The ObamaCare Replacement (American Health Care Act) Scored By CBO

The CBO Scored the ObamaCare Repeal and Replace, and it is Generally What One Would Expect

The CBO scored the ObamaCare repeal and replace plan (American Health Care Act), it reduces the deficit by $337 billion over the decade and increases the uninsured by 24 million by 2026.

Below we offer facts about the report and some simple explanations; we’ll also offer some opinions and insight into what it means for America.

We’ll offer our opinion on tens of millions of uninsured sick, poor, and seniors losing care to provide tax breaks for the wealthy. The Republican AHCA isn’t “better” than ObamaCare in terms of providing access to universal coverage (one of four things the replacement plan was supposed to do), even if it broadens consumer choice in some respects.

UPDATE: The latest CBO report shows less savings and less uninsured with 1 million less uninsured and $119 billion in savings rather than $337 over ten years. See the latest CBO report here.

READ: Read a summary of the report by the CBO and the full report here.

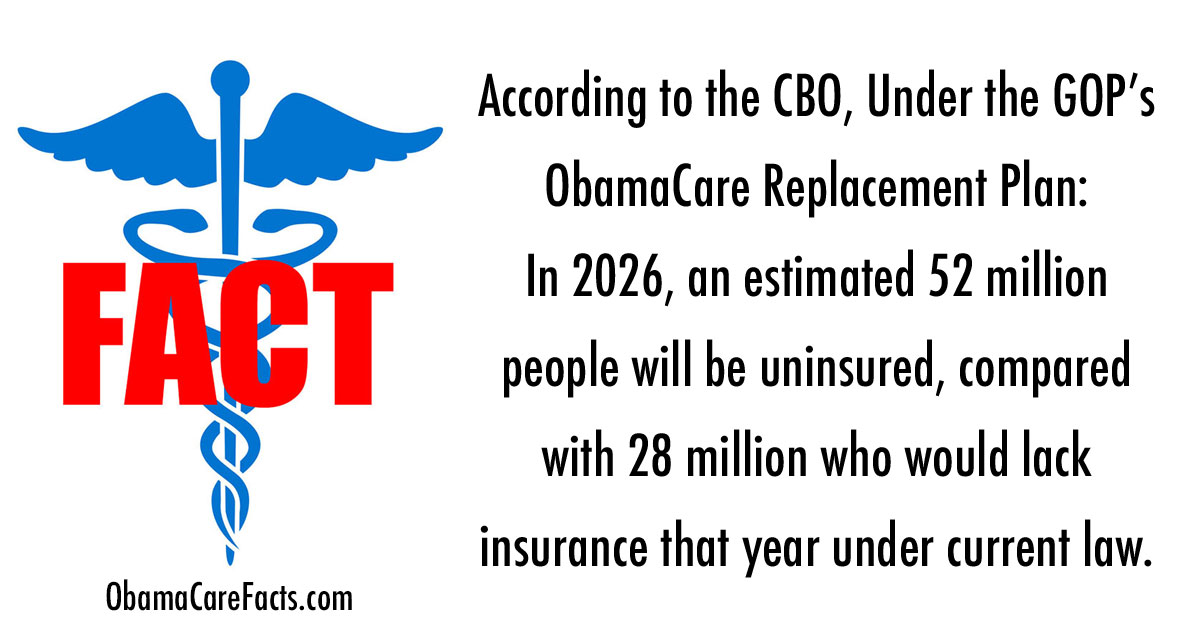

TIP: The uninsured rate under the ACA is at an all time low. This plan will essentially double the uninsured rate. The total number of uninsured under the ACA was projected to be about 28 million or so in the last CBO report. It was 44 million before the ACA. This plan leaves 52 million people uninsured. In other words, the AHCA, TrumpCare, RyanCare, or whatever you call the Republican plan, doubles the uninsured rate for nominal savings while the rich get a giant tax cut.

In 2026, an estimated 52 million people would be uninsured, compared with 28 million who would lack insurance that year under current law. – the CBO Report: American Health Care Act Budget Reconciliation Recommendations of the House Committees on Ways and Means and Energy and Commerce, March 9, 2017

Opinion and Insight: Toward Understanding the American Health Care Act CBO Report

The CBO report shows that the American Health Care Act (ObamaCare repeal and replace plan from the House GOP that Trump supports) saves $30 billion. However, it results in a lack of insurance for 24 million Americans. Some are priced out of coverage; some lose coverage due to the plan undoing aspects of Medicaid Expansion; some will opt-out now that there is no fee or employer mandate.

This should be we weighted against the new deregulation and tax breaks which could mean cheaper plans for some of those who didn’t depend on cost assistance under the ACA. However, this potential benefit seems uncertain since the GOP plan provides limited price controls and has no incentive for young healthy people to enter the market.

The GOP plan saves $30 billion by taking coverage options away from those who benefited from assistance: the sick, poor, seniors, and women, and redistributes the savings to the healthy, the rich, industries, and big businesses via tax cuts.

This doesn’t have all bad effects, but it benefits the healthy and rich more than the poor.

This is Trumped up trickle down.

