TrumpCare Explained

What is TrumpCare?

“TrumpCare” describes health care reform under Donald Trump. We explain TrumpCare and how it is different than ObamaCare.

An Introduction to the Many HealthCare Bills, Regulations, and Ideas We Call “TrumpCare.”

Below we explain different aspects of TrumpCare.

When people say “TrumpCare” they are essentially referring to healthcare changes made, attempted to be made, and/or pushed for under President Trump (especially those that impact the Affordable Care Act). This is sort of like how when people say “ObamaCare” they are referring to changes to the healthcare system under Obama, but especially the Affordable Care Act.

Changes and policy ideas under Trump that may be considered “TrumpCare” have included:

- PROPOSED: Trump has said he will pass executive orders to protect pre-existing conditions which would be repealed by the lawsuit backed by his administration along with the rest of the ACA. The specifics of these orders are not known yet.

- PROPOSED: The 2021 budget which includes almost $1 trillion in cuts to Medicaid and the ACA and $600 billion savings from Medicare.

- ATTEMPTED ONLY: The House bill to repeal and replace ObamaCare, the American HealthCare Act (AHCA),

- ATTEMPTED ONLY: The Senate’s Better Care Reconciliation Act of 2017 (this link explains the latest version of bill) and its revisions, including the “the Ted Cruz Amendment.” NOTE: The Senate version of the repeal and replace plan replaced the House bill. The Senate bill needed 51 votes which it did not get. It was followed up by the similar Graham-Cassidy Proposal.

- RULE CHANGE: The January 2017 Executive Order that takes some wind out of the individual mandate’s sails,

- RULE CHANGE: The April 2017 Regulations that allow for narrow networks and shorter open enrollment periods,

- RULE CHANGE: The October 2017 Executive Order on Association Health Plans, Short-Term Coverage, and HRAs (implemented in 2018) that expanded alternatives to major medical health plans and expanded HRAs,

- RULE CHANGE: The October 2017 cuts to Cost Sharing Reduction assistance payments to insurers who provide cost-sharing reduction assistance those with lower incomes,

- RULE CHANGE: The October 2017 changes to the employer mandate to cover birth control that make it so religious employers don’t have to cover contraceptives,

- RULE CHANGE: The November 2017 changes to Medicaid expansion that make it so states can implement work requirements for Medicaid,

- RULE CHANGE: The effective repeal of the mandate’s fee for individuals to get coverage starting in 2019 (the fee was reduced to zero).

- ONGOING COURT CASE: State attorney generals from GOP led states ended up taking the ACA to court. This one is a little complex, but here is the gist: As a result of the state attorney-led lawsuit, a Texas federal judge ruled the Affordable Care Act (Obamacare) unconstitutional on Dec 14, 2018. For now, nothing changes as the legal process play out (especially since a stay was issued). However, there could be real consequences down the road. We will let you know if anything changes. For now, despite the changes, ObamaCare is still “the law of the land.” Learn more about the 2018 ObamaCare ruling.

- LIST OF GOALS: Tom Price’s plans as shown on HHS,

- LIST OF GOALS: The TrumpCare as presented on DonaldJTrump.com (which includes provisions that are not in the current bill such as “selling across state lines;” that one isn’t scheduled until “phase 3”), and

- LIST OF GOALS: Past promises Trump has made (such as the unlikely to be implemented “insurance for everybody” and the much more likely to be implemented “selling insurance across state lines“).

In other words, “TrumpCare” is a term that describes the ongoing health care reform effort under Donald Trump (especially in respect to the way it makes changes to the ACA).

This is somewhat complicated by the fact that a repeal and replace plan did not pass Congress, and instead the Trump administration has been gradually reshaping the healthcare system using executive orders, legislative action, action in congress, and changes done via federal agencies like HHS.

With the above in mind, we examine all things TrumpCare below and describe how TrumpCare (i.e. changes to the healthcare system under Trump, but especially changes to the Affordable Care Act) is different from ObamaCare (i.e. changes to the healthcare system under Obama, but especially the Affordable Care Act). To do this we will compare Trump’s plan on his site, to the House bill, to the un-passed Senate bill that replaced the House bill, and the parts of those bills and other ideas that went on to be implemented in other ways.

UPDATES ON REPEAL AND REPLACE: A round of repeal and replace attempts failed in 2017, since then the idea of repeal and replace has been put aside in favor of changes made mainly via the executive branch (both through rule changes via institutions like HHS and through executive orders by Trump).

NOTES ON THE REST OF THE ARTICLE: Since repeal and replace has been put on hold, and since a piecemeal tactic of gradual repeal through other means has been embraced, a lot of the information below now reads more as a wish list and account of past repeal and replace attempts than a game plan for moving forward. You can expect to see aspects of the plan below rolled out through orders and rule changes, and you’ll note that some items below have already been implemented (like the mandate being reduced to zero), but there is not likely to be comprehensive legislation thought of as Trumpcare unless something major changes in 2020 forward due to the Democrats winning a majority in the House in the 2018 election.

TrumpCare as Found On DonaldJTrump.com, compared to the HealthCare Bills Passed in the House and Senate

NOTE: Keep in mind things are changing rapidly, so everything below is subject to change.

The following is a short version of Trump’s plan on his website (see the full version with a cost analysis below), the sections in red have not been addressed yet.

In other words, most of what Trump promised didn’t make it into “phase 1 of the American HealthCare Act/Better Care Reconciliation Act,” or the new rules, with the exception of a few items like repealing the mandate’s fee and beefing up HSAs.[1]

NOTE: There has been many, many attempted and actual changes to the Affordable Care Act during Trump’s time in office. The repeal and replace plans did not pass, but many changes did occur (these were done via HHS and executive orders). This page focuses on what Trump promised on his site and the repeal and replace plans. See the links above for the orders and HHS changes, we’ll work on weaving them into here shortly. With that said, many planks from the bills got done via orders and HHS, and another repeal and replace plan with similar provisions is likely, so the rest is worth a read from that perspective.

