Health Care Reform Timeline

A Timeline of Health Care Reforms 2010 – 2022

Here is an easy to understand Health Care Reform Timeline 2010 – 2022. The healthcare reform timeline lays out health insurance reforms and health care milestones contained within the Affordable Care Act (ObamaCare). Find out how the new health care law affects healthcare in the United States and you each year.

What is Health Care Reform?

Obama’s Health Care Reform, commonly called ObamaCare but officially called the Patient Protection and Affordable Care Act (PPACA) or Affordable Care Act (ACA) for short, was signed into law on March 23, 2010. The ACA is meant to “provide affordable, quality health care for all Americans and reduce the growth in healthcare spending, and for other purposes.”

ObamaCare’s reform of the health care system under the ACA has been an ongoing effort to improve the national health care system. Although reform has taken great strides under President Barack Obama, efforts to make health care better have been in motion for decades.

Why Does the Health Insurance Industry Need ACA Reforms?

Why Does the Health Insurance Industry Need ACA Reforms?

Why change the healthcare system? Before we get to the health care reform timeline, here are some reasons ObamaCare health care reform was signed into law.

• A PBS report stated that 44 million Americans are currently without health insurance. Part of this is due to the extraordinary costs of quality health insurance in the US. HealthCare reform ensures these Americans have access to health care.

• The Medicaid part D prescription drug “donut hole” coverage gap was leaving seniors unable to afford their medication or paying out of pocket. The ACA closes the donut hole.

• Government funding for private Medicare Advantage plans costs the taxpayer money; it was supposed to save the taxpayer money when going on the private market. Obama’s Health Care Reform reigns in wasteful spending.

• Insurance companies could deny you for pre-existing conditions or drop you when you got sick. After 2014 you can no longer be denied coverage or treatment based on health status.

• Insurance companies could drop you for being sick or stop treating you when you reached annual or lifetime limits. Over 60% of bankruptcies were related to medical costs even though many of those bankrupted had insurance. The issue was that lifetime and annual dollar limits didn’t cover expensive treatments. The only reason you can be dropped on new ACA protected health plans is for fraud. Lifetime and annual dollar limits are on their way out.

• Insurance companies had no limits on raising your premiums. The rate review provision protects you against unjustified rate hikes. So far the program has curbed the rising cost of employer-based premiums and reduced premiums for many Americans due to the new State-based health insurance marketplaces.

• Millions of people are too poor to afford health insurance, yet make too much to qualify for Medicaid. The ACA expanded Medicaid and CHIP to over 15 million men, women, and children who fell through the cracks in states that chose to opt-in. Many State’s chose to opt-out of expanding Medicaid coverage.

• Before the ACA, preventative measures and wellness visits were not covered adequately. All new plans require essential health benefits and preventive services to be covered with no out-of-pocket costs.

• Small businesses have historically had an increasingly difficult time offering health benefits due to cost. The SHOP marketplaces offer tax breaks of up to 50% of employers share of employee premium costs.

• Some of America’s largest firms don’t offer health benefits. The 2015 employer mandate ensures full-time workers at large companies have access to health benefits. Small firms are exempted.

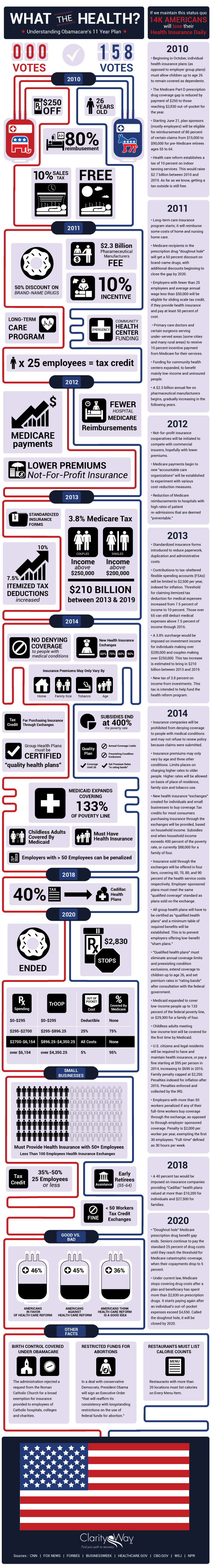

ObamaCare timeline infographic by Clarity Way.

