What Will Happen If ObamaCare is Repealed?

If ObamaCare is repealed those who get cost assistance and those with preexisting conditions could lose coverage options.

If ObamaCare is repealed those who get cost assistance and those with preexisting conditions could lose coverage options.

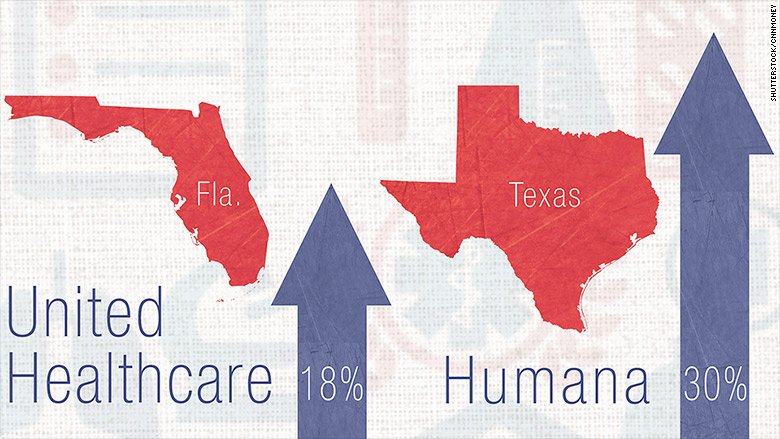

Insurers are planning rate hikes for 2016 under ObamaCare. ObamaCare being both the reason we know about it, and part of the reason it’s happening.

Last week a story went viral about a guy in South Carolina who didn’t get ObamaCare and ended up needing it.

All Silver plans offered on the Health Insurance Marketplace offer cost sharing reduction subsidy options. The amount of reduction you qualify for is based on your projected income.

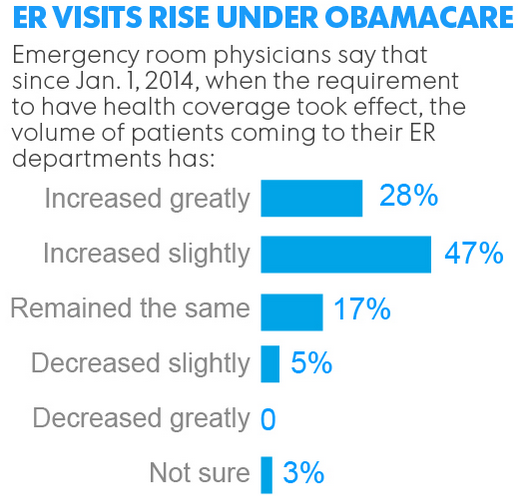

A study shows that ER visits have increased as more people have gotten coverage under the Affordable Care Act. This expected short term outcome isn’t ideal, but speaks to habits of the previously uninsured, the fact that ER visits are covered under the ACA, and an increased doc shortage as demand outpaces supply in the short term.

A qualifying employer must offer health coverage regardless of what other coverage options an employee has.

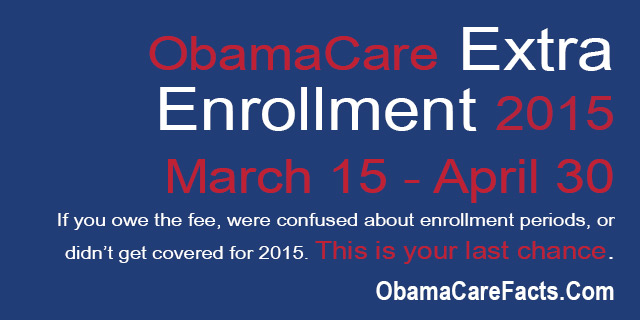

Open enrollment ended February 15, 2015 but last minute shoppers have until April 30 to get covered and avoid the fee, if they don’t have a health plan yet. *Healthcare.gov customers and select states only.