- Completely repeal Obamacare. TIP: Keeping in in the administration is backing a lawsuit that could result in the ACA being effectively completely repealed, ObamaCare hasn’t been completely repealed under TrumpCare (for example, as it stood when it passed the House). There are some notable changes to the ACA however in practice and in the proposed bill. Under TrumpCare, the mandates are replaced with a 30% fee for 12 months for re-entering the market in the House version (there is no 30% fee in the Senate version, just a 6 month wait for coverage after you enroll if you have a gap in coverage), out-of-pocket cost assistance is eliminated, tax credits are based on age instead of income in the House version (the Senate version offers tax credits based on both age and income for those making between 0% and 350% FPL), and Medicaid expansion funding is frozen (plus there are additional cuts to funding). Meanwhile, while bans on discriminating against preexisting conditions are kept, some essential health benefits can be excluded from plans on a state level by using a state-based waiver (although there is a high-risk pool that pairs with this, there are issues of funding).

- Modify existing law that inhibits the sale of health insurance across state lines.

- Allow individuals to fully deduct health insurance premium payments from their tax returns under the current tax system. TIP: The income threshold for medical expenses is reduced from 10% to 5.8% under the AHCA, this isn’t directly related, but is noteworthy.

- Allow individuals to use Health Savings Accounts (HSAs). Contributions into HSAs should be tax-free and should be allowed to accumulate. TIP: Health savings accounts were already in effect and tax-free under the Affordable Care Act, the wording of this aside. With that in mind, the BCRA decreases the penalty for withdrawal for non-healthcare related purposes from 20% to 10%. UPDATE: The July 13th update to the BCRA includes a promised Trump provision of allowing people to pay for premiums tax-free via an HSA.

- Require price transparency from all healthcare providers, especially doctors and healthcare organizations like clinics and hospitals.

- Block-grant Medicaid to the states.

- Remove barriers to entry into free markets for drug providers that offer safe, reliable and cheaper products.

With Trump’s plan in-theory covered, below we examine TrumpCare in-action as it is found in the Paul Ryan inspired American HealthCare Act (the one that has passed the House but not the Senate) to see how it is different from ObamaCare (the Affordable Care Act).

TIP: The Better Care Act is being done as a budget reconciliation bill so it can pass with fewer votes than a full repeal and replace. This also helps explain why some [not all] of Trump’s promises like “selling across state lines” aren’t in the bill. It does not explain why other promises, like the promise to “cover everybody,” didn’t make it into the bill. Consider, the CBO currently projects 49 million without coverage by 2026 under the Better Care Act (which will be “TrumpCare” if it passes).

TrumpCare and Pre-existing conditions: The waivers, paired with reduced cost assistance, a fee for re-entering the market, fewer employers offering health plans, and the freezing of Medicaid expansion could lead to many being effectively excluded from insurance due to having a preexisting condition despite the high-risk pools (the effect is indirect, not direct). We explain TrumpCare and Pre-Existing Conditions in detail here to help clear up the confusion. In words, TrumpCare weakens protections on pre-existing conditions, but it doesn’t eliminate them.

TrumpCare/American HealthCare Act/Better Care and Reconciliation Act Summary

The latest version of TrumpCare, with all the changes to the Better Care Reconciliation Act and provisions from the American HealthCare Act (and with its MacArthur Amendment, Upton Amendment, and McSally Amendment), AKA TrumpCare “phase 1” (or TrumpCare 1.0) contains provisions that:[2]

First, the American HealthCare Act made the following changes (most of which the BCRA keeps; items the BCRA changed are crossed out ):

- Takes away ObamaCare’s fee for not maintaining coverage or an exemption, and instead charge

a 30% feeif you want to reenter the market after not having coverage for more than 63 days (see changes below), - Offers tax breaks for large employers and industry (by cutting ObamaCare tax increases) UPDATE: The July 13th 2017 changes keep the Medicare tax increase and increase to the investment tax made by the ACA (see below),

- Offers

tax credits based on age (instead of credits based on income like ObamaCare),NOTE: See How TrumpCare’s Tax Credits and related Cost Assistance Work, Take away ObamaCare’s out-of-pocket assistance,Removes metal tiers,- Prevents Planned Parenthood from accepting Medicaid and thus effectively partially defunds Planned Parenthood,

- Freezes ObamaCare’s Medicaid expansion funding,

- Allows state waivers to undo ObamaCare’s essential health benefits (and allows for lifetime and annual limits on certain benefits),

- Repeals of ObamaCare’s requirement for large employers to cover people,

- Allows states to charge more based on age or health status via state-based waivers (unlike ObamaCare),

- Allows states the option of creating a taxpayer-funded high-risk pool.

The Senate Bill that is Replacing the House Bill does everything noted above with a few changes, they are:

- There is a 6 month waiting period if you want to reenter the market after not having coverage for more than 63 days (but no 30% fee),

- Further reduces Medicaid spending,

- Tax credits are based on age and income from 0% – 350% FPL (but there is no slow phase-out up to 600% FPL like the House bill, 350% is the cliff).

- Cost Sharing Reduction subsidies are approved until 2019 on a per-month basis (so they are cut, but they aren’t cut right away like they were in the House bill).

Then the latest July 13th update to the Better Care Reconciliation Act makes a few changes that include:

- Less tax breaks for the rich (i.e. the 3.8% investment tax and a 0.9% payroll tax increases under the Affordable Care Act are retained under the latest version of the BCRA)… taxes on industry are still cut.

- Flexibility on Medicaid funding if a public health emergency takes place.

- A Block grant option to allow states to add the newly eligible Medicaid population to coverage under the block grant.

- Extra money for stabilization. $70 billion more than the first draft of the bill’s $112 billion for state-based health care initiatives to drive down premiums.

- Extra money for high-risk customers. If an insurer offers one of those plans that meets the Obamacare criteria, that insurer would be eligible for money from a fund designed to help high-risk customers, which could potentially mitigate some of the two-tier issues created by new, nonqualified plans.

- Extra money for the opioid epidemic. $45 billion for fighting drug addiction and would ease the sale of low-premium “catastrophic” insurance plans.

- New financial support to help low-income people purchase health insurance.

- A provision to allow people to pay for insurance with pre-tax money via HSAs (which is great for customers who buy their health plans out-of-pocket).

NOTES: Immediately following the July 13th version a few more changes were made. The bill now also includes “the Ted Cruz Amendment” which allows insurers to sell inexpensive plans to consumers that include basic coverage up to an annual cap (so limited benefit plans with annual limits would be able to be sold again under the latest version of the BCRA). This amendment is likely to bring down average premiums considerably, but it does this by allowing insurers to sell low-benefit, low-cost, plans with annual limits. So there is a trade-off there.

TIP: In other words, everything not crossed out above is “what is in TrumpCare.”