The Timeline of Obama’s Health Care Reform 2010 – 2022

Many of the protections, reforms, and taxes are already enacted. Some of the biggest changes roll out in 2014. Our timeline of health care reform breaks down what has already happened and what is scheduled to happen each year until ObamaCare is fully implemented.

NOTE: Please note that some provisions have been changed over time. Some have been removed, some never implemented, and some postponed. Make sure to check our site for updates on any given provision.

ObamaCare Health Care Reform Timeline 2010-2012

First, let’s start with the facts on what ObamaCare has done to reform the healthcare industry so far:

• ObamaCare allowed the FDA to approve more generic drugs to drive competition up and prices down.

• ObamaCare increased rebates on drugs through Medicare for Seniors.

• ObamaCare is closing the Part D Medicare Coverage Gap or “Donut Hole” that was forcing Seniors to pay out of pocket for drug costs. There is also a 50% discount on brand-name drugs. Seniors currently get a rebate to cover the costs, and ObamaCare is scheduled to close the Medicare coverage gap for good in 2020.

• The PCORI, an independent non-profit advisory board, also known as the Patient-Centered Outcomes Research Institute, studies different types of treatments to ensure quality affordable healthcare under ObamaCare.

• Chain restaurants must now display calories to promote wellness and healthy living. This helps to keep the cost of health care down since fewer people will need it if they stick to healthier eating.

• Health Insurance companies can’t drop your coverage when you are sick.

• Individuals can’t be denied coverage for pre-existing conditions.

• Children under the age of 19 can’t be classified as having pre-existing conditions.

• Children under the age of 26 can stay on their parent’s insurance.

• Income exclusion for Indian Tribe health benefits that were provided after March 23rd, 2010

• ObamaCare cuts Medicare funding to hospitals and other healthcare facilities and then reinvests the money back into Medicare reform.

• “Comparative Effectiveness Research” (CER) studies the effectiveness of drugs by comparing drug to drug and seeing which one works best. They are scheduled to continue to research and publish studies until 2019.

• ObamaCare established a “Patient-Centered Outcomes Research Institute” (PCORI) — a public-private entity to oversee ObamaCare’s funding, goals, and outside partnerships.

• ObamaCare created a high-risk pool for individuals with pre-existing conditions. These individuals can still get treatment but at higher rates. The high-risk pool is scheduled to disappear in 2017, at which point high-risk individuals will buy the same insurance as everyone else. In general, there are no pre-existing conditions on new plans starting 2014.

• Insurance companies can no longer discriminate for disabilities or domestic abuse.

• The law imposed a 10% tax on tanning booths. The concept is to tax and regulate products and services that are likely to cause people to need to use their health coverage in order offset what it costs to treat these individuals.

• Rate Hike Review was implemented. Insurers can no longer increase your premiums for profit (also known as “price gouging”). They must justify rate hikes over 10% to the state and then display them on their website (and .gov website) the same day. As of Sept 2012, this measure saved Americans $1 billion. However, not all States are using this rule, causing large premium increases in their respective States.

• The 80/20 rule was implemented. Insurance companies now have to tell their customers how their money is being spent. If they don’t spend at least 80% of the money on health care, they have to give customers a rebate for the difference. The 80/20 rule has saved Americans $1.1 billion dollars via rebates.

• Health Insurance companies can no longer turn down a claim without an appeal process. Customers have legal standing to fight the appeal.

• Anti-fraud funding has increased, and new ways to stop fraud were created.