ObamaCare covers one type of birth control per person from each of 18 FDA-approved categories at no out-of-pocket cost, although some plans have exemptions. This page will tell you what kinds of birth control are covered, which health plans have exemptions, how to get free birth control under the Affordable Care Act, and how to get help… Read More

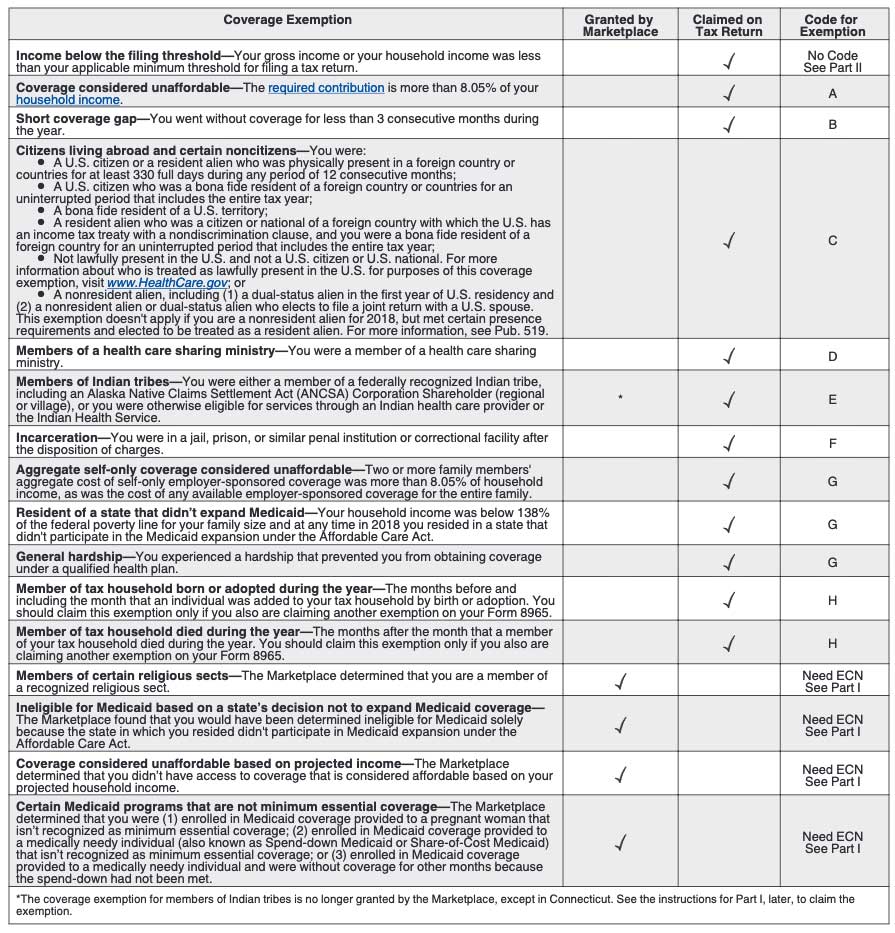

If you go less than three months in a row without coverage or if you get covered during open enrollment, you can claim an exemption on form 8965 and avoid the fee

Children can stay on their parent’s plan until 26; when they turn 26, they qualify for special enrollment. Additionally, many employers offer dependent coverage for young adults. Below is a comprehensive guide to the Affordable Care Act’s provisions for young adults under 26, ensuring they maintain access to health insurance coverage. What the ACA Does… Read More

A recent HHS blog post helps to illustrate one of the many small, but noticeable, ways ObamaCare has helped to curb healthcare costs across the nation. A new study, in the Annals of Emergency Medicine, shows that, following the implementation of the Affordable Care Act, the annual rate of emergency department visits by young adults age 19 to 25 decreased by 1.4 percent in 2011.

Our experience is that while Obamacare may be far from perfect, it does provide coverage for our 29 year old son who otherwise would be excluded from health insurance because of a preexisting condition.

My income is lower than average, so we watch every penny carefully and live within our means. I used to have a Healthcare plan that fit my budget and worked well for my family of 6. It cost less than $300 per month, and the deductible was $4000. I felt good about being able to… Read More

Whomever claims the dependent for the month in question is responsible for their health coverage. Options are based, at least partially, on income.