Pros and cons of TrumpCare: On the negative side, the result of TrumpCare will be tens of millions without affordable health coverage, or with “junk plans” in some states. On the positive side, it could reduce costs for those who aren’t priced out of the market. Large employers and those who don’t rely on assistance, or don’t get much assistance, could see cheaper plans even if they would not be as comprehensive as ACA plans.

NOTE: The house bill cut $880 billion from Medicaid and many of the ACA’s taxes, the Senate bill. The grand result is some money is saved, but tens of millions lose their plans. The tax cuts don’t bring down premiums, but they could have positive effects for economic growths (see supply-side economics).

TIP: If you want the full version of the summary, see Summary of the American Health Care Act by the Kaiser Family Foundation. We offer a simple overview of everything “TrumpCare” including this new act and its amendments below.

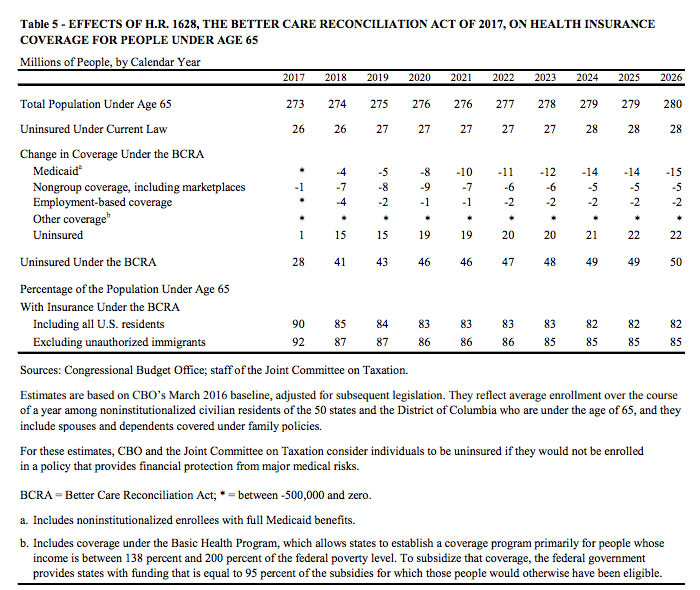

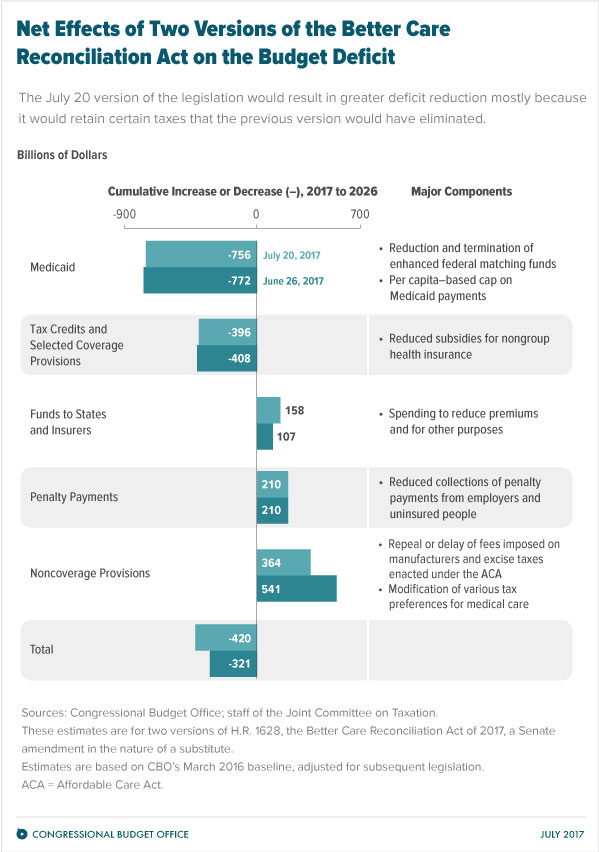

UPDATES ON UNINSURED RATES AND COSTS: According to the CBO’s July 20, 2017 report, the CBO and JCT estimate that enacting the Better Care Reconciliation Act of 2017 would reduce federal deficits by $420 billion over the coming decade and increase the number of people who are uninsured by 22 million in 2026 relative to current law (for a total of 49 million uninsured; about what it was before the ACA’s coverage provisions took effect). That is 15 million less from reducing Medicaid funding and 7 million less from reducing cost assistance and getting rid of the individual and employer mandates (keep in mind 75% of families on Medicaid are working poor). Get more Better Care Reconciliation Act of 2017 CBO Report Facts.

NOTE: Tom Price’s HHS contests the 22 million number and asserts that a few more million will have coverage by 2026; both the CBO and HHS agree that the uninsured rate will increase, and they agree that new low-benefit, low-cost, plans with annual limits included in the “Ted Cruz Amendment” will bring costs down on average by bringing costs down for some. However, their estimates of how many people will be covered under their plans differ. See the image below for the CBO’s estimates of how many will be uninsured under the BCRA (AKA TrumpCare). Then see the following graphic to understand the changes to spending, revenue, and the deficit.

The CBO estimates for uninsured under the BCRA.

Different versions of the Better Care and Reconciliation Act costs compared by CBO.

The Difference Between ObamaCare (The ACA), the Senate’s TrumpCare (BCRA), the House’s TrumpCare (the AHCA) Explained

The following table shows the main difference between ObamaCare, the Senate’s Better Care Reconciliation Act of 2017, and the Houses American HealthCare Act (the bill that passed the house that many are calling TrumpCare):

TIP: Note, not all the recent changes are reflected in the chart below.

