400% Federal Poverty Level (FPL) Subsidy Cliff

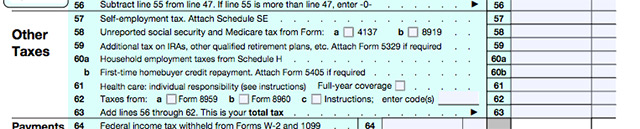

Tax Credits to lower health insurance premium costs are generally available to anyone making 100% – 400% of the Federal Poverty Level. The 400% cut-off creates a “Subsidy Cliff”, meaning that families who make just slightly more than the limit can lose all assistance, resulting in a loss of thousands in potential savings by earning… Read More