alarming rates. Learn more about ObamaCare insurance premiums.

• ObamaCare is the first step toward true health care reform in the US. The fact is, about 60 percent of all personal bankruptcies in the US are related to medical bills. The health care law helps protect you from medical bankruptcy by ending annual & lifetime limits. Find out more health care facts.

• Other insurance reforms to curb the cost of premiums are already in effect as well. These include a Medical Loss Ratio policy and other accountability measures. Many more protections went into effect in 2014. So far, the average insurance premium has gone down, primarily due to subsidies and the 80/20. Americans saved $1.9 billion due to the new ObamaCare consumer protection provisions in 2013 alone.

• ObamaCare means 21 new taxes. Get the facts on how they will affect you, your family and your business. Get the ObamaCare taxes facts.

• ObamaCare states that “affordable insurance” means paying either no more than 8% of your annual household income for the cheapest health plan offered to you or no more than 9.5% of household income for employee-only coverage if insurance is obtained through an employer. Please note that ObamaCare does not guarantee “affordable insurance.”

• ObamaCare provides lower prescription drug costs for people on Medicare.

• ObamaCare provides free preventive women’s services, including mammograms, as one of the 10 essential benefits covered under every new insurance plan.

• Young, healthy Americans and those making above 400% of the FPL are projected to pay more for insurance, while many others are projected to pay significantly less.

• ObamaCare ensures that there are no out-of-pocket costs to patients receiving mammograms and colonoscopies, which are two of the most widely used forms of preventive health care.

• ObamaCare reforms Medicaid and expands it to over 15 million of our nation’s poorest. That’s 6.1 million less than the last estimate due to States opting-out out of providing coverage, despite 100% federal funding for the first 3 years and 90% thereafter. Learn more about ObamaCare’s Medicaid expansion.

• States will have to spend millions on Medicaid over the next ten years regardless of whether they implement Medicaid Expansion. However, states that do implement ObamaCare’s Medicaid Expansion will reap billions in additional federal dollars.

• As a direct result of Texas opting-out of Medicaid expansion, over a million Texans went without health insurance in 2014. In 2010, 25% of Texans didn’t have access to health insurance. This includes 1,247,300 children. Many of the States who opted out have the highest uninsured rates in America.

• ObamaCare’s new Medicare Value-Based Purchasing Program means hospitals can lose or gain up to 1% of Medicare funding based on a quality vs. quantity system. Hospitals are graded on a number of quality measures related to treatment of patients with heart attacks, heart failures, pneumonia, certain surgical issues, re-admittance rate, as well as patient satisfaction. Learn more about ObamaCare and Medicare.

• ObamaCare’s insurance reform helps to insure millions of Americans each year. 48.6 million Americans went without insurance during all of 2011, compared to 49.9 million in 2010. The rate of uninsured decreased from 16.3% to 15.7%, the biggest percentage drop since 1999, due to the Affordable Care Act.

• ObamaCare mandates that Medicaid payments be raised to the same level Medicare pays doctors. While it varies from state to state, primary care physicians will see an average 73% pay increase. This will make it easier for new Medicaid recipients to find doctors willing to take on Medicaid patients.

• 25 States have opted out of setting up a State-Run Health Insurance Exchange. This leaves the federal taxpayer responsible for providing care for their constituents. 19 are running State Exchanges, while 7 have set up Joint State / Federal Exchanges. Find out more about ObamaCare’s state-run Exchanges.

• ObamaCare makes it illegal for health insurance companies to terminate coverage for any reason other than customer fraud or failure to pay premiums.

• ObamaCare provides $20 billion in tax credits for as many as 4 million small businesses to offset the cost of purchasing insurance on the Health Insurance Exchanges.

• Medicare and Medicaid both help to prevent “price gouging” by hospitals. ObamaCare’s reforms strengthen these protections.

• Only the top 3% of small businesses will have to pay the additional 0.9% ObamaCare Medicare tax increase.

• Only 0.2% of businesses have over 50 full-time equivalent employees and don’t already offer insurance to their full-time workers. Providing these folks with insurance is the only “employer mandate” in ObamaCare.

• Over half of all uninsured Americans are small business owners, employees or their dependents. Learn the truth behind the ObamaCare small business taxes and how they affect America’s biggest job creators.

• Do you want a single payer plan? Starting in 2017, states were able to get a waiver to set up their own approved health care solution under the Affordable Care Act.

• The April 2014 CBO projections expected 5 million Americans to receive Tax Credits to purchase insurance on the Exchanges. See recent CBO projections.

