What is Affordable Employer Coverage Under ObamaCare?

Understanding Affordability Exemptions for Individual and Employer-Sponsored Health Coverage

Under ObamaCare employer-sponsored coverage must cost no more than 8% (adjusted each year), after the employer’s contribution, to be considered affordable. If the amount exceeds 9.5% (adjusted each year), then the person can get an exemption to use the marketplace.

This applies to employee-only coverage, family-member-only coverage, and to the aggregate cost of two or more family members (the average price for one or more dependents, not the combined price, and not including the employee).

Meanwhile, for those without access to employer-based coverage, if the cheapest marketplace plan for an individual or a family after cost assistance would cost more than 8% of household income, the individual or family is exempt from the fee to get coverage.

Exemptions can be claimed on the 8965 form at tax time. However, additional steps may need to be taken to qualify (such as filling out the forms below).

The Exemption Forms:

- If you are applying for an affordability exemption for coverage that costs more than “8%” of MAGI for self-only coverage you’ll need to fill out this form: https://marketplace.cms.gov/applications-and-forms/affordability-ffm-exemption.pdf

- If you are applying for the marketplace because coverage costs more than “9.5%” MAGI for employee-only coverage you’ll need to fill out this form: https://www.healthcare.gov/downloads/employer-coverage-tool.pdf

That is the simple version of how affordability exemptions work. Below are some key details. When in doubt, read the 8965 exemption instructions or contact HealthCare.Gov for assistance.

The Affordability Exemptions

Keeping in mind that the “8%” and “9.5%” numbers adjust each year (it was 8.16% and 9.56% for 2017 for example), for 2018 you can claim a coverage exemption for yourself or another member of your tax household for any month in which:[1]

- The cheapest marketplace coverage (AKA the lowest-cost Bronze plan) in your region for individual or family coverage after cost assistance would cost more than 8.05% of household income. In this case, the individual or family is exempt from the fee to get coverage and may be able to purchase catastrophic coverage via the marketplace.

- The cheapest employer-based coverage for self-only coverage would cost more than 8.05% of household income after the employer’s contribution. In this case, that person is exempt from the requirement to get health insurance (but can’t necessarily use the exchange).

- The cheapest employer-based coverage for one or more family members on aggregate would cost more than 8.05% of household income after the employer’s contribution. In this case, those family members are exempt from the requirement to get health insurance (but can’t necessarily use the exchange).

- The cheapest employer-based coverage for self-only coverage would cost more than 9.56% of household income after the employer’s contribution. In this case, the person can both get an exemption and use the marketplace.

- The cheapest employer-based coverage for one or more family members on aggregate is over 9.56% of household income after the employer’s contribution. In this case, those members can both get an exemption and use the marketplace.

In other words, in the marketplace, 8.05% is the key number for individuals and families. If the cheapest plan costs more than this for the individual for self-only coverage or the family for a family plan, the individual or family is exempt.

However, with employer coverage, it is a little more complicated as one has to consider self-only coverage and coverage for one or more members of aggregate (even in cases where the whole family is offered coverage) and both the 8.05% and 9.56% figures (as the 8.05% relates to being exempt and the 9.56% number relates to being able to use the marketplace).

TIP: When one or more members technically has “affordable employer coverage,” but the family as a whole doesn’t (for example, due to employers not contributing as much to spousal and dependent coverage as they do to employee-only coverage), this is called the family affordability glitch. This glitch can result in families being exempt from the fee, but not having access to cost assistance, and other complex situations. Read more below to better understand the complex cases that can occur.

TIP: Medicaid/CHIP is still an option for some families with access to employer-based coverage. So some families may find they can get assistance that way, even when marketplace assistance isn’t an option.

Past numbers: To clarify the numbers on this page, the exemption for unaffordable employer coverage was originally (unofficially) called “the 9.5% rule” in 2014. However, the numbers are revised each year, and this can get confusing. It was “the 9.56% rule in 2015, “the 9.66% rule” for 2016, “the 9.69%” rule for 2017… and then “the 9.56%” rule (oddly enough) for 2018. You can see how this presents a problem when writing about the law. On this page we may use the terms 9.5% rule or 8% rule as placeholders for the current value (so we don’t have to make minor edits each year). So below when you see “9.5%” or “8” please realize it is generally referring to the figures for this year (as presented above).