UPDATE: Sine both the BCRA and the AHCA didn’t pass, this has historical value, but doesn’t reflect what actually happened. That said, you’ll notice some of these items were passed through other means.

| The Difference | The Basics of TrumpCare; The Senate Version (The Better Care Reconciliation Act of 2017 or BCRA) | The Basics of TrumpCare; the House Version (The American HealthCare Act or AHCA) | The Basics of ObamaCare; the Current Law (the Affordable Care Act or ACA) |

| Employer Mandate | Large businesses don’t have to provide insurance to full-time workers or pay a fee (retroactive starting in 2016). | Large businesses don’t have to provide insurance to full-time workers or pay a fee. | Large Businesses have to provide insurance to full-time workers. |

| Individual Mandate | There is no individual mandate (the requirement to get coverage or pay a fee). Instead, there is a 6 month waiting period to reenter the market if you have a gap in coverage for more than 63 days in the previous year (meaning if you apply for coverage during open enrollment or during a special enrollment you have to wait 6 months from the date of application to enroll in coverage). | There is no individual mandate (the requirement to get coverage or pay a fee). Instead, there is a 30% charge for 12 months if you have a gap in coverage for more than 63 days and reenter the market. | There is a fee if you don’t maintain coverage or an exemption each month (for those who can afford it). |

| Pre-Existing Conditions | Preexisting Conditions are covered, but state-based waivers can be used to exclude certain conditions from lifetime and annual limits (but people of the same age on the same plan can’t pay higher premiums or cost-sharing). | Preexisting Conditions are covered, but state-based waivers can be used to exclude certain conditions from lifetime and annual limits and can be used to charge sick people more (although the state must establish a high-risk pool). | No one with pre-existing conditions can be denied coverage or charged higher insurance rates. |

| Essential Health Benefits | States can waive essential health benefits and therefore reinstate annual and lifetime limits. The state-based waivers could result in women and sick people, who rely on essential health benefits and their annual and lifetime limits, paying more (or even being excluded from the market due to cost). | States can waive essential health benefits and therefore reinstate annual and lifetime limits. The state-based waivers could result in women and sick people, who rely on essential health benefits and their annual and lifetime limits, paying more (or even being excluded from the market due to cost). | Essential health benefits are covered on all plans with no annual or lifetime limits. |

| Cost Assistance | Tax credits are based on income and age for those making up to 350% of the Poverty Level (the credits start at 0% and stop at 350% creating a cliff; but expanding credits to 0% – 100% to offset Medicaid cuts). Out-of-pocket assistance is extended on a per-month basis until 2019. | Tax credits are based on age for those making up to 600% of the Poverty Level (the credit then phases out slow); out-of-pocket assistance is cut. | Those making between 100% – 400% of the poverty have access to premium tax credits based on income; out-of-pocket assistance is offered for 100%-250% FPL. |

| Medicaid funding | Obamacare’s Medicaid expansion is phased out over four years, funding is cut, and extra dollars are given to states who spend less on Medicaid (and taken from states who spend more). 90% of the current federal funding would be provided in 2020, and it would decrease by 5% each year until 2023, after which it would be eliminated. People would not be allowed to join the expansion from 2020 onwards. Also, there is a per capita cap for federal Medicaid spending. After 2025 growth in spending would shift from the consumer price index for medical care to the CPI for all goods, a lower level of growth. That means Medicaid expansion is frozen, states who expand on their own are punished, states will get less funding for Medicaid in general, and federal funding will continue to decline after 2025. | Medicaid expansion funding is frozen; block-grants might be added to a later bill. | Medicaid is expanded to all adults in all states that expand and the Federal Government pays 90% of the costs. |

| Taxes | TrumpCare cuts most taxes on industry. |

TrumpCare cuts most taxes on industry. This includes the 3.8% tax on high earners. | ObamaCare taxes those who profit the most off of healthcare. |

| Ratios | Older Americans can be charged 5x more than young people under TrumpCare. Premium costs for the same plan for the same age customer cannot differ (community ratings). | Older Americans can be charged 5x more than young people under TrumpCare. Premium costs for the same plan for the same age customer can differ (no community ratings). | Under ObamaCare you can’t be charged more for having a preexisting condition. Older Americans can be charged 3x more than young people. Premium costs for the same plan for the same age customer cannot differ (community ratings). |

| High-Risk Pools | TrumpCare allows for high-risk pools to create a state-funded (taxpayer-funded) reinsurance program (via state-level waivers). | TrumpCare allows for high-risk pools to create a state-funded (taxpayer-funded) reinsurance program (via state-level waivers). | The Affordable Care Act expanded coverage and got rid of high-risk pools. |

| Cost and Coverage | CBO’s July 20, 2017 report: CBO and JCT estimate that enacting the Better Care Reconciliation Act of 2017 would reduce federal deficits by $420 billion over the coming decade and increase the number of people who are uninsured by 22 million in 2026 relative to current law (for a total of 49 million uninsured; about what it was before the ACA’s coverage provisions took effect).

The cost and uninsured rate are subject to change based on changes to the bill. This bill notably saves more and covers more than the House bill |

The plan (after amendments) had a price tag that came in under the ACA according to the Congressional Budget Office, saving $119 billion over the decade (according to their first report). However, it did this by leaving 52 million without coverage by 2026 (it increases the uninsured by 23 million by 2026 for a total of 51 million uninsured). The cost and uninsured rate are subject to change based on changes to the bill. | The Affordable Care Act, therefore, costs $321 billion more and insures 22 million more people by 2026 than the Senate Bill. |

| Bottomline | The Senate’s TrumpCare might bring premium costs down for some, but less assistance and less on healthcare means hospitals and the sick, poor, and elderly will see new hurdles while the most wealthy (business, large employers, high earners) will see tax breaks. | The House’s TrumpCare might bring premium costs down for some, but less assistance and less on healthcare means hospitals and the sick, poor, and elderly will see new hurdles while the most wealthy (business, large employers, high earners) will see tax breaks. | The Affordable Care Act reduced the uninsured and bankruptcy and helped keep hospitals full, but people were struggling with costs. For those with assistance, however, the ACA meant tens of millions had access to affordable coverage for the first time. Currently, uninsured rates are at an all-time low. |

OPINION ON UNIVERSAL HEALTHCARE: The biggest gripe people will have with TrumpCare is that it is not a universal healthcare system (a universal healthcare system is not a government-run system, it is simply any system that doesn’t exclude citizens from care). Instead, TrumpCare results in more uninsured than we had before the Affordable Care Act. All TrumpCare’s good points aside, a plan that results in more uninsured and not less will be hard to spin. Trump recently said [paraphrasing], “Australia’s healthcare system is better than ours.” To be clear, I think many would agree with that. Australia has universal healthcare, meaning it doesn’t leave 15% of its citizens without coverage due to preexisting conditions and costs. Trump at one point promised “health care for everybody.” Here I must note that the Senate could essentially re-write the house bill to create a system like the Australian one (thereby fulfilling Trump’s promise). For more see: ObamaCare and Australia’s HealthCare Systems Compared.

Trump on Australia and the new bill, “It’s going to be fantastic health care,” Trump said, referring to his new health care plan. “I shouldn’t say this to our great gentleman and my friend from Australia because you have better health care than we do.”

