What to Do if You Missed the Deadline For Open Enrollment 2018

Here is a list of things you can do if you missed the Dec. 15 deadline for ObamaCare’s open enrollment 2018 in the health insurance marketplace.

Here is a list of things you can do if you missed the Dec. 15 deadline for ObamaCare’s open enrollment 2018 in the health insurance marketplace.

The Individual Mandate Fee for 2018: Not Having Health Insurance in 2018 The fee for not having health insurance under the Affordable Care Act is unchanged from 2016. It is a flat fee of $695 per adult and $347.50 per child (up to $2,085 for a family), or 2.5% of household income (whichever is greater). “For 2016 the annual fee… Read More

There are a few taxes related to ObamaCare that require the attention of most tax paying Americans. Below we review the most important tax tips for 2018. In a nutshell, you’ll likely want to: Have your 1095 form filed on your behalf (by your insurer, employer, or the Marketplace) on hand. Get Form 8962, Premium Tax Credit (PTC) Get Form 8965, Health… Read More

The Shared Responsibility Payment For 2018 The penalty for not having health insurance in 2018 is expected to be $695 per adult and $347.50 per child (up to $2,085 for a family), or it’s 2.5% of your household income above the tax return filing threshold for your filing status – whichever is greater. You’ll pay 1/12 of the total fee… Read More

What do you need to Know to Enroll in Medicare for 2018? We cover everything you need to know about open enrollment in Medicare 2018. Get the facts on 2018 Medicare open enrollment. When Is Medicare Open Enrollment For 2018? Medicare open enrollment lasts from October 15 to December 7 each year. Your coverage will start… Read More

Affordability Exemptions and the Family Affordability Glitch for 2018 Plans Below we present the affordability exemptions for 2018 for employer and non-employer coverage and explain the family affordability glitch. Affordability exemptions are one of the more complex aspects of the ACA, so make sure you understand all the specifics below before claiming one on form 8965 or from HealthCare.Gov. TIP:… Read More

2018 Guidelines for Medicaid and CHIP We explain how to get covered under Medicaid and CHIP in 2018. Enrollment in Medicaid and CHIP is 365 days a year, so there is never a wrong time to see if you and your family qualify for assistance. The Basics of Medicaid and CHIP Each state has its own… Read More

2018 Premium Tax Credits Under the Affordable Care Act (ObamaCare) We explain how Premium Tax Credits work on 2018 health plans under the Affordable Care Act (ObamaCare). Tax credits can be taken in advance, or at tax time. In other words, ObamaCare’s Premium Tax Credits (PTC) can be paid to your insurer in advance as… Read More

Health Saving Accounts and ObamaCare for 2018 We cover everything you need to know about Health Savings Accounts (HSAs) for 2018, including how HSAs work with health plans under the Affordable Care Act. TIP: The Affordable Care Act is sometimes called “ObamaCare” or the “ACA” for short. Thus, this page is about HSAs and how… Read More

Out-of-Pocket Maximums and Deductible Limits For 2018 Each year the ACA sets new limits for out-of-pocket maximums and deductibles. Here are the limits for 2018 plans for individuals and families. For 2018, your out-of-pocket maximum can be no more than $7,350 for an individual plan and $14,700 for a family plan before marketplace subsidies. For 2018, your maximum deductible is… Read More

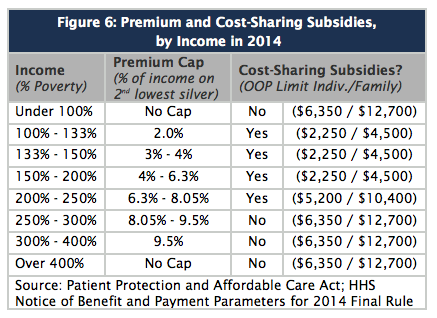

How Do Cost Sharing Reduction Subsidies Work? ObamaCare’s Cost Sharing Reduction Subsidies (CSR) lower out-of-pocket costs, based on income, for Silver plans bought on the Health Insurance Marketplace. Please note that CSR subsidies are paid to insurance companies, not to individuals. They are intended to offset the expenses of offering lower-cost health insurance to qualifying individuals. Eliminating… Read More

ObamaCare’s open enrollment period for 2018 starts on November 1st, 2017 and ends on December 15th, 2017. This is what you need to know to enroll for 2018. Some states have longer enrollment periods, so you will have to check your state’s rules. • Open enrollment is the only time you can get cost assistance, enroll… Read More

Understanding the 2018 Federal Poverty Guidelines For Cost Assistance Under the Affordable Care Act (ObamaCare) in 2018 and 2019 We explain the 2018 Federal Poverty Guidelines for assistance under the Affordable Care Act (ObamaCare). You’ll use these guidelines to determine cost assistance on plans sold during 2019’s open enrollment season. How Cost Assistance Works With… Read More

Open enrollment is still on for ObamaCare (the Affordable Care Act). 2018 open enrollment starts November 1, 2017, and ends December 15, 2017 (extended to January 2018 in some states).

The 2017 Federal Poverty Level Guidelines (Used in 2017 and 2018) Understanding the Federal Poverty Guidelines for Determining Cost Assistance For 2017 Medicaid and CHIP and Cost Assistance on Health Plans Held in 2018 Below are the 2017 Federal Poverty Guidelines used for Medicaid/CHIP in 2017 – 2018 and cost assistance on 2018 health plans under the… Read More

Published: April 10, 2017 Last Updated: Sept 7, 2018 Understanding ObamaCare’s 2018 Open Enrollment Period ObamaCare’s 2018 Open Enrollment period started November 1, 2017 and ends on December 15, 2017. However, some states extended enrollment until January 2018. See state-specific deadlines for 2018 coverage below. Open enrollment is the only time you can enroll in a health… Read More

Below we present the affordability exemptions for 2017 for employer and non-employer coverage and explain the family affordability glitch.

Although health insurance premiums are up 22% on average for 2017, but many can get a plan for a $100 or less through healthcare.gov.

Updated Cost Assistance Information for 2017 For 2017, shoppers can get three types of health insurance cost assistance under the ACA: Premium Tax Credits, Cost Sharing Reduction Subsides, and Medicaid/CHIP. Below is updated cost assistance information for 2017 plans, including all plans purchased during 2017 open enrollment Nov 1. 2016 – Jan. 31. 2017. TIP: Seniors… Read More

Out-of-Pocket Maximums and Deductible Limits For 2017 Each year the ACA sets new limits for out-of-pocket maximums and deductibles. Here are the limits for 2017 plans for individuals and families. For 2017, your out-of-pocket maximum can be no more than $7,150 for an individual plan and $14,300 for a family plan before marketplace subsidies. For 2017, your maximum… Read More

Health Saving Accounts and ObamaCare for 2017 We cover everything you need to know about Health Savings Accounts (HSAs) for 2017, including how HSAs work with ObamaCare plans. What Are Health Savings Accounts? Health savings accounts are tax-advantaged medical savings accounts that you can draw money from for certain medical expenses. They work a bit… Read More

The Individual Mandate Fee for 2017: Not Having Health Insurance in 2017 Although the 2017 ObamaCare fee isn’t published yet, we can look at the 2016 fees to get a rough estimate of the penalty for not having health insurance in 2017. “For 2016 the annual fee for not having insurance was $695 per adult and $347.50 per child… Read More