Types of Health Insurance Plans

The Types of Health Insurance Plans Sold On and Off of ObamaCare’s Marketplace

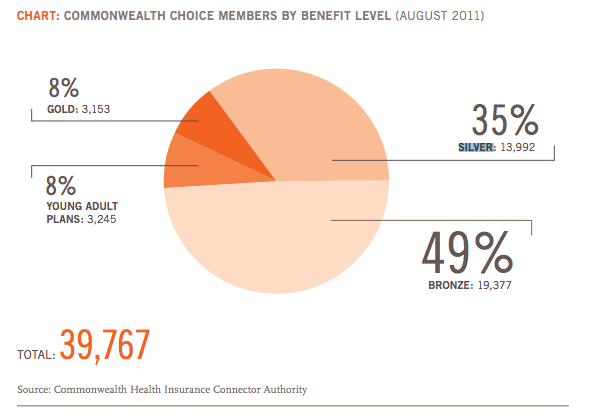

There are four types of health insurance plans available through ObamaCare’s Marketplace. They are Bronze, Silver, Gold, and Platinum health insurance plans.

These Qualified Health Plans represent four tiers of coverage and are sometimes referred to as “metal plans” due to their quality corresponding to the value of their metal types. In other words a “Gold” plan is better than a “Bronze” health insurance plan in terms of cos-sharing.

Aside from the 4 basic plan types, people under 30 and people with hardship exemptions can buy a “catastrophic” health plan through the marketplace. Catastrophic health plans have a low premium but very high out-of-pocket costs.

We get into details on metal plans below, but first let’s cover some things that will help you understand metal plans Bronze, Silver, Gold, and Platinum: how to get them, when to get them, the differences between PPOs and HMOs, HSAs, cost-sharing, getting lower costs, and more.

Make sure to enroll in a health plan during open enrollment. Every health plan type has it’s own open enrollment period. For private coverage inside and outside the marketplace you have from November 15th, 2014 to February 15th, 2015 to shop.How to Get a Health Plan

Consumers looking to obtain private health insurance under ObamaCare have two smart options. During each years annual open enrollment period:

1. Go to HealthCare.Gov and fill out an application. You’ll find out if you qualify for cost assistance and will get to compare all health plans offered on the marketplace in your region. You don’t make a choice until you officially enroll in a plan, so if you start early you are simply seeing health plan options, not making a commitment.

2. Shop for quotes”] outside of the marketplace. Folks can purchase private health plans with the help of a licensed agent, through a broker, or direct from the provider. Most quality agents, brokers, and providers will help you to understand your marketplace options, as well as, your options outside of the marketplace. For instance, an insurer can show you all their plan options, not just their marketplace or non-marketplace plans. Like with the marketplace, you can shop all day without making a commitment.

NOTE: For those who won’t buy private insurance, you can obtain insurance through their employer, or qualify for Government based insurance like Medicaid or Medicare. See types of coverage that will help you avoid the fee for not having health insurance. See enrollment periods for other health plan types here.

Keep reading for tips on how health insurance works to ensure you get the best plan at the best price.

Make Sure You Understand Your Health Insurance Plan

When shopping for a health insurance plan it’s important to understand more than what basic “metal plans” are available. To properly compare plans you’ll have to understand your estimated income, medical needs and costs for next year, the docs you’ll need and drugs you take, and what you can pay in an emergency. You’ll also need to understand things like deductibles, premiums, insurer networks, drug formularies, HMOs, PPOs, HSAs, and other technical health insurance terms that affect what type of coverage you get and how it works.

All marketplace plans have a maximum out-of-pocket cost no more than $6,600 for an individual and $13,200 for a family for 2015 and must provide at least ten essential benefits as part of their covered benefits. When you shop for coverage your focus should be on cost sharing and networks since all plans cover the essentials and protect your wallet in an emergency.

Read our guide to buying health insurance, our guide to comparing health plans, and our guide to how health insurance works to learn more about how technical health insurance terms affect your plan’s benefits and costs. We don’t cover everything on this page, and there is a lot of important ground to cover.