A Summary of Trump’s Order and HHS Regulations

The Trump Executive Order (“Trump’s Order”) does little more than instructing the IRS not to enforce the mandates as harshly. The results are complex. See Trump Executive Order on the ObamaCare Mandates (the Fees)!

Unlike the Order, the Trump Administration HHS regulations (“Trump’s rules”) change a lot.

In summary, the regulations:

- Lower cost assistance by lowering the actuarial value of Silver Plans,

- Allow for plans with higher out-of-pocket costs and narrower networks,

- Make special enrollment harder, and

- Make open enrollment shorter.

On the plus side, the deregulation will likely lower costs a bit for those full-time employees with higher incomes and health coverage who will remain at their job (which, to be fair, is a good chunk of Americans).

See Trump Administration’s First Big ObamaCare Regulations Summary for more details.

A Summary of the Latest Version of TrumpCare (Now the Senate’s Better Care Reconciliation Act of 2017 or BCRA)

Above we illustrated the absolute basics and showed how TrumpCare and ObamaCare were different. Below, we’ll explain some more details about RyanCare/TrumpCare/McConnellCare (or whatever one would call it), the reconciliation bill that didn’t originally pass the House, but then passed after being Amended, and now has become the Senate bill.

Keeping in mind that the bill is still being debated and everything below is subject to change, the basics of what TrumpCare does can be summarized by saying TrumpCare (as it stands now):

- Repeals the fee for the mandates (it doesn’t repeal the mandates) for both individuals to pay a fee for not having coverage and for large employers to insure their employees.

- Freezes Medicaid expansion funding and reduces Medicaid funding in general. The bill freezes federal funding so states can’t continue to expand Medicaid without raising state taxes; it doesn’t repeal Medicaid Expansion, just freezes funding. Likewise, the bill reduces Medicaid spending over time, but doesn’t repeal Medicaid. The specifics of what happens is complex and dates are subject to change (you can read about details here), but generally funding is phased down over time.

- Eliminates most of ObamaCare’s taxes on those with higher incomes, employers, and industry (the result being a major tax break for the top fraction of a percent). Although, the July 13th revisions in the senate bill retained the 3.8% investments tax and a 0.9% payroll tax increases under the Affordable Care Act.

- Replaces tax credits based on income with tax credits based on income and age (other income-based assistance like Medicaid remains). Notably, tax credits are offered to those making 0% – 350% of the poverty level (the ACA notably didn’t offer credits to 0% – 100% because it intended that group to have expanded Medicaid; this plan cuts Medicaid but offers tax credits to lower incomes). This is notably different than the House bill which offered credits based on age only from 0% – 600% FPL and then phased out.

- Those who reenter the market after having a gap in coverage of 63 days or more have to wait 6 months after they re-enroll via open enrollment or special enrollment.

- … however it doesn’t do the litigation reform, sell across state lines, or the transparency reform promised on Trump’s site (to be fair this is, even if only unofficially, supposed to be phase 1 of 3).

NOTE: One thing to note early on here is that the plan originally cut small business tax credits (although they were added back in by the Senate, it is still worth noting) and the plan currently cuts assistance for seniors who are not on Medicare (and raises the ratio older Americans can be charged). Neither of these is in-line with past rhetoric from Trump or the GOP.

Also worth noting here before moving on, is that both the House and Senate bill embrace waivers and the ability of insurers to sell “junk plans” (low premium, high deductible, low benefit plans).

This started with the MacArthur Amendment (an Amendment to the American HealthCare Act which the Senate bill kept with same changes) which allows states to undo key ObamaCare protections at a state level. Then this continued with the July 13th changes with a provision backed by Ted Cruz.

This will, in many cases, result in Republican-led states being able to charge the sick and elderly more while giving younger and healthier people a break, in the name of “encouraging fair health insurance premiums.”

The problem with that is that it could drive young and healthy people to low-cost plans, pushing premium costs up for those who choose more robust plans.

To offset the fact that the sick can be pushed out of the market on a state level, and to attract insurers to states to increase competition, it also creates a risk adjustment program as did the ACA, ObamaCare. It does all of this via three waivers:

TIP: Changes made by the Senate bill are crossed out.

A waiver for community health ratings (so the sick and elderly can be charged more),- A waiver for essential health benefits (so states can exclude certain conditions for annual, lifetime, and other cost-sharing limits), and

- A waiver that allows for risk adjustment measures including an “invisible risk pool” (explained below).

TIP: The house bill also contained two other amendments. They are the Upton Amendment, that adds funding for high-risk pools and the McSally Amendment which un-exempts Congress and their staffers from the changes (the bill originally exempted Congress and let them keep ObamaCare).

NOTE: The Amendment originally exempted Congress from the changes and allowed them to keep ObamaCare. However, this was changed (after drawing ire).

The Effects of TrumpCare As it Stands Now

The grand result is that the plan is that it reduces costs for the wealthy, healthy, and young, but substantially raises costs for many in other demographics.

The middle class is helped a little (for example they might see lower employer coverage costs over time, and those without employer coverage who made over 400% of the poverty level were helped).

However, the same middle class would suffer went without coverage (as re-entering the market would mean an additional 30% fee for 12 months), and they might also have problems with costs if they lost their jobs or got sick.

Meanwhile, our poorest people, women, seniors, and low-wage workers would all see some new hurdles.

A Few Problems With TrumpCare Worth Highlighting

The goal here is to try to present honest information and note harp on the TrumpCare sticking points, with that said there are a few problems worth highlighting before moving on.

- It lets insurers charge older Americans more and allows for “junk insurance” by getting rid of standards like actuarial values.

- It defunds Planned Parenthood.

- Women, seniors, and lower-income Americans get the short end of the stick, while industry and higher-income Americans get a better deal.

- The biggest negative is that it fails to address many sticking points of ObamaCare, and doesn’t seek to expand coverage. Instead, it addresses some Republican’s issues from a centered standpoint by trading entitlements for low-income people for entitlements for all.

TIP: Want to know what Americans like and don’t like about ObamaCare? See the comments of our Tell Trump What You Like or Don’t Like About ObamaCare page.

The Costs of TrumpCare 1.0

- According to the Congressional Budget Office, the CBO and JCT estimate that enacting the American Health Care Act (without Amendments) would reduce federal deficits by $337 billion over the coming decade and increase the number of people who are uninsured by 24 million in 2026 relative to current law.

