Are Lab Fees Included For Free Under ObamaCare?

Wellness visits and key preventive care are covered with no out-of-pocket costs, but some related services aren’t covered without cost sharing.

Wellness visits and key preventive care are covered with no out-of-pocket costs, but some related services aren’t covered without cost sharing.

We explain Scott Walker’s plan to repeal and replace ObamaCare. We compare it to the ACA and examine what it gets right and wrong.

College students have a number of health plan options including the Marketplace, Medicaid, school health plans, catastrophic plans, and their parents plan. Below we take a look at student health options under the Affordable Care Act (ObamaCare). FACT: A university health plan counts as Minimum Essential Coverage for ObamaCare if it’s fully insured or self insured. Aside… Read More

You can use your Health Savings Account (HSA) for out-of-pocket medical costs, including dental and vision and dental and vision premiums.

How IRA’s and HSAs work with the ACA Before-tax and tax deductible contributions (like to a traditional IRA) lower MAGI and increase subsidies. After-tax contributions lower MAGI on withdrawal (like the Roth IRA). HSA’s are tax free in and tax free out, which make them especially cool. This is generally true for ObamaCare’s tax credits… Read More

A 2015 Health Affairs study shows out-of-pocket spending on the pill decreased nearly 50%, saving women an estimated $1.4 billion per year on birth control

Employers who reimburse employees for individual non-group health plans face a $100 a day or $36,500 per year, per employee excise tax. This rule applies to all employers, but the fine itself is only levied on those who have to comply with ObamaCare’s mandate (firms with 50 or more full-time equivalent employees).

I wanted to share my story since so many people were affected by what just happened to myself and my coworkers yesterday. I was hired in as a full-time non-career employee. This meant that I had the ability to work 40 hours a week while learning about working for the State Of Michigan while I… Read More

If you switch plans mid-year what you paid toward your deductible or out-of-pocket maximum will reset. This can be avoided with a multi-state plan.

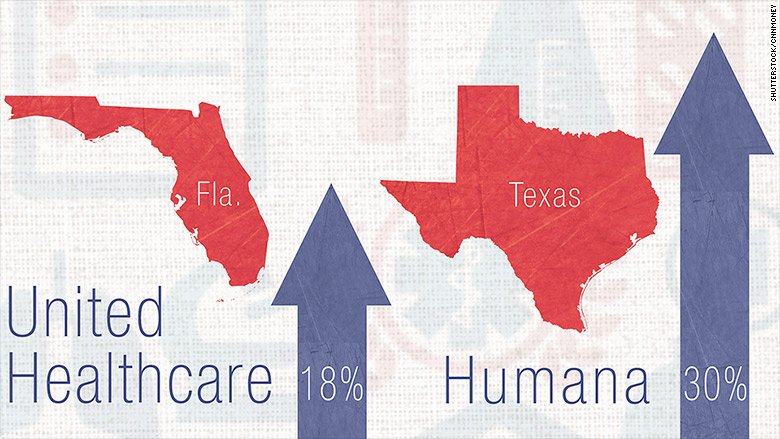

Insurers are planning rate hikes for 2016 under ObamaCare. ObamaCare being both the reason we know about it, and part of the reason it’s happening.

This site is full of facts about ObamaCare. Facts based upon the theory of what ObamaCare would bring. I doubt that this will be published, but I am a REAL ObamaCare user. I received a significant benefit in subsidies by using the marketplace. Due to significant health problems and lack of income I pay a… Read More

All Silver plans offered on the Health Insurance Marketplace offer cost sharing reduction subsidy options. The amount of reduction you qualify for is based on your projected income.

ObamaCare covers one type of birth control per person from each of 18 FDA-approved categories at no out-of-pocket cost, although some plans have exemptions. This page will tell you what kinds of birth control are covered, which health plans have exemptions, how to get free birth control under the Affordable Care Act, and how to get help… Read More

Tax credits are based on annual household income, not monthly income. If projected annual income changes you can adjust cost assistance to avoid repayment. Quick Facts on Cost Assistance and Changes to Income There are three important things to understand about cost assistance and changes to income: Marketplace cost assistance is based on projected annual household income,… Read More

An allowed amount is the maximum amount an insurer will pay for a covered health service, the remainder owed by the insured is called “balance billing”. Allowed Amount Versus No Dollar Limits No lifetime or annual dollar limits means there is no limit to what an insurer will spend on all care as a whole,… Read More

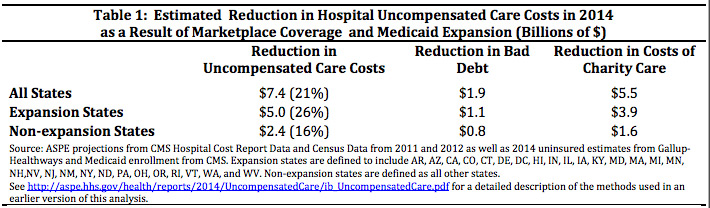

According to HHS the expansion of Medicaid and the increased coverage under the ACA has led to a reduction in unpaid medical bills saving taxpayers and hospitals billions. Highlights from the factsheets can be found below (for a list of citations see page 3 of this PDF). NOTE: This information is from a 2015 report. Logically… Read More

The Affordable Care Act (ObamaCare) was signed into law 5 years ago on March 23rd, 2010. We look at the successes, sticking points, and politics of the law.

Employers can use Health Reimbursement Arrangements (HRAs), Employer Payment Plans, and Flexible Spending Accounts (FSAs) to save money on healthcare. We take a look at healthcare arrangements to find out how they can benefits employers and employees alike. We will also look at how they affect employer and employee taxes and penalties. It’s important to understand… Read More

The best health insurance plan for an individual or family is going to depend on the income and needs of that family. With that said, many will find a marketplace plan that qualifies for cost assistance to be the best value for them. Very generally speaking the best health plan when it comes to benefits… Read More

Under the ACA you can take tax deductions for medical and dental expenses that exceed 10%* of your annual Adjusted Gross Income using a Form 1040, Schedule A. This includes deductions for most medical and dental costs for you, your spouse, and your dependents. Most people won’t take this deduction, but if you’ve had a… Read More

Phil Robertson claimed 110 million Americans have STIs, he mis-quoted a CDC report, ignored the fact CPAC is anti-healthcare reform, and blamed it on hippies (obviously).

Yes. Since cancer screenings are a preventive service (one of ObamaCare’s Minimum Essential Benefits), all ObamaCare health insurance plans have to cover lung cancer screenings. In most cases, this service must be offered at no out-of-pocket costs.

A plan has to offer pediatric dental coverage. That being said, the recipients of the plan can deny dental or vision.

Everyone gets one free wellness visit a year. This is a chance to set up screenings that are also covered at no out-of-pocket costs.

ObamaCare’s Cadillac Tax is a 40% excise tax on high end plans above $10,200 for individuals and $27,500 for family coverage that was set to start in 2018 but was been delayed. This tax is not deductible. The excise tax is one of the main revenue sources for the ACA, helps curb healthcare costs, and… Read More