Open Enrollment 2016

A quick overview of everything you need to know about getting coverage, switching plans, and cost assistance during ObamaCare’s 2016 open enrollment period.

A quick overview of everything you need to know about getting coverage, switching plans, and cost assistance during ObamaCare’s 2016 open enrollment period.

The new ObamaCare lawsuit is based on the Constitution’s Origination Clause, which requires that the House be the first to pass a bill “for raising revenue.”

As of September 2015 an estimated 17.6 million are enrolled in ObamaCare including 15.3 million in the Marketplace and Medicaid and 2.3 million young adults.

ObamaCare is a law, the law contains cost assistance based on income and tax filing status. Whether this is a handout depends upon your definition of handout.

If you file a tax extension with form Form 4868 the extension applies to all ACA related tax forms including Form 8962 for tax credits and Form 8965 for exemptions.

We explain Scott Walker’s plan to repeal and replace ObamaCare. We compare it to the ACA and examine what it gets right and wrong.

College students have a number of health plan options including the Marketplace, Medicaid, school health plans, catastrophic plans, and their parents plan. Below we take a look at student health options under the Affordable Care Act (ObamaCare). FACT: A university health plan counts as Minimum Essential Coverage for ObamaCare if it’s fully insured or self insured. Aside… Read More

How to Understand Household Income, Family Size, Tax Family, and Coverage Family for ObamaCare Cost Assistance For ObamaCare, your “household” is your “tax family” (head of household, spouse, and tax dependents). Cost assistance is based on household income and size, the people who share a plan are called a “coverage family.” With this in mind, Household… Read More

How IRA’s and HSAs work with the ACA Before-tax and tax deductible contributions (like to a traditional IRA) lower MAGI and increase subsidies. After-tax contributions lower MAGI on withdrawal (like the Roth IRA). HSA’s are tax free in and tax free out, which make them especially cool. This is generally true for ObamaCare’s tax credits… Read More

Funding a 401(k) lowers MAGI, but funding a Roth IRA doesn’t due to how it’s taxed. Anything that affects MAGI can affect ObamaCare’s tax credit amounts.

710,000 who got subsidies through ObamaCare have yet to file tax returns, while 9% (7.5 million) who did file paid $1.5 billion in penalties (although many qualified for additional exemptions).

If you estimated your income to qualify for subsidies, but didn’t make enough, you don’t owe back any money and can keep the tax credits you got in advance.

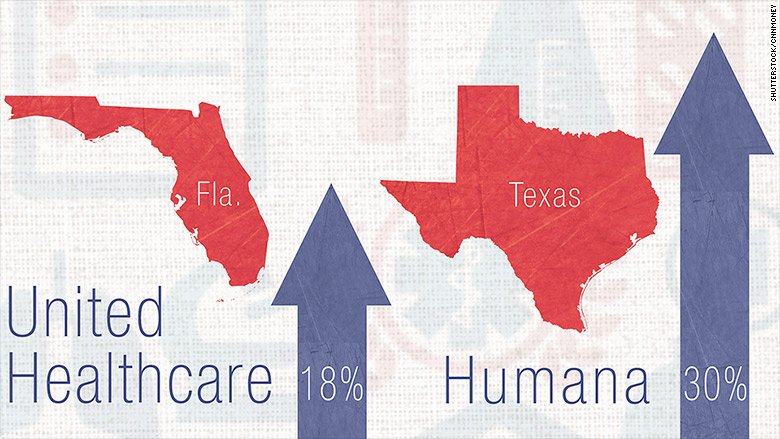

Just days after the Supreme Court Declared subsidies legal many major health insurance companies declared mergers. Mergers include Aetna (AET) buying Humana (HUM) for $230 a share, 23% higher then Market price the day before the announcement.

Death benefits received from life insurance are typically non-taxable and thus won’t impact the household MAGI ObamaCare’s subsidies are based on.

If an employer plan would cost more than 9.5% of household MAGI for self only coverage, after employer contribution, then it qualifies you for ACA coverage.

Employers who reimburse employees for individual non-group health plans face a $100 a day or $36,500 per year, per employee excise tax. This rule applies to all employers, but the fine itself is only levied on those who have to comply with ObamaCare’s mandate (firms with 50 or more full-time equivalent employees).

Under the ACA you can be charged a tobacco surcharge for smoking of up to 50% of your premium after subsidies, regardless of where you get coverage. Typically won’t be charged the full amount and some insurers may not charge anything at all.

The Supreme Court has been busy making America awesome, not only did they uphold subsidies they also declared same-sex couples have a right to marriage. Generally almost all of their recent decisions have fought back against discrimination, repression of freedom speech, repression of freedom of religion, and repression of individual liberty. It hasn’t seemed to matter… Read More

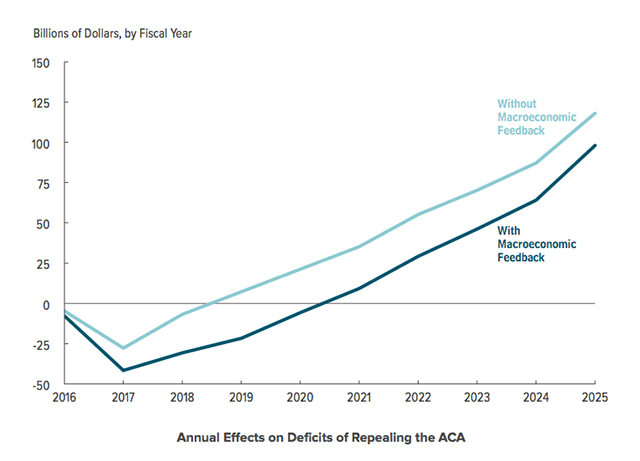

Repealing ObamaCare would increase the federal deficit by at least $137 billion over ten years and increase the number of uninsured by 19 million by 2016.