- According to the Congressional Budget Office, the CBO and JCT estimate that enacting the American Health Care Act (with Amendments) would reduce federal deficits by $119 billion over the coming decade and increase the number of people who are uninsured by 23 million in 2026 relative to current law.

- MOST RECENT: According to the Congressional Budget Office, the plan in its current form saves $321 billion over the decade. However, it did does by leaving 49 million without coverage by 2026 (it increases the uninsured by 22 million by 2026 for a total of 49 million uninsured). The cost and uninsured rate are subject to change based on changes to the bill. See a breakdown of the costs here.

The CBO report done after the Amendment shows 1 million less uninsured and about $200 billion in less in savings. See the Key Facts From the May 2017 CBO Report on TrumpCare (the American HealthCare Act). UPDATE: We will do some key facts from the Senate bill soon.

TIP: That CBO scoring is subject to change, the plan has been revised since it was scored. The passed bill was not scored at the time of passing.

Is This Like TrumpCare Promised on Trump’s Website?

Obviously, that is “get rid of the mandates” as it says on Trump’s site, but that isn’t “insurance for everybody,” and that isn’t “not letting them die in the streets.”

In words, the plan doesn’t include everything Trump promised by a long shot, but it does touch on many of his ideas as found on DonaldJTrump.com.

The GOP has also discussed future legislation that would allow insurers to sell across state lines and aimed to reduce litigation in healthcare, but that isn’t in this bill.

However, again, that was only supposed to be phase 1 of 3, and regardless that plan didn’t pass. No one knows what is coming next. With that in mind, Trump has said he generally supports it (even if not all Republicans do).

Here we should note that most of “the good stuff” can’t be passed in a budget reconciliation rule, and it is, in fact, likely the Byrd rule will be used to whittle down the provisions that aren’t fully budget-related in the Senate.

Sorry for the long introduction, “who knew healthcare could be so complicated?”

BOTTOM LINE: This is a centered bill that leans to the pro-business and free-market right-wing. It isn’t a “way better” plan than ObamaCare by most measures, it doesn’t cover everybody, and it will result in some people being left on the streets according to the CBO. However, this is hardly the worst case scenario, in that it is not a full repeal. TrumpCare, as it stands now, is a workable alternative that shifts around “winners and losers,” without completely undoing ObamaCare (in phase 1 at least). Obviously, higher-income Americans and Businesses are the “winners,” but this is arguably consistent with Trump and the GOP’s message. We didn’t elect Bernie Sanders, so we didn’t get single payer, we didn’t elect Hillary, so we didn’t get ObamaCare 2.0, we elected Trump and Ryan, so we got their plan, which we call TrumpCare. That isn’t as much a judgment call as it is a summing up of reality.

Trump said, “we aren’t going to let them die in the streets.” He was talking about his plans to ensure everyone had access to care… although the last plan he supported would have left 52 million “on the streets.”

TIP: For now “the ACA (ObamaCare) is still the law of the land“. With that said, one should expect a continued effort to pass provisions like those featured below in the near future.

NOTE: The current TrumpCare plan, the AHCA, has its pros and cons (just like ObamaCare has its pros and cons). See those pros and cons if you are interested.

IMPORTANT: TrumpCare is a word that describes any changes to the ACA, ObamaCare, under President Trump. Nothing is written in stone yet, and the most recent bill is still being debated and change. Thus, all provisions below are subject to change.

Past Updates on TrumpCare

The next section includes some past updates on TrumpCare so you can get a sense of what was promised or tried in the past and compare that to what is happening now. A lot of small changes have happened very quickly so forgive the notes.

UPDATE: Trump and Republicans in Congress had stated that they would seek to repeal ObamaCare within Trump’s first hundred days in office. True to their word the process of repeal has begun. Trump has signed an executive order on ObamaCare. “The American Health Care Act” is on the table. After a meeting with President Obama, President-elect Trump suggested he would either amend ObamaCare or repeal and replace it, not just repeal it, and would keep key provisions like guaranteed coverage for preexisting conditions and allowing kids to stay on their plans until 26. More recently, Trump promised “simultaneous repeal and replace,” “insurance for everybody,” and he doubled down on his longstanding promise of “negotiating with drug companies.” Unfortunately, after a meeting with drug companies, Trump backed away from allowing negotiations.

UPDATE: With Tom Price selected to be health secretary, and him favoring the GOP solution for preexisting conditions, it is likely we will get a “Continuous Coverage Exclusion” for pre-existing conditions.” It’s not the same as the ACA version. For example, it has very long exclusion periods, so make sure you understand the implications! See our review of the GOP ObamaCare alternative plan and our review of the Burr, Hatch, and Upton plan for an idea of what Republicans have suggested for ACA replacements in the past. It is very likely TrumpCare will draw elements from past GOP plans, as ultimately it is Congress who makes the laws.

TIP: The GOP forever altered the lexicon when they called the Patient Protection and Affordable Care Act “ObamaCare.” With this in mind, Trump’s healthcare plan has been unofficially dubbed “TrumpCare.” This is true even though no formal plan is on the table yet.

TIP: You can see Trump’s healthcare reform to make America great again here. See Vox’s TrumpCare article for a different take. We discuss all things TrumpCare below, including a line-by-line review of his original plan and all the updates since the election. There is a lot of ground to cover, so read carefully.

An Overview of TrumpCare (“TrumpCare” as found on DonaldJTrump.com)

Above we covered what is happening, below is what Trump promised on his website.

The two are aligned, but none of the big promises he made like “healthcare for everybody” have been kept. We only got “a way better plan.” Perhaps it was meant as wordplay to insinuate supporting Ryan’s Better Way plan word-for-word with a few tweaks.

The bottom line here is we got a more centered plan. We got phase one of the plan on his site, not the one we heard about rhetorically in Trump’s speeches.

With that in mind, the information below is still useful for understanding TrumpCare in its current iteration.

On his website, the TrumpCare plan listed is part a rehash of the Republican playbook, “insurance across state lines, HSAs, get the sick out of the healthcare system to keep costs down,” and part, an “oddly socially liberal market-based healthcare reform and cracking down on big pharma.”

The new “The American Health Care Act” is pretty much what Trump promised (minus a few “oddly socially liberal” reforms and cracking down on big pharma).

Despite some of the expected Republican views being included in his written plan, some parts of the plan and the words that Trump says paint a very different picture.

