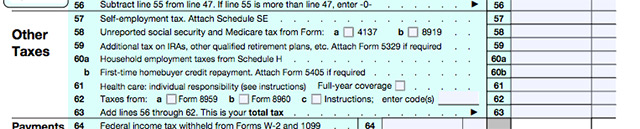

ObamaCare 1040 Forms

Everything You Need to Know About Your 1040 and the ACA You’ll need to file a 1040 form under ObamaCare, find out what sections of the 1040 apply to health insurance and what type of 1040 you need to file. Need to Print Out a 1040 Form? Get a list of all 1040 forms and instructions… Read More