How Health Insurance Works Summary

With our current private health insurance system, you choose a private plan and pay into a private pool with the rest of the members of that plan/insurer network. Then, the insurer barters deals on behalf of you using the power of the single fund to ensure you get the best deal on healthcare. In return, your insurer charges you a premium and a portion of out-of-pocket expenses for covered services up to your maximum. Insurance saves you money on cost-sharing and protects you from bankruptcy in an emergency.

Why Buy Health Insurance?

For the young and healthy, health insurance is a means to protect you in an emergency. For those who need medical services and families who need regular care, health insurance offers cost-sharing options that result in much lower costs than insurance purchased on one’s own. Insurers broker deals with healthcare providers and barter down prices for you, without them your medical bills would be astronomically less affordable.

Some people will get the short end of the health insurance stick, paying in for years more than they take out. Others will take much more than they pay. Such is insurance, like car insurance not needing to use your coverage is a quality problem. Under ObamaCare the less you make, the less you pay for coverage… but you still are responsible for cost-sharing amounts.

Avoiding the Fee For Not Having Coverage

Most Americans will have to obtain a qualifying health plan (“minimum essential coverage“) and maintain coverage throughout the year or face a per-month fee (unless they qualify for an exemption). You don’t have to use the Marketplace to buy insurance, you can obtain insurance through your workplace, get private insurance outside of the exchange, obtain coverage through a Government healthcare program like Medicaid, CHIP, or Medicare, or obtain qualifying insurance other ways. Below we will break down types of health insurance that count as “minimum essential coverage”.

Qualifying Health Plans and Minimum Essential Coverage

You will need a qualifying health plan, known as minimum essential coverage to avoid the fee starting 2014, luckily most common types of health insurance count as minimum essential coverage.

Minimum essential coverage includes the following:

- Employer-sponsored coverage (including COBRA coverage and retiree coverage)

- Coverage purchased in the individual market, including a qualified health plan offered by the Health Insurance Marketplace (also known as an Affordable Insurance Exchange)

- Medicare Part A coverage and Medicare Advantage plans

- Most Medicaid coverage

- Children’s Health Insurance Program (CHIP) coverage

- Certain types of veterans health coverage administered by the Veterans Administration

- TRICARE

- Coverage provided to Peace Corps volunteers

- Coverage under the Non-appropriated Fund Health Benefit Program

- Refugee Medical Assistance supported by the Administration for Children and Families

- Self-funded health coverage offered to students by universities for plan or policy years that begin on or before Dec. 31, 2014 (for later plan or policy years, sponsors of these programs may apply to HHS to be recognized as minimum essential coverage)

- State high-risk pools for plan or policy years that begin on or before Dec. 31, 2014 (for later plan or policy years, sponsors of these programs may apply to HHS to be recognized as minimum essential coverage)

Minimum essential coverage does not include coverage providing only limited benefits, such as coverage only for vision care or dental care, and Medicaid covering only certain benefits such as family planning, workers’ compensation, or disability policies.

Qualified Health Plans on the Health Insurance Marketplace

During open enrollment folks can buy or change health care plans through the Health Insurance Marketplace. The marketplace is simply an online marketplace for buying Federally regulated and subsidized insurance. Only those making less than 400% of the federal poverty level may be eligible for subsidies, but everyone can use the marketplace as a price comparison tool to buy health insurance that meets the qualifications of the Affordable Care Act.

Anyone looking into what types of health insurance plans are available to them should make sure to fill out a marketplace application at HealthCare.Gov (the official Health Insurance Marketplace) and also shop outside the marketplace for quotes. Although different folks will find the best plan in different places, the health insurance marketplace is the only place to receive cost-assistance for Americans making less than 400% of the Federal Poverty Level.

Should I Use the Marketplace to Buy Health Insurance Plans?

If you make less than 400% of the Federal poverty level (and don’t have access to employer-based coverage) than it is a no brainer, using the Health Insurance Marketplace could mean big savings for you and your family. Signing up for the marketplace to see if you qualify for cost assistance in the form of Premium Tax Credits for lower premiums and Cost Sharing Reduction subsidies for lower out-of-pocket costs only takes a few minutes. (Check out our Health Insurance Marketplace Guide for details on signing up). The less you make, the better your chances are of finding the right insurance on the marketplace for you and your family. Let’s take a look at some of the reasons why using the marketplace makes sense.