Below we’ll look at what Trump’s written position and past statements could mean for the future of healthcare reform, and how TrumpCare is different (or not ) from ObamaCare. Make sure to see our review of “The American Health Care Act” for an idea of how it is the same and different than TrumpCare as written on DonaldJTrump.com.

First, let us get a glimpse a Trump speaking his mind so we can set the stage.

“The Government’s Gonna Pay For It” – Wildcard Donald Trump on Single-ish Payer.

TIP: See how past healthcare proposals from the GOP differ and relate to each other. Past healthcare reform proposals compared.

The Cost of TrumpCare

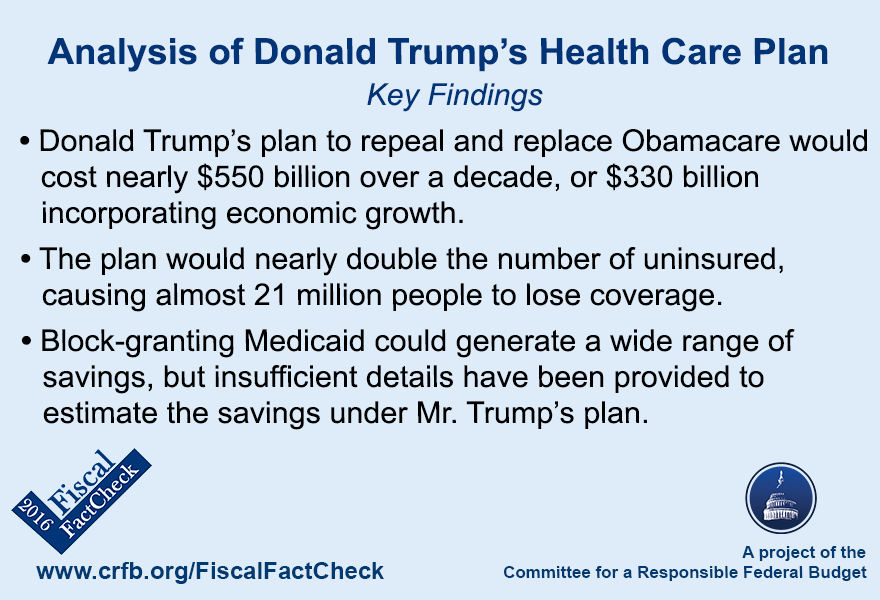

The Committee for a Responsible Federal Budget did a review of Trump’s healthcare plan. The following article shows a breakdown of costs: MEASURING TRUMP’S HEALTHCARE PLAN. The result is a cost of roughly $550 billion over ten years under conventional scoring and about $330 billion with dynamic scoring (see breakdown below).

Note that this analysis does not include Mr. Trump’s call to negotiate aggressively for Medicare drugs, a policy that is not listed on his website. He has previously claimed that $300 billion a year could be saved through negotiation, a claim we rated as false because Medicare will only spend an average of $111 billion each year on prescription drugs. Based on previous estimates by CBO, actual savings would likely be small or negligible.

NOTE: The plan assumes a full repeal of ObamaCare before replacing it. While this is possible given Trump’s statements, it isn’t necessarily what we would get from the future President Trump.

NOTE: Like him or hate him, Trump has mentioned some critical health policies like expanding Medicaid and debating drug costs for Medicare. These didn’t make it into the Trump plan as written, but it would be a mistake to overlook the benefits of strategies like debating drug prices for Medicare.

| 10-Year Estimates of “Healthcare Reform to Make America Great Again” | |

| Policy | Costs (+) / Savings (-) |

| Repealing Obamacare Coverage Provisions | -$1,120 billion |

| Repeal Obamacare Tax Increases | $660 billion |

| Repeal Obamacare Medicare Savings | $940 billion |

| Dynamic Effects from Growth (excluded from conventional scores) |

-$220 billion |

| Subtotal, Repeal Obamacare | $260 billion |

| Allow insurance to be purchased across state lines | -$10 billion |

| Create deduction for individual insurance premiums | $100 billion |

| Allow importation of prescription drugs | -$20 billion |

| Require price transparency and promote health savings accounts (HSAs) | * |

| Subtotal, Replace Obamacare | $70 billion |

| Total under Dynamic Scoring (including growth from repealing Obamacare) |

$330 billion |

| Subtract Dynamic Effects from Growth (excluded from conventional scores) |

-$220 billion |

| Total under Conventional Scoring |

$550 billion |

* Less than $10 billion of net costs or savings.

Source: CRFB calculations based entirely on various CBO estimates for the independent pieces. All estimates are very rough and rounded to the nearest $10 billion. Interactions or interest costs not included.

TrumpCare As Written on DonaldTrump.com

Below is an annotated version of TrumpCare. I explain what each measure means for America and the current ObamaCare system.

1) Completely repeal Obamacare. Our elected representatives must eliminate the individual mandate. No person should be required to buy insurance unless he or she wants to.

COMMENT: No Republican is likely to repeal ObamaCare in full. Saying “repeal ObamaCare” is a way of saying, “get rid of key provisions like the mandates, subsidies, coverage for preexisting conditions, insurance on parents’ plans for those under 26, and specifically, regulations on key businesses favored by the GOP.” This doesn’t mean Trump plans to do all of this. It means he could. Past GOP replacement or repeal plans have gone after the aforementioned provisions before. Trump says we must eliminate the individual mandate to obtain and maintain coverage, so that part seems likely. From there, we can speculate that this could, by extension, mean getting rid of subsidies and a few other key regulations, such as bans on annual and lifetime limits or rules against discrimination based on gender or health status. Of course, Trump hasn’t explicitly stated what he plans to do, so nothing is certain. The thing I want to stress here is that “repeal the mandate” almost certainly means eliminating the clause requiring insurance companies to cover people with preexisting conditions. Although President Trump has suggested he will keep preexisting conditions protections, it will take some real skill to get rid of the mandate but not the protections. The mandate and open enrollment together protect insurers from people waiting until they are sick to sign up. Thus, the two together keep costs down. As in pre-ACA times, we could see that only a health issue that occurs while a person is covered by an insurance policy would be covered, or we may see that people can only keep their plans if they elected to maintain their coverage. We want to avoid reading too much into a single website statement or offhanded comment made before or since the election. Instead, we want to make clear that repealing the mandate could, by extension, mean repealing key provisions which many Americans rely on to ensure access to affordable coverage. See why Republicans can’t just repeal ObamaCare.

