Losing Employer Health Insurance, Where Do I Apply?

When you lose employer health coverage it triggers a special enrollment period in the Health Insurance Marketplace, this is true even outside of open enrollment.

When you lose employer health coverage it triggers a special enrollment period in the Health Insurance Marketplace, this is true even outside of open enrollment.

A person who doesn’t have health coverage can be penalized during the three month probation period, or waiting period. 90 days is the maximum waiting period for employers, and each individual gets a less than three month gap each year without coverage.

During open enrollment you can switch from COBRA to ObamaCare’s Marketplace at anytime, outside of open enrollment you must wait until COBRA ends.

Employer payment plans are valid under the ACA, count as group health plans, and are subject to market reforms (no pre-exiting conditions, no dollar limits, etc).

Starting 2015 employers with over 200 employees need to auto-enroll employees with an opt-out. Employers with less need to let their employees know about their health coverage options, then offer no more than a 90 day waiting period for coverage to start.

Employers can use Health Reimbursement Arrangements (HRAs), Employer Payment Plans, and Flexible Spending Accounts (FSAs) to save money on healthcare. We take a look at healthcare arrangements to find out how they can benefits employers and employees alike. We will also look at how they affect employer and employee taxes and penalties. It’s important to understand… Read More

Under the ACA full-time status is 30 hours a week. Employers can use a look-back period of up to 12 months. Employers typically use 27 hours as a safe harbor to ensure employees qualify as part-time status.

Employers must provide child dental, if they don’t offer it, then they aren’t offering a qualified health plan and you should be able to apply to use the Marketplace.

Someone with access to affordable employer-sponsored coverage can’t get Marketplace cost assistance, the employer’s contribution to their health costs is the subsidy.

If you are unemployed you have lots of options. Cost assistance is based off of projected annual income and being laid off triggers a special enrollment period.

A spouse or dependent can’t get cost assistance on the Marketplace if they have access to an affordable employer plan that costs less than 9.56% household income per person.

As an employer with less than 50 FTE you can make any arrangement you want with your employee, but for tax deductions, you’ll have to follow certain IRS rules for employer contributions.

A plan has to offer pediatric dental coverage. That being said, the recipients of the plan can deny dental or vision.

If you work 30 hours a week on average you are full-time. If your employer has more than 50 full-time employees, they must offer you coverage.

In general, all private plans have adopted the calendar year as a policy period. This makes switching plans easy in regards to cost sharing.

The mandate is meant to ensure that large employer provide coverage that cost no more than 9.56% of household income.

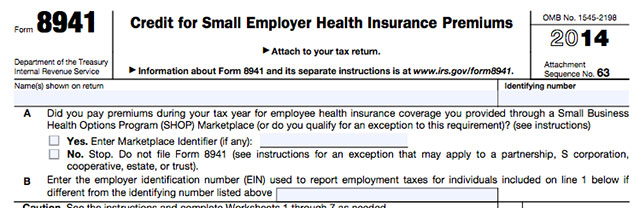

The SHOP credit claimed on 8941 is determined by calendar year and is claimed for each month you provided qualifying coverage to employees.

If you have an employer sponsored plan that costs more than 9.56% of your household income for employee-only coverage, you can opt-out of employer coverage and use the Marketplace.

ObamaCare and Health Insurance for the Self-Employed The Affordable Care Act (ObamaCare) has some important implications for how the self-employed go about obtaining, maintaining, and paying for health coverage. If you’re self-employed, most of the healthcare provisions in the ACA apply to you. Let’s take a look at how you’re affected by ObamaCare, how you can reduce the cost of coverage, and how… Read More

The requirement to provide coverage is based on current full-time status and length of employment, not full-time status at time of hiring.

Anyone looking for 1095C instructions you can find them here. You can see our 1095 page for more details.

Voluntary termination of employment still counts as losing your coverage and your job, thus you qualify for a Special Enrollment Period of at least 60 days.

Employers can make healthcare arrangements to help employees with health insurance payments or simply just choose to pay an employee more taxable income

Starting in 2015, employers who don’t offer qualifying coverage, will make a Employer Shared Responsibility Payment. Get simplified instructions on the fee below. This page covers employer responsibility under the ACA and the payment. For more details see Employer Mandate. What is Shared Responsibility? Shared Responsibility is part of the ACA’s Title I. Subtitle F—Shared Responsibility for… Read More

Employers can get a Tax Credit for up to 50% of their contribution to employee premiums by filing Form 8941, Credit for Small Employer Health Insurance Premiums. Get detailed HTML based instructions on Form 8941 from the IRS, simplified instructions ObamaCare’s employer tax credit form can be found below. What is Form 8941, Credit for Small Employer Health Insurance Premiums?… Read More