If you have access to an employer health plan you can’t get ObamaCare’s subsidies, you can keep the plan without subsidies or switch to an employer plan.

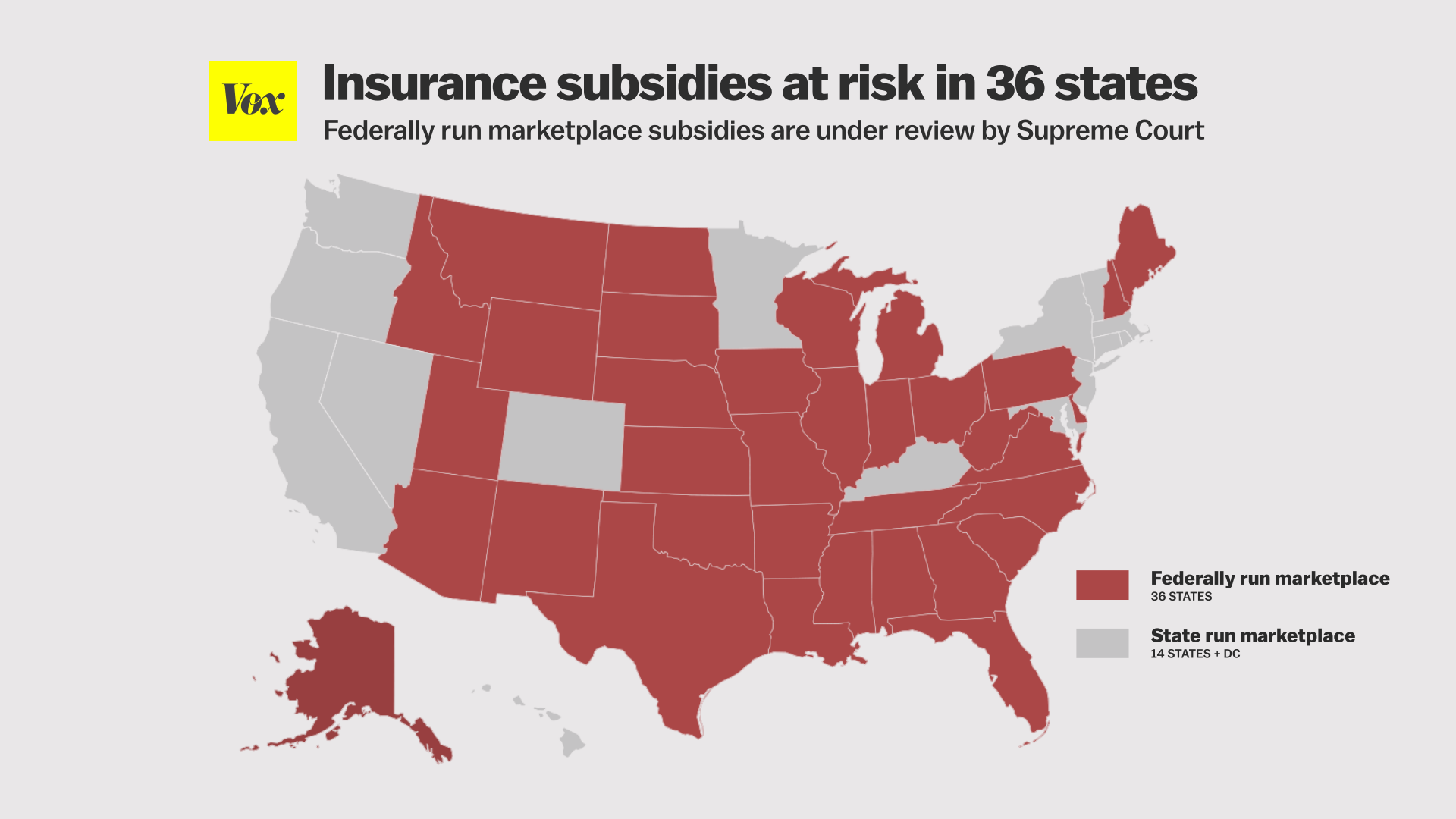

A Supreme Court ruling on King V Burwell (the lawsuit challenging the legality of subsidies offered through HealthCare.Gov) is expected in June of 2015.

Everything you need to know about ObamaCare for June 2015 including Hawaii’s exchange, a subsidy lawsuit, Florida and Medicaid, and other healthcare news (plus multiple instances of the word “boondoggle”).

Insurers are planning rate hikes for 2016 under ObamaCare. ObamaCare being both the reason we know about it, and part of the reason it’s happening.

This site is full of facts about ObamaCare. Facts based upon the theory of what ObamaCare would bring. I doubt that this will be published, but I am a REAL ObamaCare user. I received a significant benefit in subsidies by using the marketplace. Due to significant health problems and lack of income I pay a… Read More

Last week a story went viral about a guy in South Carolina who didn’t get ObamaCare and ended up needing it.