Cheap Health Insurance: Are Health Care Plans Cheaper on the Marketplace?

Those looking for cheap health insurance will want to check their state’s Health Insurance Marketplace first. In many cases, equivalent healthcare plans sold on the marketplace will have very similar price tags to those sold off of the marketplace. If you don’t qualify for subsidies in some cases buying insurance from a broker or directly from a health insurance company can be your best bet. If you make under 400% of FPL and could qualify for subsidies then it makes sense to purchase your insurance through the marketplace. No matter what you decide to do you can always shop around for quotes. How you obtain health insurance is your choice!

You should use the marketplace if:

- You make between 100% to 400% of the Federal Poverty Level

- You want to see if you qualify for Medicaid

- You want to limit the amount of homework you do. The process of using the marketplace is simple and it walks you through purchasing insurance. In some cases, the best plans are on the marketplace, even for those without cost assistance. Find out how to compare plans like a pro.

You may not want to use the marketplace to buy health insurance plans if:

You make close to or more than 400% of the Federal poverty level. Health insurance companies are charged a fee to sell health plans on the exchange and not all insurers compete. In some states and some regions the marketplace is your best option, in others outside of the marketplace will be. With health insurance, the rule of thumb is shop for quotes during open enrollment until you find the right one for you. If we had to tell folks one method, regardless of income, that will always be the Health Insurance Marketplace.

Other factors to take into consideration:

There are different levels of plans on and off of the exchange. If you and your family will use a lot of medical services you are going to want to focus on benefits, networks, and out-of-pocket costs just as much as you are premiums if not more so. In some instances, it may make sense for you to shop outside of the marketplace. regardless of how you shop you’ll need to understand your family’s needs to find the plan with the best price point for you.

Now let’s talk about the Bronze, Silver, Gold, and Platinum Qualifying Health Plans sold on the exchange and how those metal plans affect costs and coverage.

Types of Health Insurance Plans Sold on the Health Insurance Marketplace

The new Qualified Health Plans sold on the health insurance marketplace are sometimes called “metal plans”. The reason for this is that they are named after different types of metals Bronze, Silver, Gold and Platinum. A Bronze plan is the lowest level of standard qualifying health plan while platinum is the highest. The better the plan, the higher the premium, but the lower the out-of-pocket costs.

All Qualified Health Plans sold on the marketplace can be purchased with subsidies, potentially resulting in lower premium and out-of-pocket costs for you and your family. All plans sold on the marketplace are guaranteed to meet the standards of ObamaCare and include the minimum essential benefits and free preventative services. All cost-sharing is of out of pocket costs. Please see ObamaCare health benefits for services that are covered at no out of pocket charge on all plans.

The same insurer may offer multiple plans within each tier, featuring different combinations of deductibles, co-pays, and other coverage options. But each Bronze plan requires the insurer to pay, on average, at least 60 percent of covered expenses.

ObamaCare Metal Plans

There are four types of Metal plans you can choose from in your state’s Health Insurance Marketplace as well as a catastrophic health plan.

Actuarial value

Before you read this section it is very important that you understand actuarial value. Actuarial value is the average amount a plan will pay for covered services for everyone using the plan, it is not what the plan will pay you specifically. Premiums and costs not covered by your plan don’t factor into determining actuarial value, only costs insurers pay count.

NOTE: Specific percentages below are subject to change each year.

Types of Metal Plans

Each metal plan has a minimum average actuarial value which can be used to tell how good a plan is, what type of subsidies it qualifies you for based on income, and if it provides minimum value.

NOTE: All plans have a maximum out-of-pocket cost no more than $6,350 for an individual and $12,700 for a family and must provide at least ten essential benefits as part of their covered benefits.

1. Bronze plans split covered expenses 60-40 on average.

Bronze plans are the cheapest plans. All employer plans and non-catastrophic marketplace plans must provide at least the value of a bronze plan.

