Can My Employer Pay for Individual Health Coverage?

An employer can’t pay for a plan an employee choses if they have to comply with the employer mandate, but can reimburse a group plan.

An employer can’t pay for a plan an employee choses if they have to comply with the employer mandate, but can reimburse a group plan.

The Individual Shared Responsibility Payment is the fee for not having Minimum Essential Coverage. Follow our guide to make calculating your payment easy. UPDATE 2019: For 2019 forward there is no fee for not having health insurance in most states. In this sense, the Individual Shared Responsibility Provision has been effectively repealed as the federal… Read More

The ObamaCare Mandate Exemption and How You Can Qualify for an Exemption from the Tax “Penalty.” From 2014 – 2018, who chose not to purchase insurance had pay a tax “penalty” unless they qualified for an exemption. Exemptions from ObamaCare’s tax “penalty” mandate are available to a number of Americans. We will cover all of… Read More

The Employer Mandate / Employer Penalty The ObamaCare Employer Mandate / Employer Penalty, originally set to begin in 2014, was delayed until 2015 / 2016. ObamaCare’s “employer mandate” is a requirement that all businesses with 50 or more full-time equivalent employees (FTE) provide health insurance to at least 95% of their full-time employees and dependents up… Read More

What Does ObamaCare Cost? Below we look at what ObamaCare costs individuals and families, what ObamaCare costs taxpayers, and what ObamaCare costs in terms of government spending. FACT: The Affordable Care Act (ObamaCare) lowers costs based on income. Plans costs less than $100 a month for the majority of Americans who qualify for assistance each… Read More

The Department of Justice announced support for a District Court ruling that found ObamaCare unconstitutional based on its individual mandate.

20 states sued the federal government in February claiming the individual mandate is unconstitutional. The Trump administration refuses to defend the provision. This could lead to a loss of preexisting conditions protections.

If your income is low enough that you don’t need to file for a tax return, you qualify for an exemption from the ObamaCare Individual Mandate. This exemption does not require an application to take effect.

What Happens if I Missed the Deadline for ObamaCare? If you miss the annual deadline for ObamaCare Open Enrollment, you might miss your opportunity for cost-assisted coverage. However, you may still have options for obtaining health insurance. Open enrollment for private individual and family health plans is limited each year. For example, most states have… Read More

Our ObamaCare 2022 Guide: Everything You Need to Know About ObamaCare Subsidies, Rates, Dates, Enrollment, and More We cover everything you need to know about ObamaCare in 2022 including information on enrollment, assistance, benefits, plan types, and more. In this article, we’ll cover what you need to know for 2022 coverage purchased during open enrollment 2022 (Nov 1,… Read More

Our ObamaCare 2020 – 2021 Guide: Everything You Need to Know About ObamaCare Subsidies, Rates, Dates, Enrollment, and More We cover everything you need to know about ObamaCare in 2020 including information on enrollment, assistance, benefits, plan types, and more. Below we’ll cover what you need to know for 2020, and for 2021 coverage purchased in 2020. TIP:… Read More

Everything You Need to Know About ObamaCare for 2019: Information on Subsidies, Rates, Dates, Enrollment, and More We cover everything you need to know about ObamaCare in 2019 including information on enrollment, assistance, benefits, plan types, and more. NOTE: This page covers everything you need to know for 2019 up until open enrollment 2020 (which happens at the… Read More

A Texas federal judge ruled the Affordable Care Act (Obamacare) unconstitutional on Dec 14 2018. For now nothing changes. However, there could be real consequences down the road. UPDATE: The Judge officially ordered a stay, thus for now the ACA will remain in effect while the ruling is appealed. UPDATE: The Department of Justice (DOJ)… Read More

Below is a list of archived pages that are important to the site: ObamaCare Basics ObamaCare News: Daily ObamaCare Updates ObamaCare: Everything You Need to Know About the ACA ObamaCare What is ObamaCare? ObamaCare Facts ObamaCare Summary How Does ObamaCare Work? How Will ObamaCare Affect Me? Health Insurance Exchange ObamaCare Individual Mandate Minimum Essential… Read More

Sign up for “TrumpCare” between November 1 and December 15, 2018 to get health coverage and cost assistance for 2019. Get covered at Healthcare.Gov.

The Individual Mandate Fee for 2018: Not Having Health Insurance in 2018 The fee for not having health insurance under the Affordable Care Act is unchanged from 2016. It is a flat fee of $695 per adult and $347.50 per child (up to $2,085 for a family), or 2.5% of household income (whichever is greater). “For 2016 the annual fee… Read More

The Shared Responsibility Payment For 2018 The penalty for not having health insurance in 2018 is expected to be $695 per adult and $347.50 per child (up to $2,085 for a family), or it’s 2.5% of your household income above the tax return filing threshold for your filing status – whichever is greater. You’ll pay 1/12 of the total fee… Read More

President Trump signed an executive order on Oct 12, 2017 to expand access to “association health plans,” to expand these across state lines, to expand short-term coverage, and to expand HRAs.