2) Modify existing law that inhibits the sale of health insurance across state lines. As long as the plan purchased complies with state requirements, any vendor ought to be able to offer insurance in any state. By allowing full competition in this market, insurance costs are expected to go down, and consumer satisfaction is expected to go up.

COMMENT: Republicans have always wanted to sell insurance across state lines. The conversation as to why or why not is nuanced. It’s not a bad idea and would make his constituents happy. See The Problem With G.O.P. Plans to Sell Health Insurance Across State Lines.

3) Allow individuals to fully deduct health insurance premium payments from their tax returns under the current tax system. Businesses are allowed to take these deductions so why wouldn’t Congress allow individuals the same exemptions? As we allow the free market to provide insurance coverage opportunities to companies and individuals, we must also make sure that no one slips through the cracks simply because they cannot afford insurance. We must review basic options for Medicaid and work with states to ensure that those who want health care coverage can have it.

COMMENT: Deducting health insurance premiums makes a lot of sense. People are getting taken to the cleaners with rate increases. Trump says he will expand Medicaid here too, or eluded to a variation of this. That is potentially a big deal, and very opposite of what the Cruz’s and Rubio’s of the world want (which means Trump could face opposition on this from his own party). See why Medicaid expansion is so important.

4) Allow individuals to use Health Savings Accounts (HSAs). Contributions into HSAs should be tax-free and should be allowed to accumulate. These accounts would become part of the estate of the individual and could be passed on to heirs without fear of any death penalty. These plans should be particularly attractive to young people who are healthy and can afford high-deductible insurance plans. These funds can be used by any member of a family without penalty. The flexibility and security provided by HSAs will be of great benefit to all who participate.

COMMENT: The Republican view part two. Expanding HSAs sounds great, but the actual policy is typical code for, “benefit upper-middle class who can afford to fund HSAs.” The GOP would like to give people a free 1,000 to fund an HSA, but as much as I love HSAs, you can’t fund $3,000 to $6,000 for the tax benefits if you don’t have the income to do it. Learn more about HSAs.

5) Require price transparency from all healthcare providers, especially doctors and healthcare organizations like clinics and hospitals. Individuals should be able to shop to find the best prices for procedures, exams or any other medical-related procedure.

COMMENT: If Trump didn’t just suggest expanding Medicaid-like programs, I would be shocked to realize that Trump just called for war on the price setters of the healthcare industry. I’m pretty sure he is implying he will let Medicare negotiate drug prices. See why Drug costs are crippling the American taxpayer.

6) Block-grant Medicaid to the states. Nearly every state already offers benefits beyond what is required in the current Medicaid structure. The state governments know their people best and can manage the administration of Medicaid far better than the federal government. States will have the incentives to seek out and eliminate fraud, waste, and abuse to preserve precious resources.

COMMENT: The Republican view part three. It’s not a bad move, but block-grants sound better on paper. See why block grants are worse than they look on paper.

7) Remove barriers to entry into free markets for drug providers that offer safe, reliable and cheaper products. Congress will need the courage to step away from the special interests and do what is right for America. Though the pharmaceutical industry is in the private sector, drug companies provide a public service. Allowing consumers access to imported, safe and dependable drugs from overseas will bring more options to consumers.

COMMENT: Trump just suggested measures that would result in big Pharma losing a great deal of money; once you pay non-US prices you’ll never go back. See why the US pays more than other countries for drugs.

TrumpCare as Spoken By Donald Trump

Trump’s health policy is largely unknown; that much is clear. All we can do is listen to what he is saying and judge it for what it is.

Single-Payer – Trump Style

Trump has essentially insinuated that he plans to implement a market-driven version of single-payer insurance. He made this very clear in a debate where his dialogue with Cruz focused on the Medicaid side:

CRUZ: So does the government pay for everyone’s health care?

TRUMP: … I’m not fine with it. We are going to take those people…

CRUZ: Yes or no. Just answer the question.

TRUMP: Excuse me. We are going to take those people, and those people are going to be serviced by doctors and hospitals. We’re going to make great deals on it, but we’re not going to let them die in the streets.

CRUZ: Who pays for it?

COMMENT: Go to about 8 minutes into the video below and see Trump win a debate against Republicans by pushing moral healthcare policies.

Learn more about Donald Trump on HealthCare from ontheissues.org.

How is TrumpCare Different From ObamaCare?

TrumpCare, as written on Trump’s site, is like Republican health care reform meets BernieCare. TrumpCare in-action (the House bill) is meanwhile part Trump’s plan and part RyanCare (literally it is a lot like Ryan’s Better Way Plan; or more accurately, it is Ryan’s Better Way Plan).

On the site, the plan has little in common with ObamaCare outside of Medicaid expansion. So far in real life, it is looking like the GOP will push to block grant Medicaid, which could have a number of implications. Block-grant could mean expansion, or it could mean provide loopholes to decrease federal funding (the fear of liberals). Like on many of these issues, it really is still too early to tell.

On the site, Trump sounds as though he wants a complete repeal of the ACA, but language since the election hints that this won’t be the case. It makes little sense to try to get rid of every part of the Affordable Care Act, especially the parts about that aren’t drawing criticism.

Trump seems to be dropping the mandates and some subsidies, pushing Medicaid expansion rhetorically, pushing Medicaid block-grant in practice, deregulating a little, regulating a little, and maybe initiating some version of a free-market single-payer/public option like we saw in Upton, Burr, and Hatch’s CARE plan or Pence’s HIP.

Trump’s stance on healthcare, as far as we know, contains a lot of room for bipartisan reform. It is still too early to know what a Trump will do as a President under the GOP controlled congress, but if it is a moderate version of what he has said, Americans should be just fine.

In many ways, the real issue all comes back to Trump’s pronouncements that, “we aren’t going to let them die on the street” and “the goal is insurance for everybody.” Were those empty promises, or real ones?

Politicians almost always put out a rough outline, the PPACA is 1,000 pages of legislation, so we can’t make a completely fair comparison just yet. Stay tuned.

UPDATE POST TRUMP ELECTION: Now that Trump has been elected, we will discuss what policies he attempts to implement. We will keep this page updated as Trump begins to shape his repeal or replace plan. For now, the ACA is still the law of the land (albeit with some changes like the Order and new Regulations). However, everything from ObamaCare’s cost assistance to ObamaCare’s fee still applies despite the recent rules and suggested replacement plans.