Better Care Reconciliation Act of 2017 Facts

Everything You Need To Know About the Better Care Reconciliation Act of 2017 (BCRA) AKA The Latest Version of TrumpCare

We explain everything you need to know about the Better Care Reconciliation Act of 2017 (BCRA); the Senate’s new healthcare bill to replace ObamaCare.[1][2][3]

Below we cover everything you need to know about the Better Care Reconciliation Act of 2017 (BCRA) AKA TrumpCare as it stands now. First, we’ll give you some background, then offer some quick facts, then offer a summary of the new bill, then finally we’ll compare the ACA, AHCA, and BCRA.

UPDATE 2019: This plan never passed, and thus some specifics here are of historical interest only.

NOTE: The Senate needed 51 votes to pass this bill, as of July 18th, 2017 they do not yet have the votes. While the plan failed to pass the Senate, it has since been followed up with other repeal and replace attempts like the Graham-Cassidy Proposal.

FACT: The Better Care Reconciliation Act of 2017 (BCRA), AKA TrumpCare, is the Senate bill to repeal and replace the Affordable Care Act (ACA), AKA ObamaCare. It is based on the House’s American HealthCare Act (AHCA).

- READ the First Version: The Better Care Reconciliation Act of 2017 (AKA TrumpCare AKA the Senate ObamaCare bill).

- READ the BCRA as it stood July, 13th 2017 (the latest version): the full text of the Revised Senate Health Care Bill 7/13/17. See also “the Ted Cruz Amendment” (this is now part of the BCRA).

- CBO Report of the First Version: H.R. 1628, Better Care Reconciliation Act of 2017.

- CBO Report of the Latest Version: H.R. 1628, Obamacare Repeal Reconciliation Act of 2017.

- Overview: See our page on the CBO report of the Better Care Reconciliation Act of 2017.

Quick Facts on the Better Care Reconciliation Act of 2017 or BCRA (TrumpCare as it Stands Now)

Here are some quick facts about major changes, costs, and uninsured rates:

NOTES: Changes may still be made to the bill, as the bill has yet to pass. For example, a round of changes unveiled on July 13th, 2017 offered more funding for Medicaid and less tax breaks, and then immediately following that the “Ted Cruz” Amendment was added. The constant changes mean that CBO projections of cost and coverage will end up needing to be revised, and it means a few specifics listed below could change (if and when a final bill is passed). With those notes in mind, this page will give you a general breakdown of everything you need to know about the ObamaCare repeal and replace plan, The Better Care Reconciliation Act of 2017.

- The Better Care Reconciliation Act of 2017 cuts assistance for the sick, poor, and elderly and as a trade-off gives generous tax breaks to industry.

- In exchange for Medicaid cuts, tax credits based on income and age are extended to 0% of the poverty level (the ACA cut them off at 100% because Medicaid was supposed to be expanded; this bill freezes Medicaid expansion and lowers Medicaid funding for states over time).

- States can use waivers to offer plans without essential health benefits.

- Premiums will likely decrease on average under the BCRA over time, but part of this is because low-premium, low-benefit, high-deductible, plans with annual limits will be allowed to be sold. Despite the average going down, some older and sicker Americans will see their prices go up (and they are projected to be part of the group that loses coverage).

- The employer mandate to offer coverage and the individual mandate to get coverage are cut starting retroactively in 2016.

