ObamaCare Lawsuits

Updates on ObamaCare Related Lawsuits: Subsidies, NFIB, Hobby Lobby, John Boehner, and More.

Get updates on ObamaCare related lawsuits and find out how a series of lawsuits targeting ObamaCare’s key provisions have shaped the health care law.

Below is a breakdown of each lawsuit against ObamaCare (the Affordable Care Act) and its outcome. Please follow the links on this page for detailed discussions on each lawsuit and the part of the law they affect.

Although it tackles it from an investment angle, this video from 2013 does a good job of giving an overview of the intentions of different lawsuits against the ACA.Quick Summary of Important ObamaCare Lawsuits

Although there have been a number of lawsuits focused on the ACA, there are only a few important ones that made it to the Supreme Court and affected the way the Affordable Care Act works. Below is a list of the most important lawsuits and their impact on the Affordable Care Act.

The Ongoing District Court ruling that found ObamaCare Unconstitutional – This is an ongoing lawsuit. A Texas Federal District Court judge found the ACA unconstitutional due to the mandate’s fee being removed by Congress. Right now the lawsuit is expected to go into appeals courts. If appeals are no successful the entire ACA could be struck down in court. You can read more about the ongoing suit on our page titled “Trump’s Justice Department Supports District Court Ruling that ObamaCare is Unconstitutional.”

2015 King V Burwell – This lawsuit argued that subsidies issued by the IRS on behalf of HealthCare.Gov were illegal because the law’s language made it sound as though only states that created their own exchanges could issue tax credits. The courts ruled that the intentions of the law were clear, and the IRS could issue tax credits for states whether they created an exchange or used the federal exchange at HealthCare.Gov.

2014 Burwell V Hobby Lobby (and other contraceptive lawsuits) – This lawsuit, and a few others, all argued that employers shouldn’t be forced to provide coverage that included contraception. The courts agreed, and now a third party provides contraception coverage at no additional charge to those whose private employers are exempt for the mandate for religious reasons (houses of worship and other institutions were already exempt).

2012 NFIB V Sebelius – This lawsuit challenged ObamaCare’s requirement to have insurance and the expansion of Medicaid on a state level. The ruling allowed states to opt-out of expanding Medicaid without losing current federal funding, but confirmed that the individual mandate’s requirement to buy insurance was officially tax (and therefore legal).

Arguably the law’s most important provisions in regards to expanding coverage are subsidies, Medicaid expansion, the employer mandate, and the individual mandate. These provisions are the glue that holds the rest of the law together, at this point all but the employer mandate have made their way to the Supreme Court and have been upheld to some extent.

Aside from the above, there are other lawsuits, which didn’t reach the Supreme Court. We discuss those and the above cases in more detail below.

This video from before the King V Burwell ruling discusses the then upcoming subsidy lawsuits.ObamaCare Origination Clause Lawsuit

On Oct 26, 2015 the Pacific Legal Foundation filed a petition stating that ObamaCare violates the Constitution’s Origination Clause which requires tax-raising bills to originate in the House of Representatives. At the center of the suit is a claim that the individual and employer mandates are a vehicle from raising revenue and that they were not part of the original bill passed by the house. You can learn more about the latest ObamaCare lawsuit here.

ObamaCare Subsidy Lawsuits: Subsidies For States Who Didn’t Set up Their Own Marketplace

The ObamaCare subsidies lawsuits were a series of different lawsuits against the legality of subsidies. The subsidy lawsuits include King v. Burwell, Halbig v. Burwell, Pruitt v. Burwell, and to some extent Indiana v. IRS. All suits were originally titled “v. Sebelius” until Kathleen Sebelius was replaced by Sylvia Mathews Burwell as United States Secretary of Health and Human Services (HHS). The outcome of these lawsuits decided the legality of subsidies in 36 states that had deferred their state based marketplaces to the federal government HealthCare.Gov.

The ruling against King in King V Burwell solidified the fate of all these lawsuits when the Supreme Court declared subsidies issued by the IRS on behalf of HealthCare.Gov legal, and rules that both state and federal marketplaces were to be considered the same under the law.