For a Bronze plan with 60% actuarial the insurer will, on average, pay 60% of covered health expenses while the policyholder must come up with the other 40%. In other words, a plan with 60% actuarial value covers 60% of out-of-pocket costs on average for all policyholders, not just you.

Bronze plans have the most basic benefits and most limited networks of doctors and hospitals. The actuarial value reflects this since that percentage is determined by the average expenses your insurer will have.

A Bronze plan is a good choice for those who don’t plan on using many medical services. Many low-income Americans may qualify for free or very low-cost Bronze plans. That being said in many cases a Silver plan will provide better value as Bronze plans won’t qualify for Cost Sharing Reduction subsidies (CSR). You will be getting a low premium in exchange for the fact that you will pay more out-of-pocket and have a more narrow network.

More than 50% of all medical costs are incurred by a very few unfortunate people. Since your deductible will be high and all plans have the same maximum limits on the amount you can pay in a year, most of the costs you pay for a Bronze plan will go to the unfortunate people who get cancer or have a bad accident and reach their cost sharing limit.

2. Silver plans split covered expenses 70-30 on average.

Silver plans are “the marketplace standard” meaning that premium caps are based on the cost of Silver plans. A Silver plan on the marketplace can’t cost more than 9.5% of your income if you make less than 400% of the Federal Poverty Level (FPL) due to Advanced Premium Tax Credits. The less you make, the lower your premium cap is.

Like Bronze Plans, the actual value of Silver plans can range. They simply must have at least a 70% actuarial value.

Silver plans are the only plans eligible for Cost Sharing Reduction subsidies (CSR)

A Silver level plan is a good choice for individuals and families who have access to marketplace subsidies, especially CSR subsidies. If you make below 250% FPL the chances you won’t find your best plan to be a marketplace Silver plan is slim. Go with an HMO when in doubt, you’ll need referrals, but this will be your cheapest option. Like with any other plan, make sure your medical needs are covered in-network.

3. Gold plans split covered expenses 80-20 on average.

Gold plans cost a little more, but the lower deductibles and better out-of-pocket cost-sharing coverage means that families won’t have to worry about health care costs stopping them from their families getting the care they need. Even if your premium is capped you’ll have to pay more to make up the difference if you want a gold plan.

Gold plans are smart for those who don’t get CSR subsidies and need the low deductible and robust networks some gold plans provide.

4. Platinum plans split covered expenses 90-10 on average.

Platinum plans have the lowest out-of-pocket costs and the highest monthly premiums. This is the right choice for anyone who wants “the best coverage” for them and their family and is a smart buy for those who are sick or who have dependents who are likely to use costly health services. Even if your premium is capped you’ll have to pay more to make up the difference if you want a Platinum plan.

Platinum plans only make sense if your total medical spending will exceed the amount you will pay in premiums or if you need very specific treatments.

5. Catastrophic Coverage

Catastrophic coverage is available to some people under 30 and those with hardship exemptions. Catastrophic plans only cover the bare minimum health benefits and have a very limited network. You’ll have high out-of-pocket costs and a high deductible but this type of plan will protect you in a worst-case scenario and will ensure that you avoid paying the shared responsibly fee for not having health coverage. If you get a catastrophic plan you should assume most of your medical costs will be out-of-pocket.

NOTE: You can also get covered through Medicaid on the marketplace. As a rule of thumb if you make less than 250% FPL a Silver plan is the way to go, if you make less than 138% and your state expanded Medicaid then you’ll go with Medicaid.

The Silver Standard: How Premium Caps Work

ObamaCare caps the amount of your income you have to spend on health insurance based on your income. If your premiums exceed a certain percent of your income, you’ll be eligible for “premium subsidies” to help reduce your monthly premium costs. For example, if your income is between 300 percent and 400 percent of the federal poverty level, you can’t spend more than 9.5 percent of your income on premiums. So, if your premiums can cost only a fixed percent of your income, why wouldn’t you just go straight for a platinum-level plan?

