ObamaCare Facts: Facts on the Affordable Care Act

ObamaCare Facts 2023 – We Tell you the Facts, Not The Talking Points

We provide up-to-date facts on ObamaCare (the Affordable Care Act). Get the ObamaCare facts on enrollment, assistance, benefits, plan types, and more.

What is ObamaCare?

ObamaCare Facts Image Public Domain, Photo by Chuck Kennedy; U.S. Government Work

The official name for “ObamaCare” is the Patient Protection and Affordable Care Act (PPACA), or Affordable Care Act (ACA) for short.

The ACA was signed into law to reform the health care industry by President Barack Obama on March 23, 2010, and upheld by the Supreme Court on June 28, 2012, and June 17, 2021.

Despite some subsequent court battles and changes to the law, the Affordable Care Act is still “the law of the land ” today. That means all the benefits, rights, and protections discussed below are still in effect.

FACT: Under the Affordable Care Act, the uninsured rate fell to the lowest rate in recent history.

FACT: Before ObamaCare, people could get charged more or dropped from their health plan for being sick in the past.

ObamaCare Basics

Obamacare means cost assistance like tax credits, out-of-pocket savings, and expanded Medicaid. It also means expanded employer coverage and annual open enrollment periods. It also means new rules for insurers. It also means lots of new benefits, rights, and protections for consumers.

That is the basics. However, there are lots of specifics to cover. Let’s start by covering ObamaCare’s main aims and impacts.

ObamaCare Overview

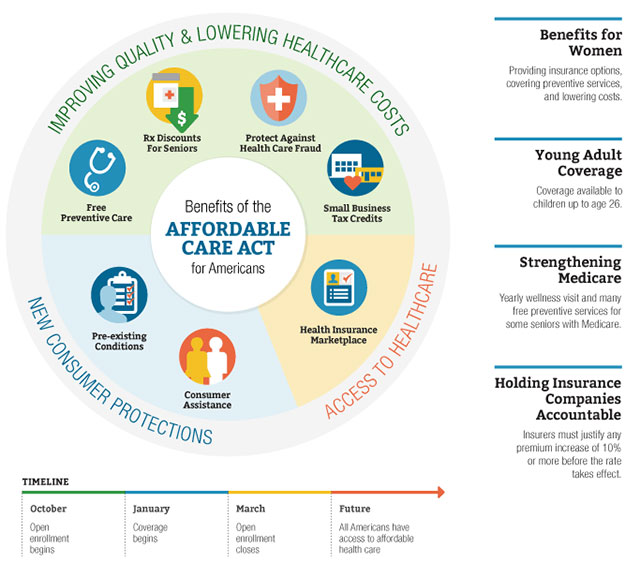

The goal of the Affordable Care Act is to give more Americans access to affordable, quality health insurance and to reduce the growth in U.S. health care spending.

To accomplish this, the ACA expands the affordability, quality, and availability of private and public health insurance through consumer protections, regulations, subsidies, taxes, insurance exchanges, and other reforms.

Below are some of the most important things to know about the law:

- ObamaCare expands access to health coverage. It does this by expanding Medicaid to single adults, expanding employer coverage, requiring insurers to cover preexisting conditions, offering cost assistance for premiums and out-of-pocket costs on plans sold on state Health Insurance Marketplaces and the federal marketplace HealthCare.Gov, letting young adults stay on their parents plan until 26, and more.

- ObamaCare improves the quality of coverage. For example, all major health plans must now offer 10 essential benefits, including maternity care, lab services, and mental health services.

- ObamaCare’s cost assistance lowers premiums and/or out-of-pocket costs. Many single adults and families qualify for marketplace cost assistance or free or low-cost coverage under Medicaid/CHIP based on factors like family size and income. You’ll find out if you qualify when you sign up for health insurance through the marketplace or a marketplace-approved broker.

- ObamaCare curbs healthcare costs. For example, via regulations and taxes on those who benefit the most from healthcare reform, like insurers and drug companies.

- ObamaCare creates an open enrollment period during which people can use federal and state marketplaces to shop for coverage with cost assistance. The official federal marketplace is HealthCare.Gov (but a marketplace-approved broker can also help you shop for plans). Open enrollment runs from November 1st to January 15th each year in most states unless the deadline is extended (although some states have unique deadlines). Make sure to get a plan that qualifies for the ACA’s benefits and protections each year during open enrollment!

FACT: Due to ObamaCare’s cost-curbing provisions, healthcare spending growth has been curbed under the Affordable Care Act. In 2014 costs grew at the slowest rate on record (since 1960). See data from HealthSystemTracker.org and CMS.Gov.

FACT: Between 2010 and 2016, the Affordable Care Act helped lower personal bankruptcies by nearly 50%! This is just one example of the ways that ObamaCare is working.

See the video below from HealthCare.Gov, the official Health Insurance Marketplace used to sign up for health plans with cost assistance during open enrollment. Or, keep reading to learn about the Affordable Care Act’s benefits, rights, and protections.

IMPORTANT: Don’t forget to get covered at HealthCare.Gov during open enrollment so you can take advantage of cost assistance options! Those with lower incomes and children should note that Medicaid and CHIP enrollment is offered 365 days a year. Find out what to do if you miss open enrollment.

IMPORTANT: A number of things changed with the Affordable Care Act over the years. For example, the fee for going without health insurance was reduced to $0 on a federal level starting in 2019, and short-term health insurance was expanded. Keep in mind some states have implemented their own individual mandates.