FACT: Although the main focus of the lawsuits was on the premium tax credit, other aspects of the law could have been in jeopardy with a ruling against subsidies. These included: tax credits for employers, the “mandate” for large employers to provide coverage to employees, and cost sharing reduction subsidies.

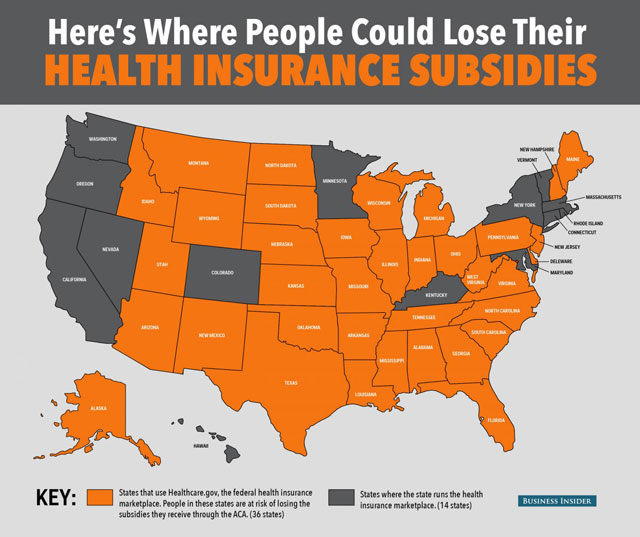

This map from businessinsdier.com shows the 36 states where people could have lost their health insurance subsidies due to the ObamaCare subsidy lawsuits.

ObamaCare Subsidies Lawsuits Overview

The subsidy lawsuits all shared the same basic challenge: that subsidies are illegal unless a state has set up it’s own health insurance marketplace. This claim was based on the specific wording of the law, which says subsidies are for health coverage obtained on an “Exchange established by the State under section 1311.” The law does not mention subsidies for health insurance if a state doesn’t set up a marketplace since, at the time it was written, it was assumed that most states would establish their own exchanges (although the law clearly also mentions what happens when the state defers it’s marketplace to the Federal government or sets up a partnership exchange). The IRS later clarified the subsidy rule stating that it applied to the federal marketplaces as well. Lawsuits also charge that the IRS did not have the authority to do this, and that the law should be interpreted as written. This was also addressed in King V Burwell as the Supreme Court affirmed the IRS ruling.

ObamaCare Subsidies Lawsuit: Intentions Vs. Execution

The intention of the law was that states would set up their own marketplaces, and that subsidies would be available to those who shopped on the marketplaces (be they state or federal or joint). The law didn’t foresee the majority of state deferring setting up and running their marketplaces to the federal government (healthcare.gov is a federal marketplace). The states that deferred their marketplaces did so based on the idea that subsidies would be available through the federal website. These numbered 36 states, since Oregon and Nevada now use the federal website, and included all Republican led states except Idaho.

We will discuss the cases of King, Pruitt, and Halbig and Halbig v. Burwell below. Since the arguments are the same in all cases, we won’t repeat it in each instance on this page.

King v. Burwell Subsidy Lawsuit 2014

King v. Burwell received an important ruling in United States Court of Appeals Fourth Circuit in Richmond. It was similar of the Halbig v. Sebelius case. The wording of the part of the law that concerned subsidies, and the difference between a state exchange and a federal exchange were the primary points in question.

Part of the law in question: Marketplace Cost Subsidies, Section 36B

Outcome: The three-judge panel of the United States Court of Appeals for the Fourth Circuit ruled unanimously that the ambiguity in the statute’s language meant that the subsidies could be given to both those who signed up using state exchanges and those who used federal exchanges.

On November 7, 2014, the Supreme Court granted certiorari in the case. Certiorari means that a higher court reviews the decision of a lower court, The case went to the United States Supreme Court. The case was argued March 4, 2015 and decided June 25, 2015. Chief Justice Roberts delivered the opinion of the Court in which Justices Kennedy, Ginsburg, Sotomayor, and Kagan joined. The judgement of the United States Court of Appeals for the Fourth Circuit was Affirmed. Justice Scalla wrote the dissenting opinion, and was joined in dissent by Justices Thomas and Alto.

