How Do Deductibles Work With ObamaCare?

Deductibles are lowered by Cost Sharing Reduction subsidies, on Silver plans only. You’ll pay out of pocket for all care not subject to a copay before you meet your deductible.

Deductibles are lowered by Cost Sharing Reduction subsidies, on Silver plans only. You’ll pay out of pocket for all care not subject to a copay before you meet your deductible.

Open enrollment ends February 15th. That means February 15th is your last chance to get cost assistance and coverage each year, unless you qualify for a special enrollment period.

You are right on the cusp of your income being too low for subsidies in Idaho. This is because Idaho did not expand Medicaid. However, everyone is wrong. You qualify for the maximum Tax credit and cost sharing reduction subsidy at that income.

My wife and I (retired, too much income for subsidies, not eligible for medicare etc) apparently qualify for exemptions because last year’s ‘grandfathered’ policy was cancelled and the cheapest bronze is in excess of 8% of our AGI/MAGI. finding someone at healthcare.gov or at the two insurance providers in our area who understood how to help… Read More

The ObamaCare alternative, a plan by Burr, Hatch, and Upton called the Patient Choice, Affordability, Responsibility, and Empowerment (CARE) Act is here. Just wait until you see what is inside.

Get the facts on the ObamaCare replacement plan by Burr, Hatch, and Upton: the Patient Choice, Affordability, Responsibility, and Empowerment (CARE) Act. Below we present a summary, some quick facts, a pros and cons chart, a complete section-by-section breakdown, and finally we compare the CARE Act proposal to ObamaCare. Keep in mind this is an older replacement… Read More

Being 65 or older you don’t qualify for Marketplace cost assistance, being a resident Alien you may not qualify for Medicare subsidies, but you can still buy Medicare.

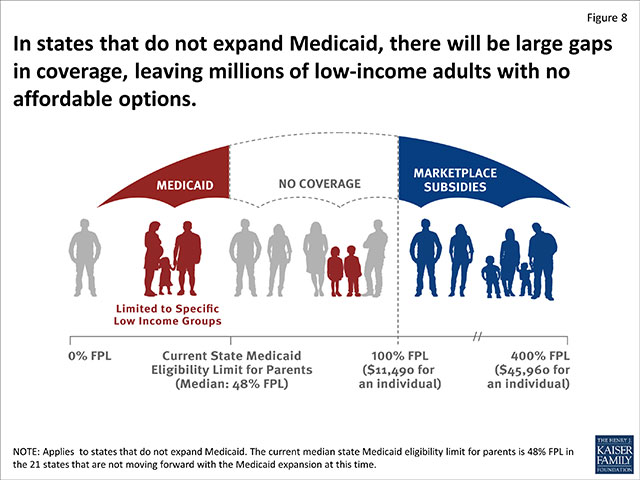

What is the Medicaid Gap? The “Medicaid gap” describes the gap between state Medicaid eligibility and Marketplace subsidy eligibility in states that didn’t expand Medicaid. How Does the Medicaid Gap Work? Below are some quick points to illustrate the “gap” between those who qualify for subsidies and those who qualify for affordable health insurance due… Read More

They say the 60th time is a charm, or even if they don’t… The house voted for the 56th time to repeal ObamaCare, and the vote passed 239-186. Added together with provisional attempts this is the 60th GOP attempt to repeal the law.

ObamaCare’s Open enrollment ends on February 15th, are you covered? Time is running out to get coverage for 2015.

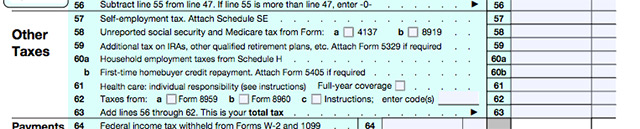

Everything You Need to Know About Your 1040 and the ACA You’ll need to file a 1040 form under ObamaCare, find out what sections of the 1040 apply to health insurance and what type of 1040 you need to file. Need to Print Out a 1040 Form? Get a list of all 1040 forms and instructions… Read More

