How TrumpCare’s Tax Credits Work

Age Based Tax Credits Under TrumpCare, the American HealthCare Act (AHCA), Explained

TrumpCare, the American HealthCare Act (AHCA), offers tax credits for health insurance premiums based on age and no out-of-pocket cost assistance.

The Affordable Care Act offers tax credits based on income and offers out-of-pocket cost assistance.

UPDATE 2019: This plan never passed, and thus the specifics here are of historical interest only.

NOTE: Since the plan discussed above didn’t pass the Senate, for the time being tax credits under the Affordable Care Act still stand. Learn about cost assistance under the Affordable Care Act under Trump.

How Age Based Tax Credits Under TrumpCare Work

This could change, but in terms of how it works right now (according to the most recent version of the American HealthCare Act):

Starting in 2020, ACA income-based tax credits for those making between 100% – 400% of the poverty level are replaced with a flat tax credit adjusted for age for those making up to 600% of the poverty level (at 600% the credit is reduced slowly, at ten cents per dollar of income, so there is no hard cliff and instead those making much more than 600% will still get an increasingly small credit).

Credits are payable monthly; annual credit amounts are:

- $2,000 per individual up to age 29

- $2,500 per individual age 30-39

- $3,000 per individual age 40-49

- $3,500 per individual age 50-59

- Families can claim credits for up to 5 oldest members, up to limit of $14,000 per year.

That means a family with many seniors in it who aren’t Medicare age could cap out at $14,000.

Furthermore:

- The AHCA/TrumpCare takes away out-of-pocket cost sharing reduction (CSR) assistance and replaces it with nothing (although $100 billion for 10 years is set aside in a Patient and State Stability Fund which can be used to subsidize cost sharing at a state level).

- The AHCA/TrumpCare freezes Medicaid expansion funding, so in some states the age-based tax credit will be the only form of assistance to those with low incomes.

- The AHCA/TrumpCare reduces eligibility levels for CHIP from 138% of the poverty level to 100% (it repeals the ACA’s increase in Medicaid eligibility to 138% FPL for children ages 6-19 as of December 31, 2019).

The net result is that those who depend on income based cost assistance will see their premiums and cost sharing go up in many cases, and those who don’t get much assistance could see a break.

Generally credits will increase for young adults with incomes above 150% FPL and decrease amounts for adults 50 and older above that income level.

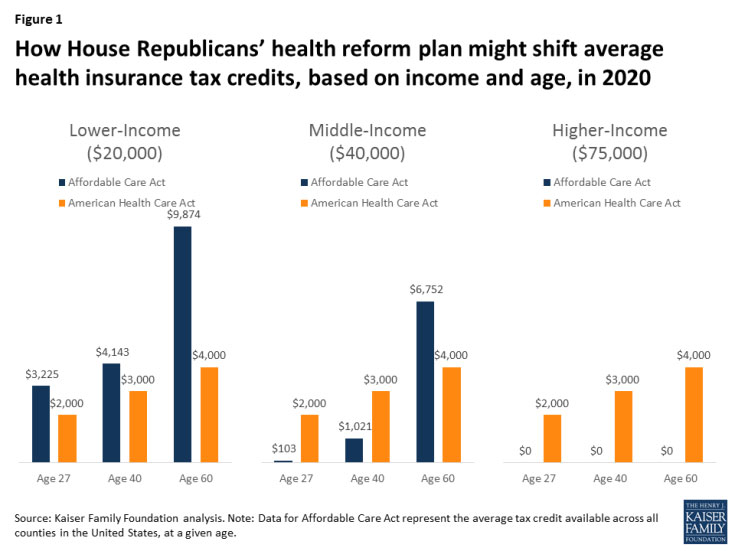

The table from KFF.org below gives an idea of how credits would change under the American Health Care Act. Notice how many demographics are not helped, but a few notably are. Notice how those who lose the most are those with low incomes and seniors.[1]

| Table 2: Projected Annual Premium Tax Credit available in the Individual Market under the Affordable Care Act and the American Health Care Act, 2020 | |||||||

