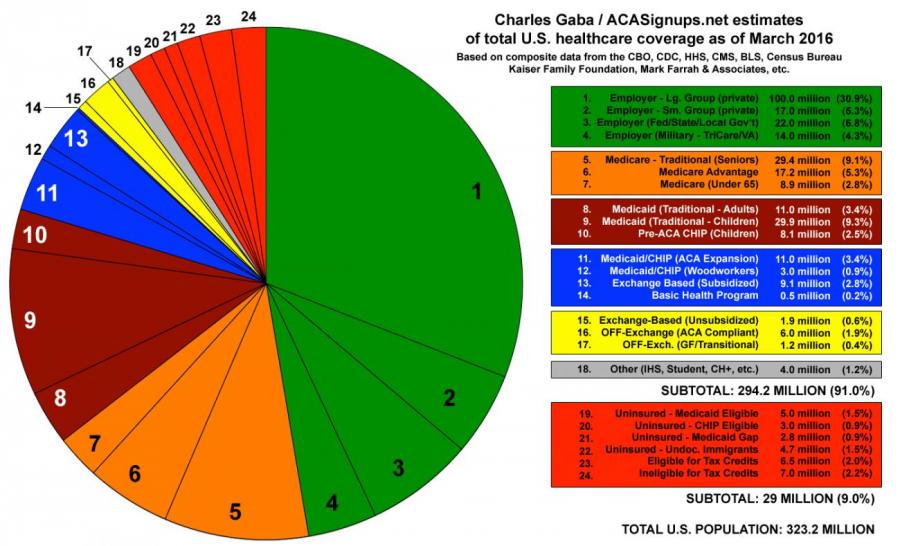

Nearly Everyone’s Healthcare Coverage is Heavily Taxpayer Subsidized

Nearly everyone’s health coverage is highly subsidized (via tax breaks, if not credits). The group that costs tax payers the most money in healthcare is employees.