• There are increased rebates for brand-name pharmaceuticals purchased through Medicaid.

• New annual taxes have been levied on pharmaceutical companies.

• ObamaCare payment increased to physicians, mostly in rural areas.

• Some Small Employers became eligible for tax credits to help with health care related costs.

• ObamaCare improved treatment for patients with chronic illnesses.

• The law prohibited non-group plans from canceling coverage.

• A limit was placed on what type of insurance accounts can be used to pay for over-the-counter drugs without a prescription. This does not include insulin, asthma medication, or other vital drugs.

• Employers must list employee benefits on their tax form. This helps to determine whether the company will get tax breaks or credits for insuring employees.

• Hospitals in “Frontier States” (ND, MT, WY, SD, UT ) received higher Medicare Payments.

• Hospitals in “low-cost” areas received higher Medicare payments for 2 years.

• All new plans must provide preventive care free of charge.

• ObamaCare does away with annual spending caps.

• ObamaCare works toward eliminating lifetime limits and reduces annual limits of health insurance plans.

• New tools to fight fraud were established; this returned more than $2.5 billion in 2009 alone.

• $716 Billion was cut from Medicare and Medicare Advantage and reinvested it back into Medicare and ObamaCare. This covers a lot of ground. Read more on ObamaCare and Medicare.

• ObamaCare places a $2500 limit on tax-free spending under FSAs (flexible spending accounts).

• ObamaCare established state consumer assistance programs to help consumers file complaints, appeals, enroll in health care, and other consumer-related assistance to better understand trouble spots that need oversight.

• Your FSA cost of an over-the-counter medicine or drug cannot be reimbursed from Flexible Spending Arrangements (FSAs) or health reimbursement arrangements unless a prescription is obtained. The change does not affect insulin, even if purchased without a prescription, or other health care expenses such as medical devices, eyeglasses, contact lenses, co-pays, and deductibles. A similar rule went into effect on Jan. 1, 2011, for Health Savings Accounts (HSAs), and Archer Medical Savings Accounts (Archer MSAs).

• FSA and HRA participants can continue using debit cards to buy prescribed over-the-counter medicines if requirements are met.

• The hospital “pay-for-quality” program began. This is part of an overall effort to promote quality, not quantity, in the healthcare industry.

• There was a 3.8% tax increase on capital gains over a certain amount, unearned income, interest, dividends, annuities, rent, royalties, and inactive businesses. Exemptions included income from tax-exempt bonds, veterans benefits, and qualified plan distributions such as those from an IRA or 401k.

• The 3.8% tax does not apply to selling your primary residence in most cases.

• The Affordable Care Act has a 5-year plan that works to simplify administrative tasks associated with health insurance such as reducing paperwork.

• Starting in 2012 there was a new tax on private health insurance plans.

ObamaCare Health Care Reform Timeline 2013

• Health Insurance Exchanges opened for low to middle-income Americans to make it easier for them to shop for health insurance. Those making over 400% of the poverty level are allowed to purchase insurance on the exchange but do not receive tax credits or discounts. The insurance purchased on the exchange didn’t go into effect until Jan 1st, 2014.

• A health insurance exchange was set up by state or by the federal government if the state decided not to run their own exchange.

• Tax credits, discounts on out-of-pocket costs, tax breaks and other subsidies are available on the exchange. The help you get on the exchange is directly related to your adjusted gross income.

• There is a .9% ObamaCare Medicare tax on those making over $200k as an individual or $250k as a business or family. This accounts for somewhere between 1.5% and 4.2% of taxpayers. These numbers are from recent IRS and census reports. 2% is often used as a rough estimate. Most sources agree the number is under 3%. 3% is also the number of businesses making over this amount in taxable income.

• 3.8% Medicare tax on unearned income over $200K for individuals and $250K for families and businesses.

• A $500,00 deduction cap was set on compensation paid to insurance company workers.