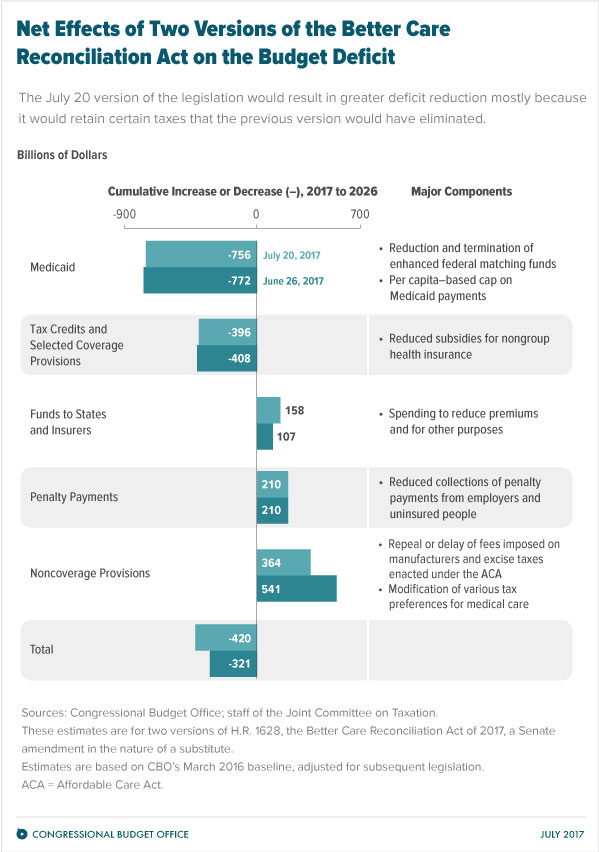

- CBO and JCT estimate that enacting the Better Care Reconciliation Act of 2017 would reduce federal deficits by $420 billion over the coming decade and increase the number of people who are uninsured by 22 million in 2026 relative to current law (total of 49 million uninsured).

- The largest savings would come from Medicaid cuts.

- The largest increases in deficits would come from repealing or modifying tax provisions in the ACA that are not directly related to health insurance coverage, including repealing a surtax on net investment income and repealing annual fees imposed on health insurers.

FACT: Of the 22 million who lose coverage by 2026, 15 million lose coverage from reducing Medicaid funding; 7 million loose coverage from reducing cost assistance and getting rid of the individual and employer mandates. Keep in mind that 75% of families on Medicaid are working poor. Medicaid also funds long-term care for seniors, assistance programs in schools, and help for those considered disabled by Social Security, which has extremely rigid standards. Get more Better Care Reconciliation Act of 2017 CBO Report Facts.

Quick Background on BCRA (TrumpCare as it Stands Now)

To catch you up to how we got to this point.

- The Affordable Care Act has been “the law of the land” since 2010, but it has gone through some changes. You can learn about the current law here.

- The process of drafting these bills has included many changes. These include GOP-backed lawsuits that changed the ACA by allowing states to opt-out of Medicaid expansion. Examples are the House bill to repeal and replace ObamaCare, the American HealthCare Act (AHCA), and The Senate’s Better Care Reconciliation Act of 2017, the Senate version of the House bill. The Senate version replaces the House bill.

- The Senate and House bills are very different from TrumpCare as presented on DonaldJTrump.com. That version includes provisions that are not in the current bill such as “selling across state lines.” This is supposedly scheduled for “phase 3.” Both the Senate and House bill are very different from promises Trump has made like “insurance for everybody.”

- People should also be aware of the January Executive order that takes some reduces the mandate’s power, the April 2017 Regulations that allow for narrow networks and shorter open enrollment periods, and Tom Price’s plans as shown on HHS.

A Simple Summary of the Better Care Reconciliation Act of 2017

The bottom line: The Better Care Reconciliation Act is ObamaCare-lite with less assistance. It offers less cost assistance and less access to Medicaid, and as a trade-off offers lots of tax breaks. It also lays the groundwork for defunding Planned Parenthood and places restrictions on plans offering abortion coverage. It is less generous than ObamaCare in almost all respects (with the exceptions being that there is no mandate and those making less than 100% FPL can get tax credits). Meanwhile, it is more generous than the House bill by some measures (for example cost assistance based on income) and less generous by others (for example deeper cuts to Medicaid). So compared to the House bill, it is a mixed bag, but compared to ObamaCare, it is less generous by most measures (to everyone except specific high earners and industry).

Read the full text: The Better Care Reconciliation Act of 2017 (AKA TrumpCare AKA the Senate ObamaCare bill).

- Tax credits: The House Bill called for tax credits based on age, ObamaCare offered tax credits based on income. Meanwhile, the Senate bill keeps ObamaCare’s income-based tax credits but adjusts them for age; it is a hybrid. The Senate bill is less generous than ObamaCare in a few ways. Under the Senate bill, those earning up to 350% of the poverty level are eligible for credits. ObamaCare’s cap is 400%; the House bill notably offered credits to those earning up to 600%. The result here is that the Senate bill offers more assistance to older Americans than the House bill. Like the House bill and unlike ObamaCare, it extends credits to 0% – 100% of the poverty level; which is good. However, poorer Americans and those making over 350% of the poverty level get no assistance.

