Didn’t Get a 1095-A or ECN? You Can File Taxes Without Them.

You can find the information found on a 1095-A yourself. You don’t need a 1095-A from the Marketplace to file the 8962 form and don’t need an ECN for the 8965 from.

On this page, we explain how to file your taxes if you got an incorrect 1095-A, didn’t get a 1095-A, or didn’t get an Electronic Confirmation Number.

UPDATE FOR 2019: This information is still generally helpful and relevant. In each year the IRS and/or marketplace may or may not issue updates on solutions.

UPDATE FOR 2017: The IRS confirmed you can file without the 1095-B or C, but not a 1095-A in 2016 (see Questions and Answers about Health Care Information Forms for Individuals (Forms 1095-A, 1095-B, and 1095-C). This means the advice below is going a bit against the grain. With that in mind, people may find all the data below helpful.

If you are expecting to receive a Form 1095-A, you should wait to file your 2016 income tax return until you receive that form. However, it is not necessary to wait for Forms 1095-B or 1095-C in order to file. – The IRS

NOTE: This information is helpful whenever thinking about 1095 forms, but if it’s before April of any year, you will likely want to follow up with the Marketplace and wait for your form. 1095-A forms weren’t filed until February 2nd, 2015 last year.

Double Checking For an Incorrect 1095-A

Most people who got tax credits through the Health Insurance Marketplace got their 1095-A in February or March 2015, it was correct, and all was well. However, some people got a piece of incorrect data on their 1095 form. Everyone should make sure their 1095-A is right by checking it against the SLCSP tool below.

The Fix: You can check double check the Second Lowest Cost Silver Plan (SLCSP) reported on your 1095 against the Second Lowest Cost Sliver Plan on HealthCare.Gov https://www.healthcare.gov/taxes/tools/silver/. Just pick your state and find the second lowest cost sliver plan (all cost assistance is based on this “benchmark” plan)

Already Filed? If you already filed, you probably got a few more dollars than owed, no worries. The Treasury Department, said (paraphrasing), “If you like your refund, you can keep it.” If you feel that the amount was wrong for any reason, you can dispute your 1095-A results (directions for California only). You can also amend your tax return with the right information. In some instances you could owe more back by filing using incorrect data, so it’s worth double-checking. If you didn’t file yet, you are advised to call the Marketplace and wait for your form.

Finding the Information on a 1095-A yourself

Some people still haven’t gotten their 1095-A. It could still be sent before April 15th, but the first step to getting the correct form is contacting the Marketplace and IRS. The second step should be double-checking for the form online.

- www.healthCare.gov/taxes

- Call the Marketplace Call Center at 1-800-318-2596. TTY users should call 1-855-889-4325.

- Call the IRS Tax help Line for Individuals at 1-800-829-1040.

- Fee tax advice is also available through Volunteer Income Tax Assistance at 1-800-906-9887, or if you are over 60 years old there is free Tax Counseling for the Elderly at 1-800-906-9887.

When all else fails you can try the method below, it’s IRS approved, and it’s only four pieces of information per-person who got tax credits.

If you are running out of time to file for April 15th deadline. Here is what to do:

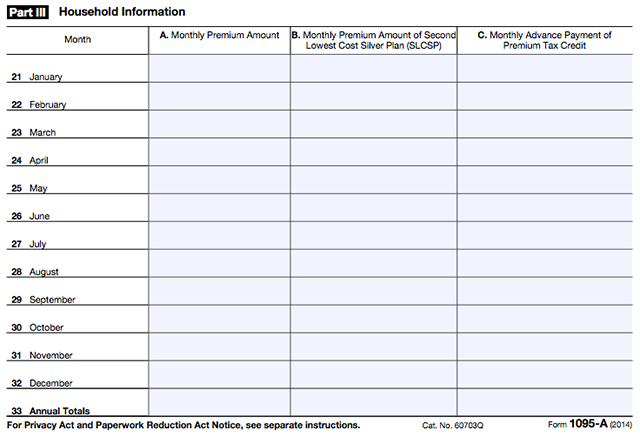

- Download a blank 1905-A form

- Now collect the following pieces of information for PART III – Household Information:

- The months you, your spouse, and dependents had coverage. (Call your insurer or look at your bank statements) NOTE: This information should also be added to PART II columns D and E, but simply filling out PART III of the form will give you the same information, since you are filing out PART III columns A, B, and C for each month.

- Your total premiums paid for you, your spouse, and dependents. (Call your insurer or look at your bank statements) NOTE: Unless you adjusted cost assistance or switched plans this should be the same each month.

- The cost of the Second Lowest Cost Silver Plan in your Marketplace. (https://www.healthcare.gov/taxes/tools/silver/)

- The total amount of Advanced Premium Tax Credit that was paid on your behalf. (Your insurer will have this information too) NOTE: You can compare the amount that you paid to the full price of the plan, the difference is your Advance Payment of Premium Tax Credit.

- If you are married, then you’ll also need “Policy Number (Form 1095-A, line 2)”. So it’s a smart move to get the policy number from the Marketplace or your insurer. You only need to enter the LAST 15 digits of the policy number (that’s all that show on a 1095-A sent to you as well).

- Now that you have all of that information add the total amount in for each column.

Should I File My Own 1095-A?

We have been advising people that the Marketplace files 1095-A’s to the IRS on behalf of the individual or family. However, we got a comment from a reader about the IRS asking the individual to fax in their 1095-A. So if you still don’t have a 1095-A, then it seems smart to fill out and file the form along with your taxes (or at least to hold onto it if it’s needed down the road). This is a common sense conclusion and is not backed up by official documentation.

Official sources all say that the Marketplace files, not the individual. This remains true as of April 3rd, 2015 with the IRS and Treasury suggesting one file for an extension using Form 4868 rather than filing a 1095-A one’s self. So do keep that in mind if you choose to go this route.

You can see our 1095 instructions page to understand what each field means if you need further direction. There is nothing on there, aside from what we described above that isn’t straight forward.

Quote From the IRS on What to Do If You Didn’t Get the Form or it Was Incorrect

What do taxpayers do if they lost or never received their Form 1095A or if it is incorrect? If Form 1095-A was lost, never received, or is incorrect, taxpayers should contact their Marketplace directly for a copy. Information regarding how to reach the Marketplace is available on HealthCare.gov as well as IRS.gov/aca.

If taxpayers experience difficulty obtaining the Form 1095-A, Health Insurance Marketplace Statement, from their Marketplace, they should review the monthly billing statements provided by their health coverage provider or contact the provider directly to obtain the coverage information, monthly premium amount, and amount of monthly advance credit payments made on their behalf. – IRS

What to Do If You Didn’t Get an Electronic Confirmation Number (ECN) For an Exemption

In some cases, those who applied for an exemption are still waiting for an Electronic Confirmation Number (ECN). This is the easiest fix of all. Just enter “PENDING” instead of the ECN and file your 8965 exemptions form.

Other Important Notes

While we are at it, here are some other things of note:

- Unless you got a Marketplace plan, 1095 forms aren’t needed until next year. Most insurers and employers got transition relief for 2014, so don’t expect 1095-B or 1095-C forms.

- This is the first year the 1095-A forms went out. How often is version 1.0 the best? Arguably not often and for some, not in this case. Expect less trouble next year.

- The IRS can’t send you to jail or do much of anything if you file incorrectly by mistake. You’ll either get to keep the excess amount, or the IRS will withhold it.

- You can file a Tax Extension using form 4868, but you should read the 4868 instructions and read about the implications. There are penalties associated with filing an extension.

Tyrell Bretos

If you are going for best contents like I do, only go to see this web page every day for the reason that it gives feature contents, thanks|

Gilles Duval jr

I am trying 2 get a copy of my 1095A form. I can submit my taxes

ObamaCareFacts.comThe Author

It is on your HealthCare.Gov or state-exchange website in your account after you log in. You can always call for help getting it if you can’t find it.