Affordability of Employer-Sponsored Coverage and the Marketplace

If employer sponsored coverage is affordable under the “9.5% rule,” then the employee can’t get cost assistance through the Health Insurance Marketplace for themselves or their family members. If the employer offers health coverage to that person’s family, then all qualifying family members will not be eligible for cost assistance either.

Affordability of Employer-Sponsored Coverage and Medicaid / CHIP

Families with access to “affordable” coverage through an employer may still qualify for Medicaid or CHIP depending upon if the state expanded Medicaid, their income, their family size, and age of the children. Since the eligibility level is different for each state, the easiest way to see if you qualify is to contact HealthCare.Gov or your state Medicaid office.

How the 8% Affordability Exemption Works

If employer coverage costs more than “8%” (adjusted for the year) of Modified Adjusted Gross Income MAGI of families income for self-only coverage for an employee, or of a family income for family coverage, they are exempt from the per month fee for not having coverage. Because both are based on the family’s income, it is possible for the employee’s family members to be exempt, but not the employee. These hardship exemptions can qualify you for a catastrophic plan. If it costs more than 9.5% (adjusted), you can use the Marketplace and qualify for cost assistance.

If Marketplace coverage costs more than “8%” of families income then you qualify for the same exemption from purchasing health insurance and from owing the fee.

Find out If You Qualify for an Affordability Exemption

The best way to find out if you qualify for an affordability exemption is by filling out the worksheet on page 10 of the 8965 – Exemptions worksheet. It is possible for one family member to qualify for an exemption, but not the other one.

Affordability Exemption Vs. Affordable Workplace Coverage

Employer-sponsored coverage costing more than “9.5%” of MAGI for employee-only should not be confused with an affordability exemption from the fee for not having insurance. The affordability exemption requires the lowest-priced coverage available to you or a household member would cost more than “8%” of your household MAGI for self-only coverage. Thus it is possible for an employee or family member to be exempt from the fee, but not be eligible for marketplace subsidies. This is sometimes called “the family affordability glitch“.

While the above may seem fair, it has actually caused many families to be priced out of truly affordable health insurance. Let’s take a closer look at why employer-sponsored coverage that is considered affordable can actually lead to unaffordability and what you can do about it.Is Affordability Based on Household Income or Employee Only Income?

An employer can use household income for the employee to determine affordability. However, an employer won’t know household income. As a “safe harbor” employers typically will use employee only income as reported on their W-2 form for determining affordability. If an employer provides unaffordable coverage and the employee gets marketplace subsidies, they get a hefty fine. Given this, in most cases employer-sponsored coverage will not exceed 9.66% of income. However, some may find that coverage exceeds “8%” for them or a family member, thus it’s important to understand the information presented on this page.

On our site and other sites you may hear the “9.5%” threshold described as household MAGI or employee-only income depending on it’s being discussed practically or technically. For additional information about this and other safe harbors see IRS.gov/aca.

Quick Facts on Affordable Coverage

Let’s take a quick look at the main points behind what makes coverage affordable inside and outside the workplace. By placing all the key ObamaCare affordability facts side-by-side we will try to paint a clear picture of a slightly complex issue:

• Marketplace tax credits cap premiums (for base-level silver plans at “9.5%” household income). 9.66% of income for self-only coverage is sort of the benchmark for the maximum a plan should cost.

• All exemptions are for self-only coverage, not the cost of a family plan.

• All employer-related exemptions discussed on this page require you and your employer to fill out forms (find the forms below)

• If the cheapest Bronze plan on the marketplace would cost more than “8%” of your household income after subsidies, you are exempt from the fee.

• If employer-sponsored coverage would cost more than “8%” of household income for any household member, they qualify for an exemption.

• There is also an exemption If two or more family members’ aggregate cost of self-only employer-sponsored coverage is more than “8%” of household income.

• Being exempt from the fee doesn’t disqualify you from getting cost assistance, but being offered employer-sponsored coverage does.

• If you or a family member has access to affordable employer-sponsored insurance they can’t get marketplace cost assistance.

• To be considered affordable a job-based health plan can’t cost more than “9.5%” of an employee’s household income after employer contributions. However, most employers will use employee-only income since they won’t know household income for sure.

• There is no specific rule that says an employer must provide affordable insurance to an employee’s dependent. It is simply assumed the insurance will be affordable if the employee-only coverage is affordable. This has proved not true in cases and is the root of the “family affordability glitch”.