ObamaCare’s Key Benefits, Rights, and Protections

Below is a quick rundown of the most important benefits, rights, and protections in the Affordable Care Act. Decide for yourself what you think about the health care law, based on the ObamaCare facts and not the ObamaCare talking points.

ObamaCare offers some new benefits, rights, and protections:

- Letting young adults stay on their parents’ plan until 26

- Stopping insurance companies from denying you coverage or charging you more based on health status

- Stopping insurance companies from dropping you when you are sick or if you make an honest mistake on your application

- Preventing gender discrimination

- Stopping insurance companies from imposing unjustified rate hikes

- Doing away with lifetime and annual dollar limits

- Giving you the right to a rapid appeal of insurance company decisions

- Expanding coverage to tens of millions by subsidizing health insurance costs through the Health Insurance Marketplaces (HealthCare.Gov and the state-run Marketplaces)

- Expanding Medicaid to millions in states that chose to expand the program

- Providing tax breaks to small businesses for offering health insurance to their employees

- Requiring large businesses to insure employees

- Requiring all insurers to cover people with pre-existing conditions

- Making CHIP easier for kids to get

- Improving Medicare for seniors

- Ensuring all plans cover minimum benefits like limits on cost-sharing and ten essential benefits, including free preventive care, OB-GYN services with no referrals, free birth control, and coverage for emergency room visits out-of-network

FACT: ObamaCare gives tens of millions of women access to preventive health services and makes it illegal to charge women different rates than men. Get more ObamaCare women’s health services facts.

FACT: Over 50 million Americans with private health insurance now have access to preventive services with no cost-sharing because of the new minimum standards of ObamaCare.

Getting Coverage and Cost Assistance Under the Affordable Care Act

The Affordable Care Act’s annual open enrollment period is the only time of year in which individuals and families who don’t qualify for other coverage (like Medicare or Employer coverage) can enroll in coverage that offers the benefits of the Affordable Care Act (like cost assistance and protection for preexisting conditions) without qualifying for a special enrollment period.

- At the end of each year, there is an open enrollment period for health insurance.

- In most states, enrollment runs from November 1st to January 15th, with coverage starting as early as January 1st unless an extension is granted.

- The deadline used to be December 15th, but a 2021 permeant extension extended the previous deadline. The new deadline is January 15th.

- ObamaCare’s Open Enrollment Period for 2023 health plans ran from November 1, 2022, to January 15, 2023, in most states.

- ObamaCare’s Open Enrollment Period for 2024 health plans runs from November 1, 2023, to January 15, 2024, in most states.

- Some states may extend the deadline each year, as may the federal marketplace HealthCare.Gov. See state-based deadlines, extensions, and other dates for this year.

- During open enrollment, individuals and families can enroll in a health plan that is eligible for cost assistance based on income and family size.

- Outside of open enrollment, options are mostly limited to Medicaid/CHIP and short-term health insurance.

- Until the end of 2018, if you didn’t get and maintain Minimum Essential Health Coverage or obtain an exemption for each month of each year, you would owe a fee for each month you or a tax dependent didn’t have coverage or an exemption.

- From 2019 forward, the fee for not having coverage is reduced to zero in most states (i.e., make sure to check if your state has the fee or not).

- Although the fee has been reduced to zero in most states, those doing taxes for previous years and those in states that still have a fee will be happy to know that every family automatically qualifies for a “less than three month” short coverage gap exemption each year. Other exemptions can be found on form 8965.

- Each coverage type has its own enrollment period. Employer coverage and Medicare have their own enrollment periods. Medicaid and CHIP can be enrolled in 365 days a year. Short-term health insurance is an option all year round, but it won’t protect you from the fee.

- Even though individuals and families can shop outside of the marketplace for health plans, for example, through a health insurance broker or agent, only health plans sold on the Health Insurance Marketplace are eligible for cost assistance. Luckily, a HealthCare.Gov-approved qualified agent or broker outside the marketplace can help you enroll in a marketplace plan (in other words, as long as you shop during open enrollment, you have options as to where you shop).

- Those using the marketplace may qualify for one or more of three types of assistance based on family size and income. First, premium tax credits lower premiums. Second, out-of-pocket cost assistance lowers out-of-pocket costs on Silver plans. Third, Medicaid and CHIP are free or low-cost health insurance for low-income individuals and families.

- Make sure to brush up on some tips for getting the best health plan. You’ll want to consider metal plans, premiums, coinsurance, and copays. As well as deductibles, out-of-pocket maximums, networks, and HSAs. See our guide to buying health insurance and our guide to comparing plans for information on all those terms and more.

Remember, options outside of open enrollment are limited to Short-Term Health Insurance, Medicaid, and CHIP. Keep in mind employer coverage and Medicare have unique enrollment periods. Learn more about enrollment periods.

TIP: If you are getting cost assistance and your income changes throughout the year, make sure to update the Marketplace. If you take too much or too little of Advanced Premium Tax Credits, you’ll have to adjust them at tax time using form 8962.

FACT: Only plans that comply with ObamaCare’s rules qualify for cost assistance and offer all the benefits, rights, and protections ensured by the law. So, for example, short-term health insurance doesn’t have to meet the same standards and doesn’t qualify for cost assistance.

FACT: Americans with private health insurance now have access to preventive services with no cost-sharing because of the new minimum standards of ObamaCare. Only those who qualify for cost assistance can get premium tax credits and out-of-pocket assistance, but the rest of the Affordable Care Act’s benefits are offered to anyone on a major medical health plan obtained after 2014.

