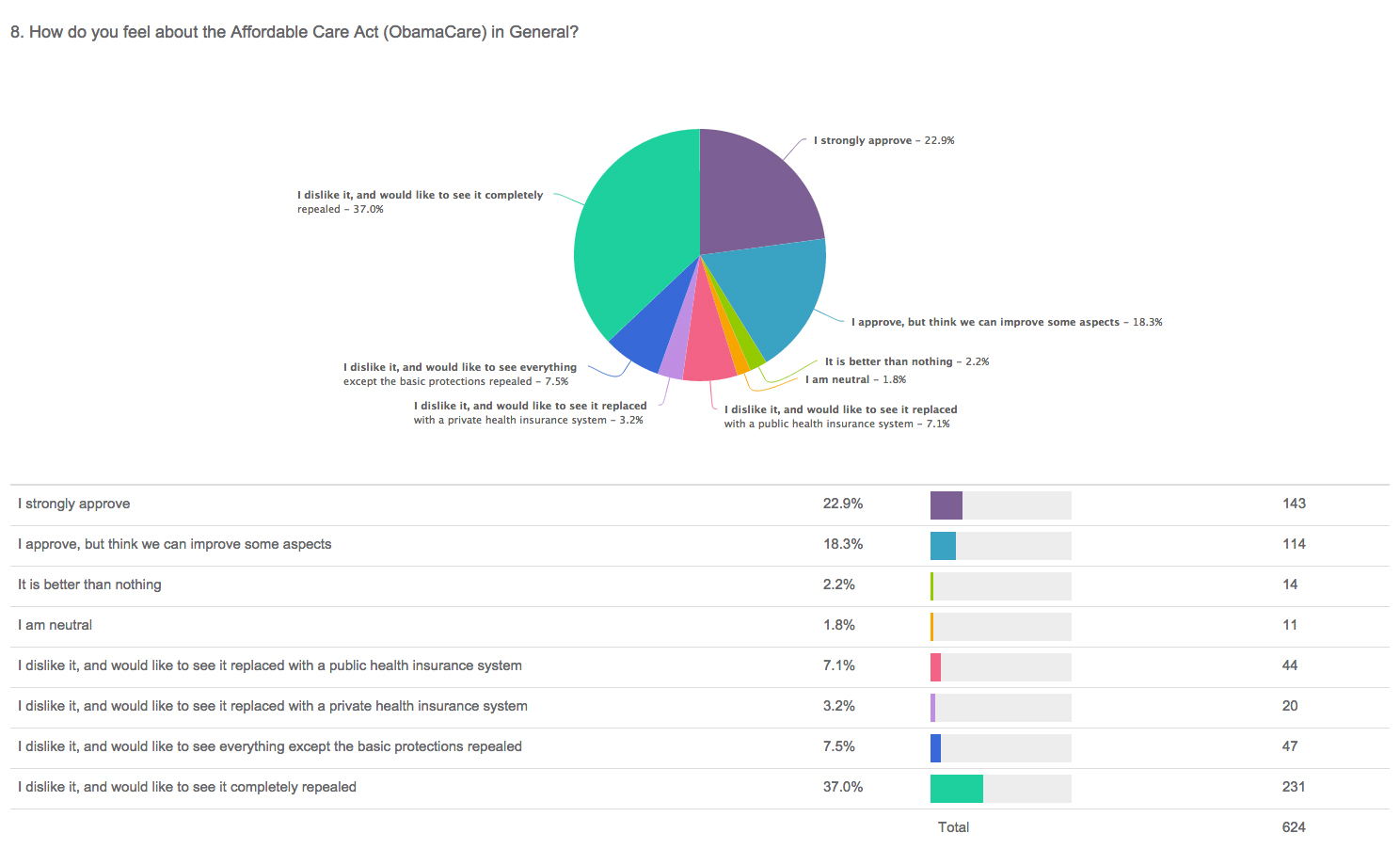

Can I Keep ObamaCare if Employer Coverage is Too Expensive?

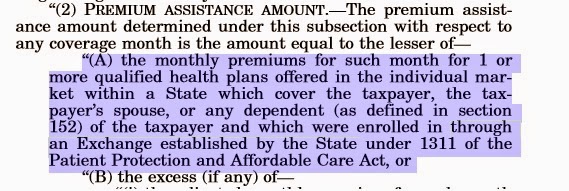

You can keep ObamaCare no matter what, but you can only keep subsidies if employer coverage would cost more than 9.56% of household income for employee-only coverage.