Tennessee Medicaid Expansion

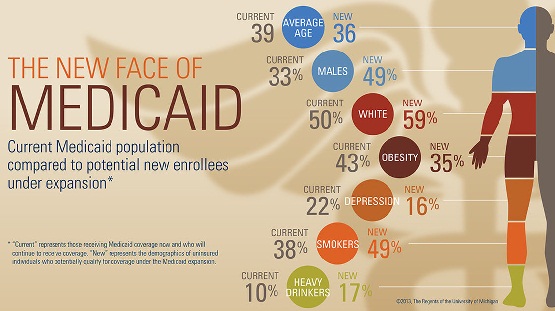

Tennessee may move forward with Medicaid Expansion alternative. Tennessee Medicaid Expansion would cover about 330,000. NOTE: May move forward should be stressed. Unlike in other expanding states, there is a lot of opposition to covering Tennessee’s 330,000. Officials elected by Tennesseans feel that the 330,000 aren’t worth the extra costs. What do you think? An Alternative Plan… Read More