FACT: The majority of young U.S. adults will qualify for cost assistance via ObamaCare’s marketplaces, and many will qualify for Medicaid in states that expanded Medicaid due to the average incomes of young adults. Find out how ObamaCare affects young people.

Last year those who shopped around and switched plans saved more. You can shop for quotes on health plans with the help of HealthCare.Gov or a Qualified broker. Are you covered? See tips and tricks related to getting the right health plan.

FACT: Despite rate increases each year, most marketplace users can get a plan for $100 or less due to the ACA’s Advanced Premium Tax Credits cap premiums based on “household income and family size.” Learn more about how cost assistance works with the Affordable Care Act.

FACT: ObamaCare does not replace private insurance, Medicare, or Medicaid/CHIP. If you have Medicare or Medicaid/CHIP, you don’t need to worry about open enrollment and marketplace plans. You are considered to have Minimum Essential Coverage.

FACT: ObamaCare doesn’t regulate your health care; it regulates health insurance along with some of the worst practices of the for-profit healthcare industry.

The video below will tell you Everything You Need to Know About ObamaCare in under 7 minutes. The video below was made in 2014, but everything outside of a few dates is still applicable.

Tips on Taking Advantage of ObamaCare in 2023

Below are some more facts that will help you take advantage of the benefits and protections offered by the Affordable Care Act:

- For any time of the year, we suggest learning more about how health insurance works and how cost assistance works to make sure you get the best health plan for you and your family. We can hardly cover everything here. Please see the links on this page for further reading and lots of useful tips.

- For those who stay covered on a marketplace plan each year, you need to change plans and verify your information by December 15th (subject to extensions) each year to ensure your cost assistance is correct and the plan of your choice starts by January 1st (or after you pay your premium). If you don’t verify your information, you might not be re-enrolled or might be re-enrolled in a different plan (if your insurer or region stops offering the plan for example).

- Even if you miss Dec 15 deadline, you should still verify your plan and info. If your income changes or you have a life change (like getting married or having a baby), then you may be eligible for different cost assistance amounts. There is no wrong time to update your Marketplace information; this will ensure you avoid owing back excess tax credits.

- The best way to make sure you keep your insurance is to make sure you pay your premium every month. Consider putting your premium payment on auto-pay. If you miss a premium payment, you could get dropped from coverage and be left without options beyond filing an appeal.

FACT: Aside from the HealthCare.Gov website, you can also sign up for the marketplace by mailing in an online application (read these instructions first), get in-person help, or call the 24/7 helpline 1-800-318-2596 (TTY: 1-855-889-4325). Learn more about other ways to sign up for health insurance.

On TrumpCare: Sometimes healthcare reform under Trump, especially when it made changes to the ACA, was called “TrumpCare.” A few things changed from 2017 – 2020 under the Trump administration (including an executive order that impacted the mandates and a set of new rules that shortened 2018 open enrollment, allowed for higher out-of-pocket costs, and allowed for narrower networks). There was not however a repeal and place plan passed through Congress, nor did Trump himself repeal the ACA. Until further notice, ObamaCare is still “the Law of the Land.” Repeal and replace attempts in 2017 included the American HealthCare Act, the Better Care Reconciliation Act of 2017, and the Graham-Cassidy Proposal.

TIP: Keep in mind, we could see another “repeal and replace” effort in the future. That means we could see a push to reconsider Republican-favored provisions featured in past bills. Republicans have favored tax credits based on age, expanded HSAs, privatizing “block-grants” for Medicaid, defunding Medicaid, having the flexibility to create stricter rules for Medicaid (such as work requirements), bringing back high-risk pools, defunding of Planned Parenthood, the eliminating the individual and employer mandates, eliminating of out-of-pocket cost assistance, and taxes on industry.

Is ObamaCare Working?

Although statistics on the ACA change each year, we can look at some past data to show the ACA is working.

First off, according to Gallup data, the uninsured rate under the Affordable Care Act (ObamaCare) dropped to record lows of 10.9% in 2016 but since rose to 13.7% in 2019.

By the end of open enrollment 2016, there was estimated to be as many as 12.7 million in the marketplace, and very roughly 20 million total covered between the Marketplace, Medicaid expansion, young adults staying on their parent’s plan, and other coverage provisions.

Today, the enrollment numbers are still impressive and there are still tens of millions of Americans covered under the ACA’s coverage provisions! Consider, in 2020 the total enrolled in HealthCare.Gov and state marketplaces in 2020 was 11.4 million. Meanwhile in 2019 14.8 million were covered by Medicaid expansion and about 2.6 million were able to stay on their parents’ plan, and in 2015, it was estimated that 9.6 million had gained coverage due to the employer mandate.

Enrollment numbers aside, new data is coming out each month that helps to show that key provisions of the ACA are working (like the 50% reduction in bankruptcies from 2010 to 2016).

If you ask Obama himself about the ACA and the Future of US Health Care, he’ll tell you that most of the program is working better than expected, but there is still more work to be done. This message is mirrored even by some of his biggest critics… even Donald Trump’s own administration released a report showing how the Affordable Care Act is working (see: Reforming America’s Healthcare System Through Choice and Competition).

With that in mind, there are parts of the ACA that need more help, and even supporters of the law are in favor of real reforms that improve coverage and costs without increasing the uninsured.

We can summarize the pros and cons of the Affordable Care Act as:

- Great coverage expansion for the sick and poor.