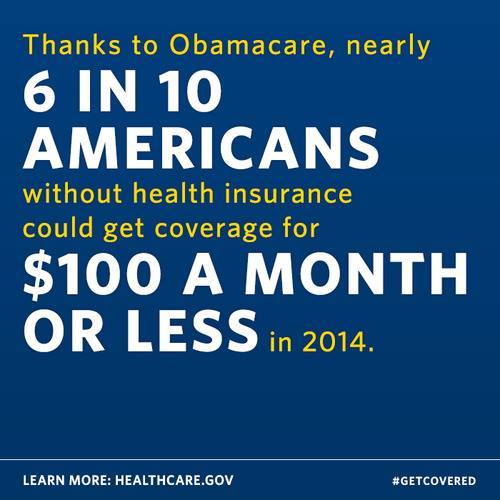

ObamaCare Premium Tax Credit Subsidies are available to those making between 100%-400% of the Federal Poverty Level. For 2014-2015, this means that if the income for a one-person household is over $46,680 you will not qualify for Premium Tax Credits.

I thought last year was bad. But, after telling me how much better my 2014 plan was compared to my personal plan in 2013 (I was already enrolled in my own personal plan, which the government canceled), the State of Washington canceled my new plan. So, I had to shop again. Perhaps the total premium didn’t… Read More

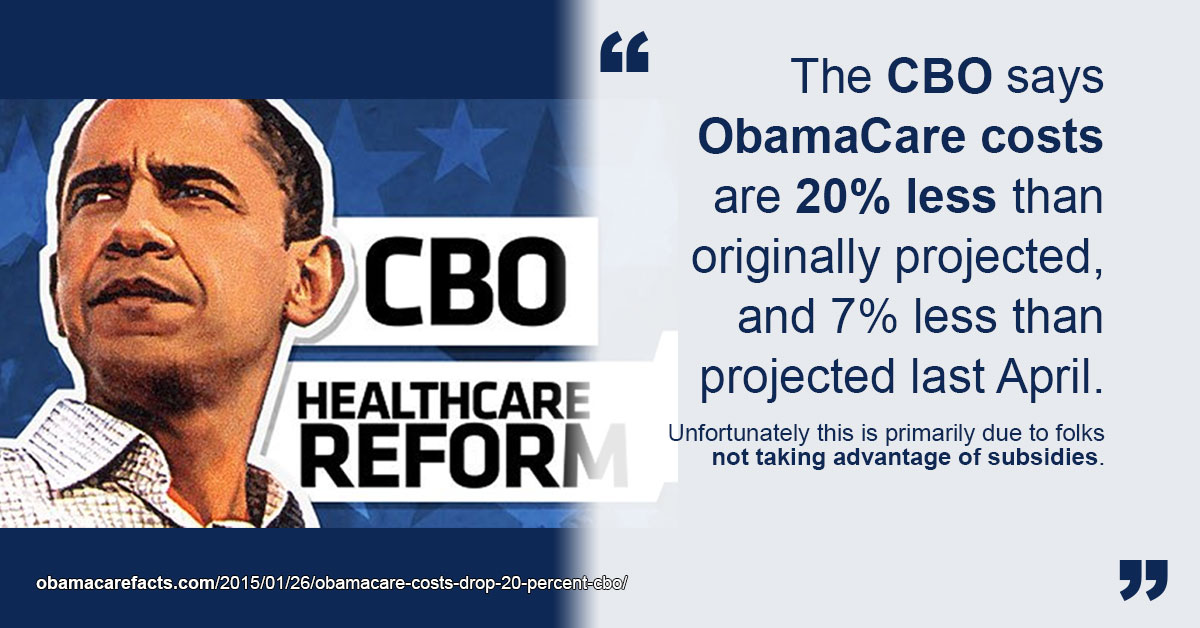

The latest CBO report is in, ObamaCare’s costs are 20% less than expected. The CBO projects ACA related provisions to cost $571 billion through 2019, that’s $139 billion less than projected in 2010 and 7% less than projected last April. CBO and JCT currently estimate that the ACA’s coverage provisions will result in net costs to the federal… Read More

