ObamaCare Calculator: Subsidies, Tax Credits, Cost Assistance

How to Calculate Tax Credits and Subsidies for Health Insurance Sold on the Health Insurance Marketplace

Our ObamaCare calculator will help you calculate tax credits and subsidies for health insurance sold on the Health Insurance Marketplace. Use this quick health insurance tax credit guide to help you understand the process. Or, just use one of the ObamaCare subsidy calculators found below for a quick estimate on marketplace cost assistance.

Cost assistance for individuals, families, and businesses is calculated automatically when you fill out an application on the Health Insurance Marketplace. However, it’s good to understand how the process works yourself.

Use the tools below to find out if you qualify for Tax Credits for lower premiums, Cost-Sharing subsidies for reduced out-of-pocket costs, or Medicaid on your state’s Health Insurance Marketplace.

NOTE: We’ve created a page on Modified Adjusted Gross Income (MAGI) to help you understand the type of income used for cost assistance on the Marketplace. You can also see below for how MAGI works and how to apply that to tax credits.

How to Calculate Premium Tax Credits and Subsidies

Below we tell you everything you need to know about how cost assistance is calculated for the Affordable Care Act (ObamaCare). Before we get to that, we have provided you with a few different calculator options which can help you calculate how much assistance you qualify for.

Here are a few useful ways to calculate marketplace tax credits and out-of-pocket cost-sharing subsidies:

- Use the subsidy calculator below or try one of the other subsidy calculators we provide. (Quick and easy)

- Do it by hand. Below we give you the formula you need to calculate your cost assistance by hand. (Long but accurate to your exact situation)

- Apply at the Health Insurance Marketplace (HealthCare.Gov) or use the HealthCare.Gov cost estimator. (The official process)

Any of those methods will give you a generally correct answer, but be aware that your final totals will be based on your income, family size, and the cost of the plan you choose.

NOTE: Below are a few helpful tools and walkthroughs for estimating assistance. In most cases, people won’t know the exact amount of assistance they qualify for until the year is done. This is because there is a broad range of factors that affect assistance, including income earned during the upcoming year that hasn’t happened yet! On that note, please familiarize yourself with tax credit repayment limits so you can understand your responsibilities if your income changes during the year.

ObamaCare Calculator: Calculating Subsidies

Use the “ObamaCare” subsidy calculator below to get an idea of what kind of cost assistance you are eligible for under the Affordable Care Act when you buy a health insurance marketplace plan.

NOTES: The calculator below provides estimates only; you won’t know your exact credit until you apply for the Marketplace. Also, the calculator may suggest plans depending on your region and may give the option to contact a broker who can help you better understand your options. Keep in mind you can only buy marketplace plans that qualify for cost assistance during open enrollment (whether you use the marketplace yourself or get assistance from a broker).

Why Use Our ObamaCare Tax Credit Calculator? You can always find out exactly how much assistance you qualify for based on income after you enroll in HealthCare.Gov or your state marketplace and put in your income information. The website will even show you your premium and out-of-pocket costs after assistance. With that in mind, this page is useful because we can help you to find out roughly how much assistance you’ll get without having to fill out the official form, and we can also give you tips on how assistance works!

Other Subsidy Calculators

You can also use these other ObamaCareFacts.com-approved ObamaCare Cost Assistance Calculators to get an idea of what kind of cost assistance you are eligible for.

- Use the Kaiser Calculator. This will give you an idea of what type of cost assistance you qualify for and what a plan will cost after cost assistance in your region.

- Use the ehealthinsurance.com subsidy calculator. This tool will help you see if you qualify for cost assistance and will give you the option to shop for quotes outside of the marketplace.

Please note that the ObamaCare Cost Calculators use modified adjusted gross income and not total gross income or net income to figure out cost assistance and insurance cost estimates. Estimates tend to be based on the cheapest-cost Silver plan in your region.

Also note that as little as a $1 difference in income can exclude you from receiving a subsidy.

Learn more about how to buy health insurance or get more details on Health Insurance Marketplace subsidies.

Some Quick Tips on ObamaCare’s Cost Assistance Subsidies

Before you start shopping for health insurance, make sure you understand the following quick tips about cost assistance under the Affordable Care Act:

- You’ll need to understand the Federal Poverty Guidelines, commonly called Federal Poverty Level (FPL), to know what type of cost assistance you are eligible for in the upcoming year. You can find the current Federal Poverty Guidelines here.

- Cost assistance and exemptions are based on your Modified Adjusted Gross Income (MAGI) for the year in which you get covered (you won’t know exactly what you’ll make, so you’ll have to project it based on last year and what you know about the upcoming year).

- MAGI is the income of your household (you and anyone you claim as a dependent) after deductions.