- A struggle for those in the middle class who don’t get cost assistance (especially considering those who can only afford high deductible plans, but can’t afford to fund an HSA up-front).

- Lots of cost-curbing and benefits in the healthcare sector.

- Some frustrating sticking points like the family glitch that require immediate attention (and which Democrats have campaigned on addressing at times).

In all, the latest news is good news about total costs and coverage.

For example, a June 2016 study by the Urban Institute shows the latest long-term spending projections are $2.6 trillion less than the original post-ACA baseline forecast through 2020 — a reduction in projected spending of almost 13%. Read more. Meanwhile, the uninsured rate was estimated to hit an all-time low fell to 9.1% in 2015 according to a 2016 report. Another report demonstrated a steady falling trend under the ACA but estimated it at an all-time low of 11%.

Meanwhile, a 2019 report from the Trump administration showed the ACA was still working despite changes under the Trump administration.

FACT: ObamaCare doesn’t ration health care. It protects consumers from the healthcare coverage and cost-based rationing that insurance companies have been doing for decades.

FACT: According to a 2019 Kaiser Family Foundation poll, the majority of Americans support lowering prescription drug prices and ensuring the ACA’s pre-existing conditions protections, while a minority support repealing and replacing the ACA.

NOTE: See the current marketplace sign-up numbers here; despite ebbs and flows throughout the year, the enrollment numbers are growing consistently on average.

FACT: Studies have shown that anywhere from 20,000 to 44,000 Americans died each year from lack of health insurance before the ACA.

FACT: In 2010, 19.5% percent of uninsured were employed, and 14.7% maintained full-time employment for the entire year. In 2010, only 53.8% of private-sector firms offered health insurance. The fact is, poor working families were, and still are the most likely to be uninsured. By expanding coverage and cost assistance, the Affordable Care Act helps working families have access to health coverage.

Other milestone achievements of the ACA over the years include:

- A January 2015 report by the Commonwealth Fund showed a reduction in the number of uninsured Americans and an increase in affordability and access to care under the Affordable Care Act. In some cases, the numbers of uninsured people were the lowest they had been since 2001, especially for those younger people and those with low incomes. This means that fewer Americans are putting off care or struggling with medical debt.

- According to another January 2015 report by the Commonwealth Fund, the growth of costs related to employer-sponsored health plans, including premiums and deductibles, had risen faster than the average income since 2003. However, in 31 states, that growth slowed since the ACA was signed into law. That trend generally has continued in many states, but inflation in healthcare is still outpacing increases in workers’ incomes (causing workers to in some cases “feel the pinch” of rising healthcare costs).

- Due to the ACA’s cost-curbing provisions, health care spending in 2014 grew at the slowest rate on record (since 1960). Meanwhile, health care price inflation was at its lowest rate in 50 years in 2014 as well.

- By 2015, 8.2 million seniors have saved more than $11.5 billion on their prescription drugs since 2010 – an average of $1,407 per beneficiary.

- By 2015, the ACA’s provisions have helped save $19.2 billion in fraud – about a $10 million increase from the five years before that.

- Preliminary data gathered in 2015 showed that between 2010 and 2013, due to new ACA provisions, about 1.3 million fewer events occurred that could cause hospital-acquired conditions such as pressure ulcers, infections associated with central lines, and falls and traumas. As a result, it was estimated that between 2010 and 2013 50,000 fewer people lost their lives, and there was a $12 billion in cost savings.

- Due to ObamaCare’s focus on quality over quantity, re-admissions among Medicare beneficiaries were driven down by 150,000 by 2015.

- Medicaid expansion and increased coverage have combined to reduced unpaid medical bills, resulting in less medical debt for consumers and fewer unpaid hospital bills, which hurt hospitals and state taxpayers. Hospitals’ uncompensated care costs were estimated to be $7.4 billion (21%) lower in 2014 than they would have been in the absence of coverage expansions.

FACT: 74,424,652 individuals were enrolled in Medicaid and CHIP in June 2017. See June 2017 Medicaid and CHIP Enrollment Data Highlights.

FACT: According to CDC data, 75% of all healthcare expenditures go toward treating chronic diseases, many of which are preventable. Chronic diseases cause 7 in 10 deaths each year in the United States.

TIP: Want more ObamaCare facts? A good way to find out about how the Affordable Care Act is working is to check out the 100 page 2016 White House Report. Most of the information in there remains relevant even as time moves on. See our summary of the ObamaCare White House Report December 2016. For something more recent, see the 2019 report done by the Trump administration.

Why did we need healthcare reform? ObamaCare was enacted to address the “healthcare crisis” (a term that describes the fact that premiums were rising faster than inflation, that healthcare spending was raising as a percentage of GDP, and that the uninsured rate was increasing because of this). The ACA was a first step to solving our problems and their effects like bankruptcy due to medical debt, but it wasn’t the final step. There are still “sticking points” that need to be “fixed.” So far, the biggest gains have been made in states that embraced ObamaCare. The states that rejected key provisions like Medicaid Expansion and the exchanges bring down the national average as their costs are higher, their choice of insurers are fewer, and their uninsured rates are higher. The conscious effort to obstruct ObamaCare at a state and federal level has been actively contributing to the ability of critics of the law to spin the “death spiral” talking point. See facts on how the ACA is working and more facts on the healthcare crisis before the ACA and why we needed reform.

Free Preventive Services and Ten Essential Benefits

Above we covered the ACA’s main benefits, but let’s talk about them in detail.