Updo Hairstyles

I’d personally also like to convey that most individuals that find themselves devoid of health insurance are generally students, self-employed and people who are out of work. More than half of the uninsured are really under the age of Thirty five. They do not really feel they are wanting health insurance as they are young in addition to healthy. Their particular income is generally spent on housing, food, along with entertainment. A lot of people that do go to work either full or not professional are not offered insurance through their work so they go without with the rising tariff of health insurance in the usa. Thanks for the strategies you write about through this site.

Ck hicks

Insurance has gotten very complicated. I have been retired for 20 years and have Medicare and coinsurance paid by the city. Now I don,t know what o do

ObamaCareFacts.comThe Author

Well if you have Medicare you don’t have to do anything in terms of the Affordable Care Act unless you are trying to get coverage for the rest of your family and you are the head of household.

vicki mckinney

This has been a headache from day 1 there always changing the amounts, and put down wrong income when calle there should be a better system than this!!!! I have called every week for my 1095a form and still waiting

Don Vzo

I think that the Market place is a Joke. I am a tax specialist that works for a “Big Name” tax software company and I have seen many tax payers that have ended up owing exuberant amounts of taxes do to mistakes on there 1095-A forms and or they have canceled there coverage and the “Market Place” has failed to ensure the coverage was canceled and the tax payer owed that way as well. Allot of times the forms are incorrect and or the tax payer does not get them at all. When you contact the Market place about these issues they are rude and promise to get you the forms sent out in 30 days or less and they are never received,. even after calling repeatedly for them and getting the same scripted answer each time. Just saying

ObamaCareFacts.comThe Author

We have seen a lot of complaints related to 1095-a form problems. It is for sure one of the aspects of the ACA that seems to need to be addressed. Glad to have your insight.

Ceasar Rengifo

I been enroll in medical so 1095 A part three is blank The IRS want me to fill 8962 and reconcile

How to doit

ObamaCareFacts.comThe Author

The page above essentially explains the answer to your question. I would start by contacting the marketplace, but if I couldn’t get an answer would use the method discussed above.

judith

Have don’t have 1095a four 2018 can your email to me?

ObamaCareFacts.comThe Author

It is important to remember that we aren’t the marketplace. To get your 1095 you need to sign into your marketplace profile at HealthCare.Gov. If this doesn’t work, contact them and get their assistance. In most cases this will do the trick, if you are still have problems they are still the best place to go for direction. Make sure to read the advice above again carefully. Feel free to ask follow up questions.

Robin Aposhain

WHAT IF I FILED MY TAXES AND THEN DIDNT PUT MY 1095A IN IT BECAUSE I DIDNT HAVE . CAN I ADD IT TO MY TAXES OR HOLD IT TO NEXT YEAR?

ObamaCareFacts.comThe Author

The marketplace files your 1095-a on your behalf and submits it to the IRS. You only need it in terms of it being used to file form 8962 (the form where tax credits are calculated). You should be able to access your copy via your marketplace account.

Diana Merrick-Ortega

i have contacted Marketplace in 2017 by phone many times to send me the form i needed many times i had moved i gave them my new addresses and never received at either of my new addresses the form 1095-a i had my tax preparer to finally e file my taxes without the form got notification this year stating i must file with it this year well i have still not received that years form even after calling for the form 3 times and we are now 4/14/2018 14 business day wait each time and they still havent gotten it to me at any of the addresses they say they had on file . i live on a fixed income of social security and dont have retirement nor pension so this is quite a big deal if i have to pay tax on the credit i got

Unknown

Tried filing my parents final tax return for 2014 filing period and the IRS sent me a letter stating I needed to file 1095-a. Problem is both of my parents are deceased and the healthcare market place is refusing to give me the 1095-a form

ObamaCareFacts.comThe Author

That is an absurd situation. I would call the IRS directly and explain to the the problem.

Scott Ayar

I have not received a 1095-A form. How can I get one?

Lisa

I didn’t get my 1095-A form for 2016. Healthcare.gov want let me in bc I can’t remember my password I am freaking out wat do I do

ObamaCareFacts.comThe Author

I would call if you forget your password! You can also likely request a new one via the login screen.

W. Manson

Not as much help as I expected. I followed directions to get the next lowest cost Silver plan and the info is not easy to obtain. The instructions took me to Covered CA web site and had to fill in a bunch of information to get a “quote” and it gave me a bunch of plans but which one is the second lowest? There are several. Why do we even need the “Second Lowest Silver Plan” cost? Need to explain why we need the info and how to get it more easily. Still waiting to get my 1095-A from Covered CA. The problem for me was I only took ins. from Covered CA for 5 mo. until I started my new job and got coverage through them. Once I reported that to Cov. CA they “inactivated” my account so that I can’t access any forms online and they apparently didn’t send my 1095-A because I show as “inactive”. I had to call to request it.

Prakash

I enrolled my family members in market place for 2016. Actually, I didn’t know that I am a non resident aliens for tax purpose and can’t joint file tax with my spouse. I just knew this while filing tax for 2016. I consulted with tax professionals about this and they told me that I need to repay all the amount that marketplace paid for us which I cannot do it. My family is below 200% poverty line. What will be the consequences of not filing the tax jointly and how much will be the amount we need repay? Please reply.

Belle Louisiane Saucier

This is awful. I’m an independent 21 year old woman and I feel utterly helpless. When calling the marketplace in December of 2016, I thought for sure I was taking care of what was necessary. Now, to be here and realize I probably won’t be receiving my tax return is heart breaking. I received a 1095-B with Medicaid which is the new health program I qualified for and was relieved because it was so fitting. The 1095-A is through Medicare….which is a program I don’t understand. The IRS will withhold unless I can complete an 8962 form and a 1095-A which I’m not familiar with either of those? I thought turbo tax would make it easy. I wish I understood these directions well enough. Please someone help

J Lu

I bought a personal health coverage from January to February, and then I was employed in April and received a company coverage after that. But now I have only the 1095-B form after my employment. Should I considered myself covered for January and February? Or is the personal purchase not applied for tax return?

Thank you!

ObamaCareFacts.comThe Author

If the health coverage was major medical, then you are considered covered for those months. If you call the insurer they should be able to give you insight about your 1095.

Cmc

My best friend did my taxes last night. I have the peach state health insurance but I didn’t get the 1095a form but she filed it my taxes anyways. Will I get in trouble if I forgot to file my 1095a form?

Hailey

I already filed, I didn’t even know I needed a 1095A, since I never received one. I have been calling and calling my Marketplace, to no avail. I’m literally crying because I cannot get these forms. I did all my billing electronically, so I have no payment letters or bills. I dropped my coverage two months ago, Jan 2017, so now I don’t even have a username and password to get the forms electronically. I’m so lost.

Rosa Solis

I am entering my marketplace-assigned policy number on turbo tax and it is saying that it is a duplicate for me to re-enter. How do I get the correct numbers if hose are on the 1095-A forms that were sent to me

crystal gully

My ex husband carried insurance on the kids last year. I carry the kids on my taxes. He has the 1095a form for the kids and refuses to give it to me. Can I file without the form?

Megan wotty

Hello I have not received my 1095-A form how can I get ahold of one thanks

Timothy Shepherd

Find an easier way to assign an ECN. Should just be able to enter some personal information and have one assigned.

Michael

If me and my wife file married filming separated how do we file the 1095-a

Lynette Langley

I am so tired of all of Obama Care and health market graphics. They said I had health insurance for 2016. And I have never never received any thing from them for the 2016. I even had to put my husband in the hospital in April and now have a 40,000.00 medical bills. Do you honestly think if I knew I had medical Insurance I would have turned it in. Now they are saying they are sending me a 2095. But I never had the insurance. This sucks.

Samantha Campione

what do i do if i received an ECN this year, but can not find it at this time? is there a way to obtain it again?

Eric Chase

My 1095A is wrong. I received 2 1095A’s. Jan and Feb seem correct. The amounts are based on projected income at the time of enrollment and all columns have amounts. Late Feb I reported a change in income. So from March thru Dec I received a 1095A with only Column A showing the amount of the enrollment premium. All other entries show zero. The marketplace tells me that is because I didn’t ask for APTC when I reported the income change. However, the insurance companies monthly billing invoice that I receive shows the premium minus APTC—and the balance due which is paid through automatic credit card payment. So, the invoice indicates that the ATPC was paid directly to the insurance company. Do I file 8962 based on what I believe to be correct? Also, when I calculate the correct SLCSP do I use that figure for all 12 months or just the months that have zero filled in. And, the enrollment premium amount does not match the actual enrollment premium on the invoice. Should I change them or use what is on the 1095A? Phew!!! Thanks for any advice you can give me.