The facts below are our original “ObamaCare facts” page. These ObamaCare facts will give you a sense of how things used to be and what has changed. See our up-to-date “ObamaCare” facts page here. It is easy to forget that time when women paid more than men for health insurance, or when you could be denied… Read More

Deferred Action for Childhood Arrivals (DACA) recipients are not eligible for ObamaCare, don’t have to comply with the mandates, can’t use the marketplace, and can’t get cost assistance.

We explain how Trump can obstruct ObamaCare by “blocking insurer bailouts” (by not reimbursing insurers for cost sharing assistance.)

We explain what a “skinny repeal” of ObamaCare is (it essentially means key provisions like the mandates go, but much else stays) and what it could mean for you.

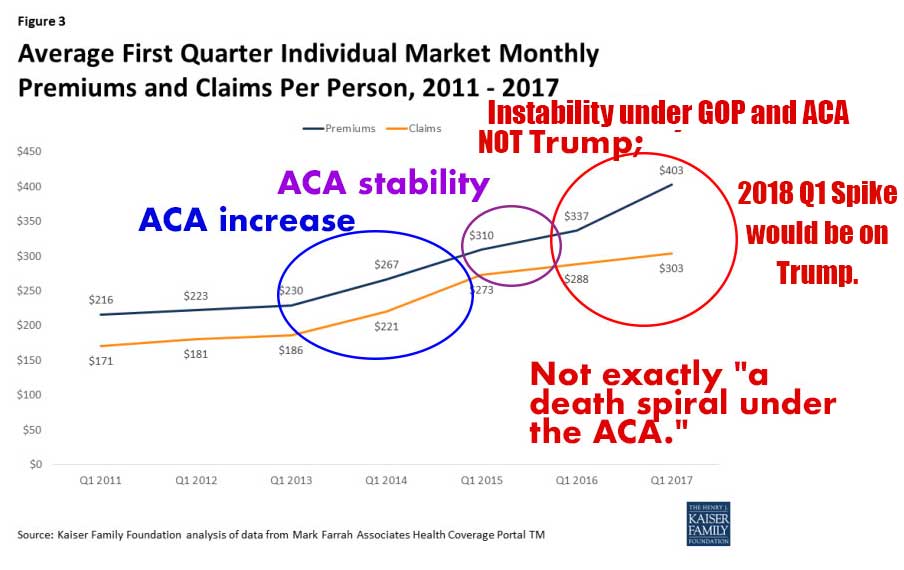

A new report from the Kaiser dispels the “ObamaCare death spiral” myth, showing that insurance premiums are generally stabilizing under the ACA.

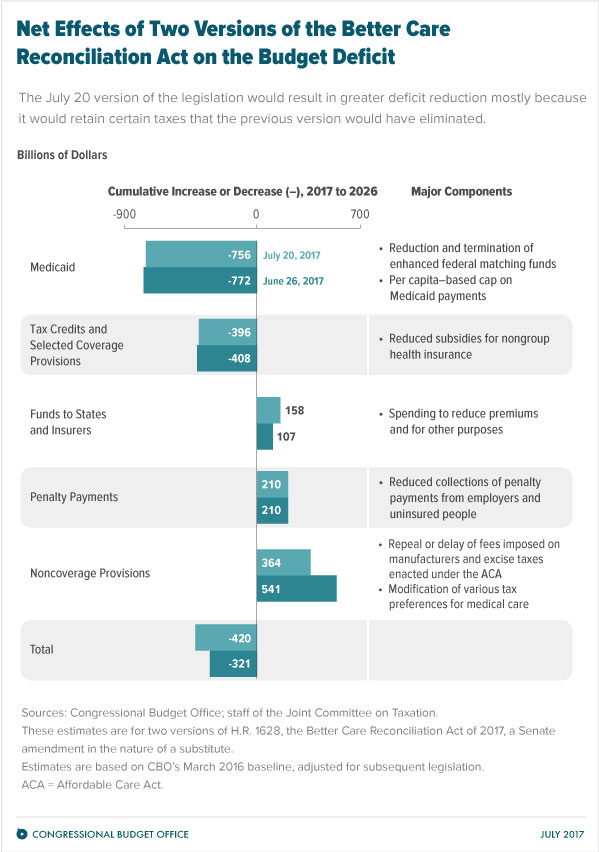

Everything You Need To Know About the Better Care Reconciliation Act of 2017 (BCRA) AKA The Latest Version of TrumpCare We explain everything you need to know about the Better Care Reconciliation Act of 2017 (BCRA); the Senate’s new healthcare bill to replace ObamaCare. Below we cover everything you need to know about the Better Care Reconciliation… Read More

We explain the difference between ObamaCare and the House and Senate versions of TrumpCare (i.e. the difference between the ACA, AHCA, and BRCA).