ObamaCare’s new benefits, rights, and protections include the requirement that most non-grandfathered (or non-grandmothered) health insurance plans cover preventive services and services from at least ten categories of essential health benefits with no annual or lifetime dollar limits. Learn more about grandfathered health plans.

The Ten essential health benefit categories include outpatient care, emergency care, hospitalization, maternity and newborn care, mental health services and addiction treatment, prescription drugs, rehabilitative services and devices, lab services, pediatric dental and vision, and free preventive services.

- A minimum amount of services from the Ten Essential Benefit categories must be included in all non-grandfathered plans as “covered services.” Covered services are services your plan covers in-network at the plan’s cost-sharing amount.

- Free preventive services including a yearly check-up, immunizations, counseling, and screenings must be included in all non-grandfathered plans at no out-of-pocket costs.

- Many of ObamaCare’s numerous provisions have already been enacted. The rest of the program continues to roll out until 2022. See our Affordable Care Act timeline for more information.

- The Affordable Care Act contains ten titles that span over 1000 pages, but most of its key provisions are in the first title. The first title is about 140 pages long. These pages are mostly blank space with about 450 characters per page. If you would like to read the whole title, would like a summary of the title, or would like a summary of the provisions within one, check out our summary of the Patient Protection and Affordable Care Act.

FACT: Any insurance plan that starts after 2014 must follow new health insurance rules and include Ten Essential Benefits. All health plans sold through the health insurance marketplace adhere to these rules.

FACT: Policies issued before 2010 (“grandfathered” health plans) and short term health plans don’t have to adhere to all the new rights and protections offered by the Affordable Care Act.

FACT: According to the CDC, 75% of all healthcare expenditures go toward treating chronic diseases, many of which are preventable. Chronic diseases cause 7 in 10 deaths each year in the United States. The Affordable Care Act includes a major focus on wellness; this includes funding for programs that educate the public on health and wellness and new rules for employer wellness programs.

FACT: ObamaCare provides free preventive women’s services, including mammograms, as one of the 10 essential benefits covered under every new insurance plan. The Fact is, ObamaCare gives tens of millions of women access to preventive health services and makes it illegal to charge women different rates than men. Get more ObamaCare women’s health services facts.

ObamaCare, Taxes, Shared Responsibility, and Exemptions

The Affordable Care Act also includes a lot of benefits, but it also includes new taxes.

Most of the new taxes are on high-earners, large businesses, and the healthcare industry. However, there are some tax-related provisions every American should be aware of.

These are: tax credits to subsidize costs for low-to-middle income Americans and small businesses, which started in 2014; an Employer Mandate for large employers to provide health insurance to full-time employees by 2015/2016 or pay a fee; an Individual Mandate for individuals and families obtain health insurance or pay a fee which started in 2014; and lastly, new limits on medical deductions.

UPDATE 2019: Remember, the mandate’s fee is reduced to zero for 2019 forward in most states. With that said, since it is still relevant in past years, below are a few more ObamaCare facts about the fee.

UPDATE 2019: Despite efforts to repeal the employer mandate by Republicans, the employer mandate is still the law moving forward.

TIP: The next two points only apply to cases in which the fee would be owed.

What is the Health Insurance Marketplace?

ObamaCare creates state-specific and federal health insurance marketplaces (also known as exchanges) where individuals and families can shop for subsidized health insurance based on income.

ObamaCare creates state-specific and federal health insurance marketplaces (also known as exchanges) where individuals and families can shop for subsidized health insurance based on income.

- When you fill out a Marketplace application, you’ll also find out if you qualify for lower costs on coverage, Medicaid, CHIP, or Medicare.

- If you or a dependent has coverage through your employer, you can’t get subsidies on the marketplace.

- ObamaCare’s official health insurance marketplace is HealthCare.Gov. However, many states set up their own marketplaces. Find your state’s marketplace here.

- Apply for the health insurance marketplace early. Applying and enrolling are not the same thing. Although for many of us the application process will only take a few minutes, the verification process can take time. Once your application is verified, you have until the last day of open enrollment each year to enroll in a plan. Learn more about how to sign up for health insurance – ensure you don’t miss the annual deadlines!

- Remember, insurance purchased by the 15th of each month starts on the 1st of the next month after you pay your premium. If you sign up during the second half of the month, your coverage won’t start until the second month. Please check with your insurer for specific start dates.

Get covered: HealthCare.gov is the official site on the Affordable Care Act and the Health Insurance Marketplace. Ready to sign up for health insurance? Find your state’s health insurance marketplace now.

Should I buy insurance through the health insurance marketplace? Your options for obtaining coverage are changing. For some of us, buying private insurance through the health insurance marketplace will be our best option; for others, buying health insurance through a private broker will be the smarter move. Find out which option is right for you and your family. ObamaCare and health insurance plans.

If you like your doctor, you can basically keep them: If you like your doctor, and your health insurance provider includes your doctor in your network, you can keep your doctor. Nothing in the ACA prevents you from keeping your doctor, although you have to pick a network that your doctor participates in… and so some people do run into the problem of not being able to keep their doctor when they change plans. Learn more about ObamaCare and doctors.

FACT: If you don’t have coverage, you can use your state’s Health Insurance Marketplace to buy a private insurance plan. Many Americans will qualify for lower costs on monthly premiums and out-of-pocket costs through the marketplace. Please note that if you have access to employer-based insurance, you cannot get cost assistance through the marketplace.