Viole

When I filed my taxes, I didn’t have my ECN, so I put down “pending”. Now that I have my ECN, should I file an amended return just to put in the ECN? That would be the only change – the tax refund amount would stay the same.

ObamaCareFacts.comThe Author

I was under the impression that the ECN was sent to the IRS from the marketplace as well as to the filer. With that said Turbo tax recommends filing an amended return. I’ll have to leave it at that until I can find the correct answer. Any insight is welcome!

https://ttlc.intuit.com/questions/3195043-i-received-a-health-care-exemption-ecn-but-i-already-filed-my-taxes-can-i-add-this-to-my-tax-returns-without-amending-or-what-steps-should-i-take

catherine johns

Filed late. Found out had to pay back all and more of what I thought was help with health insurance. My husband s income went up ad he is getting social security disability. Taxes say we owe over 9000 dollars because of covered California. We would of got back 1700 dollars. Why am I paying back more than if I would of not had it. We don’t have a savings just getting back in the green . Shock and it will be very hard to pay. Be careful using covered California.

Kevin Cross

You do not know your lax law. My daughter and I both recently received a letter from the IRS stating WE MUST FILE FORM 8962 and FORM 1095-A or we will have consequences.

Lisa Willey (Willev)

I never received the 1095A form or it got lost in the mail. I am being claimed on my parents tax return. They sent in their return with my name and they got a letter from the IRS saying they need the form. I don’t know how to get it and they only have 20 days to respond?

Please advise

ObamaCareFacts.comThe Author

If you are missing your 1095-A you always should just call healthcare.gov or your state marketplace. They file the form. If they filed it, then a record should be in your account and they can help you access it. If they never filed and the form is missing, then next step becomes the insurer (who has a record of your coverage) and even the IRS themselves. The form originates with the marketplace, so always start there.

Rene

I field 01/30/16 without the 1095a learned that I need it fixed it on 03/02/16 8 weeks was the week of 4/27/16 ors states that they doesn’t have any documentation saying that I responded to the letter which I did with my tax professional. So there is an option to send it again and wait another 8 weeks or just let them fix it no telling how long would it takes. I’m just so annoyed with this never been through this in twenty something years I been filing but my tax professional receive an confirmation that it went through on 03/02 yet they doesn’t see it I told them that I will not send it again hoping that it is there and they overlook it instead of me sending it again. To whom it may concern you can call the market place and ask them to give you the information off the 1095 # 1-33 and write that information down exactly and print out a form and copy it that’s how I did it and my numbers did not change at all and still waiting for my taxes… What a bummer!

Katie

If I was sent an incorrect 1095A and am having trouble with Form 8962, can I simply not send it in? I have been pulling my hair out trying to collect the necessary information and am still confused and worried. If they withhold my tax return, will that effect any of my tax filings for the year 2016?

Jesi

Ten Facts on Filing an Amended Tax Return

IRS Tax Tip 2013-59, April 19, 2013

1. What should you do if you already filed your federal tax return and then discover a mistake? Don’t worry; you have a chance to fix errors by filing an amended tax return. This year you can use the new IRS tool, ‘Where’s My Amended Return?’ to easily track the status of your amended tax return. Here are 10 facts you should know about filing an amended tax return.

Use Form 1040X, Amended U.S. Individual Income Tax Return, to file an amended tax return. An amended return cannot be e-filed. You must file it on paper.

2. You should consider filing an amended tax return if there is a change in your filing status, income, deductions or credits.

3. You normally do not need to file an amended return to correct math errors. The IRS will automatically make those changes for you. Also, do not file an amended return because you forgot to attach tax forms, such as W-2s or schedules. The IRS normally will send a request asking for those.

4. Generally, you must file Form 1040X within three years from the date you filed your original tax return or within two years of the date you paid the tax, whichever is later. Be sure to enter the year of the return you are amending at the top of Form 1040X.

5. If you are amending more than one tax return, prepare a 1040X for each return and mail them to the IRS in separate envelopes. You will find the appropriate IRS address to mail your return to in the Form 1040X instructions.

6. If your changes involve the need for another schedule or form, you must attach that schedule or form to the amended return.

7. If you are filing an amended tax return to claim an additional refund, wait until you have received your original tax refund before filing Form 1040X. Amended returns take up to 12 weeks to process. You may cash your original refund check while waiting for the additional refund.

8. If you owe additional taxes with Form 1040X, file it and pay the tax as soon as possible to minimize interest and penalties.

9. You can track the status of your amended tax return three weeks after you file with the IRS’s new tool called, ‘Where’s My Amended Return?’ The automated tool is available on IRS.gov and by phone at 866-464-2050. The online and phone tools are available in English and Spanish. You can track the status of your amended return for the current year and up to three prior years.

10. To use either ‘Where’s My Amended Return’ tool, just enter your taxpayer identification number (usually your Social Security number), date of birth and zip code. If you have filed amended returns for more than one year, you can select each year individually to check the status of each. If you use the tool by phone, you will not need to call a different IRS phone number unless the tool tells you to do so.

Jesi

This is actually from the official irs.gov site but I couldn’t find the link to it. It eased my mind a little knowing this, since I filed my taxes approximately 3 weeks ago not knowing about the 1095-a form and panicked because today is the deadline to file.

I spent several days looking for an answer. Their site is so full of info it kind of drowns you, but I could never find anything specific about the 1095-A form other than you needed it and to wait till you had it. Not much help once I’d already done it. Tip #3 was what I was looking for.

ObamaCareFacts.comThe Author

Great post. Thank you!

Duc Nguyen

I’ve already filed a tax without 1095A form and o got a mail from IRS requires me to send them a copy of 1095A. i made a call to health insurance marketplace and ask them about my information of 1095A, they showed me how to get it by logging into online account. But i didnt see it, and them either. They told me only Medical is showed on my account. I dont know what to do then. Please help.

ObamaCareFacts.comThe Author

The truth is, as much as I hate not having a solution, there isn’t much in the way of help to give. The correct move is to contact the marketplace and file for an extension as needed. We note the workaround above, but in the whole year since we wrote this we never once got any solid confirmation that this was a completely acceptable process so are hesitant to double down for this year. With that said, just about every tip and trick is contained in the page above.

Rose Fari

I live in California and have the same issues with my 1095A form being promised and not received. I needed that from for my daughter’s college financial aid application and here it is April 18th and it’s still not reseolved. The problem is that Kaiser and Covered California do not have consistent information on my policy’s begining and end dates (what a surprise)—so my 2015 policy is in a PENDING STATUS. I have called both Kaiser and Covered California probably 30 times since last year to resolve my issues and they continue to “escalate my case” without any resolutions.

Here’s the bottom line: if you live in California, file a complaint with the State of California Department of Social Services against Covered California (my Marketplace) to request a state hearing to resolve your issue. If you’re not in California, FIND the equivalent department in your state. Also requested a formal grievance with your health insurance company. Here in California, the insurance company is given 30 days resolve issues.

If my issues aren’t resolved, I will file a complaint with the Department of Managed Healthcare to investigate.

I hope this gets resolved soon.