• ObamaCare laid out new rules about the amount that can be contributed to an FSA. A cap of $2,500 was applied to reform FSA’s and prevent individuals from overpaying and then needing to rush to use the money before it disappeared.

• Part D Coverage Gap or “Donut Hole” reduction went into effect.

• The deduction for Part D retiree drug subsidies for employers was eliminated.

• ObamaCare increased (7.5% to 10%) threshold at which medical expenses, as a % of income, can be deductible)

ObamaCare Health Care Reform Timeline 2014

• The Individual Mandate: There is a tax starting at 1% of your income or $95, which rose to 2.5% of your income or $685 by 2016 for individuals. I was capped at $285 in 2014 for a family but rose to $2,085 by 2016. It cannot exceed these amounts. The tax helps pay for emergency and future coverage you may need. The tax penalty is paid on your tax returns. This is a “tax”, not a “mandate.”

• Coverage can no longer be denied for your pre-existing conditions.

• The ACA took measures to prevent all types of discrimination in regards to your right to health care. Factors such as pre-existing conditions, health status, claims history, duration of coverage, gender, occupation, and small employer size and industry can no longer be used by insurance companies to increase health insurance premiums.

• The only factors that can affect premiums of new insurance plans starting in 2014 are your income, age, tobacco use, family size, geography and the type of plan you buy. This applies to all plans sold through your State’s health insurance marketplace.

• All new plans sold must include Ten Essential Health Benefits.

• There is no annual dollar limit on coverage.

• Congress must shop on the health insurance exchanges.

• Pharmaceutical companies became subject to a new tax.

• ObamaCare Medicaid Expansion expanded coverage to 15.9 million low-income individuals in states that opt-in. The supreme court ruling has given states the opportunity to opt-out of Medicaid expansion.

• Insurance purchased on the health insurance exchange/marketplace went into effect.

• Employers were able to shop on the health insurance exchanges for employee insurance.

• Tax credits, tax breaks and help with up-front costs became available to those struggling to pay for insurance.

• There is a new tax on medical devices.

• Insurance companies are taxed based on their market share.

• ObamaCare raised the bar on medical expenses before you deduct them from your taxes.

• Small Business Employers can shop for employee coverage on the health insurance exchange.

ObamaCare Health Care Reform Timeline 2015

• Employers with over 50 full-time equivalent employees must offer health insurance.

• Doctors’ income is based on the quality of care not the quantity of care. This is a vast simplification of the actual documentation in the bill. It is a protection from the current fee-for-service payment model.

ObamaCare Health Care Reform Timeline 2017

• States are scheduled to be able to implement their own plans if those meet the standards of ObamaCare such as single-payer plans, which are similar to ObamaCare, but instead of buying private insurance everyone pays a tax, and everyone has coverage.

• States are given the flexibility to allow businesses with more than 100 employees to purchase coverage through the SHOP Exchange

• No more pre-existing conditions may be considered for anyone including high-risk customers.

ObamaCare Health Care Reform 2018

• All health care plans, including plans held since before preventive care was required, are scheduled to offer preventive coverage.

• The “Cadillac” tax for higher quality coverage for individuals and employers purchasing insurance for employees is expected to be put in place.

ObamaCare Health Care Reform 2020

• ObamaCare is scheduled to eliminate the Medicare Gap instead of offering rebates to seniors.

For more information on health care reform check out our extensive coverage of Obama Care Facts.

Health Care Reform Timeline Summary

The Affordable Care Act is nearly 2,000 pages long. The wording can be confusing, but the details of every benefit, tax, protection, and reform are listed in there. The above health care reform timeline gives you a good idea of most of what is contained in the bill and how its provisions are scheduled to unfold over the next decade. We will continue to update our health care reform timeline to keep it accurate and up to date to help provide all information on healthcare reform under the Affordable Care Act in one easy to use place.

Health Care Reform: ObamaCare Reform Timeline![]()