Cost Sharing Reduction Subsidies 2023

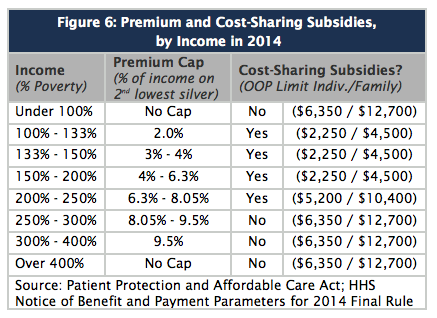

Cost Sharing Reduction (CSR) subsidies reduce your out-of-pocket expenses on silver plans purchased through the health insurance marketplace for those with incomes between 100% – 250% of the poverty level. For 2023 CSR values remain unchanged and provide 70%, 73%, 87%, or 94% Actuarial Value depending on income. CSR subsidies lower your coinsurance, and lower… Read More