Key Facts From the May 2017 CBO Report on TrumpCare

Summary of the May CBO Report on the American Health Care Act of 2017 (TrumpCare)

Here is a quick summary of the May CBO Report on the American Health Care Act of 2017, sometimes known as TrumpCare, the House bill to repeal and replace ObamaCare.[1][2]

UPDATE 2019: This information is historically relevant in that it paints a picture of what would have happened had the repeal and replace plan from 2017 been passed. That said, given that this never took place, the impacts of repeal and replace would differ depending on the state of healthcare at the time and the specifics of a future plan.

The Bottom Line on the CBO Report on the American HealthCare Act of 2017 (TrumpCare)

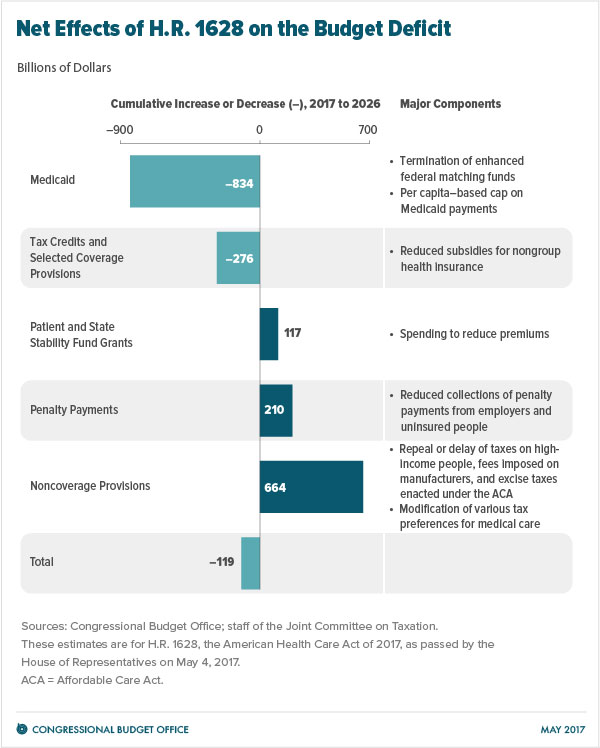

The bottom line on TrumpCare is that 23 million lose their plans over 10 years (14 million from Medicaid, many of whom are working poor, and 9 million others). Many lose cost assistance; only the working poor lose tax credits and out-of-pocket cost assistance. The rich get a giant tax cut including a reduction of the capital gains tax. Also, there is a modest reduction in spending of about $119 billion over ten years (only a small fraction of the total budget over 10 years).

Specifically, according to the report:

CBO and JCT estimate that enacting the American Health Care Act would reduce federal deficits by $119 billion over the coming decade and increase the number of people who are uninsured by 23 million in 2026 relative to today’s current law [for a total of 51 million uninsured people].

That is 23 million MORE uninsured people than under ObamaCare for a total of 51 million uninsured. ObamaCare would have left 28 million people uninsured; it’s still not great, but instead of fixing the problem, the AHCA makes it worse.

In 2026, an estimated 51 million people under age 65 would be uninsured, compared with 28 million who would lack insurance that year under current law.

Obviously, 23 million losing their plan isn’t good, but some may think the savings justify it.

However, while the savings may sound like a lot, it isn’t really that impressive compared to our nearly $4 trillion dollar annual budget.

Consider, the richest Americans get hundreds of billions in tax breaks collectively, and the poorest lose hundreds of billions in assistance, and the NET savings are only $119 billion.

If there were cuts in spending and no tax breaks, then the bill would have saved hundreds of billions and paid down the debt. Instead, it funnels money to the richest Americans and cuts the mandate, which is notable and important!

Consider, when paired with Trump’s other budget items, there is even less assistance and more cuts. For example, Trump’s elimination of the estate tax in the budget cut would give a $50 billion tax break to a family like the Waltons alone, not to mention families like the Trumps and Kushners.

The bottom line is that this plan cuts $119 billion by kicking 23 million off their plan over a ten year period and slashes taxes for the wealthiest Americans. The effect of the American HealthCare Act is magnified by Trump’s A New Foundation for American Greatness Fiscal Year 2018 budget.

THAT IS NOT WHAT TRUMP PROMISED.

It is shockingly different than what Trump promised. It doesn’t mean it is all bad news.

Below we take a look at the pros and cons of the CBO report and illustrate some more key facts.

Poor, older Americans would be hit especially hard. The average 64-year-old earning just above the poverty line would have to pay about 9 times more in premiums.

TIP: It is worth noting that this is somewhat of an improvement to the last CBO report done before this version of the bill was passed. This version has 1 million less uninsured people (a good thing) and about $200 billion in less in savings to counterbalance to the 1 million more insured.

Understanding the CBO Report on TrumpCare

The first thing to note is that no estimate is ever perfect. Numbers could change depending on state action as this bill leaves a lot up to the states and many other factors could affect figures as well.

It is a Republican talking point that “the CBO is wrong.” However, it is true that the CBO can be off on estimates.

The CBO is almost never very far off, but they always have to predict the future based on current laws, which means these are estimates.