- As noted, cost assistance is initially based on your projected income for the upcoming year. However, it is later adjusted for your actual MAGI income at the end of the year. If you are unsure of your income, consider taking only partial tax credits upfront to avoid repayment.

- Cost assistance is only available through the Health Insurance Marketplace.

- The marketplace is only open during open enrollment! Open enrollment is the only time of year you can get health insurance in the individual and family market without qualifying for special enrollment.

- All non-exempt Americans can use the marketplace to see if they qualify for cost assistance. However, there are a few exceptions. If you are eligible for Medicare, you won’t use the marketplace. If you have access to qualifying employer-based insurance, you can use the marketplace but can’t get cost assistance. If your state didn’t expand Medicaid, there may be other eligibility requirements for Medicaid in addition to income.

- Cost assistance includes Advanced Premium Tax Credits for those making between 100% and 400% FPL, Cost Sharing Reduction subsidies for those making between 100%-250% FPL, and Medicaid for those making less than 138% FPL and living in states that expanded Medicaid.

- The 400% Federal Poverty Level (FPL) Subsidy Cliff was temporarily removed by the American Rescue Plan and extended through 2025 by the Inflation Reduction Act. Through 2025, if you make over 400% FPL ($58,320 for an individual or $120,000 for a family of 4 for 2024, for example), tax credits gradually decrease as your taxable income rises.

- Cost Sharing Reduction subsidies are only offered on Silver plans.

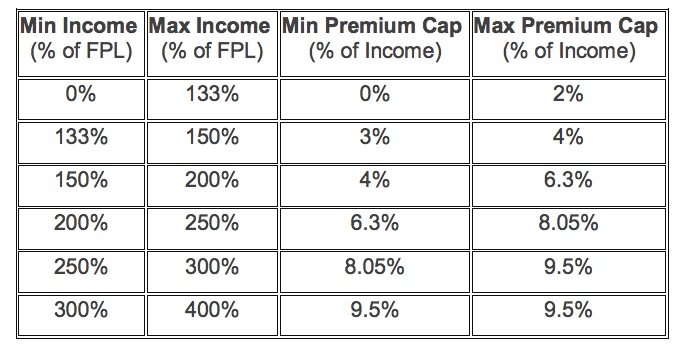

- Tax Credits cap the maximum premium you can pay. This amount falls between roughly 2%-9.5% of your MAGI for the second lowest cost Silver plan (true for both individual and family plans regardless of family size). The lowest cost Bronze plan will typically be cheaper, but remember, only Silver plans qualify for cost-sharing reduction assistance.

- Children can also get Medicaid cost assistance through CHIP.

- Tax credits can be paid in advance to lower your premium upfront or can be deducted from your Federal income taxes at the end of the year. If you didn’t take the full Tax Credit in advance or if you made less than you projected last year and didn’t adjust your info in the marketplace, you can deduct the remaining amount on your Federal Income Taxes using Form 8962, Premium Tax Credit (PTC). Everyone who takes a tax credit needs to file form 8962.

- If your income changes, you should report it to healthcare.gov or your state’s exchange so they can adjust your cost assistance levels. This will keep you from paying too much or owing money on your year-end taxes.

- If you have a plan from the previous year, verifying your plan and information is good practice before the next year starts. See more about verifying information and switching plans.

- For small business owners who are looking for information on small business tax credits, please see our page on using the Small Business Health Options Program (SHOP).

- Check out our ObamaCare subsidies page for more information on tax credits, out-of-pocket subsidies, and Medicaid and CHIP.

What if My Income Changes? Do I Have to Adjust Tax Credits or Cost Sharing Reduction Subsidies?

If your income changes, you may have to pay back Tax Credits, or as Tax Credits are refundable, you may be eligible for a bigger refund. Cost Sharing Reduction subsidies don’t have to be paid back if your income increases, but in some instances, you may be eligible for a refund if your income was lower than projected. Almost everyone who got Tax Credits will have to report them on their Federal Income Taxes. You may want to check out our page on filing taxes under the Affordable Care Act to better understand your responsibility regarding cost assistance.

ADVICE: It’s important to update your Marketplace account with any information that could affect cost assistance. This will help you get the right amount of assistance and avoid any complications that could come up when you file your taxes. Expect to report your Tax Credits to the IRS in detail.

How to Calculate Tax Credits By Hand

You can use the guide below to learn more about calculating tax credits by hand. If you want a more detailed overview, check out form 8962, the form used to claim and adjust premium tax credits.

Below is some helpful information from a free guide offered by www.zanebenefits.com. We have added notes and other information when appropriate.