- Medicaid expansion: Obamacare’s Medicaid expansion is phased out over four years under this bill. 90% of the current federal funding would be provided in 2020, and it would decrease by 5% each year until 2023, after which it would be eliminated. People would not be allowed to join the expansion from 2020 onwards. In other words, it freezes expansion as the House bill did. On the plus side, tax credits will be available to people that fall off the expansion because there is no cut-off at 100% FPL. This means millions will lose access to coverage, and millions more who would have been covered in the future won’t be; the change happens more slowly than it did with the House bill.

- Medicaid spending: The Senate bill retains the House’s per capita cap for federal Medicaid spending. After 2025, however, growth in spending would shift from the consumer price index for medical care to the CPI for all goods, a lower level of growth. That means states will get less funding for Medicaid in general (not just expansion) and then rates will continue to decline after 2025. This is a bigger cut than was in the House bill.

- Ratios: The Senate bill will allow older Americans to be charged a 5:1 ration (five times more than younger Americans) like the House bill. ObamaCare allows only a 3:1 charge. This means lower income seniors not yet on Medicare could see substantial increases in their costs.

- Work requirements: The bill allows states to set up work requirements for Medicaid. That means you have to be working or seeking work to get Medicaid in states that opt-in to this. We assume that work requirements will exempt the elderly, the disabled, and those with severe mental health issues.

- Cost-sharing subsidies: Cost-sharing subsidies would be extended to 2019. This means those who depend on cost sharing assistance for those making between 100% of the poverty level and 250% is kept until at least 2019. The House bill cut this completely, so the Senate bill is a slight improvement. Uncertainty about cost-sharing has been causing instability in the markets and is contributing to a 19% projected increase in 2018, so some certainty is good here.

- State waivers for Obamacare regulations: States will be able to waive essential health benefits (benefits from 10 essential categories like maternity care and mental health). The House bill allowed for this too. However, the Senate bill won’t allow states to repeal the community rating provision mandating insurers not to raise premiums based on health status, medical claims, gender, or most of the other factors that they used when setting rates in the past. In other words, those with preexisting conditions will be better protected than they were under the House bill.

- Tax Cuts: Both the House and Senate bill cut most of ObamaCare’s taxes such as the Medical device tax, taxes on drug makers, the mandates. It cuts the mandate to get coverage and the mandate to offer full-time employees coverage

as well as the 3.8% tax on investment income on people earning an annual income above $200,000. In other words, this bill cuts hundreds of billions in taxes (mostly benefiting the wealthy), and it cuts the mandate for employers to cover workers’ medical insurance or pay a fee. Notably, it also cuts the individual mandate. UPDATE: The changes on July 17th retained the 3.8% investments tax and a 0.9% payroll tax. - The continuous coverage provision? The House bill charged 30% more for a year if a person didn’t get coverage (a continuous coverage provision). It seems they have struck this from the Senate bill. Unless I’m missing something, there won’t be a fee for failing to get coverage or for re-entering the market.

- Abortion and Planned Parenthood: No plans purchased using funding from the bill are permitted to cover abortions. It says “the term ‘qualified health plan’ does not include any health plan that includes coverage for abortions.” Unlike the ACA, there is no “charge a dollar more” for plans that cover abortions. Additionally, none of the funds allocated by the bill can be given to healthcare providers providing abortion. In other words, nobody who uses cost assistance can get coverage for abortions. The bill also effectively defunds Planned Parenthood with these provisions by blocking them from taking Medicaid payments.

- Small business tax credit: The House bill cut the small business tax credit. The latest version of the BCRA also eliminates the small business tax credit.

A Breakdown of the Changes in the New Version of the BCRA (The Senate’s ObamaCare Repeal and Replace Plan)

The senate unveiled an updated version of the Better Care Reconciliation Act of 2017 on July 13th, 2017 that made some notable changes to the bill.

The bill includes the following changes:

- Less tax breaks for higher-incomes (i.e. the 3.8% investments tax and a 0.9% payroll tax increases under the Affordable Care Act are retained)… taxes on industry are still cut.