• Due to Tax Credits and up-front assistance, Americans making less than 400% of the Federal Poverty Level (roughly $88k for a family of 4) could see up to a 60% reduction in the cost of health insurance premiums. Unfortunately, the increasingly popular high-deductible health insurance plans have kept many insured people from being able to afford both insurance and healthcare.

• Uninsured Americans cost the American healthcare system an additional $49 billion each year. Only 12% of uninsured families pay their hospital bills in full. This includes families making over $88k a year. These costs affect the rising cost of insurance premiums; ObamaCare helps to reduce this spending drastically by eliminating dollar limits.

• When insurance goes on sale via the health insurance exchanges in 2016, the cost of insurance premiums must be 8% or less of your modified adjusted gross income to be considered affordable.

• ObamaCare allows newly insured Americans to choose any available participating primary care provider, OB-GYN, or pediatrician in their health plan’s network or emergency care outside of the plan’s network without a referral.

• ObamaCare prevents insurance companies from limiting the number of benefits a customer can receive in their lifetime.

• Members of Congress will purchase their health care through the health exchange like the rest of us. Get more facts about the ObamaCare insurance exchange.

• In 2011, ObamaCare helped around 86 million Americans who had previously been subject to co-pays or deductibles to use free preventive services.

• ObamaCare aims to improve community health care centers in an effort improve health care for those who cannot afford private healthcare.

• ObamaCare doesn’t increase the deficit. It is projected to cut the deficit by over a trillion dollars over the next two decades.

• ObamaCare offers countless benefits and protections that have been rolling out since 2010 and continue into 2022. Find out more about the benefits of ObamaCare.

• In 2013, American employers with 25 or less full-time employees could receive tax breaks of up to 35% (25% for non-profits) of the cost of their employees’ insurance premiums. In 2014, it increased to 50% (35% for non-profits).

• Employers with more than 50 full-time equivalent employees must insure their full-time workers or pay a tax (like the current state-run unemployment and worker’s compensation programs).

• ObamaCare won’t cause 650,000 jobs to be lost as some of its detractors claim (this number isn’t even in the CBO report on The Affordable Care Act). The often misrepresented quote stated that part of the job loss ObamaCare might have created is from employees who cut back their hours since they no longer had to rely solely on their jobs for their family’s health care. This has not been documented. In fact, ObamaCare’s projected effect on job growth in Government jobs and Health Care rivals its projected job loss in other markets.

• Although ObamaCare hasn’t resulted in job loss, the “employer mandate” has resulted in a number of full-time workers at large firms having their hours cut back to part-time in order for employers to avoid providing their full-timers with health insurance. On the same note, many larger firms have moved workers from part-time to full-time to provide them with benefits.

• If you or your family chooses not to purchase healthcare through the Online Health Insurance Exchange, you can still buy private insurance, get insurance through your employer, or through Medicare or Medicaid. Those who chose not to purchase insurance will pay an income “penalty” tax to help cover the rest of us. In other words, it is a tax, not a mandate; no one is actually forcing you to have health insurance.

• ObamaCare cuts $716 billion of waste from Medicare and reimbursements to private Medicare Advantage plans and reinvests it into Obama’s health care reform. In other words, $716 billion is saved, and then $716 billion is reinvested back into ObamaCare and Medicare. Doctors and hospitals almost universally agree on this reform.

• 19 million Americans making under 400% of the Federal Poverty Level are estimated to receive tax credits to help pay for the cost of health insurance premiums.

• ObamaCare reduces costs of premiums for millions of families and small businesses and provides billions of dollars in tax relief.

• The healthcare industry, specifically doctors, will be rewarded for quality over quantity.

• The Affordable Care Act allows religious institutions to choose to be exempt from providing controversial contraception and reproductive health services to women. Multiple businesses have also received an exemption after taking the ruling to court.

• The Affordable Health Care Act doesn’t just focus on insurance; it also reforms the parts of the healthcare system that aren’t working or are costing the tax payer money. For example, by focusing on preventive measures instead of just treatment, ObamaCare will save tens of billions of dollars and tens of thousands of lives and dollars.

• The ObamaCare fact is, the average American will save money under ObamaCare. In fact, many Americans are already paying less for health care services.

• ObamaCare cuts the national deficit by over two hundred billion dollars during its first 10 years.

• ObamaCare tries to make it easier for small businesses to provide coverage to workers by offering Tax Credits to employers who enroll their workers in private healthcare plans.

• The Affordable Care Act (ObamaCare) is more than just a website. The ACA contains over a thousand pages of provisions that increase the affordability, quality, and availability of health insurance through consumer protections, regulations, subsidies, taxes, exchanges, reforms, and the expansion of Government programs.

ObamaCare Facts: The years change, but the truth doesn’t.

![]()