ObamaCare and Minimum Essential Coverage

Only certain types of major medical health insurance protected you from the Individual Mandate’s shared responsibility fee (the fee for not having coverage) when it was applicable. This type of coverage is called minimum essential coverage.

- All insurance bought on the Health Insurance Marketplace, major medical plans outside the Marketplace, Medicare part A and C, Medicaid and CHIP, and most employer-sponsored plans are considered minimum essential coverage.

- Most private individual and family health insurance sold outside of open enrollment (like short-term health insurance) is not considered minimum essential coverage, and won’t protect you from the fee.

From 2019 forward Minimum Essential Coverage doesn’t mean as much regarding the fee, but it is still a standard that denotes coverage that meets the standards of the ACA.

ObamaCare and Cost Assistance

Above we touched on the basics of getting covered and getting cost assistance; below, we’ll offer some additional details.

There are three ways to save money on your health insurance through ObamaCare’s marketplaces. First, Advanced premium tax credits, which lower your monthly premium costs. Second, Cost Sharing Reduction subsidies, which lower your out-of-pocket costs for copays, coinsurance, deductibles, and out-of-pocket maximums. Lastly, Medicaid and CHIP, which do both. Learn more about ObamaCare cost assistance.

- Cost assistance is only offered through your state’s health insurance marketplace, although some private health insurance brokers and providers work with the marketplaces to assist you in getting subsidies.

- Americans making less than 400% of the federal poverty level may be eligible for free, low-cost, or reduced-cost health insurance due to cost assistance subsidies like Tax Credits, which reduce premium costs, and cost-sharing subsidies, which lower cost-sharing on copays, coinsurance, and deductibles.

- Cost Sharing Reduction subsidies (CSR) are only available on Silver plans.

- Tax Credits can be applied in advance (in part or in full) to lower your premiums or can be adjusted on your federal income taxes.

- If your income changes, report it so the marketplace can adjust your subsidies. You may qualify for bigger credits if your income decreases and you will save yourself from potentially having to repay advanced tax credits.

- Make sure cost assistance is right, but when in doubt, aim low. You don’t have to pay back Cost Sharing Reduction subsidies or Medicaid, but you could end up owing Advanced Premium Tax Credits back up to the limit for your income level when you file taxes. See Tax Credit form used to pay back Tax Credits for details on filing and limits.

FACT: The primary reasons for Americans being uninsured are cost and job loss. The ACA helps to curb costs.

FACT: ObamaCare takes measures to prevent all types of discrimination in regards to your right to health care. Insurance companies can no longer use factors such as pre-existing conditions, health status, claims history, duration of coverage, gender, occupation, and small employer size org industry to increase health insurance premiums.

FACT: The only factors that can affect premiums of new insurance plans starting in 2014 are your income, age, tobacco use, family size, geography, and the type of plan you buy. This applies to all plans sold through your State’s health insurance marketplace.

FACT: The amount of out-of-pocket costs your health plan covers can affect your rates. Plans that cover more out-of-pocket costs like deductibles, coinsurance, and copayments also have higher premiums.

FACT: KFF.org estimated that 3.5 million people qualified for an estimated average premium subsidy of $2,890 per person in 2014. The CBO estimated that the average subsidy in 2015 would be $3,900. In 2017 the average premium subsidy was about $4,452 according to KFF.org. These numbers help us to understand that each year cost assistance ensures that those who qualify for assistance will pay low rates, even when premiums increase! This is due to the way cost assistance caps premiums and out-of-pocket spending based on family size and income.

FACT: Medicaid and CHIP are types of cost assistance. Medicaid and CHIP enrollment in 365 days a year. That means there is never a wrong time to apply for Medicaid and CHIP!

MAGI and FPL

Cost assistance is based on Modified Adjusted Gross Income (MAGI). That means the cost is based on your income after most deductions. Once you know your MAGI, you can use the Federal Poverty Level (FPL) Guidelines to determine your assistance amount.

As long as you have the right documents, you can simply fill out a marketplace application, and it will calculate cost assistance for you. However, knowing how MAGI and the Federal Poverty Guidelines work will allow you to make smart choices about how many advanced tax credits to take upfront.

Each year you’ll use last year’s guidelines for determining this year’s assistance amounts. For example, the 2020 Federal Poverty Guidelines are used to determine cost assistance for marketplace coverage for this year. Don’t worry though; the marketplace can help you figure out your assistance amounts. They are calculated when you sign up and give your information!

TIP: If you don’t have access to cost assistance or want to see other private plan options available, you can shop for health insurance quotes outside of the marketplace too. Qualified health insurance brokers and agents outside of the marketplace can even help you shop for marketplace plans. Just make sure you choose a marketplace plan if you want cost assistance, and of course, make sure you choose a broker or agent who is qualified to help you enroll in one if this is the direction you want to go.

Medicaid and CHIP

ObamaCare Expanded Medicaid and CHIP to millions of Americans. You can apply for Medicaid or CHIP at any time of the year.

If you miss open enrollment, you can still sign up for Medicaid and CHIP, but you won’t be able to use the marketplace to do so. Medicaid / CHIP eligibility differs in each state because many states did not expand Medicaid.

There are millions of Americans eligible for Medicaid who simply haven’t signed up yet. Keep spreading awareness and educate yourself about which states have expanded Medicaid eligibility under Medicaid Expansion.

Below are some figures from 2014, since then a few states have expanded Medicaid:

- Over 15 million men, women, and children are eligible for Medicaid in states that participated in Medicaid Expansion.

- More states are expanding Medicaid every year. Find out if your state expanded Medicaid.

