Short Term Health Insurance Vs. ObamaCare

Understanding Short Term Health Insurance Under the Affordable Care Act

We explain short term health insurance and how it is different than major medical coverage purchased on the marketplace during open enrollment under the Affordable Care Act (ObamaCare).

Short term health insurance is typically a limited benefit health insurance. Short term doesn’t follow the new rules of the Affordable care Act and don’t qualify for cost assistance. Furthermore, you’ll owe the fee even if you get short term health insurance in states that still have a fee (as limited benefited insurance that doesn’t comply with the ACA won’t protect you from the fee).

With that said, short term can be a great choice for filling in the gaps between major medical (such as when switching jobs), and it is also a reasonable alternative to some shoppers who want only a bare bones catastrophic coverage option and doesn’t want to fund an HSA (short term plans also don’t qualify for an HSA).

In other words, there is nothing wrong with short term health insurance, but it is a product that only makes sense in some situations at the moment.

What is Short Term Health Insurance

Short term health insurance is a temporary health option that is meant to provide coverage in between other insurance options. Its benefits usually insure against catastrophe. It is coverage that protects against accidents or major illnesses. This is different from comprehensive coverage, which typically includes preventive care, physicals, immunizations, and sometimes dental or vision care.

What Do I Need to Know About Short Term Health Coverage Under the ACA?

Its important to understand the following key points about short term coverage under the Affordable Care Act (ACA) also known as “ObamaCare.”

- Short term health plans are non-renewable, meaning your insurer doesn’t have to renew your plan.

- Short term health plans don’t have to cover pre-existing conditions; you can be denied coverage for a pre-existing condition.

- Short term coverage doesn’t prevent you from being denied payment or dropped when you are sick if you didn’t disclose your preexisting medical condition at the time of application.

- Short term health plans aren’t guaranteed issue; you can be denied coverage for non-health reasons.

- Short term health plans also lack many other protections offered by the Affordable Care Act.

The Differences Between Short Term Health Insurance and Minimum Essential ACA-Compliant Insurance Under the Affordable Care Act

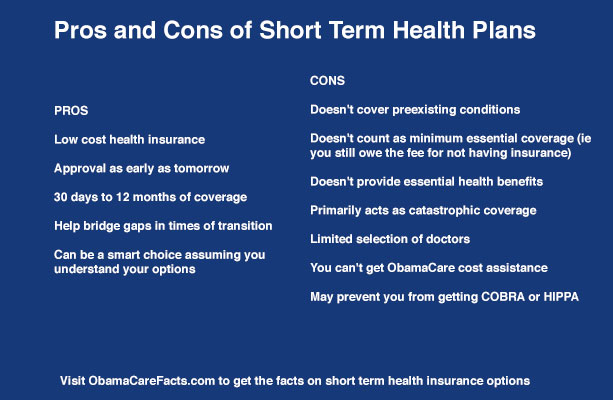

Here is a quick list of differences between Short Term Health Insurance and Minimum Essential ACA-Compliant Insurance Under the Affordable Care Act:

Short term health insurance:

- Low cost health insurance

- Approval as early as tomorrow

- 30 days to 12 months of coverage

- Help bridge gaps in times of transition

- Doesn’t cover preexisting conditions

- Doesn’t count as minimum essential coverage (i.e., you still owe the fee for not having insurance)

- Doesn’t provide essential health benefits of ObamaCare

- Primarily acts as catastrophic coverage

- Limited selection of doctors

- You can’t get ObamaCare cost assistance with a short term health insurance plan

- Having this coverage may prevent you from getting COBRA or HIPPA

Minimum Essential Coverage (obtain through work, the health insurance marketplace, Medicaid, or Medicare):

- Generally higher premiums than short term (Medicaid and plans with Marketplace cost assistance are the exception)

- Only offered during open enrollment

- 1 year contracts only (special rules apply for Medicaid and changing plans under Medicare)

- Cover spreexisting conditions

- Counts as minimum essential coverage (i.e., you won’t owe the fee for not having insurance)

- Provides the essential health benefits of ObamaCare

- Meant to be comprehensive coveage

- Selection of doctors and networks depends on the plan

- You can get ObamaCare cost assistance on marketplace plans

The bottomline: Short term and major medical are two very different health insurance products. Which one is right for you depends purely on your situation and the current federal rules for health insurance. For open enrollment 2018, most customers will want to shop for minimum essential coverage. However, if rules change under Trump, short term health insurance could make more sense for more shoppers. We will keep you informed if and when things change.