Jim

I received 1095A which shows I have coverage from February to December 2015. This is incorrect. I had coverage from February through July at which time I notified my provider that I was canceling my policy because I started receiving coverage from my new employer. Not sure how I should file my 2015 tax return.

sharon

Wow…I see that sooo many people are dealing with the incompetant and non-compliant Health connection. I am dealing with the ever slow and incompetent Maryland Health connection. I have no 1095A form in my inbox or mailbox as their site specifies and I believe is required to supply…I need the allowed amount to file or I have to pay all of my subsidy back…I’ve been trying for 3 weeks and still no answer as to when the information that I HAD TO GIVE TO THEM regarding my premium paid and subsidy amount that was paid. They asked me the amounts….I replied, “Isn’t that what this form is supposed to summarize? Why are you asking me the consumer?” So frustrating. We need serious reform with Maryland Health Connection.gov

John Ramey

i need the adress to send my 1095-B form can u please send that to me

dorothy wilson fudge

the market place, sent out my 1095-a form and i got it on february 4 i call them the same day because it was wrong. the market place told me on february4 that the process would take 30 days . i waited 30 days ,and call them back, they told me it was finish on february 24, 2016 i said where is my form the market place said,i had to wait 15 days to get it ,and i said why can,t they put it in my account, the market place said they going to mail it . i should have gotton it on march 10,2016 i file my taxes on march 12,2016 as of now april 7 ,2016 i still dont have my 1095-a form and irs is holding one of my taxes, i need my money to fix my house, i am not rich.

Randy Riddle

As an Ex husband, I can’t get a 1095A, the ex won’t give me one (she carried the insurance on my daughters), the marketplace won’t even talk to me and the IRS won’t take my taxes without one

Patricia McGuire

I have not received my 1095 A form, because I never had insurance through the marketplace. I had state insurance the whole year. Now the IRS is with holding my return until this matter is resolved. It has been over 30 days since I called them about this matter, but nothing as of yet.

DB Dillon

I just received the third incorrect 1095-A. After hours on the phone with a rep from CoveredCA, I have little confidence in their ability to get it right. I have the correct numbers. I need to file my taxes. Can I manually input my numbers, and hope for the best?

Fred P Singleton

I did not get my Health Insurance through the marketplace, so where can I get a 1095-A? I purchased my policy direct from Humana and chose the Humana Gold covereage. The IRS says they cannot complete processing my return until I furnish a copy of my 1095-A, Form 8962 and a corrected copy of my 1040 page 2?

Can Humana give me a copy of 1095-A?

Lelsie

I never received my 1095 A I am a dependent on a plan through my fathers job. I filed on turbo tax and checked the box saying that I had coverage all year and received a letter from the IRS requesting a form 8962 and form 1095A which are apparently impossible to get so I guess I have to make up things to put into the boxes myself? This is an unnecessary waste of time. a better system needs to be developed to obtain the information to put into these boxes. Does anyone have any idea what I can do to get this information? The IRS gave me a week to get the information and I’m a full time student with tons of tests this test which makes figuring this out seem impossible.

Dirk

I think this is all BS. The marketplace did not generate the 1095 form for me. Upon contact they tell me that it will take up to 30 days to generate.

The markeplace is a contractor and I believe that they should have to provide the form on time, or when found that they failed provide it within 72 hours or face STIFF penalties, including but not limited to having to pay all penalties for non-filing/late filing by the individual.

But that would only make sense and nothing the government touches makes any sense.

Carla

I called on Feb 8 and was told it would be on my account the following morning. I called again on the 10th and then the 13th, told the same each time. Then on the 15th I was told they shouldn’t have told me that, it would be much longer. After looking she said no one had even escalated the case. She said she was doing it. On the 22nd I was told that they could find no escalation and were doing it again. On March 2 I got a call from the market place and was told my claim had been denied. What f’n claim? He asked what was wrong with the 1095 I received. I said well nothing except I didn’t receive one. He said just get it online (as everyone before him said). Then after looking he said oh, it isn’t there (as everyone before him said). Then told me he would send the escalation back to be fixed. March 15 I called and was told nothing showed and since it had now been 30 days(?) that escalation was no good and it would have to be escalated again. Now the 23rd, nothing. Sure would be nice to file my taxes.

Sheldon Zatkin

I already filed my 2015 Tax return. I moved to Germany last April and am going to school in Berlin to get my Masters. I had health coverage from Jan thru March of last year in the US. How do I file 8965 Form to get an exemption.

ObamaCareFacts.comThe Author

You are supposed to file it alongside your 1040, you might have to amend your 1040. I would check with the IRS or a tax professional in this case.

Branden

It’s funny that the marketplace can just do what they want and there is no way to do anything about it ! We have been trying to receive the 1095a form since January with no luck ! They keep sending it to the wrong address time after time even though we have given them the correct address many times ! This whole system is a joke ran by rude people that don’t do anything but play with people’s lives!

Kathleen Lacey

I just want my assigned ECN. I can not find any information on how to find or get a copy of it.

Faye walton

Can I fill out the 1095a form online or not?I have been told 2 different answers.I am waiting for a 1095a form to be mailed.it is taking forever.

ObamaCareFacts.comThe Author

You don’t file the 1095, the entity who provided you coverage does. If we get down to the last minute we will likely provide an updated 2016 panic button sort of guide (just like this one was for 2015). A year later and there has been no real confirmation by the IRS that self-filling is a smart option. With that in mind we have been timid about giving any advice beyond contact healthcare.gov ASAP and follow up.

Dre

I filled in Jan, and they sent me a letter saying I need 1095-A because I put that my kids had coverage all year, but I guess they didn’t for three months, but then I had a problem getting the info from the marketplace, but the response from the IRS said I had x amount of weeks to return the Form, the time has passed. Can’t I just sit back and wait?? Wont the IRS still process my return minus any penalty fee’s??

ObamaCareFacts.comThe Author

I’d love to give you a specific answer, but this is more a question for the IRS themselves. They are generally very helpful, although a little strapped for resources thanks to Congress. https://www.irs.gov/uac/Telephone-Assistance

Leigh Ann S

What do you do if I did get a 1095 form and didn’t apply for insurance through the marketplace in 2015?

ObamaCareFacts.comThe Author

This seems to have happened to a few people. I would call healthcare.gov first and foremost. Second, this isn’t a straightforward answer because it largely depends on what the 1095 says. In short, if it is blank and shows no tax credits that is one thing. If it shows coverage and tax credits then this is a much bigger problem.

Lori Smith

Minnesota is refusing to send 1095-A forms. What am I to do? Can the federal government step in and force Minnesota to send the forms? HELP. MNSure said they are self governed and they don’t have to follow the rules. Thanks for helping us who live in the wrong state.

ObamaCareFacts.comThe Author

Refusing? Like literally, or they just haven’t sent them yet.

Amanda

As of today, I live in Minnesota and still hot not received a 1095-A. I spoke to someone at MNSure late last week and she said it has not been sent yet. The MNSure website also does not provide my marketplace assigned policy number (since it’s one of the most poorly designed websites I have ever come across.) So now I sit and wait. Slightly terrifying since it is already March 7th.

Taye

I have filed my taxes and got a letter back saying i needed at 1095-a for my son who was on his fathers insurance from 10-01-2016 til now… i dont have access to this form since it not my insurance policy. What do i do?

ObamaCareFacts.comThe Author

The form would have been filed on behalf of whoever provided your son coverage through his father. His father should be able to track down the form through whoever provided coverage.

Sharon

It’s now almost March. Still haven’t received a 1095A for 2015. I called the New York State Marketplace over ten times, have waited on hold and talked to multiple reps, and they are completely clueless. They say they have escalated my request/concerns and will have a rep contact me but nobody does and nobody actually cares, that much is clear. I have collected what I need to do to create my own 1095A but I am incredibly worried my refund won’t be accepted without the Marketplace’s form. Should I just file without it? If the IRS sends a letter insisting on the Marketplace’s form and they still haven’t sent it, what do I do? Will this impact my ability to get coverage in subsequent years? How can all my taxes hinge on one single form that the Marketplace is unable to send me? It is absurd. Please help. I submitted other comments higher up on this thread.

Joe

This is just another problem with the pathetically designed and administered Obamacare system. To date, I have not received my 1095-A and I am cued “We had a problem with your 1095-A and cannot post it here,” when I log into to my Obamacare page. What a bunch of nonsense! All they needed was the SLCSP figure, and everything else was easily seen by my payment history from the healthcare provider. Thanks to this site, I got the SLCSP figure for my county and I can now complete my own 1095-A and 8962. If the IRS gives me any trouble about not receiving the “official” 1095-A from Obamacare, it can kiss my butt! It’s not my fault in any shape, way or form, that this plan has been pathetically administered from the get-go!

