List of States With Individual Mandates for 2022

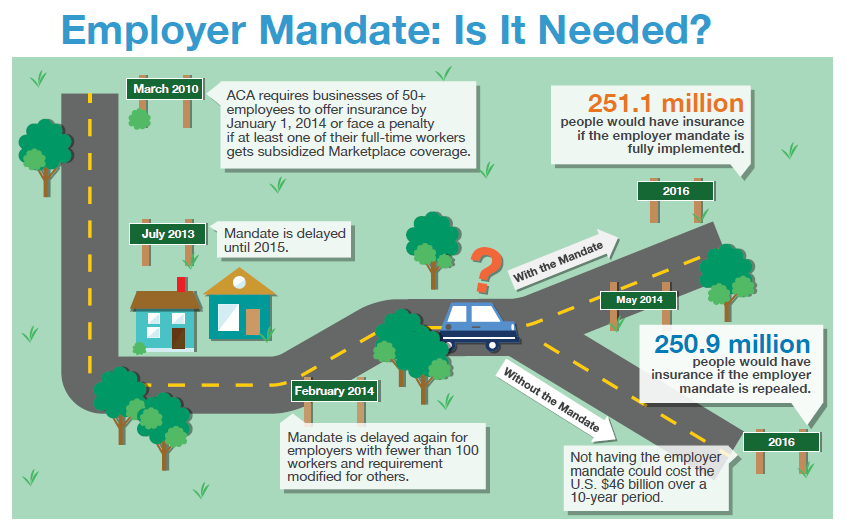

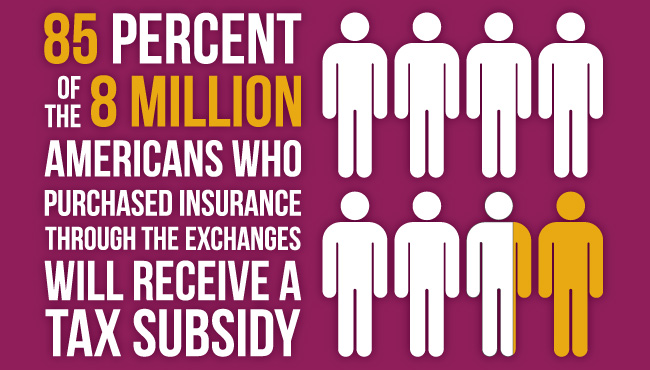

A List of States With Mandates: State-based Health Insurance Requirement and Fee for 2022 Here is a list of states where you have to buy health insurance for 2022. Although the fee for not having health insurance has been reduced to $0 on a federal level since 2019, some states still have an individual mandate…. Read More