Form 1095-A, 1095-B, 1095-C, and Instructions

The 1095 forms are filed by the marketplace (1095-A), other insurers (1095-B), or by your employer (1095-C). We have simple instructions for the 1095 forms.

Keep in mind the 1095 forms are filed by whoever provided you coverage, so individuals won’t have to fill them out themselves.

TIP: This page has been updated for 2022 (although on-page examples are from past years). The 1095 forms found in the links below are automatically updated by the IRS when new forms are released each year. Please use the official IRS instructions and this page only for additional clarification and as a way to find official resources.

What is a 1095 Form Used For?

- The 1095 form shows information about your health plan for the year.

- If you qualify for marketplace tax credits based on income at tax time, or if you took tax credits in advance, you’ll need to reference a 1095-A form to file your Premium Tax Credit form (form 8962).

- Generally speaking, you may need a 1095 form to fill out your Form 1040, U.S. Individual Income Tax Return, your Premium Tax Credit form 8962, your Form 8965, Health Coverage Exemptions, and to fill out the worksheet for figuring out your Shared Responsibility Payment on the Form 8965, Health Coverage Exemptions Instructions in years it is applicable.

All 1095 Forms with Instructions

- Form 1095-A, Health Insurance Marketplace Statement

- Form 1095-A Instructions (HTML)

- Form 1094-B, Transmittal of Health Coverage Information Returns

- Form 1095-B, Health Coverage

- Form 1095-B and 1094-B Instructions (HTML)

- Form 1094-C, Transmittal of Employer-Provided Health Insurance Offer and Coverage Information Returns

- Form 1095-C, Employer-Provided Health Insurance Offer and Coverage (HTML)

- Form 1095-C and 1094-C Instructions

See our guide to filing all ACA-related taxes.

1095-A Updates

There were a few issues with 1095-A forms over the years. If you haven’t gotten your 1095-A or got the wrong one, see the updates below for insight.

IMPORTANT: You’ll find some information below pertaining to past years. This information can help you decide what to do this year but keep specific dates in mind.

**2019 IRS Update: In a given year a person might expect to get a 1095-A, but then not get one. The advice is always the same each year: If you haven’t got your 1095-A, check your marketplace account (contact the marketplace if you need extra help). If you can’t find it there, then see this 2016 update from the Treasury and IRS (it is old at this point, but offers insight) and read the following article “what to do if you haven’t gotten your 1095-A yet.” Lastly, if you need to file without your 1095-A or are missing another form, check out our page on how to file without a 1095-A (NOTE: only consider filing without a 1095 if you don’t get yours by April).

**2017 IRS Update: The IRS has announced an extension for employers and insurers to furnish forms 1095-B and 1095-C for 2017 coverage. Employers and insurers now have until March 2nd, 2018. This might result in taxpayers not having these forms to file taxes before April 15th, 2018. Find out more here. See “1095-B, 1095-C Forms for 2017: Updates from IRS” for more information.

Who Has to File 1095-B and 1095-C Forms?

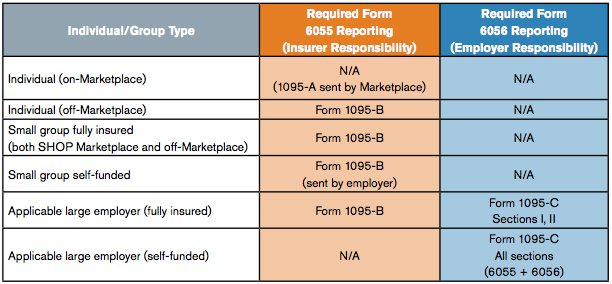

Generally, 1095-B forms are filed by insurers for: employers who use the SHOP, small self-funded groups, and individuals who get covered outside of the health insurance Marketplace.

1095-C forms are filed by large employers. If they are self-funded, they just fill out all sections of 1095-C. If they are fully insured, they get a 1095-B from the insurer and fill out Sections I and II of 1095-C.

Employers who have to file the forms will also need to file a 1094-B or 1094-C forms for Applicable Large Employer (ALE) requirements and to tell the IRS if you offered employees Minimum Essential Coverage (under PPACA section 6055 and section 6056). Learn more about the requirements.