Get the facts on low cost health insurance, how Medicaid and Marketplace subsidies can lower your costs, and how to get affordable coverage. Getting low cost health insurance is a little more complicated than just finding the right broker, picking the lowest premium plan, or general cost sharing amounts. It’s about understanding what cost assistance you… Read More

A list of ObamaCare’s Exemptions, including Hardship Exemptions, you can apply for in order to qualify for Special Enrollment or be exempt from the fee can be found below. This page just covers the basics, see our page on ObamaCare Exemptions for further details on exemptions and the fee (active on plans held in 2014 –… Read More

How Tax Refunds for Advanced Tax Credits Work under the Affordable Care Act Millions may get a tax refund under ObamaCare. If your income was lower than projected, and you had a Marketplace plan, you may get an ObamaCare tax refund. NOTE: This article was written in 2015, but has been updated for 2019 –… Read More

Can my husband and I apply separately or do we have to apply together? If I don’t qualify for cost subsidies, is it possible that my husband will?

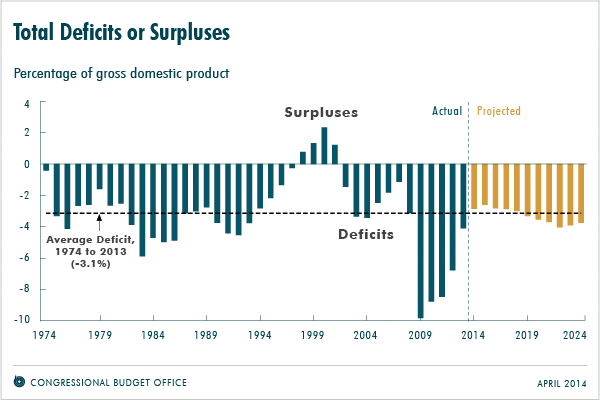

ObamaCare decreases the deficit and debt with cost controlling provisions and taxes, but subsidies, protections, and healthcare spending may result in more debt over the long term if no further changes are made. UPDATE 2019: This page was created in 2015, numbers have been revised since this was written. So the logic remains the same, but the specific numbers need to… Read More

My husband and I have not been helped but hurt and our details are below. But before I get into our details want to say that middle income people who do not qualify for subsidies, especially those who do not have health coverage via an employer (e.g. self employed or those who work for employers… Read More

Get the Facts on the 60 minutes report on ObamaCare “Dissecting ObamaCare” featuring Steven Brill author of “America’s Bitter Pill.” We fact-check the video. Watch the full of the 60 Minutes ObamaCare video. First fact-check, it’s only 13:19 minutes long, not 60:00. CBS intended each of its segments to run for approximately 15 minutes and… Read More

Cost-sharing in health insurance is your share of costs (copays, coinsurance, deductible, out-of-pocket maximum) for covered benefits in a policy period. Typically cost-sharing does not apply to Premiums, uncovered costs, or balance billing. TIP: In simple terms, cost-sharing describes your share of the costs vs. your insurer’s share of the cost in respect to your… Read More

ObamaCare’s Platinum Plan is a type of Metal Plan on the Health Insurance Marketplace. Platinum Plans qualify for Tax Credits and have the highest premiums. Other Metal Plans include Bronze, Silver, and Gold. Also, a Catastrophic Plan is available to young adults and to some people with hardship exemptions. Platinum plans have the highest premiums and the lowest cost-sharing. They only make… Read More

ObamaCare’s Gold Plan is a type of Metal Plan on the Health Insurance Marketplace. Gold Plans qualify for Tax Credits, have high premiums, and generous cost-sharing. Other Metal Plans include Bronze, Silver, and Platinum. Also, a Catastrophic Plan is available to young adults and to some people with hardship exemptions. Gold plans mean higher premiums, less Tax Credits, but much… Read More

ObamaCare’s Bronze Plan is a type of Metal Plan on the Health Insurance Marketplace. Bronze Plans qualify for Tax Credits and have low premiums. Other Metal Plans include Silver, Gold, and Platinum. Also a Catastrophic Plan is available to young adults and to some people with hardship exemptions. All plans offer basic benefits and minimum cost-sharing, Bronze Plans tend… Read More