- Flexibility on Medicaid funding if a public health emergency takes place.

- A Block grant option to allow states to add the newly eligible Medicaid population to coverage under the block grant.

- Extra money for stabilization. $70 billion more than the first draft of the bill’s $112 billion for state-based health care initiatives to drive down premiums.

- Extra money for high risk customers. If an insurer offers one of those plans that meets the Obamacare criteria, that insurer would be eligible for money from a fund designed to help high-risk customers, which could potentially mitigate some of the two-tier issues created by new, nonqualified plans.

- Extra money for the opioid epidemic. $45 billion for fighting drug addiction and would ease the sale of low-premium “catastrophic” insurance plans.

- New financial support to help low-income people purchase health insurance.

- A provision to allow people to pay for insurance with pre-tax money via HSAs (which is great for customers who buy their health plans out-of-pocket).

NOTES: Immediately following the July 13th version a few more changes were made. The bill now also includes “the Ted Cruz Amendment” which allows insurers to sell inexpensive plans to consumers that include basic coverage up to an annual cap (so limited benefit plans with annual limits would be able to be sold again under the latest version of the BCRA).

For more information, see: Senate Republicans one vote away from Obamacare repeal failure from Politico.com, or see the full text of the Revised Senate Health Care Bill 7/13/17, or see a summary from NPR.[4][5]

The Difference Between ObamaCare (The ACA), the Senate’s TrumpCare (BCRA), the House’s TrumpCare (the AHCA) Explained

The following table shows the main difference between ObamaCare, the Senate’s Better Care Reconciliation Act of 2017, and the Houses American HealthCare Act (the bill that passed the house that many are calling TrumpCare):

| The Difference | The Basics of TrumpCare; The Senate Version (The Better Care Reconciliation Act of 2017 or BCRA) | The Basics of TrumpCare; the House Version (The American HealthCare Act or AHCA) | The Basics of ObamaCare; the Current Law (the Affordable Care Act or ACA) |

| Employer Mandate | Large Businesses don’t have to provide insurance to full-time workers or pay a fee (retroactive starting in 2016). | Large Businesses don’t have to provide insurance to full-time workers or pay a fee. | Large Businesses have to provide insurance to full-time workers. |

| Individual Mandate | There is no individual mandate (the requirement to get coverage or pay a fee). Instead, there is a 6-month waiting period before reentering the market if you have a gap in coverage for more than 63 days in the previous year. This means that, if you apply for coverage during open enrollment or a special enrollment, you have to wait 6 months from the date of application to enroll in coverage. | There is no individual mandate (the requirement to get coverage or pay a fee). Instead, there is a 30% charge for 12 months if you have a gap in coverage for more than 63 days and reenter the market. | There is a fee if you don’t maintain coverage or an exemption each month (for those who can afford it). |

| Pre-Existing Conditions | Preexisting Conditions are covered, but state-based waivers can be used to exclude certain conditions from lifetime and annual limits (but people of the same age on the same plan can’t pay higher premiums or cost sharing). | Preexisting Conditions are covered, but state-based waivers can be used to exclude certain conditions from lifetime and annual limits and can be used to charge sick people more (although the state must establish a high-risk pool). | No one with pre-existing conditions can be denied coverage or charged higher insurance rates. |

| Essential Health Benefits | States can waive essential health benefits and therefore reinstate annual and lifetime limits. The state-based waivers could result in women and sick people, who rely on essential health benefits and their annual and lifetime limits, paying more (or even being excluded from the market due to cost). | States can waive essential health benefits and therefore reinstate annual and lifetime limits. The state-based waivers could result in women and sick people, who rely on essential health benefits and their annual and lifetime limits, paying more (or even being excluded from the market due to cost). | Essential health benefits are covered on all plans with no annual or lifetime limits. |

| Cost Assistance | Tax credits are based on income and age for those making up to 350% of the Poverty Level (the credits start at 0% and stop at 350% creating a cliff, but expanding credits to 0% – 100% to offset Medicaid cuts). Out-of-pocket assistance is extended on a per-month basis until 2019. | Tax credits are based on age for those making up to 600% of the Poverty Level (the credit then phases out slow); out-of-pocket assistance is cut. | Those making between 100% – 400% of the poverty have access to premium tax credits based on income; out-of-pocket assistance is offered for 100%-250% FPL. |

