There is No “Death Spiral”: Insurance Premiums Stabilizing under ACA

There is No “ObamaCare Death Spiral;” GOP Repeal Effort Main Cause of Recent Premium Hikes; Not ACA

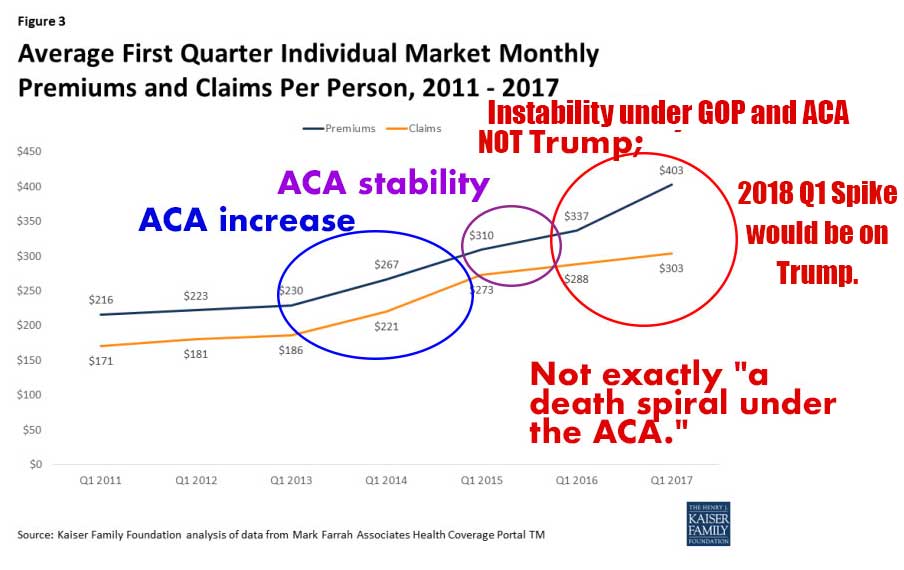

A new report from the Kaiser dispels the “ObamaCare death spiral” myth, showing that insurance premiums are generally stabilizing under the ACA.[1]

Or more specifically, the report shows the insurance claims are stabilizing under the ACA, and premiums were too until about Q1 2017 (and would potentially still be now)… if it weren’t for the ongoing instability in the market (largely caused by the GOP’s repeal and replace efforts, but certainly not explained by that alone… after-all insurers dropping out of some marketplaces, which was part of the GOP’s obstruction efforts, is also likely a major factor).

Understanding this data requires us to understand that plans are priced about 8 months or more out each year. That means the stabilizing of premiums and claims in 2016 spoke of data from 2014 and 2015, and likewise the 2017 spike speaks to data from 2015 and 2016 (meanwhile any 2018 spike will be a result of 2016 and 2017 data).

Logically then, the spike could be (but doesn’t specifically have to be) a result of things like: The GOP blocking Medicaid expansion, the 80/20 rule expiring (thus incentivizing price gouging), insurers pulling out of exchanges (sometimes in large part due to the other reasons noted here), Rubio blocking readjustment payments, and the general uncertainty regarding the at-the-time potential (and now real) GOP win and thus a repeal and replace effort.

In other words, part of the recent round of increases in premiums have very little to do with ObamaCare’s assistance, and instead have more to do with the lack of insurers and uncertainty in the market (something that is most easily simply blamed on both parties lacking decisive action to fix the ACA and no obstruct before reaching this point).

The clearest sign that the ACA itself is not in a death spiral, but that there are problems are: 1. claims data has stabilized, but 2. insurers pulling out and uncertainty is causing insurers to price gouge and play scared (after-all if the GOP takes away cost sharing reduction, insurers eat the costs, and if the GOP blocks readjustments, insurers eat the cost, and if a state doesn’t have Medicaid expansion and only one insurer offers plans, insurers eat the cost).

With all that said, there are more increases projected to be occurring in 2018 (which are essentially now based on 2016 and 2017; they are already priced). When we see these premium increase it will be tempting to blame it one the ACA, but this time it will largely due to instability under the Trump administration (such as the projected 19% increase due to uncertainty over cost sharing reduction subsidy payments specifically, and the repeal and replace effort generally).

This isn’t to say the ACA doesn’t deserve a critical eye, or that Democrats couldn’t have done more, but it is to say the data does not suggest that the ACA (especially had it been implemented fully and not obstructed) would have caused the current spikes on its own.

We can tell this from a few different data points, but one of the most compelling is the chart featured above which tracks premiums and claims.

We can see claims are stabilizing (which should should mean premiums are stabilizing)… but we see premiums aren’t stabilizing. Again, especially given insurers pricing this 8 months out it is not a “blame Trump” thing (2018 may be, but 2017 is not). It is however a blame at least the GOP and Democrats equally thing (as GOP obstruction did just as much to cause the spikes, if not more, than Democratic party policy).

When we look at the uncertainty in the market related to cost sharing reductions, blocking reinsurance payments, and repeal; it paints a clear picture (especially when considered alongside the other data points in the report).

That picture is: the ACA caused a price hike in the early days (as was projected; which is why the readjustment payments that the GOP keep blocking were included in the law in the first place), but the spike in claim growth is finally subsiding (as projected as well).

This would have meant lower premium growth this year, but the uncertainty of repeal essentially caused another price hike.

When we consider that this is now getting spun as “a reason for repeal” and “an ObamaCare death spiral” by the White House and Republicans in the House and Senate, the situation only becomes more complex.

Putting opinions aside, from a purely fact-based perspective, the problem with that narrative (to reiterate once more) is that the market was stabilizing under the ACA, there is no death spiral, and instead the political chaos under the repeal effort (and the related uncertainty) is actually causing a premium hike this year.

See proof of the above claims at the Kaiser Family Foundation: Individual Insurance Market Performance in Early 2017, or simply consider the excerpts of the report below.

“Early results from 2017 suggest the individual market is stabilizing and insurers in this market are regaining profitability. Insurer financial results show no sign of a market collapse.”

While the market on average is stabilizing, there remain some areas of the country that are more fragile. In addition, policy uncertainty has the potential to destabilize the individual market generally. Mixed signals from the Administration and Congress as to whether cost sharing subsidy payments will continue or whether the individual mandate will be enforced have led to some insurers to leave the market or request larger premium increases than they would otherwise. A few parts of the country may now be at risk of having no insurer on exchange, though new entrants or expanding insurers have moved in to cover most areas previously thought to be at risk of being bare.”

“As we found in our previous analysis, insurer financial performance as measured by loss ratios (the share of health premiums paid out as claims) worsened in the earliest years of the Affordable Care Act, but began in improve more recently. This is to be expected, as the market had just undergone significant regulatory changes in 2014 and insurers had very little information to work with in setting their premiums, even going into the second year of the exchange markets.”

– KFF.org.

Opinion: Moving forward with a plan that works for all of America makes sense, but causing instability in the market and blaming it on “ObamaCare” to pass the Better Care Reconciliation Act of 2017 doesn’t. This is especially true given the fact that one could argue, based on the CBO data, that there isn’t much of anything in the BCRA that would actually bring down the underlying claim costs (upon which insurance premiums; and to be fair cost sharing costs like deductibles and copays, are based).

- Kaiser Family Foundation: Individual Insurance Market Performance in Early 2017