Key Facts From the CBO Report on TrumpCare

Below are some key facts from the CBO on the American HealthCare Act (AHCA or TrumpCare) in its current form without changes from the Senate. All figures are for the decade spanning 2017-2026 unless otherwise specified.

- 14 million fewer people will be insured in the first year after the AHCA passes.

- 23 million fewer will be insured in 10 years after the AHCA passes.

- That is slightly better than the last CBO report, but not much. It means the uninsured rate will go up to levels higher than before the Affordable Care Act. The total number of uninsured people was reduced by about 20 million under the ACA and is projected to go down a bit more over the next 10 if we keep the ACA. See the previous CBO report on TrumpCare, and the previous CBO report on ObamaCare.

- AHCA would cut spending on Medicaid by $834 billion.

- Medicaid would cover 14 million fewer people. That means 14 million of those people who will lose cover coverage are on Medicaid, but the other 9 million aren’t. Of those who will lose Medicaid, many are working poor. Some will lose coverage due to work requirements; learn more.

- Premiums will go up in 2018 and 2019. After that, there will be significant variation depending on whether someone lives in a state that opts out of key Obamacare insurance rules.

- The ACHA repeals $664 billion worth of taxes and fees that had financed Obamacare. These mostly tax the wealthy outside the repealing of the mandate. This is offset by $783 billion in NET cuts to assistance programs. Thus, the bill will save $119 billion, which is $32 billion less than a previous version of AHCA.

- The largest increases in the deficit would come from repealing or modifying tax provisions in the ACA that are not directly related to health insurance coverage such as repealing a surtax on net investment income, repealing annual fees imposed on health insurers, and reducing the income threshold for determining the tax deduction for medical expenses.

-

- In 2026, 51 million people under age 65 would be uninsured. That is almost twice as many as the 28 million who would have lacked coverage under Obamacare.

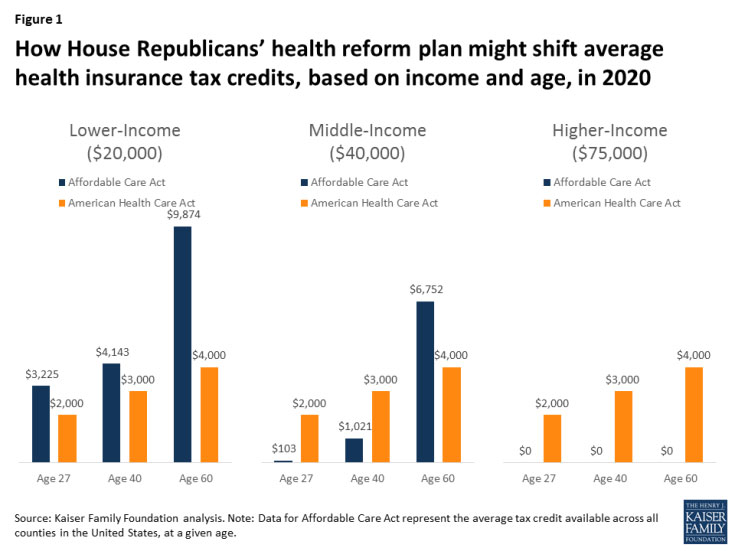

- Many will struggle under the law as tax credits will be based on age while out-of-pocket assistance is cut. This means seniors and the poor will see very large increases in personal costs.

- Many of the newly uninsured will be those who had gained employer coverage under the ACA. Perhaps the most significant mandate that the bill takes away is the mandate for insurers to cover full-time employees.

- In states that waive some Obamacare rules, premiums could decline by about 20% on average over a decade compared to current law. This means people will pay less but get fewer benefits.

- 1 out of 6 Americans will live in an area with an unstable insurance market in 2020 where sick people could have trouble finding coverage. That means that the problem of plan selection under the ACA will continue under the AHCA instead of being addressed and fixed. This time it will target the sick.

- Poor, older Americans would be hit especially hard. The average 64-year-old earning just above the poverty line would have to pay about 9 times more in premiums due to losing cost assistance offered by the ACA but not by the AHCA.

- Savings of $6 billion from repealing a tax credit for certain small employers who provide health insurance to their employees. In other words, small businesses lose their tax credit. This saves a relatively unimpressive $6 billion over ten years while hurting the employees who will lose their health insurance.

TIP: Although premiums have been rising under current law, most subsidized enrollees purchasing health insurance coverage in the nongroup market are largely insulated from increases in premiums because their out-of-pocket payments for premiums are based on a percentage of their income; the government pays the difference between that percentage and the premiums for a reference plan.

OPINION: TrumpCare takes away assistance and hopes to curb rates. This means the net effect is that many people will pay more, 23 million lose coverage. There will be a total of about 51 million uninsured under TrumpCare. This huge human cost is designed to produce a relatively modest net savings of about $10 billion a year. The rich get a giant tax cut; the poor lose assistance and coverage.

See 10 key points from the CBO report on Obamacare repeal from Politico. We relayed a few of their points above alongside some points from the report that they didn’t mention. Check out their article for a brief and shareable list.

Michelle

This sucks big time lots of people are going to die! Might as well call it Deathcare