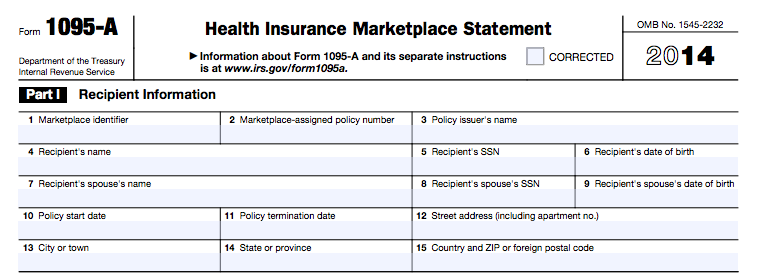

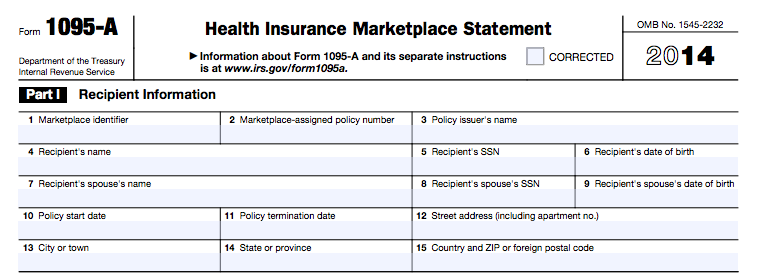

Misplaced Form 1095A, How Can I Get Another?

If you misplaced a 1095-A you can find it online. You can also find the information on your 1095 yourself, or request another copy from the Marketplace.

If you misplaced a 1095-A you can find it online. You can also find the information on your 1095 yourself, or request another copy from the Marketplace.

All the best information we have about 1095-A’s discusses how to get the form filed, at that point it’s up to the IRS. We can only imagine they are working hard to get everything flowing smoothly. You can always call them to follow-up or get assistance from TAS (tax payer advocate services).

The tobacco surcharge only applies to those who smoke 4 or more times a week, it doesn’t include ceremonial or celebratory use.

If your income varies from week-to-week you’ll make a reasonable prediction of your annual income, which you can base on last year. You should consider taking only part of the tax credit up front and then adjusting the net tax credit on the 8962 – Premium tax credit form at the end of the year.

In some cases the amount of the Second Lowest Cost Silver Plan (SLCSP) on a 1095-A may be incorrect, you can find the correct SLCSP here.

The Treasury department and IRS confirmed those who filed using an incorrect 1095-A will not be charged additional taxes based on the corrected forms. This applies to both the federal exchange HealthCare.Gov and the state exchanges. UPDATE: 2019: While this page was written in 2015 and applies first and foremost to the 2014 plan year, the information… Read More

Health insurance tax credits are based on Modified Adjusted Gross Income. Social Security survivors benefits only count toward MAGI of tax filers.

You probably owe the Individual Shared Responsibility Payment since you only had qualifying health coverage for 5 months out of the year. This fee is charged on your year-end tax return. You could also owe money if you didn’t claim exemptions on form 8965, or you received too much money in tax credits up front.

We explain how to file your taxes if you got an incorrect 1095-A, didn’t get a 1095-A, or didn’t get an Electronic Confirmation Number.

You can use any 330 day period outside the US for ObamaCare’s travel exemption. This means you can have two exempt periods in the same year of 12 months each.

A Health Reimbursement Arrangement (HRA) doesn’t affect premium tax credits, but a Employer Payment plan is excluded from an employee’s gross income and affects tax credits in that way (tax credits are based on Modified Adjusted Gross Income).

The ACA doesn’t directly affect tax brackets, however Americans can use a Health Savings Account to lower their household income. This can help them qualify for more cost assistance and potentially lower the rate at which they are taxed

Social Security payments are deducted from AGI, but added back in for MAGI. Therefore they generally do count as income for ACA cost assistance.

The IRS does allow you to make incremental payments. Just make sure to file all your forms, including ACA related forms, before applying for a payment agreement.

Under the ACA you can take tax deductions for medical and dental expenses that exceed 10%* of your annual Adjusted Gross Income using a Form 1040, Schedule A. This includes deductions for most medical and dental costs for you, your spouse, and your dependents. Most people won’t take this deduction, but if you’ve had a… Read More

When you enrolled you got cost assistance based on your projected income for the year, if you made more then you may have to pay back tax credits.

When you pay the tax penalty it goes toward healthcare spending on ACA subsidies, Medicare, Medicaid, and other federal and state healthcare programs.

There was an increase to the Medicare tax, if you are a higher-earning employee this may account for the paycheck deduction. It could also be related to paying into employer-sponsored coverage.

Nothing in ObamaCare (the Affordable Care Act) prevents you from filing for a tax extension using form 4868. There is no ACA related penalty for filing the extension.

If you would have paid the fee, but were exempt from the fee, you still qualify for the extra enrollment period March 15 – April 2015. You’ll need to attest to this situation when you apply for the Special Enrollment period through the Marketplace.

If you filed your taxes using an incorrect ACA tax form (or your taxes were done incorrectly) and paid more than you should follow the IRS process for appealing a tax dispute.

Any disparities between actual income and what’s reported on a person’s marketplace application will turn up when that person files their next tax return. Cost assistance that was given that should not have been will have to be repaid to the government.

Taxable social security payments, IRA contributions, and taxable IRA interest aren’t deducted from Modified AGI. Your Modified AGI is used to determine subsidies.

You are exempt from the tax penalty if you spent at least 330 full days outside of the U.S. in a 12 month period. You will apply for this exemption while filing your 2014 tax return.

Generally, if you or your dependent didn’t have marketplace coverage then you answer no to Marketplace related questions.