Individual Health Insurance Tax Credits

The amount of your health insurance tax credit is based on the premium for the second-lowest-cost “silver plan” in your state’s individual Health Insurance Marketplace (although you can apply Tax Credits to any marketplace plan and pay or save the adjusted amount).

The amount of the tax credit varies with income, such that the premium you would have to pay for the second-lowest-cost silver plan is capped as a percentage of income (adjusted for household size), as follows:

Income Level Premium as a Percent of Income (these amounts adjust slightly each year; the caps are printed each year on form 8962 at tax time and earlier in the year in the federal register).

TIP: The premium tax credit caps below are an example. See the premium tax credit caps for 2020 to see the most recent premium tax credit caps. Remember, there is no top cap until 2025.

Understanding MAGI and AGI can save you lots of money. For instance, lowering your MAGI with a Health Savings Account (HSA) can increase the amount and type of cost assistance you qualify for. Lowering your MAGI can even help you save in other areas (such as student loans) as well.

How to Calculate Your Health Insurance Tax Credit

Step 1: Calculate Your Modified Adjusted Gross Income (MAGI)

Step 2: Use Your MAGI and Household Size to Determine if You are Eligible for a Tax Credit

Be aware that, to avoid getting too much or too little cost assistance, you’ll want to verify your information with the Marketplace if your income changes.

Step 1 – Calculate Your Modified Adjusted Gross Income (MAGI)

Modified Adjusted Gross Income, or MAGI, can be a little confusing. Please note that the specific numbers below are meant as examples to help you understand marketplace cost assistance and how HSAs can help lower Modified AGI, and they are not necessarily current. Double-check all thresholds before filing taxes.

Why Does MAGI Matter?

Modified Adjusted Gross Income is a measure used by the IRS to determine if a taxpayer is eligible to use certain deductions, credits, or retirement plans. “Modified Adjusted Gross Income” (not “Adjusted Gross Income”) will be used in determining eligibility for your health insurance tax credits. The IRS phases out the tax credit as your income increases. The IRS determines how much you really earned by adding MAGI factors back to your AGI. Beginning in 2014, your MAGI determines whether you will be eligible for premium tax credits on the new Health Insurance Marketplaces.

What is Adjusted Gross Income?

Generally, your Adjusted Gross Income (AGI) is your household’s income less various adjustments. Adjusted Gross Income is calculated before deductions (itemized or standard), exemptions, and credits are taken into account.

What is Modified Adjusted Gross Income?

Generally, your Modified Adjusted Gross Income (MAGI) is the total of your household’s Adjusted Gross Income and any tax-exempt interest income you may have.

NOTE: Some specifics below are subject to change: 1. Specific deduction amounts are subject to change, and 2. Some deductions are subject to change due to changes in the tax code each year.

Adjusted Gross Income (AGI, as defined by IRS)

+ Excluded foreign income

+ Tax-exempt interest

+ Non-taxable Social Security benefits

= MAGI

Let’s talk about what income is counted under MAGI. Since MAGI includes AGI, the list below comprises both MAGI and AGI. The list will help you understand which types of income do count toward deductions that affect HSA’s and cost assistance, and which don’t.

Income Counted Under MAGI:

Earned Income

Wages, salaries, tips

Self-employment, business and farm income after deduction of business expenses (including depreciation and capital losses)

Unearned Income

Interest (taxable and non taxable)

Social Security (SSA) income

Dividends

Taxable state income tax refunds and credits

Portion of scholarships, awards or fellowship grants used for living expenses

Alimony received

Capital/other gain

IRA distributions (taxable amount only)

Pensions and annuities

Rental real estate income and royalties

Unemployment Compensation

Other income if taxable (such as, prizes, jury duty pay not given to employer, etc.)

MAGI Income Deductions:

Business/Self-employment expenses, include:

Farm expenses

Depreciation

Capital losses (limited to $3,000, or $1,500 if married filing separately, in a tax year)

Rental/real estate losses

Partnership and S Corporations losses

Royalties loss

Estate and trust loss

Educator expenses (limited to $250 per educator in a tax year)

Real estate mortgage investment loss

Business expenses of Reservists, Performing Artists, and Fee-Basis Government Officials

Health Savings Account Deduction

Moving Expenses (if you moved in connection with new job)

Tax deductible part of self-employment tax

Self-employed SEP, SIMPLE, and qualified plans

Self-employed health insurance deduction

Penalty on early withdrawal of savings

Alimony paid

IRA deduction

Student loan interest (limited to $2,500 in a tax year)

Tuition and fees (limited to $4,000 in a tax year)

Domestic production activities deduction (up to 9% of qualified production activities)

NOTE: For MAGI, alimony paid must be entered under the Miscellaneous Expense screen in the IES Worker Portal (for non-MAGI, you enter alimony paid on Support Expenses screen). IES does not track annual caps for MAGI income deductions. Workers must ensure that deductions that exceed the annual caps are not entered. For example, if a teacher reports $50 per month in educator expenses from January through June, the cap of $250 will have been reached by May. Do not allow the expense for the remaining months in the calendar year.