The premium caps are based on the second lowest cost Silver health plan in your area. According to the Congressional Budget Office, subsidy levels in each market are tied to the premiums of the second cheapest silver plan. So, if you go with the second cheapest silver-level plan available in your market and you make between 300 percent and 400 percent of the federal poverty level, you won’t have to spend more than 9.5 percent of your income on premiums. However, if you opt for a gold or platinum plan, you’ll have to make up the difference in costs between that plan and the silver plan.

Silver Plans and Cost Sharing Reduction Subsidies

Cost Sharing Reduction Subsidies (CSR) are also only offered on Silver plans. Silver plans for this reason almost always provide the best value for folks with subsidies. Only folks without access to cost assistance or with lots of specific medical needs will want to look at other plans as a rule of thumb.

Buying Health Plans: Group Health Plans

Employers can use the exchange to shop for group health plans. Group health plans also use the metal system. Group health plans will not always be the same as individual and family health plans. Employers will use a section of the marketplace called the SHOP to purchase group health care plans for employees.

Medicare, Medicaid and CHIP Health Plans on the Marketplace

When you apply for the marketplace you will be made aware if you or a family member qualifies for cost assisted plans like Medicare, Medicaid or CHIP.

Buying Health Plans: Catastrophic Health Plans

Aside from the four metal plans sold on the health insurance exchange young people making under a certain amount of the Federal poverty level may be eligible for bare-bones catastrophic health plans. These plans have low actuarial value, a high deductible, and limited network but the monthly rates are very low. When you sign up for the marketplace you will be made aware if you or a family member qualifies for a catastrophic health plan.

Please be aware that while catastrophic plans are offered to some low-income young people, people with hardship exemptions, and those who cannot afford Bronze Plans, tax subsidies cannot be used to reduce its premiums.

Buying Health Plans: What is a Qualified Health Plan?

Starting in 2014, an insurance plan that is certified by the Health Insurance Marketplace, provides essential health benefits, follows established limits on cost-sharing (like deductibles, copayments, and out-of-pocket maximum amounts), and meets other requirements. A qualified health plan will have a certification by each Marketplace in which it is sold.

Qualified Health Plans: What is Actuarial Value

The four new metal health plans each have their own unique benefits and “actuarial value.” Actuarial value refers to the average amount of insurance expenses that would be paid for by the plan. The higher the actuarial value of a plan, the lower the out-of-pocket costs for the plan member. With respect to the plan names, the more expensive the metal, the higher the actuarial value. For example, a Platinum Plan covers 90% of covered medical expenses while a Bronze Plan only covers 60%.

Actuarial value is the number of costs your insurance company covers on average, not an exact number that you will pay. That being said, as a rule of thumb we can assume the higher the actuarial value a plan has the less cost-sharing / out-of-pocket costs you will be responsible for.

Insurance Plan Types and Medical Savings Accounts

Beyond the types of ObamaCare metal plans offered on the marketplace, it’s important to understand the different types of plans each metal can be and how savings accounts can be paired with them.

There are four types of health insurance plans: Health Maintenance Organizations (HMOs), Participating Provider Options (PPOs), Exclusive Provider Organizations (EPOs), and Point of Service (POS) Plans. Consumer Directed Health Plans (CDHPs) can be paired with Health Savings Accounts (HSAs), Flexible Spending Accounts (FSAs), or, on some grandfathered plans, Archer Medical Savings Accounts (MSAs); allowing employers, employees, or self-employed individuals to contribute tax-free dollars towards their medical expenses.

FACT: A PPO doesn’t require that you get a referral from a doctor before getting treatment from out-of-network like an HMO. Regardless of your plan, if you get services out of network you will have to pay more for them.

Insurance Plan Types

HMO Health Maintenance Organization plans often offer the best pricing & the least flexibility. They serve up lower prices by limiting your care to the doctors, clinics & hospitals within the HMO’s network. HMOs require you to choose a primary care physician (PCP) who coordinates your health care & provides you referrals before you are able to get treatment from other network providers or specialists. If you go out outside the network your services won’t be covered except treatment for medical emergency.