• The main concept is “8%” of household income is the number that is unaffordable and get’s you an exemption, while “9.5%” is the max you can pay for a plan after tax credits or through an employer for it to be considered affordable.

What is Considered Affordable Health Insurance?

On the Health Insurance Marketplace coverage is considered unaffordable if the minimum amount each household member must pay for the premiums is more than 8% of household income (for the cheapest bronze plan after subsidies). In the workplace coverage is only unaffordable if the employee-only premium (not the families) exceeds 9.5% (and meets other minimum requirements, making it comparable to a bronze plan on the marketplace).

FACT: 9.5% (adjusted) of household income, for self-only coverage, is affordable in the workplace. 8% (adjusted) of household income, for self-only coverage, is Affordable in the Health Insurance Marketplace. This does mean that coverage can be affordable by one standard and unaffordable by another.

Family Affordability Glitch

The fact that a family member would have qualified for cost assistance, but doesn’t due to technically having affordable coverage through an employer (as the rule that dictates affordability applies to the employee only and not the cost of a dependent’s coverage) is sometimes called the “family affordability glitch”.

FACT: At the root of the glitch is the fact that the law was fairly unclear as to how affordable insurance would be calculated for employee’s dependents. This has resulted in some sticker shock on family plans in the workplace.

The Affordability Exemption

Even though a family member may not qualify for cost assistance, they can still qualify for an affordability exemption.

If self-only coverage for a family member under the employer-sponsored plan exceeds 8% of household income, the family member may be exempt from the fee or qualify for catastrophic coverage… But, they won’t qualify for cost assistance even if the cheapest marketplace plan may have cost them less than 8% of household income after cost assistance!

See more on cost assistance and exemptions.

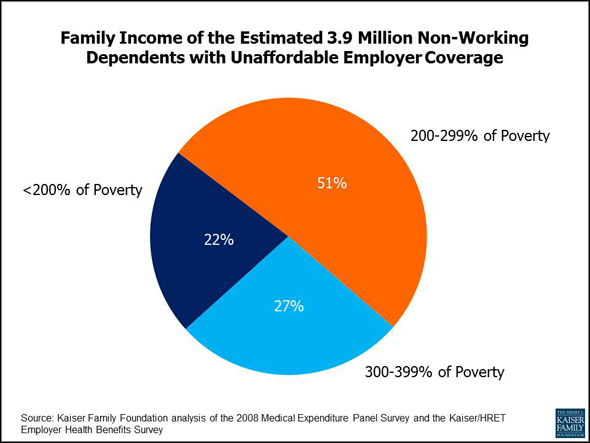

In 2011 3.9 million non-working depedents were priced out of affordable insurance due to what some call the “family affordability glitch”. Learn more about the affordability of job-based insurance from Kaiser.

Options For Those Without Affordable Coverage

If an employer offers a plan to a family member, that person could find themselves paying more than 8% of household income for a plan (granting them an exemption from the fee), but less than 9.5% (exempting them from marketplace cost assistance due to the employer-sponsored coverage being “affordable”). For this person, they will either have to take the “technically affordable” employer-based coverage, shop for a private plan without cost assistance, see if they qualify for a catastrophic marketplace plan, or go without insurance and use their exemption.

The big problem with all of this is that while being exempt from the fee is attractive, being barred from cost assistance due to a family member holding down a job just seems out-right unfair.

What Forms You Need to Apply For Exemptions for Employer-Based Coverage

If you plan on claiming that coverage is unaffordable for any reason, both you and your employer will need to fill out at least one of these forms.

If you are applying for an affordability exemption for coverage that costs more than 8% of MAGI for self-only coverage you’ll need to fill out this form: https://marketplace.cms.gov/applications-and-forms/affordability-ffm-exemption.pdf

If you are applying for the marketplace because coverage costs more than 9.5% MAGI for employee-only coverage you’ll need to fill out this form: https://www.healthcare.gov/downloads/employer-coverage-tool.pdf

Reforming Employer-Sponsored Coverage Affordability

While the law made calculating affordability for family members with access to employer-based health plans pretty unclear, the issue has been known about for some time. That being said, the chances that we will see reform that give families of employees the choice of getting marketplace cost assistance, or reform that better defines affordability for an employee’s family may be slim.

The main issue is that we find Democrats hesitant to change the law and we find Republicans none-to-eager to extend cost assistance to more Americans. 50% of Americans currently get coverage through work, extending marketplace cost assistance to more Americans would mean taxpayers would have to foot the bill.