Des

Definitely need the form,last yr taxes 10 a firm wrong without attachment for for tax subsidization. So please wait,you’ll be sorry. I am hoping to not have an extension this yr,plus have to do last yr over long form. Luckily have h r block, but they didnt catch the form wrong or needed another form. Don’t worry if their wrong you’ll get a letter by the revenue. Too bad this insurance thing with marketplace had to happen. What a headache to good people that are organized

Shannon Demny

I had a problem with getting my 1095-A last year and filed anyway. My return was accepted and I got money deposited. I didn’t see my 1095a pop up in my healthcare.gov account and in my inbox until later on in the fall of 2015. So ridiculous. Lol. At least the issues are hopefully resolved. This year I got my 1095-a in the mail and online. Here’s to hoping I don’t have any more problems. To those who have missing 1095-A forms, keep calling and bugging the heck out of the people at healthcare.gov. It is a pain in the butt and it will probably take a few months to several months, but I always recommend making a trail to document if you should ever have to appeal a decision “they” make. It’s all about who you talk to. Unfortunately, many people who first answer the phone have no power or authority to see or generate a 1095-A. If your account has technical problems like mine did due to screw ups at Healthcare.gov and with their wonky, buggy system, God help you because that is going to make things worse from personal experience. Good luck everyone. Maybe one day this hot mess will not be as much of a hot mess.

Kellie Padilla

I had health insurance through the marketplace in 2014 and for 1 month in 2015. I forgot that I had that insurance for a month so I went ahead and filed my taxes electronically. The same day I filed them, I received the 1095A form. Will I still receive my return if I did not file my 1095A form?

Eve

I sent my 1095a aweek ago. I have not heard anything yet.

NICOLE

if some one could lease help me , last year I filed my taxes then later ecieved my 1095 , no in 2015 I haven’t even received my 1095 g , hours and hours of waiting on the phone I have not gotten any help idk how to amend and if I can file this yeasr taxes with last yeaRS

James

Why are you guys still keeping my 1095A ? It’s not correck.

maria

I actually filed on 1/23/16 and waited….and waited….was accepted same day…with no updates results…called today since tomorrow 2/13/16 was my anticipated DDD and I was told they sent out a letter stating i had to do the 1095a form. Never explained to me what it is…after researching online I found out. I have my 1095a thankfully. I’m in MASS and I only had to pay for insurance for a month due to other insurance becoming effective. So…I don’t know…it’s all confusing and absolutely aggravating. Not like I needed the money! Its fine I can wait another ten years for it…joking. .

Tegen

So why is it company’s are required by law to get W2s out by a certain date. But Obama care can send them out when ever they want or not at all. Basicly no matter how we file our taxes there not going to be right.

Whyaskyoudontcare

WTH? Are there numbers that need to be calculated on the 1095-A, B, whatever and entered? The IRS instructions basically say follow the instructions, a process which is called circular reasoning, kids.

If the IRS has the rest of your info on your 1040/1040A/1040 E-Z, etc., that info should match the reported info in the IRS’s database and thus verify that you were covered in 2015.

BTW, I’m missing two 1095s. At my age I could be waiting the rest of my life for my 2015-1095s, so I’m requesting for a letters of confirmations of coverage and attaching them.

kimberly lind

if you paid for insurance through the market place,but you filed your taxes and didn’t include that information will your refund be denied?

Angela mcham

I didn’t know about the 1095a form so I filed my taxes Jan 19 I filed my 1095a Feb 1 will I have to wait those 6-8 weeks to get my return back?

ObamaCareFacts.comThe Author

You can amend your return: https://www.irs.gov/uac/Newsroom/IRS-Offers-Tips-on-How-to-Amend-Your-Tax-Return

AKIRA h

I SIGNED INTO MY MARKETPLACE ACCT AND MY 1095 WAS READY. I PRINTED IT OUT AND WAS GOOD TO GO. I FILED EARLY AND LIBERTY TAX TOLD ME I DID NOT NEED THAT FORM. I WAS REJECTED AND NOW I HAVE TO START ALL OVER WITH MY 1094A : (

ObamaCareFacts.comThe Author

Annoying! It’s 1095-A just for clarification. Anyone who got credits needs a 1095-A and needs to file an 8962. If you want an exemption you need 8965 as well.

judy Ricketts

please tell me in simple what form 1095a is for I have read the comments and do out under stand. Please help me. I am old and need help

ObamaCareFacts.comThe Author

1095 helps you fill out your 8962 tax form and 8965 forms (related to cost assistance and exemptions for health insurance). It’s used to prove what months you had coverage and to show what amount of assistance you got.

Sharon

Yes, it’s true! I had no issues for 2014, but the NY State Marketplace completely screwed me over for 2015. My plan had an issue with their online payment system at the beginning of 2015, and as a result issued incorrect information to the marketplace that my plan was canceled, despite me having paid my premium on time. I was correctly enrolled, and paying all along, but the marketplace decided I had no healthcare, and my insurance never bothered to correct this. It wasn’t until April of 2015 that I realized the discrepancy when I called the Marketplace with an unrelated question and they said they had no record of my coverage. Spent months trying to get everything resolved, got a case number, had it escalated, uploaded all my paid receipts, nothing. Finally I arranged did a three-way conference call between my plan, Health First, and the Marketplace, all of which went nowhere. Finally I was told that regardless of my status with the Marketplace I would definitely still receive a 1095-A form for 2015 since I did receive a tax credit—and this is what makes no sense. How could I have been enrolled AND received a tax credit and yet the Marketplace says I don’t exist? Anyway, it’s Jan 30, everyone else I know has their 1095A and I have nothing. I’m planning to file my own form thanks to the incredibly helpful info outlined this site and from all you commenters. Curious to hear if there are any further updates from those with filed with their own forms for 2014. P.S. I found the form for the 2015 SLCSP for my state, but am having trouble locating my Marketplace Policy Number, which is not obviously available in my account when I log in nor is it anywhere on the documents that were mailed to me. Sort of terrified that this might not exist if I do indeed don’t exist to them in 2015. Anyone know if I could use my general Marketplace ID number? Too exhausted by this maddening process to call them about this today.

Sharon

Hi, I’m wondering if the good people who run this site can help me based on my above query. I called the NY marketplace again to check in on the status of my 1095 which is still not here and once again they were completely clueless and unhelpful. The second person I spoke with offered to write a complaint and file it which has been done multiple times before with no results. They also said they have no “marketplace policy id” for my 2015 account, so if I were to fill out the form myself, how would I account for that? Could I use my marketplace ID number instead (which is different than the marketplace policy ID)? My other question is this: Because the Marketplace claims to have no record of my having health insurance for 2015, despite my receiving a tax credit and my insurance provider (HealthFirst) saying I was definitely a paying member, should I even bother filling out a 1095 myself? This is honestly a nightmare.

Matt

I have the same problem as you. No record of my enrollment despite me paying premiums and receiving the tax credit the whole year. The people working at the marketplace help center don’t seem to care much either.

Melissa

Guess what? The Marketplace messed up the 1095-A forms this year, (2016) too. Surprise!

erica

This is what will make people get insurance through another source because waiting on the 1095a is rediculous when you have bills that are past do the people you owe want there money now I will not be using the market place for health insurance in 2016

ANA

I RECEIVED A 1095-A FORM SHOWING THAT I WAS PAYING FOR INSURANCE WHICH I NEVER DID SO I RECEIVED A LETTER STATING FOR TAXES 2014 I NEEDED TO FILE MY TAXES WITH 8962 WHAT CAN I DO IN THIS CASE I CALLED THE MARKET PLACE AND THEY COULDN’T FIND ME?

ObamaCareFacts.comThe Author

Hmm, double check with HealthCare.Gov. You can always check with the IRS too, but if you can’t be found there is a chance you used different login info. Maybe another family member signed up? It could be a lot of things.

Kelle Careccia

I think the marketplace and everything related to it is like a bad dream -you can spend weeks trying to get anyone on the phone, at any time, whether calling NYState numbers directly, your health care provider, this tax assistance number…it’s all prompts and being put on hold for literally hours if you’d like….every time you call…it’s insane!!!!!!!!!!!!

