Why Did My Insurance Premium Go Up?

Your rates didn’t go up because of legislation directly increasing premiums, some who had lower rates before saw rates go up as a response to new protections

Your rates didn’t go up because of legislation directly increasing premiums, some who had lower rates before saw rates go up as a response to new protections

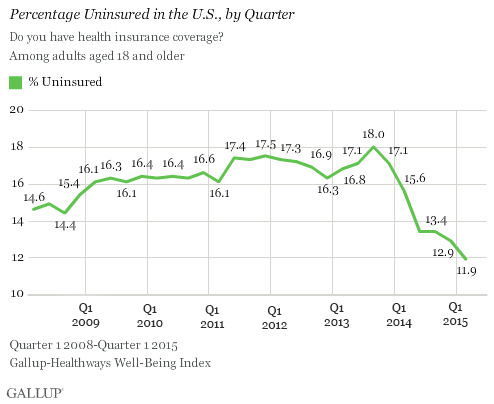

Under the Affordable Care Act (ObamaCare) the uninsured rate dropped to 11.9% for Q1 of 2015. This is down about 1% from last quarter and 5.2% since 2013.

Non-taxable Social Security benefits are counted as income for ObamaCare and affect tax credits. This includes disability payments (SSDI), but does not include Supplemental Security Income (SSI).

If you got cost assistance for even one month you need to file 8962 using a 1095-A. This is true even if you no longer need Tax Credits.

Rand Paul announced he is running for President, but didn’t mention ObamaCare. What cuts would Libertarian (ish) Rand Paul make to the safety net and federal programs? Luckily Rand is very vocal about the rest of his policy ideas and how the budget should look

Meridian health insurance is a physician-owned and operated group of health plans and companies. They service Medicare and Medicaid in low-resource environments. In some states, in some regions, they really let insurers (of all types public and private) get away with some B-S. Essentially the insurer is offering a network that is so tight that your coverage becomes lackluster (to be fair you coverage was also probably cheaper than other offers)

Get the latest 1095-A information from the Treasury department and IRS released on April 3rd, 2015. Those who filed won’t be penalized, but can amend.

Lump-sum income is counted for the month for Medicaid and Medicare, but for ACA subsidies we believe it counts as annual.

The Supreme Court won’t hear a lawsuit, that among other things, challenges the legality of the Independent Payment Advisory Board (IPAB).

ObamaCare isn’t “socialism”. Under ObamaCare we have a regulated private health care industry that uses a mix of public and private funding..

TRICARE is subject to the elimination of copayments for authorized preventive services for certain TRICARE beneficiaries for non-grandfathered plans.

When one spouse turns 65 and becomes eligible for Medicare the other spouse can get a Marketplace plan or stay on the current plan if they are under 65.

The Affordable Care Act (ObamaCare) was signed into law 5 years ago on March 23rd, 2010. We look at the successes, sticking points, and politics of the law.

Health insurance tax credits are based on Modified Adjusted Gross Income. Social Security survivors benefits only count toward MAGI of tax filers.

Employers can use Health Reimbursement Arrangements (HRAs), Employer Payment Plans, and Flexible Spending Accounts (FSAs) to save money on healthcare. We take a look at healthcare arrangements to find out how they can benefits employers and employees alike. We will also look at how they affect employer and employee taxes and penalties. It’s important to understand… Read More

The best health insurance plan for an individual or family is going to depend on the income and needs of that family. With that said, many will find a marketplace plan that qualifies for cost assistance to be the best value for them. Very generally speaking the best health plan when it comes to benefits… Read More

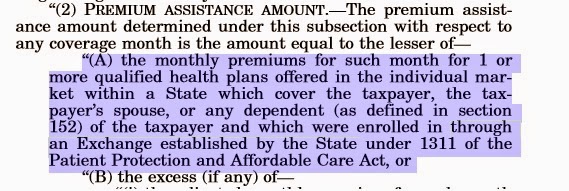

We’ve simplified King V Burwell, the ObamaCare subsidy lawsuit. We explain the Supreme Court case, its history, ideology, and outcome in simple terms. King V Burwell Summary King V Burwell was a lawsuit heard by the Supreme Court in 2015. It challenged the legality of subsidies issued by the IRS on behalf of states that used… Read More

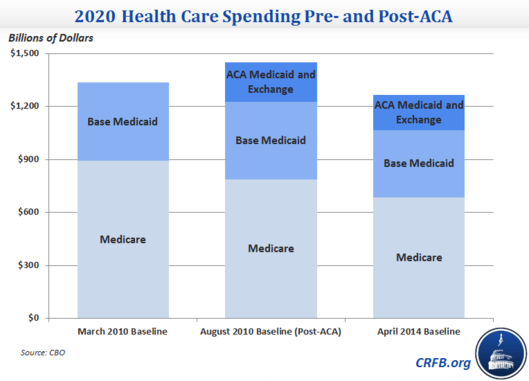

When you pay the tax penalty it goes toward healthcare spending on ACA subsidies, Medicare, Medicaid, and other federal and state healthcare programs.

There was an increase to the Medicare tax, if you are a higher-earning employee this may account for the paycheck deduction. It could also be related to paying into employer-sponsored coverage.

On March 4th, the Supreme Court began hearing oral arguments for King V. Burwell (the ObamaCare subsidy lawsuit about an exchange established by the state). Here is what we know so far.

Summary of the Health Care and Education Reconciliation Act of 2010 The HealthCare and Education Reconciliation Act of 2010 was signed into law along with the Patient Protection and Affordable Care Act, below is a summary. The health care related sections of both of these laws is what we usually think of as “ObamaCare”. The Student Aid and Fiscal… Read More

ObamaCare’s Cadillac Tax is a 40% excise tax on high end plans above $10,200 for individuals and $27,500 for family coverage that was set to start in 2018 but was been delayed. This tax is not deductible. The excise tax is one of the main revenue sources for the ACA, helps curb healthcare costs, and… Read More

Orrin Hatch’s replacement plan for ObamaCare, dubbed “the freedom option” in a WSJ op-ed, is an alternative to amending the law to clarify that Healthcare.Gov can issue subsidies, and is essentially a rehash of the old “repeal ObamaCare” plan.

When you get covered through the Marketplace that plan lasts a year. However, you can cancel at anytime. This means you can keep coverage for any length of time up to a year, each year.

The wrong 1095-A forms went out to about 800,000. This form is used to adjust cost assistance on taxes. The wrong forms had correct subsidy amounts, but wrong calculations.