PPO Preferred Provider Organization plans offer networks of doctors, hospitals & clinics that are deemed “preferred providers.” Go to them for treatment & you get lower rates negotiated by the insurance company. However, PPOs provide more flexibility than HMOs because they allow you to seek care outside the network, but doing so will likely cost you more in deductibles & co-pays. Unlike HMOs, PPOs don’t require you get a doctor referral before you see a specialist. Many of the plans, do require prior approval for certain expensive services.

POS Point of Service plans can reduce your out-of-pocket costs by choosing providers in the network — or you can seek services outside the network and pay more. It’s your choice. The exact definition varies from one state to another. Many POS plans are more like a HMO in that they require you to choose a PCP and get referrals for specialist care. Some even cover higher costs if your PCP decides to refer you to an out of network specialist.

EPO Exclusive Provider Organizations plans offer a managed care plan where services are covered only if you go to doctors, specialists, or hospitals in the plan’s network (except in an emergency).

ADVICE: Consider the tax benefits of using one of the health savings accounts below. Make sure you understand limits on the accounts & periods in which you must use the funds if applicable.

Types of Health Savings Accounts

FSA Flexible Spending Account. FSAs are set up through an employer plan & they allow you to set aside pre-tax dollars for certain health and dependent-care needs. For example, the money can be used to pay for deductibles, prescription co-pays and other treatments not covered by your insurance. A big downside for many: whatever you don’t use by the end of your company’s benefits year will be forfeited. Check with your employer’s Human Resources department for specifics on their FSA. They can provide a list of FSA-qualified costs that you can purchase directly or be reimbursed for. A few common FSA-qualified costs include:

- Copays for medical treatments & doctor visits,

- Hospital & doctor fees for medical tests & services (for example, X-rays & cancer screenings).

- Physical Rehabilitation.

- Dental & Orthodontic expenses (like cleanings, fillings, or braces).

- Inpatient treatment for alcohol or drug addiction

- Vaccines (immunizations) & flu shots.

HSA Health Savings Account. HSAs are tax-preferred savings accounts available to those enrolled in health plans. Employers & employees are allowed to contribute to them. HSAs allow you to set aside tax-free dollars to pay for routine, out-of-pocket health expenses. You also pay no federal taxes on interest earned by your HSA as long as you use the money to pay for eligible medical expenses, as defined by the IRS. Dental & vision are included. Unlike an FSA, HSA funds roll over annually & accumulate, even if an employee changes jobs. The accumulated funds can be removed for non-eligible expenses, but then will be subject Federal Income Tax and 20% penalty. Once an individual qualifies for Medicare these accumulated funds can still be used tax free for medical expenses Medicare doesn’t cover or can be used like an IRA or 401k (however you’ll still have to pay taxes on this, but no penalty). In addition, should a person decide they no longer want to use a high-deductible health plan, these funds can usually be rolled into an IRA retirement account without facing taxes.

FACT: Only someone who chooses a high-deductible or catastrophic health insurance plan can take advantage of an HSA.

MSA “Archer” Medical Savings Account. The Archer MSA was intended to be used by self-employed individuals & small businesses with fewer than 50 employees. The plan is entirely self-directed, including its initial setup & compliance with the plan thresholds. It works very closely to HSAs and have been replaced by HSAs since 2007, however some grandfathered plans may still use MSAs that have been “left open”.

How to Sign Up For The Health Insurance Marketplace

There are four ways to sign up for your State’s Health Insurance Marketplace.

1) Find your State’s marketplace website.

2) Get in-person help. You can find in-person help by going to LocalHelp.Healthcare.gov.

3) Call the 24/7 marketplace helpline 1-800-318-2596.

4) Mail-in a paper application. bit.ly/PaperApplication. (read these instructions first)

Compare and Buy Health Insurance Plans Now

You can go and compare health insurance plans now by finding your State’s Health Insurance Marketplace or you can find a broker or provider who you think is right for you, your family or your business. We have plenty more information on buying health insurance and comparing health plans on our site. Make sure to sign up for our mailing list for updates on shopping for health plans.

Types of Obamacare Health Care Plans

![]()