| Income (2020 FPL) | Age | Affordable Care Act | American Health Care Act | ||||

| Reno, NV | US Average | Mobile, AL | Reno, NV | US Average | Mobile, AL | ||

| $20,000 (160% FPL) | 27 | $2,899 | $3,225 | $4,522 | $2,000 | $2,000 | $2,000 |

| 40 | $3,745 | $4,143 | $5,725 | $3,000 | $3,000 | $3,000 | |

| 60 | $9,030 | $9,874 | $13,235 | $4,000 | $4,000 | $4,000 | |

| $40,000 (320% FPL) | 27 | $0 | $103 | $1,400 | $2,000 | $2,000 | $2,000 |

| 40 | $623 | $1,021 | $2,603 | $3,000 | $3,000 | $3,000 | |

| 60 | $5,908 | $6,752 | $10,113 | $4,000 | $4,000 | $4,000 | |

| $75,000 (600% FPL) | 27 | $0 | $0 | $0 | $2,000 | $2,000 | $2,000 |

| 40 | $0 | $0 | $0 | $3,000 | $3,000 | $3,000 | |

| 60 | $0 | $0 | $0 | $4,000 | $4,000 | $4,000 | |

| Source: Kaiser Family Foundation analysis. Notes: In the 2017 ACA exchange markets, premiums in Reno, NV and Mobile, AL are approximately representative of the 25th and 75th percentile, respectively. 2017 ACA premiums were increased according to National Health Expenditure projections for direct purchase. Under the ACA, people with incomes below 250% of the poverty level receive additional financial assistance for cost-sharing (not shown above). | |||||||

Other Details on TrumpCare’s Tax Credit

Aside from the points above, other details of the AHCA include:[2]

For 2018-2019, modify premium tax credits as follows:

- Increase credit amounts for young adults with income above 150% FPL and decrease amounts for adults 50 and older above that income level.

- For end of year reconciliation of advance credits, the cap on repayment of excess advance payments does not apply. – Tax credits cannot be used for plans that cover abortion.

- Premium tax credits can be used to purchase catastrophic plans.

- Premium tax credits can be used to purchase qualified health plans (i.e., covering essential health benefits) sold outside of the exchange, but are not advance-payable for such plans.

- Premium tax credits cannot be used to purchase short term policies or grandfathered individual health insurance policies sold outside of the exchange.

Furthermore, generally:

- Amounts are indexed annually to CPI plus 1 percentage point.

- U.S. citizens and legal immigrants who are not incarcerated and who are not eligible for coverage through an employer plan, Medicare, Medicaid or CHIP, or TRICARE, are eligible for tax credit. Married couples must file jointly to claim the credit. In addition, eligibility for the tax credit phases out starting at income above $75,000 (credit is reduced, but not below zero, by 10 cents for every dollar of income above this threshold; tax credit reduced to zero at income of $95,000 for single individuals Summary of the American Health Care Act 3 up to age 29, $115,000 for individuals age 60 and older. For joint filers, credits begin to phase out at income of $150,000; tax credit reduced to zero at income of $190,000 for couples up to age 29; tax credit reduced to zero at income $230,000 for couples age 60 or older; tax credit reduced to zero at income of $290,000 for couples claiming the maximum family credit amount.)

- Taxpayers who are also enrolled in qualified small employer health reimbursement arrangements (HRA) that apply to non-group coverage will have tax credit reduced, but not below zero, by the amount of the HRA benefit.

- Premium tax credit can be applied to any eligible individual health insurance policy (but not grandfathered policies or short term policies) sold on or off the exchange. Eligible policies do not include those for which substantially all coverage is for excepted benefits; policies that cover abortion (with Hyde exceptions) are not eligible policies. States shall certify plans eligible for the credit. The federal government must establish a program for making advance payment of tax credits no later than January 1, 2020; to the greatest extent practicable the program will use methods and procedures used for the ACA advance payable premium tax credit.

TIP: The details above were summarized from the official bill by the Kaiser family foundation, see their Summary of the American Health Care Act. You can also see our breakdown of the bill here.