- 5.7 million people were uninsured in 2016 because 24 states had not expanded Medicaid. See America’s Uninsured Rate is on the Rise.

FACT: States that moved forward with Medicaid expansion and established marketplaces saw the biggest reduction in the number of uninsured under the ACA; states that rejected both saw the smallest reduction. Learn more about how ObamaCare affects uninsured rates.

ObamaCare and Employers

ObamaCare helps to cover working families who don’t have access to health insurance.

- In 2015, large employers with 100 full-time equivalent employees or more had to begin insuring full-time workers.

- In 2016, employers with 50-99 full-time equivalent employees had to insure their full-time workforce as well.

This new rule is unofficially called the employer mandate. Here are some more facts about ObamaCare and business.

- Since 2010, small businesses with 25 or fewer employees have been able to get tax breaks for offering coverage (tax credits have been retroactive since 2010). ObamaCare and small business.

- The opening of the SHOP “Small Business Health Options Program” (the part of the marketplace small businesses use to buy employee health plans) began on November 15th, 2014. Small businesses can buy a SHOP plan through an agent and claim tax breaks for up to 50% of their share of employee premiums (this was true in 2014, even though they couldn’t officially use the marketplace).

- Small businesses can use a paper application or apply online for employee health coverage through the SHOP marketplace at any time.

- The small business health care tax credit may be carried back and applied retroactively to previous tax years. It can also be carried forward to future tax years. Learn more about the ObamaCare SHOP Small Business Health Options Program.

- The greater availability of health insurance and the employer mandate have contributed to a net reduction in full-time equivalent hours, a boost in part-time hours, lower uninsured rates, and have helped to eliminate “job-lock.”

- As of August 2015, we had seen 58 consecutive months of net job growth since October of 2010 under the Affordable Care Act. Learn more about ObamaCare and jobs.

- According to the January 15, 2015, report by the Commonwealth Fund: the growth of costs related to employer-sponsored health plans, including premiums and deductibles, have risen faster than the average income since 2003. However, in 31 states, that growth slowed since the ACA was signed into law.

- A Republican-backed bill called the”Save American Workers Act of 2015,” was introduced in 2015. The bill’s purpose was to change the definition of full-time employees from 30 hours to 40 hours. The bill could have increased the full-time workforce but would have likely left millions uninsured. Learn more about the pros and cons of changing the definition of full-time hours.

UPDATE: The Trump administration has made some changes to the way the ACA affects businesses. Please see a professional for the latest rules and regulations.

FACT: Only roughly the top 3% of small businesses have to pay their portion of the additional 0.9% ObamaCare Medicare tax increase. Meanwhile, only 0.2% of businesses had over 50 full-time equivalent employees and didn’t already offer insurance to their full-time workers before the ACA.

FACT: Over half of all uninsured Americans are small business owners, employees, or their dependents. Learn the truth behind the ObamaCare small business taxes and how they affect America’s biggest job creators.

ObamaCare and Medicare

ObamaCare gives seniors access to cheaper drugs and free preventive care, reforms Medicare Advantage, and closes the Medicare Part D ‘donut’ hole. The fact is, the Affordable Care Act focuses heavily on ensuring better care for seniors and keeping Medicare strong for years to come. Learn about how the Affordable Care Act affects Medicare.

Medicare isn’t part of the Health Insurance Marketplace. If you have Medicare, keep it.

Do you want to get a better idea of how the Affordable Care Act affects Medicare, Medicare Advantage, Part D, or Medigap policies? Or perhaps you have questions about how Medicare works or how Medicare enrollment works. Look at our section on ObamaCare and Medicare for the Facts on ObamaCare and Medicare reform.

FACT: By 2015 over 100 million Americans had already benefited from the Affordable Care Act. This includes more than 105 million people who accessed critical preventive services for free that had previously been subject to out-of-pocket costs. Seniors saved billions of dollars from the gradual closing of the Medicare Part D “Donut Hole.” Billions more were saved from new accountability measures for insurance companies, and that isn’t even the end of the savings from the ACA.

FACT: Aside from the “key provisions” of the Affordable Care Act (ObamaCare), there are hundreds of provisions that are very effective but rarely talked about. For example, section 3022 of the PPACA includes guidelines for the establishment of Accountable Care Organizations (ACOs) under the Medicare Shared Savings Program (MSSP). ACOs are doctors who band together and get paid based on their patients’ medical outcomes rather than on how many tests and procedures they perform.

FACT: ObamaCare’s new Medicare Value-Based Purchasing Program means hospitals can lose or gain up to 1% of Medicare funding based on a quality vs. quantity system. Hospitals are graded on a number of quality measures related to the treatment of patients with heart attacks, heart failures, pneumonia, certain surgical issues, re-admittance rate, as well as patient satisfaction. Learn more about ObamaCare and Medicare.

Qualified Health Plans

There are 4 types of Qualified Health Plans, sometimes called metal plans, available on the marketplace.

Each one has the same benefits, rights, and protections, but each has different networks and cost-sharing.

As a rule of thumb, the more “valuable” the metal, the higher the premium and lower the out-of-pocket costs. Don’t buy health insurance without understanding actuarial value and deductibles. The cheapest up-front cost option won’t always be the best, or least expensive overall, one for you and your family. Learn about the types of health plans sold on the marketplace.

Aside from the 4 basic “metal” health plan types, a “catastrophic” health plan is available through the health insurance marketplace for people under 30 and people with hardship exemptions. Catastrophic health plans tend to have a low premium, but very high out-of-pocket costs.