Read the Supreme Court Ruling on King V Burwell here.

Read the Fourth Circuit’s ruling here.

Halbig v. Burwell Lawsuit 2014

Halbig v. Burwell was a lawsuit that charged that the Affordable Care Act only made subsidies available to individuals in states that had set up their own health insurance exchanges (marketplaces). Since 36 states exchanges were run by the federal government, the majority of people in the US who are using health insurance subsidies could lose them if Halbig won.

The Affordable Care Act authorizes federal subsidies for health coverage obtained on an “Exchange established by the State under section 1311.” The law should have been written to include all of the exchanges, including the exchanges established by the federal government in 34 states (now 36) across the country. At the time it was written, legislators assumed states would set up their own marketplaces.

Part of the law in question: Marketplace Cost Subsidies

Outcome: On November 7, 2014, despite the pendency of re-hearing en banc in Halbig and the lack of a circuit split, the Supreme Court agreed to review King. In light of that, the D.C. Circuit issued an order on November 12 removing Halbig from the oral argument calendar and holding the case in abeyance pending disposition of King by the Supreme Court. Following the Supreme Court’s ruling in King on June 25, 2015 rejecting the challenge to the ACA, the plaintiffs in Halbig voluntarily moved to dismiss their case. On July 9, 2015, the D.C. Circuit granted the plaintiffs’ motion and dismissed the Halbig case.

Pruitt v. Burwell Subsidy Lawsuit 2014

Pruitt v. Burwell, a case brought by Oklahoma attorney general Scott Pruitt, relies on the same argument used against subsidies in the Halbig and King cases.

Part of the law in question: Marketplace Cost Subsidies

Outcome: On September 9th 2014 subsidies were ruled against by Pruitt v. Burwell.

IRS v. Indiana Employer Mandate Lawsuit 2014

IRS v. Indiana is tied to the subsidies lawsuits, but tackles a different subject, the legality of the employer mandate. The legality of the employer mandate is tied to the subsidy lawsuits since the lawsuit takes issue with the IRS’s authority to clarify rules pertaining to the Affordable Care Act.

Indiana v. IRS the state of Indiana and multiple Indiana school districts sued the IRS claiming that the employer mandate should not apply to schools or local governments. The IRS argued that the plaintiffs did not have standing to sue, but that argument was rejected and Judge William T. Lawrence in the U.S. District Court for the Southern District of Indiana ruled that the case could proceed. Oral arguments occurred in October 2014 but a ruling has not been issued.

Boehner’s Obamacare Lawsuit July 2014: Employer Mandate Delay

House Republicans, advocated for by John Boehner, attempted to sue the President over delaying the “employer mandate”. The irony of this lawsuit is that one of the biggest gripes Republicans have with the ACA is the employer mandate. The president used executive action to delay the mandate, which caused the controversy.

The employer mandate, the part of ObamaCare law that says employers must provide health coverage, has been put off twice, once from 2014 to 2015, and then again to 2016.

House Republicans have taken issue with the administration for not moving forward with the law as it was written. Democrats saw the lawsuit as a political move meant to distract the people.

The “Boehner lawsuit” had to navigate around the many obstacles the Supreme Court has previously put in the way of the legislative branch suing the executive branch.

UPDATE 9/08/15: A 43-page decision was written by the US District Court for DC that supported the right of the House of Representatives to sue the President. The Obama administration will immediately appeal the decision.

According to theHill.com, “The court ruled that Boehner can challenge the Obama administration for its use of executive power in spending “billions of unappropriated dollars” to support the healthcare law.

House Republicans have argued that the Obama administration illegally overstepped its powers when it began paying $175 billion to insurance companies with money that was requested — but never approved — by Congress.

Instead, the administration began making its own payments into a “cost-sharing” program that helps cover insurance companies’ costs of covering the newly insured.”

Part of the law in question: The Employer mandate.