ObamaCareFacts.comThe Author

I wouldn’t expect to get through until like mid-February. This gives you time to get your form and the Marketplace time to wrap up open enrollment and deal with the tax stuff. If it is anything like last year a little patients will go a long way for most. Remember there are people on the other end answering calls and filing forms and we have just about 10 days left of open enrollment (it’s currently Jan 20, 2016).

Kelly

I wonder what the heck is going on with ya’ll? I received a notification to amend my 2014 tax return for the premium tax credits through the healthcare marketplace. I’m not in the marketplace so don’t have a Marketplace Plan. I’ve never even looked at it. I have employer provided insurance that meets minimum requirements. Therefore- no premium tax credits. When I called the IRS they said call Marketplace. When I called them, they can’t find me in their system and yet informed the IRS I have premium tax credits. I’ve been referred to the Advanced Resolution Team, and I’m not hearing good things about them.

Thomas Loyd

IMO, once the complexity of the IRS filing system becomes well known, it could discourage participation in Obamacare. There’s got to be a simpler way. Millions of low income tax filers could be forced to professional tax filers and then having to suffer that cost as well.

ObamaCareFacts.comThe Author

For sure, maybe we should just give congress and the IRS a ring and let them know that America would be better off with a simplified tax system. (Couldn’t help myself, always room for a little humor right).

Ellen Gold

My cobra expired 7/31/14 but I ended up getting Texas State continuation. Before I decided to get private insurance though State continuation I filled out an application on healthcare.gov on 8/1/14 and then I cancelled it on 8/1/14. Although I never received a tax credit because I didn’t officially enroll until 1/1/15 I got a phone call from the IRS saying they needed a 2014 1095-A form. Healthcare. gov has nothing for me as far as a 1095-A form because they say it doesn’t exist.

I am concerned and don’t know what to do. I would appreciate your help.

ObamaCareFacts.comThe Author

If you didn’t get coverage through healthcare.gov in 2014 then you don’t need a 1095-a. The IRS doesn’t need it either. You only “need” a 1095-a if you want to prove you had coverage through the Marketplace to avoid the fee or claim tax credits on 8962. Even if you had coverage through the Marketplace you wouldn’t need a 1095-a unless you are claiming tax credits, you can just choose to file without one and attest to having coverage for 2014.

That being said we aren’t the IRS, so they do get the final say about a 1095-a being required in any instance… But from what we understand you really don’t NEED it in this situation.

Concerned

Hi:

I would be concerned that the lady could have been the target of a possible hoax/scam. She said the “IRS” phoned her requesting a 1095-A that the Marketplace had not even produced, and the caller wanted the info FAXed.

The IRS will not normally initiate a contact by phone requesting additional forms, info, etc. An IRS initial contact for supporting info, documents, etc. is normally by letter in postal mail. Since there have been many news reports about 1095-A’s recently, someone may be cold-calling potential victims in the hope of phishing info. If a person were to FAX the form to the caller, then whoever was calling would have a lot of personal info including potentially birthdate, address, and SSN.

I would assume an unexpected phone call purportedly from the IRS to be a hoax/scam until proven otherwise. In my opinion, such a recipient of a call like that should phone the IRS firsthand and verify everything, and not take any action or provide any information based on the unexpected phone call.

ObamaCareFacts.comThe Author

Really good point, thanks for posting.

ATTENTION READERS: GOOD ADVICE IN THE ABOVE COMMENT.

Tom

where can i find the fax number for the IRS in order to submit form 1095-A as i have already filed my taxes and they will not process return without it and i need it for my daughter’s college institution. please any help is greatly appreciated.

thanks!

ps this stuff is surely more frustrating than not!!!!

ObamaCareFacts.comThe Author

I don’t think a 1095-A can just be faxed and there are a number of different IRS offices where things have to be sent depending upon a number of factors. The best bet would be to call the IRS and/or check out the following link. It has a long list of different ways to file different forms. http://www.irs.gov/uac/Where-to-File-Paper-Tax-Returns-With-or-Without-a-Payment

Here is general IRS contact information: http://www.irs.gov/uac/How-to-Contact-the-IRS-1

Here is the link to the IRS contact information for on-phone help: http://www.irs.gov/uac/Telephone-Assistance

Sbalch

Nearly June and no 1095-A. No correspondence to indicate I might get one. I’m tired of calling them and getting the same old answers. I filed an extension but I think I might just finalize the thing. I only had the coverage for three months. Maybe that’s the problem? I didn’t have it long enough for the system to produce the form as it should?

ObamaCareFacts.comThe Author

Not sure, sorry you are having trouble. Even having coverage for one month should produce a 1095-A. Have you tried filing a 1095-A by hand as suggested on this page? I think a commenter had noted that the IRS had accepted their self filed 1095-A.

Ken Fogel

I filed my taxes electronically for 2014, but turbo tax never prompted me for my ECN.

I was granted an exemption and have had it from a letter from The Health Insurance Marketplace, Dept. of Health and Human Services, since Nov. 5, 2014.

I called the Healthcare.gov. phone # (1-800-318-2596), and the gentleman there couldn’t find any record of my exemption certificate number, (ECN), even after giving him my ss #.

What happened to my records? I was granted an exemption, so there must be a record of it somewhere.

I was asked for an ID #, but I was never given one.

How can you operate a system like this where if you don’t have an ECN you can be penalized, but you don’t have accurate records?

I’m keeping the letter that I got with my ECN, for my records, even though Dept; of Human Services apparently doesn’t have a record of it.

ObamaCareFacts.comThe Author

Anyone who doesn’t have their ECN yet should read the directions carefully (some you “need” an ECN, but can get away with a Code found in the directions). One’s where you truly do need an ECN you can write pending. We are already past tax time now, but for those with an extension keep this in mind.

John T

I never received a 1095A. Not even an incorrect one, even after several calls to the marketplace dating back to Feb. 1st. They are totally clueless. Anyway, I filed my taxes on April 12th using a self-prepared 1095A. My refund was approved and I received it today, no questions asked.

ObamaCareFacts.comThe Author

Thank you so much for posting that. It’s nice to know that we pointed everyone in the right direction!

hon rich

Latest action from healthcare.gov.-Today I received 11 e-mail notifications from healthcare.gov stating that I had messages on the website. When I checked the website I found 11 1095A forms, all duplicates and exactly the same as the incomplete form received in March. I am not sure what to make of this other than that this reflects the numbers of times I called to follow up on the missing 1095 A’s. Has anyone had a similar experience? Unsurprisingly, I am still waiting for the 1095 A forms requested ad nauseum to reflecl the correct coverage for the full year and I am still waiting for the IRS to approve my March 3, 2014 filing.

Reva Buckner

The date is May 10th 2015, I Filed an extension and still have not received the 1095A Form . Beginning to think I never will. I also called the marketplace from Feb.2015 until April 12, 2015 and told the same lies everyone else has been told. Was told it was being esscalated numerous times and should have it by April 7th. They never were able to pull it up on my account. They lost Jan from Sept.. I moved during that time and my coverage changed. So no record of the first 9 months. SOOOOOO Frustrating. No one else would get by with this kind of service. Do not know what to do If we do not receive it before Oct. 2015. Thanks for letting me Vent. Anyone else still having issues?

hon rich

UPDATE: A rep from the third party outreach group in North Dakota contracted by healthcare.gov called me this morning on May 19 reading from a script describing the importance of a 1095A for tax filings. Complaining that she was unable to hear me, said that a 1095A would be mailed within 14 businss days to my address on file..If I had any questions I could call the marketplace,and offered to provide the number. Honestly, as if this was no big deal.