Form 1095-A, Health Insurance Marketplace Statement Overview

Form 1095-A is an IRS form for individuals who enroll in a Qualified Health Plan (QHP) through the Health Insurance Marketplace. Typically it is sent to individuals who had Marketplace coverage to allow them to:

- Claim Premium Tax Credits

- Reconcile the Credit on their returns with Advanced Premium Tax Credit Payments.

- File accurate tax returns in general, as this information can be used to help determine exemptions and the fee.

Generally, 1095 forms, including the 1095-A form, are completed by the Marketplace, insurers, or an employer. Individuals will receive a completed 1095 form in the mail.

Who has to File the 1095-A Form?

The Health Insurance Marketplace (State, Federal, Regional, or Subsidiary) must file the 1095-A form. Individuals don’t have to file the form; they will use the form furnished to them to file other forms.

Can I File without a 1095-A Form?

If you got tax credits, then you’ll want to wait until you have your 1095-A form. It would be very difficult to get the Premium Tax Credit form filled out correctly without the information from your 1095-A. If you are running up against the wire, you can file for an extension on your taxes and request another form from the marketplace. Don’t forget: you can view your form online after it has been filed.

When is the 1095-A Form Sent?

Those who have to furnish 1095 forms must submit them by January 31st.

Where Can I Get a 1095-A Form?

You will be mailed a 1095-A form shortly after the Marketplace furnishes the form on January 31st. Look for your form by February 2nd. You can call the Marketplace Call Center at 1-800-318-2596 or contact the state or federal marketplace if you have not received it or if the 1095A you received was incorrect.

What if I Had More than One Provider?

If you had more than one type of health insurance throughout the year, then follow this rule of thumb: you’ll get 1095-A forms from every provider with who you had a Health Insurance Marketplace plan with. You’ll get forms from anyone who provided you coverage by early February.

Line-By-Line Instructions for 1095-A Form

NOTE: Some of the information below is subject to change each year. Make sure to reference the official 1095-A form of this year.

You won’t be filling out form 1095-A, but here is what you need to know to understand it. Make sure to have a copy of 1095-A open to follow along.

Part I—Recipient Information

Line 1 Marketplace identifier. The abbreviation of the Federal or State Marketplace from which you got your coverage.

Line 2 Marketplace-assigned policy number. Your policy number as assigned by the Marketplace. If it’s greater than 15 characters, only the last 15 characters show.

Line 3 Policy issuer’s name. Name of the insurance provider who issued your plan.

Line 4 Recipient’s name. You, otherwise known as: the name of the person (the recipient) identified at enrollment who is expected to file a tax return and who, if qualified, would claim the premium tax credit for the year of coverage for his or her household.

Line 5 Recipient’s SSN. Your social security number (SSN).

Line 6 Recipient’s date of birth. Your birthday.

Lines 7, 8, and 9 Spouses info. Spouses information, only if advance credit payments were made for the coverage. 8 and 9 are their SSN and birthday.

Lines 10 and 11 Policy start and termination dates. Start and end dates of the policy. (see notes under dependent information in Part II)

Lines 12-15 Address. Your address.

Part II—Coverage Household

Line 16-120 Dependent information. Same information as lines from Part I, except reported for each dependent.

NOTE: Start and end dates of your policy are important. If you, or a dependent missed even one month of coverage, you’ll need to file an exemption using the 8965 exemptions form. You can also use the instructions of that form to pay the fee.

Part III—Household Information

Line 21-22 Months, Premium Amounts, Cost of Baseline Plan, and Amount of Advanced Premium Tax Credit Payment. This is the only part of 1095-A that really matters. This shows what months you had coverage under this plan, how much it cost for all household members, what the baseline cost of a “Second Lowest Cost Silver Plan (SLCSP)” was, and how much was paid via a tax credit in advance to your insurer.

A. Monthly Premium Amount. The actual amount of your premium.

B. Monthly Premium Amount of Second Lowest Cost Silver Plan (SLCSP). The amount of the benchmark Silver plan in your region. This is what all cost assistance amounts are based on. If your plan was cheaper, you could get a bigger Tax Credit. If it was more expensive, expect less.

NOTE: If you won’t need to calculate this yourself you can use the Second Lowest Cost Silver Plan Tax tool.