In all states, those making between 100% of the Federal Poverty Level and 400% can get some sort of assistance through the Health Insurance Marketplace. In states that didn’t expand Medicaid those who make less than 100% of the poverty level may not have any options

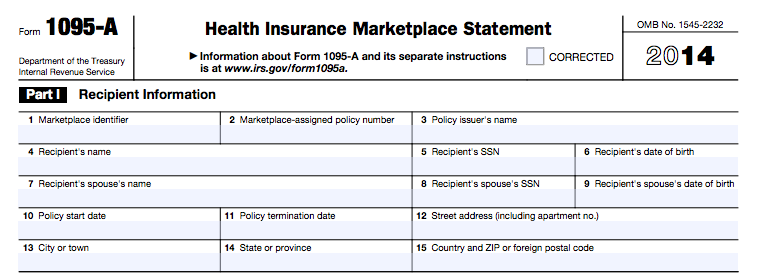

The wrong 1095-A forms went out to about 800,000. This form is used to adjust cost assistance on taxes. The wrong forms had correct subsidy amounts, but wrong calculations.

Second Lowest Cost Silver Plans and Lowest Cost Bronze Plans Explained The Second Lowest Cost Silver Plan (SLCSP) is a key plan on each state’s Marketplace, used to calculate the cost assistance you may qualify for under ObamaCare. Similarly, the Lowest Cost Bronze Plan in each state’s Marketplace is used to determine affordability for certain… Read More

Being denied Medicaid or CHIP may grant you access to a special enrollment period, an exemption, and/or catastrophic coverage depending upon your situation

Whomever claims the dependent is responsible for getting them health insurance. Cost assisted options include the Marketplace and CHIP. Whether or not a person has to pay the Fee is also based on income.

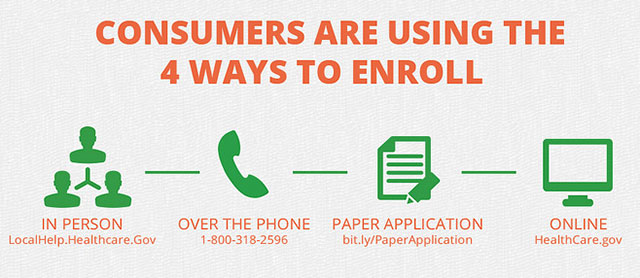

If you are running out of time to enroll in a Marketplace plan for 2015, follow the steps below to ensure you get covered.

You can go less than three months in a row without coverage without owing the fee each year. This is due to a short coverage gap exemption, this allows for things like changing jobs or being between coverage options.

Get the facts on the ObamaCare replacement plan by Burr, Hatch, and Upton: the Patient Choice, Affordability, Responsibility, and Empowerment (CARE) Act. Below we present a summary, some quick facts, a pros and cons chart, a complete section-by-section breakdown, and finally we compare the CARE Act proposal to ObamaCare. Keep in mind this is an older replacement… Read More

Good morning. I currently make $3250 a month NET. After withholdings like Taxes, SS, Medicare etc, I receive $2632.08. Of that amount child support is automatically taken out in the amount of $1311.54 which is 50% of my current salary. I get the burden of paying taxes on the child support. I get that. What… Read More

A list of ObamaCare’s Exemptions, including Hardship Exemptions, you can apply for in order to qualify for Special Enrollment or be exempt from the fee can be found below. This page just covers the basics, see our page on ObamaCare Exemptions for further details on exemptions and the fee (active on plans held in 2014 –… Read More

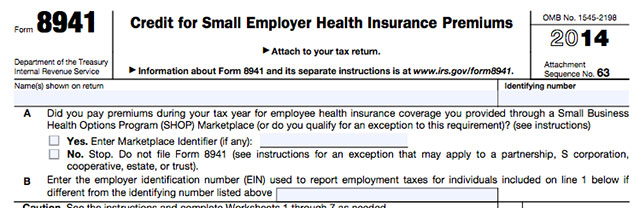

Employers can get a Tax Credit for up to 50% of their contribution to employee premiums by filing Form 8941, Credit for Small Employer Health Insurance Premiums. Get detailed HTML based instructions on Form 8941 from the IRS, simplified instructions ObamaCare’s employer tax credit form can be found below. What is Form 8941, Credit for Small Employer Health Insurance Premiums?… Read More