Danielle D'angelo

Need 1095a to file taxes

David Edelman

Hey Jenny I am in the exact same spot you are. I never received a 1095-a and I am told one has NEVER been generated . Like you I also filed our taxes with the information given over the phone by the marketplace and I also received the same IRS notice requesting a copy of my 1095-a. The marketplace cannot figure it out and they are clueless as to when I will receive it. My taxes are now on hold and this is jamming up my son’s FASFA. i may send the IRS a copy of my self prepared 1095-a along with a note explaining I am still waiting for the official one to be mailed. I will call the number on the IRS notice and see if that is okay . I will let you know what they say. The real question that no one seems to know the answer to is what happens if you send IRS your self prepared 1095-a and they can’t match it or verify the entries on it to an official 1095-a ??? Will that create more problems?

hon rich

I am still waiting for 1095 A, my IRS filing/refund is “in process” since filed on Mar 3 with marketplace verbal information .and I am frustrated that it appears no one is in charge or responsible for resolving problems. Incredibly I received the below e-mail on April 15 from the healthcare.gov team. From my personal experiences with healthcare.gov I can only deduce that they are moving forward in complete denial of the serious problems and anticipated ramifications to the public caused by their inability to produce the requisite documents.

HCGOV medium seal

Important 2014 Tax Information

Reminder: If you’re finishing your taxes today, don’t forget to include the information from your 1095-A.

If you or someone in your household signed up for coverage through the Health Insurance Marketplace last year, you should have received a statement in the mail from the Marketplace called a Form 1095-A. This statement includes important information you need in order to complete and file your tax return. Before you file your federal income taxes, be sure to locate this form.

Most people can also download a copy of their 1095-A by logging into their Marketplace account on HealthCare.gov.

What’s on Form 1095-A?

Important information about anyone in your family who enrolled in a health plan through the Health Insurance Marketplace for 2014.

Information about the monthly premiums you paid to your health plan.

The amount of any advance payments of the premium tax credit that were paid to your health plan in 2014. This is the financial assistance that lowered what you paid for your monthly premiums.

The premium for the second lowest cost Silver plan (SLCSP) that applied to you for 2014. This amount is used as a “benchmark” to set your premium tax credit.

Help is Available: If you’re having trouble locating your 1095-A or if it arrived but the information on your 1095-A is not up to date, contact the Marketplace Call Center at 1-800-318-2596. Tools and tips about health coverage and your income taxes are available at: http://www.healthcare.gov/taxes.

The HealthCare.gov Team

David Edelman

Hon Rich: I am in the same position. I have been following your posts and I was wondering if you ever contacted the IRS ? I was curious as to what advice they may have given you. I plan on calling them next week to see if I can send them a copy of my self prepared 1095-a. The IRS letter says I have 20 days to respond. I was hoping to get the official 1095-a during the last three weeks but no such luck. No help whatsoever from the Marketplace. They still can’t generate this vital form that I need so badly.

hon rich

I did contact the IRS and they appear to have a customer service team dedicated to the 1095 A issues. It took a few calls and a wait of about an hour to get a rep to generally discuss my concerns. He did not ask for my PII and did not access my filing. He said that I should send whatever I did have which in my case was an incomplete, incorrect 1095A and then a oorrected (revised benchmark) Incomplete 1095A. (Incomplete because it was missing three months of coverage.) He also said to mark up a 1095A as I think it should look and send it along with an explanatory letter, requesting that the IRS accept my information and process my return based on it. .He then said that the actual team working on this problem had 20 days to respond on top of the 20 days I had to initially reply to their request. He could not guarantee that any of this effort on my part would result in an approved filing. Please let us know if this coincides with the information you receive when you contact the IRS. I am patiently waiting for my 40th day, around the middle of May, calculated from the day of the IRS letter which was 3/31. (I filed on 3/4). to be continued….

Cherry Westerman

Very helpful for frustrated clients without their 1095-A. Thank you.

Amanda

I thought I would share this information just in case it helps someone. I called the Marketplace again today to see if they had any news on my missing 1095-a and the tier 2 specialist walked me through these steps to complete the IRS form. I saved it to my computer (which can be tricky) and now have exactly what I need to finish my taxes. If you are still waiting, I’d say just do these steps!

Jenny

Hello, I hope someone can help me. We still have not had a 1095A generated. The Marketplace is no help and they just keep giving dates and we still never recieve it. I keep calling back and getting different information. I don’t know what else to do. The IRS has our taxes on hold until we recieve it. Who generates these forms and how can I contact them? Do I need to get a lawyer? I filled out our taxes with the information given over the phone by the marketplace and the IRS put it on hold until I recieve my actual 1095A.

ObamaCareFacts.comThe Author

If you still don’t have a 1095-A you can file an extension. From this page: https://obamacarefacts.com/2015/04/06/1095-a-form-updates-treasury-and-irs-april/…. If you didn’t file yet and are still having issues you should file Form 4868 (request for an automatic extension) with the IRS by April 15. Treasury and IRS intend to release guidance shortly implementing penalty relief for individuals in this situation as long as they file a return by October 15. If you pay at least 90% of your taxes when you file form 4868 then you are considered to have “reasonable cause” and won’t owe a penalty. This can be paid through withholding, estimated tax payments, or payments made with Form 4868.

If you already filed and the IRS is simply waiting on a form from the Marketplace, not sure exactly what advice there is beyond calling the IRS and Marketplace and following up. We can be pretty safely assume that everyone at HealthCare.Gov and the IRS is pretty focused on making sure this all goes smoothly, don’t suspect there is any malicious intent. Just some year one headaches that we doubt consumers will be punished for (IRS already waived just about every fee they could for people with incorrect or missing forms).

Kay Sullivan

Like so many of the people on this page I have never received my 1095A and it does not exist on the website. I have been calling the marketplace since January and I am frustrated but pleasant. Despite that I have been hung up on many times. The representatives always tell me that someone is working on it but they don’t know who and that there is no phone number for this “person” that is working on it. I do not want my return to be held up since it is now April 3rd. so I am considering just checking the box that says I got insurance another way and then amending my return when I finally get my 1095A. The reason I chose this method is because i don’t have a policy number (box 2) from a 1095A and I read that without this number the IRS just holds onto your return until they get the 1095A from the Marketplace. Who knows how long that will be. Does anyone know of any reason that I should not go about it in this way?

Bob

Here is some information that just came out today

http://www.treasury.gov/press-center/press-releases/Pages/jl10018.aspx

http://www.irs.gov/Affordable-Care-Act/Individuals-and-Families/Questions-and-Answers-Incorrect-Forms-1095A-and-the-Premium-Tax-Credit

Its probably not what you want to hear, but at least its something.

David Edelman

To Jeff Aguilar : You rolled the dice and won. Congrats! I have read other people who posted on healthcare.gov who also used self prepared 1095-a and their returns were processed and approved. I filed on 3-14-15 using self prepared 1095-a and I received a letter from IRS dated 4-3-15 requesting a copy of my 1095-a to support my entries made on form 8962. My dice roll did not go so well. Others have also reported getting the same IRS request letter. Has anyone out there tried sending the IRS their typed self prepared 1095-a and gotten approved? Did it work? Did the IRS accept it? I looked at my buddy’s official 1095-a that he got from the marketplace and i noticed it had a small insignea on the lower right side with a six digit number under it. Like a sequence number. His corrected 1095-a had the same insignea with a different sequence number. Since our self prepared 1095-a lack this symbol will the IRS then realize it is a homemader and reject it? Almost afraid to ask this question.

Jeff Aguilar

Thanks David. I actually used TurboTax to do mine. I just typed in the numbers on its built in 1095-A form after using the calculator tool on healthcare.gov for the Second cheapest silver plan, my bank statements for monthly premium, and policy # on my insurance card. Refund did show up today as well. Sorry to hear yours didn’t go through. I wish you and those who also got the letter the best of luck getting this ridiculous mess sorted out quickly. Jeff

DaveR

I’m trying to help my son and his wife with their taxes. They received a 1095-a that showed what he paid for and credit he received from May thru November for what he purchased thru the exchange. For January thru April, he was able to “keep his previous insurance”, and for December, he received insurance thru his new employer. His older son was covered on his policy in the same way. My daughter-in-law had insurance thru her employer for the entire year. They had a baby in August who was on my son’s exchange policy from August thru November and then was on my son’s employer’s policy in December. Trying to complete the proper forms is so unclear, I can’t figure out what to do. Help!