C. Monthly Advance Payment of Premium Tax Credit. The amount of the Tax Credit that was actually paid to your insurer as “Advanced Tax Credit Payments”.

FACT: You’ll use the information for Part III to fill out your Premium Tax Credit Form 8962. This form will allow you to claim additional tax credits or to repay if you got too much assistance based on your income. Most people who got tax credits will need to fill out form 8962 since even a slight change in income will change what tax credit you are owed.

Form 1095-B, Health Coverage

This form is furnished to those who had non-marketplace coverage or more than one coverage source. Like the other forms, this is filed by your insurer or employer. 1095-B forms are not required to be sent until 2016.

Form 1095-C, Employer-Provided Health Insurance Offer and Coverage

This form is furnished to those who had employer-sponsored coverage.

TIP:more about the reporting requirements here Employers can find out.

More on 1095-B and C Forms

Aside from reading the instructions, we suggest checking out the following PDF from UnitedHealth for more information on 1095-B and 1095-C forms.

And here are some 1095-B and C pointers:

- Use the 1094-B and C forms to tell the IRS about whether you offered workers Minimum Essential Coverage (MEC)

- Use the 1095-B and C forms to show what coverage a worker had, what months they had coverage, or to show self-insured coverage. You’ll file one form per employee.

- If an employer provided self-insured coverage. This section is used for showing family members who had coverage.

For further assistance you can always call the IRS helpline. Remember 1095-B and C forms are not mandatory until 2016.

IRS Telephone Lines and Hours of Operation

The phone numbers below should not change year-to-year, however if needed you can always refer to the official IRS telephone assistance section and find the number you are looking for.

| Service | Telephone number | Hours of operation |

|---|---|---|

| IRS Tax Help Line for Individuals | (800) 829-1040 | M–F, 7:00 a.m.–7:00 p.m., local time |

| Business and Specialty Tax Line | (800) 829-4933 | M–F, 7:00 a.m.–7:00 p.m., local time |

| Practitioner Priority Service (Practitioners Only) | (866) 860-4259 | M–F, 7:00 a.m.–7:00 p.m., local time |

| e-Help (Practitioners Only) | (866) 255-0654 | e-Help Desk Hours |

| Refund Hotline | (800) 829-1954 | Automated service is available 24/7 |

| Forms and Publications | (800) 829-3676 | M–F, 7:00 a.m.–7:00 p.m., local time |

| National Taxpayer Advocate Help Line | (877) 777-4778 | M–F, 7:00 a.m.–7:00 p.m., local time |

| Telephone Device for the Deaf (TDD): Forms, Tax Help, TAS | (800) 829-4059 | M–F, 7:00 a.m.–7:00 p.m., local time |

| Electronic Federal Tax Payment System | (800) 555-4477 | 24/7 |

| Tax Exempt and Government Entities (TEGE) Help Line | (877) 829-5500 | M–F, 8:00 a.m.–5:00 p.m., local time |

| TeleTax Topics and Refund Status | (800) 829-4477 | 24/7 |

| Forms 706 and 709 Help Line | (866) 699-4083 | M–F, 7:00 a.m.–7:00 p.m., local time |

| Employer Identification Number (EIN) | (800) 829-4933 | M–F, 7:00 a.m.–7:00 p.m., local time |

| Excise Tax and Form 2290 Help Line | (866) 699-4096 | M–F, 8:00 a.m.–6:00 p.m., ET |

| Information Return Reporting | (866) 455-7438 | M–F, 8:30 a.m.–4:30 p.m., ET |

| Disaster or Combat Zone Special Hotline | (866) 562-5227 | M–F, 7:00 a.m.–7:00 p.m., local time |

| FBAR and Title 31 Help Line | (866) 270-0733 (313) 234-6146 (not toll free) |

M–F, 8:00 a.m.–4:30 p.m., ET |

More Information on 1095 Forms

We will post more information and step-by-step 1095 guides for B and C forms as they become more relevant (generally speaking they have never become all that more relevant and we have supplied employer related questions elsewhere; for more insight into the employer filed 1095 forms, see TurboTax). Otherwise, you can use our 1095-A guide to better understand the employer 1095s (a lot of the information is the same).

Use the official IRS instructions at the top of the page for more clarification.