Income Deductions Not Considered Under MAGI:

The following income deductions will no longer apply to MAGI groups:

- $90 employment deduction for employed persons

- The $30 plus 1/3 earned income exemption (EIE)

- Child care expenses

- Child support that was actually paid to someone not in the household

Income Not Counted Under MAGI:

- Child support income received

- Worker’s Compensation

- Veteran’s Benefits

- Supplemental Security Income (SSI)

- Portion of scholarships, awards or fellowship grants used for qualified education expenses

- American Indian and Alaska Native (AI/AN) income derived from distributions, payments, ownership interests, real property usage rights, and student financial assistance provided under the Bureau of Indian Affairs education programs

This list of what is considered MAGI is from a TurboTax article in regards to HSAs. Learn more about MAGI here or read the IRS’s explanation of MAGI.

How to Calculate Your Gross Income (GI)

Your gross income is the money you earned through wages, interest, dividends, rental and royalty income, capital gains, business income, farm income, unemployment, and alimony. This is the basis for your AGI calculation.

Gross income includes salary, interest earned, income from investments, and basically any income you made through business, trade, or investments.

How to Calculate Your Adjusted Gross Income (AGI)

Once you have your gross income, you “adjust” it to calculate your AGI. You make adjustments by subtracting qualified deductions from your gross income.

Adjustments can include items like some contributions to IRAs, moving expenses, alimony paid, self-employment taxes, and student loan interest.

There are many free AGI calculators available online.

How to Calculate Your Modified Adjusted Gross Income (MAGI)

Once you have adjusted your gross income, you “modify” it to calculate your MAGI. Specifically, Modified Adjusted Gross Income (MAGI) is calculated by adding back certain items to your Adjusted Gross Income including:

• Deductions for IRA contributions.

• Deductions for student loan interest or tuition.

• Excluded foreign income.

• Interest from EE (employee) savings bonds used to pay higher-education expenses.

• Employer-paid adoption expenses.

For most people, MAGI is the same as AGI.

Step 2 – Use Your MAGI and Household Size to Determine if You are Eligible for a Tax Credit

You can use the following table to figure out if you would be eligible for a tax credit in 2024 based on your 2023 income. Please see our Federal Poverty Guideline page for more details.

NOTE: The table below can be used as an example, but since these change every year, and since you use different charts for doing taxes and figuring out your assistance for the next year, it is always smart to double-check you are using the appropriate poverty level table. See a list of poverty level tables.

Below are the 2024 Federal Poverty Guidelines that went into effect in early 2023 (the ones you use for Medicaid/CHIP in 2023 and for 2024 marketplace cost assistance).

TIP: For mobile and smaller screen sizes, drag the table below to scroll and see the different poverty levels.

| 2023 POVERTY GUIDELINES FOR THE 48 CONTIGUOUS STATES AND THE DISTRICT OF COLUMBIA | ||||

|---|---|---|---|---|

| Persons in Family/Household | 100% FPL: Minimum to Qualify for ACA Assistance | 138% FPL: Medicaid Cap (in States that Expanded) | 250% FPL: CSR Subsidies Cap | 400% FPL: Previous Tax Credit Cap |

| 1 | $14,580 | $20,120 | $36,450 | $58,320 |

| 2 | $19,720 | $27,214 | $49,300 | $78,880 |

| 3 | $24,860 | $34,307 | $62,150 | $99,440 |

| 4 | $30,000 | $41,400 | $75,000 | $120,000 |

| 5 | $35,140 | $48,493 | $87,850 | $140,560 |

| 6 | $40,280 | $55,586 | $100,700 | $161,120 |

| 7 | $45,420 | $62,680 | $113,550 | $181,680 |

| 8 | $50,560 | $69,773 | $126,400 | $202,240 |

| For families/households with more than 8 persons, add $5,140 for each additional person. | ||||

NOTE: Alaska and Hawaii use different guidelines (see this link to guidelines as published on HHS.Gov).

NOTE: The Federal Register is where the guidelines are posted every year.

If you are eligible for a tax credit, an online calculator will help you estimate your actual tax credit. This estimate will give you an idea of how much health insurance will cost you and your family. Insurance rates for the next year may not yet be finalized when you use a calculator outside of open enrollment, so keep in mind that, once you are ready to purchase a health plan, the actual cost will likely change from any given estimate.

Calculating ObamaCare Tax Credits

![]()