Now, if trickle down works, as Reagan said it might, then that isn’t a bad thing.

This is also deregulation.

If deregulation works, then people really will have more “choice.” That is all Price or Ryan have said. They dodge questions and say their plan offers “choice.” Choice is not a bad thing.

We should also note that this isn’t the last step; this is the first step. More deregulation is planned, and more trickle down is planned, but the details of the next phase are not in place.

The plan would have saved more money, but Republicans gave tax breaks to the wealthy, to industry, and big business.

The plan could have covered more if Republicans think that “choice” (whatever that means) Trump’s a lower uninsured rate.

It is great that we don’t have the mandate, but we also loose billions in revenue by taking it away. It is great that we don’t have to pay as much for the safety net, but it is taken away from those who need it the most including those without robust savings or those who could lose their job at some point before they hit social security age. The list of pros and cons goes on and on.

The Republicans aren’t wrong to want to fix ObamaCare. Many people currently have high deductible plans that lead them to struggle with costs. The Republican plan helps those in those healthy young people with incomes above 400% of the poverty level and those with very high incomes who will have less of a tax burden under the plan.

However, Republicans do little to nothing in their plan to help those below 250% of the poverty level and seniors with high costs. Instead, they stick many of them in a costly taxpayer-funded “sick pool.”

The Trump administration has already planted the seeds for a line of rhetoric in which they dismiss the CBO report, but don’t be fooled. Their plan cuts funding for the sick, poor, women, and seniors and redistributes the wealth to the wealthy, industry, and large employers who fund Republican campaigns.

In some respects, we can say that this plan is “socialism for the very rich.” That is not the same thing as “covering everybody” or creating a “way better plan.” It is a Republican statist solution rather than the one that was promised during the election.

In other respects, we have to concede that lightening the load on industry and business could drive prices down in healthcare and mean more choices, even if some of those choices are junk insurance that lacks transparency and doesn’t cover women’s health services.

See what the AHCA gets right and wrong: Pros and Cons of the ObamaCare Replacement Plan AKA TrumpCare. It isn’t all good or bad, just different. However, it is not “way better,” and since that was promised rhetorically, the whole plan feels like a letdown. Plus, there are those tens of millions of uninsured each year.

The Facts on the CBO Report

Here are some key facts from the CBO Report:

CBO and JCT estimate that enacting the legislation would reduce federal deficits by $337 billion over the 2017-2026 period. That total consists of $323 billion in on-budget savings and $13 billion in off-budget savings. Outlays would be reduced by $1.2 trillion over the period, and revenues would be reduced by $0.9 trillion.

The largest savings would come from a reduction in outlays for Medicaid and the elimination of the Affordable Care Act’s (ACA’s) subsidies for non-group health insurance.

The largest costs would come from repealing many of the changes the ACA made to the Internal Revenue Code. The change includes an increase in the Hospital Insurance payroll tax rate for high-income taxpayers, a surtax on those taxpayers’ net investment income, and annual fees imposed on health insurers, and from the establishment of a new tax credit for health insurance.

Most of the savings come from defunding Medicaid Expansion. It would have saved more had money not be redistributed to the upper-class in tax cuts.

CBO and JCT estimate that, in 2018, 14 million more people would be uninsured under the legislation than under current law. Most of that increase would stem from repealing the penalties associated with the individual mandate. Some of those people would choose not to have insurance. Some people chose to be covered by insurance under current law to avoid paying the penalties; some people would forgo insurance in response to higher premiums.

Later, following additional changes to subsidies for insurance purchased in the non-group market and to the Medicaid program, the increase in the number of uninsured people relative to the number insured under current law would rise to 21 million in 2020 and then to 24 million in 2026. The reductions in insurance coverage between 2018 and 2026 would stem in large part from changes in Medicaid enrollment because some states would discontinue their expansion of eligibility; some states that would have expanded eligibility in the future would choose not to do so, and per-enrollee spending in the program would be capped. In 2026, an estimated 52 million people would be uninsured, compared with 28 million who would lack insurance that year under current law.

About 1/2 of people will be uninsured right away by choosing not to get coverage now that the fee will be gone. The rest will be uninsured due to Medicaid expansion being frozen, age-related premium increases, and funding being reduced over time.

The legislation would tend to increase average premiums in the non-group market before 2020 and lower average premiums after that, relative to projections under current law. In 2018 and 2019, according to CBO and JCT’s estimates, average premiums for single policyholders in the non-group market would be 15 percent to 20 percent higher than under current law, mainly because the individual mandate penalties would be eliminated, inducing fewer comparatively healthy people to sign up.

Although average premiums would increase prior to 2020 and decrease starting in 2020, CBO and JCT estimate that changes in premiums relative to those under current law would differ significantly for people of different ages because of a change in age-rating rules. Under the legislation, insurers would be allowed to charge five times more for older enrollees than younger ones rather than three times more as under current law, substantially reducing premiums for young adults and substantially raising premiums for older people.

In Summary: Sick and older Americans will see higher premiums; young healthy people may see lower premiums if they buy health insurance at all.