Outcome: Hasn’t been determined yet. The lawsuit was filed on November 24, 2014. You can learn more about the Boehner lawsuit here and here.

Senator Ron Johnson ObamaCare Lawsuit 2014

In January 2014 Senator Ron Johnson (R-Wis) filed a lawsuit attempting to block the federal government from helping to pay insurance costs of members of Congress and their staffs.

The federal government pays about 72% of the cost of the various health plans available to federal employees or 75% of the cost of the chosen plan, whichever is less. Private employers on average pay more than 80% of the cost of health benefits.

Part of the law in questions: Marketplace Insurance

Outcome: A three-judge panel of the Federal Court of Appeals for the 7th district rejected the lawsuit in April 2015.

ObamaCare Hobby Lobby Lawsuit 2013-2014: Contraception Mandate

ObamaCare Hobby Lobby Lawsuit 2013-2014: Contraception Mandate

Under the law for-profit employers who offer health coverage must offer insurance benefits for birth control and other reproductive health services without a co-pay. A number of companies equate some of the covered drugs, such as the Plan B contraception (“morning-after pill”) and intrauterine devices or IUDs, which are used by an estimated 2 million American women, as causing abortion . Abortion is against the religious beliefs of some religions, and thus businesses owned by those who believe that, don’t feel they should be forced to “pay for abortions”. Opponents believe that businesses should not be able to force their beliefs on their employees.

ObamaCare Supreme Court Ruling on Hobby Lobby 2013

ObamaCare won the first battle in the Supreme Court battle between Hobby Lobby and ObamaCare. On December 26th, 2013 Supreme Court Justice Sonia Sotomayor, who is in charge of hearing emergency appeals for the United States Tenth Circuit, refused Hobby Lobby appeal. The chain had to comply with the law until the decision reached the Federal Court.

ObamaCare Supreme Court Ruling on Hobby Lobby 2014

On June 30, 2014 the Supreme Court ruled that Hobby Lobby did not have to provide contraception coverage. Since they still had to provide minimum coverage, which includes everything required by law, except contraception, the outcome was that the Exchange itself would provide the contraceptive part of the employees’ health care. This ruling will likely have the same outcome for other for-profit businesses and help to widen the “narrowly written religious exemption” that was already in place.

Part of the law in question: Employers Role in Health Insurance and Religious Rights in HealthCare

Outcome: Employers can choose not to cover certain types of contraceptive health services on religious grounds by obtaining an exemption. In most cases, if an employer obtains an exemption, employees who are offered a health plan through the employer also have access to free contraceptive coverage offered through a third party.

ObamaCare NFIB Lawsuit 2012: Medicaid Expansion and State Exchanges

Is it constitutionally permissible to require millions of people to purchase health coverage to stabilize our national health-care market? Is it coercive to deploy the federal government’s huge Medicaid leverage (federal funding) to induce states to expand coverage? Can the federal government require a mandate to buy insurance or pay a fee? These were the questions at the root of the NFIB V Sebelius lawsuit.

The answer to these questions, as decided by the Supreme Court were that the mandate was actually a tax, and therefore legal. However, as a big blow to the law as intended, it was found that the law could not require states to expand Medicaid or lose Medicaid funding. So Medicaid expansion was made optional. This allowed many states to refuse to expand coverage despite full federal funding of not only the base Medicaid program, but the expansion of the program as well.

Part of the law in question: The Individual Mandate, Medicaid Expansion, and State Exchanges

Outcome: Subsidies are a tax, Medicaid Expansion is optional, and States don’t have to set up an exchange to get funding.

See a breakdown of the outcome of NFIB V Sebelius from the Kaiser Family Foundation here.

Repeal Attempts and Lawsuits and More

Some of the ObamaCare related lawsuits bring up important questions about religious freedom and the responsibilities of employers and the government in regard to healthcare, while others are simply thinly veiled repeal attempts meant to help take down the law piece by piece. Keep checking back for the latest ObamaCare lawsuits, and how they have affected the law.

ObamaCare Related Lawsuits

![]()