| Medicaid funding | Obamacare’s Medicaid expansion is phased out over four years, funding is cut, and extra dollars are given to states who spend less on Medicaid (and taken from states who spend more). 90% of the current federal funding would be provided in 2020, and it would decrease by 5% each year until 2023, after which it would be eliminated. People would not be allowed to join the expansion from 2020 onwards. Also, there is a per capita cap on federal Medicaid spending. After 2025 growth in spending would shift from the consumer price index for medical care to the CPI for all goods, a lower level of growth. That means Medicaid expansion is frozen, states who expand on their own are punished, states will get less funding for Medicaid in general, and federal funding will continue to decline after 2025. | Medicaid expansion funding is frozen; block-grants might be added to a later bill. | Medicaid is expanded to all adults in all states that expand and the Federal Government pays 90% of the costs. |

| Taxes | TrumpCare cuts most taxes on industry. |

TrumpCare cuts most taxes on industry. This includes the 3.8% tax on high earners. | ObamaCare taxes those who profit the most off of healthcare. |

| Ratios | Older Americans can be charged 5x more than young people under TrumpCare. Premium costs for the same plan for the same age customer cannot differ (community ratings). | Older Americans can be charged 5x more than young people under TrumpCare. Premium costs for the same plan for the same age customer can differ (no community ratings). | Under ObamaCare, you can’t be charged more for having a preexisting condition. Older Americans can be charged 3x more than young people. Premium costs for the same plan for the same age customer cannot differ (community ratings). |

| High-Risk Pools | TrumpCare allows for high-risk pools to create a state-funded (tax payer funded) reinsurance program (via state level waivers). | TrumpCare allows for high-risk pools to create a state-funded (tax payer funded) reinsurance program (via state level waivers). | The Affordable Care Act expanded coverage and got rid of high-risk pools. |

| Cost and Coverage | CBO’s July 20, 2017 report: CBO and JCT estimate that enacting the Better Care Reconciliation Act of 2017 would reduce federal deficits by $420 billion over the coming decade and increase the number of people who are uninsured by 22 million in 2026 relative to current law (for a total of 49 million uninsured; about what it was before the ACA’s coverage provisions took effect).

The cost and uninsured rate are subject to change based on changes to the bill. This bill notably saves more and covers more than the House bill. TIP: Subject to change with revisions. |

The plan (after amendments) had a price tag that came in under the ACA according to the Congressional Budget Office, saving $119 billion over the decade (according to their first report). However, it did this by leaving 52 million without coverage by 2026 (it increases the uninsured by 23 million by 2026 for a total of 51 million uninsured). The cost and uninsured rate are subject to change based on changes to the bill. | The Affordable Care Act, therefore, costs $321 billion more and insures 22 million more people by 2026 than the Senate Bill. |

| Bottomline | The Senate’s TrumpCare might bring premium costs down for some, but less assistance and less on healthcare means hospitals and the sick, poor, and elderly will see new hurdles while the most wealthy (business, large employers, high earners) will see tax breaks. | The House’s TrumpCare might bring premium costs down for some, but less assistance and less on healthcare means hospitals and the sick, poor, and elderly will see new hurdles while the most wealthy (business, large employers, high earners) will see tax breaks. | The Affordable Care Act reduced the uninsured and bankruptcy and helped keep hospitals full, but people were struggling with costs. For those with assistance, however, the ACA meant tens of millions had access to affordable coverage for the first time. Currently, uninsured rates are at an all-time low. |

- UNVEILED: THE SECRET SENATE HEALTHCARE BILL. A useful Business Insider article we used as a reference.

- The Better Care Reconciliation Act of 2017 (AKA TrumpCare AKA the Senate ObamaCare bill). The actual bill.

- H.R. 1628, Better Care Reconciliation Act of 2017. The CBO Report.

- Senate Republicans one vote away from Obamacare repeal failure. Politico.com.

- Read: full text of the Revised Senate Health Care Bill 7/13/17; or see: a summary from NPR.