David Edelman

I received a call from a marketplace rep named “Carol”. After giving her my PII she informed me that my 1095-a was approved and I should receive it in the mail within the next 14 days. She is from the “1095” department. I did call back the number on my caller ID and a tape responded “marketplace 1095 division” does not accept incoming calls. I HOPE I actually do receive an official 1095-a from the marketplace. I am probably going to need to send it to the IRS since I filed on 3-14-15 using my self prepared 1095-a. My taxes still have not been approved and my research on the healthcare .gov blogs show people who also did their own 1095 writing that the IRS is requesting copies of their 1095-a in order to finish processing their return . See post by HON RICH with same issue. My question to you fact check folks is if it comes down to it do you think the IRS will accept my self prepared 1095-a? It is typed and looks perfect. Or do you think they will require an official copy mailed to me by the marketplace? Even though I was told on the phone it was being mailed I am not too confident when or if I will actually get it. Has anyone out there mailed or faxed their self prepared 1095 to the IRS and gotten their taxes approved? I know you can’t answer officially but I do respect your research and opinion. Ty.

ObamaCareFacts.comThe Author

We feel that filing your own 1095-A at this point is valid. As we posted above, we have an IRS issued PDF that tells people who to find the information on their 1095-A (can’t say this came from the top down, but it certainly exists and is a hint filling it out and submitting it is the right move). Best case is the IRS gets a copy of your 1095-A, it matches up, and they process the return. If they never get a 1095-A, then they may accept a self prepared 1095-A. Seems rational. All that being said, to be clear, we have no official word as of yet. You can bet we will be posting it here when we do.

Filing your tax returns, including the 8962 form is the responsibility of the insured. The 1095-A filing at the end of the day is not. Still, with the information right at your fingertips it’s hard to justify not doing it… even if one hangs onto the completed return a little longer awaiting confirmation of a 1095-A.

Jeff Aguilar

Guys, I posted here on March 23rd with no 1095-A after two months of calling. I just said the “H” with it and sent in my taxes. I used the calculator on the healthcare.gov site to get the second lowest silver plan in my area and used my bank statements for amounts I paid for my insurance each month. For the account number (or whatever the phrasing is on the 1095-A), I just put my policy number on my insurance card. After I submitted, I saw it was accepted the same day. I got my state refund within a week (my state doesn’t have an exchange, so there was nothing to hold that back). However, when I monitored my refund status on the “Where’s my refund?” tool on irs.gov, the little 3 part progress meter that said my refund was accepted disappeared and said they were processing my taxes. I thought this going to come back and slap me in the face now. After about 3 or 4 days, no change. Now today, Easter Sunday, I checked, and my refund is APPROVED! It says it should be in the bank by the 8th! Go figure, they accepted my taxes without the 1095-A that I had been dreading the last 2 months. Jeff

Tawanda Turner

I never received my 1095-A. I filed my taxes at the end of January, I received a letter from the IRS two weeks after I filed to send a copy of my 1095-A. I called the health insurance marketplace the second week of February. It’s almost April and I still haven’t received it.

hon rich

I received the below in an email today on 3/30/2015. Absolutely outrageous.

Important information about filing your taxes

Because you enrolled in a health plan through the Health Insurance Marketplace for 2014, you need an important tax statement, called a form 1095-A, to fill out your federal income tax return.

We’re contacting you today to let you know that a statement has been mailed and will arrive in your mailbox shortly.

Until you receive your Form 1095-A, please wait to file your Federal income taxes.

If you have already filed your taxes without this information, you should file an amended return.

Tools and tips about health coverage and your income taxes are available at: http://www.healthcare.gov/taxes.

If you have questions, please contact the Marketplace Call Center at 1-800-318-2596.

The HealthCare.gov Team

David Edelman

Hon Rich : Thanks for the update. You are right it is outrageous.

Bob

I got the same e-mail yesterday.

The funniest / saddest line is to contact them if you have questions. Obviously, that doesn’t work.

At the very least and by now, they should e-mail us as to what we should do.

Give us some kind of relief that they gave the people that filed incorrect 1095-A’s.

Amanda

I’m sorry that so many people are dealing with this, but I am happy to know that I am not the only one and that others are also frustrated.

hon rich

Today I received a call from Steven, no last name and no ID, from the “INS Marketplace” to discuss my 1095A form escalation. Absent proper identification I was unwilling to provide my PII and was told that the 1095A form will NOT be mailed out without discussion with this unit first. I was told that I could call the marketplace.gov for further discussion if I would not provide my PII. You guessed it; the marketplace supervisor was unaware of any such escalation follow up unit and reviewed the data that should be present on the long awaited 1095A form that is supposedly “in the mail.” I was also advised to notify the FTC of fraudulent phone activity. And at the end of the day, no 1095A in the mail! By the way, the IRS sent me an inquiry requesting the 1095A to support my filing done in early March.Placing a call to the IRS to address the matter I waited for almost an hour only to have the responding agent cut off my call . No resolution today.

hon rich

Update:Today I am flabbergasted. Two 1095A forms, dated 3/27/2015, were finally in the mail today. And, most distressingly, they provided OVERLAPPING coverage! Why the people at healhcare.gov cannot get it right is a mystery. I worked with them more times than I can count and reviewed line by line the exact reporting issues and resolutions. Nonetheless, the correct information was ignored and the incorrect information was used. Further, my apartment number was dropped even though I confirmed several times that it was on file and it is a miracle that I even received these documents. Cannot lower my expectations any further. This poor service is unconscionable. I have written to Kevin Counihan, Marketplace, Chief Executive Officer, Centers for Medicare & Medicaid Services and briefly detailed my experiences .

His information follows:

Kevin Counihan

Director & Marketplace Chief Executive Officer (CEO)

Email: [email protected]

Phone: 301-492-4400 DC

Kevin Counihan joined the Department after most recently serving as the CEO of AccessCT, the state of Connecticut’s health insurance exchange. As the AccessCT CEO, Kevin led the successful implementation of the state’s marketplace where enrollment exceeded expectations. Additionally, he was the Director of Marketing for the Massachusetts Connector during Massachusetts’ implementation of their health reform initiative.

In his role as Marketplace CEO, Kevin is responsible and accountable for leading the federal Marketplace, managing relationships with state marketplaces, and running the Center for Consumer Information and Insurance Oversight (CCIIO), which regulates health insurance at the federal level. Kevin has over 25 years of experience in the commercial health insurance industry. He is an experienced senior executive with more than three decades of success in business, marketing, operations, product development and strategic planning for health care organizations.

Deputy Center & Policy Director: Vacant

Deputy Center & Operations Director: Karen Shields

hon rich

I think that their needs to be a revamp of the administrative side of healthcare.gov.From my harrowing year of experience dealing with the various healthcare.gov Reps, Tier II reps, managers, fraud unit and advanced resolution team, it appears that there is no one responsible for a final outcome. There also should be a place/person where the buck stops. At the very least, deadlines need to be respected.This is basic business practice. Representatives working with their clients, the public, need to have an understanding of the levity of the position.They are not sales reps and should be expected to own their actions. The current model is not sustainable and needs to be addressed and resolved immediately.

David Edelman

To: Hon Rich, extremely well said. I spent over an hour on the phone with them today with no results. However, I am very encouraged by the message you received in your portal. Like a little kid I quick checked my message portal but zero messages. You are dead on accurate with your description of the healthcare.gov experience. If you can please post when you receive it in the mail. I need the encouragement.

Mark Z

I never received my 1095A because the website shows my start date as the termination date. In effect, my plan was cancelled the day it started. No plan, no 1095A. The insurance sent me all the documentation that shows my coverage was purchased and paid for through the exchange. Problem is, healthcare.gov has no procedure in place to fix this. Anybody that you actually can talk to has no power to fix this, they just fill out a report and send it to “Advanced Resolution” and it gets assigned to a nameless, faceless caseworker who you will never be able to talk to. I made several calls, talked to several supervisors, no resolution. Can’t even get the name of my “caseworker”. I’m done calling them, it’s useless. I prepared my own 1095A form (easy to do) and will file using that. I will hold off until the last minute on the outside chance I actually get my 1095A. Talked to the IRS and they couldn’t tell me if my return would be accepted or not, but did say they might put a process in place to address this if it continues to be a problem.

Michael D.