How Health Insurance Works

Have you been wondering how health insurance works? You pay a premium for every month you have coverage. The higher your premium, the smaller your out-of-pocket expenses (copays, coinsurance, deductibles, out-of-pocket maximums) will be and the larger network of doctors and providers you can utilize.

FACT: Since 2014 all plans sold have had to offer the benefits, rights, and protections regarding cost and coverage, but each plan can offer unique costs, networks, and benefits within those limits. Learn more about how health insurance works and how to buy health insurance each year.

Getting covered is only half the battle; find out how your health insurance works by watching a video from The Kaiser Family Foundation.

- Each metal plan or private health plan has another plan type. These are HMO, PPO, and EPO plan types. If you are traveling out of state, go with a multi-state plan. If you want to limit upfront costs and know that the doctor you want is in the HMO network, consider an HMO. If you want flexibility, go with a PPO.

- It’s very important to understand the difference between in-network and out-of-network. Typically, your plan only pays full cost-sharing amounts for covered benefits in-network. Check your plan summary to see what services are covered and how.

- If you are considering getting a high deductible plan, try pairing it with a Health Savings Account (HSA).

- You don’t have coverage officially until your premium is paid! Remember to follow up with your insurance company if you don’t receive your welcome packet and make sure all premiums are paid on time.

FACT: ObamaCare allows newly insured Americans to choose any available participating primary care provider, OB-GYN, or pediatrician in their health plan’s network or emergency care outside of the plan’s network without a referral. Because of this provision, networks are very important to consider when choosing a plan as they can affect what in-network providers you have access to.

The History of the ACA

- The Affordable Care Act was signed into law by President Barack Obama on March 23, 2010.

- The ACA was amended by the Health Care and Education Reconciliation Act on March 20th, 2010.

- The ACA was upheld by the Supreme Court on June 28, 2012, and has since been subject to a number of changes over time due to executive, legislative, and judicial action.

- The ACA was upheld again by the Supreme Court on June 17, 2021, once again confirming the ACA is the “law of the land”.

FACT: ObamaCare is a nickname for a healthcare law signed by President Obama in 2010 called the Patient Protection and Affordable Care Act (PPACA). People generally refer to the final amended version of the law, the Health Care and Education Reconciliation Act, and all the subsequent changes together as The Patient Protection and Affordable Care Act, PPACA, Affordable Care Act, ACA, and/or ObamaCare.

FACT: The nickname “ObamaCare” was given to the Affordable Care Act by critics of the law in an effort to associate then-President Barack Obama with healthcare reform efforts. The name was used because Obama championed healthcare reform as a candidate in 2008, and then as a President, before signing the ACA into law in 2010. The name stuck, and Obama embraced it over time, at one point saying, “I kind of like the term ‘Obamacare,’ Because I do care. That’s why I passed the bill.” Today many people know the Affordable Care Act by its nickname.

PPACA In-Depth

For those who want to dig deeper into the PPACA, below are some things to consider.

- The ACA (ObamaCare) isn’t just one thing. It’s two laws, changes to other healthcare laws, hundreds of provisions, and additional rules and reforms called for by related legislation.

- The PPACA itself contains ten different titles, each addressing a different aspect of HealthCare reform. Most of what you hear about in the media is Title I Quality, affordable health care for all Americans.

- The most popular talking points are based on very short sections on subsidies, mandates, and the elimination of preexisting conditions. Most of the rest of the law is made up of hundreds upon hundreds of uncontested reforms that improve healthcare delivery and curb healthcare spending.

- “ObamaCare” also refers to the healthcare-related sections of the Health Care and Education Reconciliation Act of 2010 signed into law shortly after the PPACA.

- The non-healthcare sections of the Health Care and Education Reconciliation Act of 2010 discuss Pell grants and student loan reform. All reforms are currently postponed.

- See a full summary of provisions in the PPACA, a summary of the Health Care and Education Reconciliation Act, or read the official compilation of the laws here.

- Aside from the laws that make up ObamaCare, additional rules and regulations called for by the PPACA and related healthcare laws are regularly released. This included updates from the IRS, CMS, HHS, and other agencies granted the power by assorted healthcare-related laws. Important updates can be found in the Federal Register.

- Those who want to keep up with what is happening with the ACA are well-advised to keep an eye on Congress, the CBO, and the Kaiser Family Foundation. If you get current information from those sources, you’ll get a good sense of what is happening to the law each year.

STILL WANT MORE OBAMACARE FACTS? We’ve created a detailed ObamaCare Facts Health care reform timeline of every protection, benefit, and tax laid out by the Affordable Care Act from 2010 to 2022.

More ObamaCare Facts

Get more ObamaCare Facts in our ObamaCare Facts by checking out the links above or see our archived ObamaCare facts from past years.

IN CLOSING: Despite some recent changes, ObamaCare is still “the law of the land.” With that said, as time has clearly illustrated, there are still many people who would like to see ObamaCare repealed. If ObamaCare is repealed and not replaced with equivalent protections, tens of millions of Americans could be without access to affordable health coverage, and insurance companies will continue to be able to deny coverage for pre-existing conditions. Without healthcare reform, America will continue to suffer the consequences of a health care system controlled by private, for-profit companies whose bottom line is money and not health. Help ObamaCareFacts.com to spread the facts about health care reform under the Affordable Care Act.

ObamaCare Facts 2019: Facts on Everything Related to the Affordable Care Act

![]()