Advanced Tax Credit Repayment Limits

How Repaying ObamaCare’s Premium Tax Credits Works

If your income changes, you may have to pay back Advanced Premium Tax Credit Payments up to the Advanced Tax Credit Repayment Limit based on your income. If you don’t claim enough money to qualify for tax credits, you won’t owe anything back.

IMPORTANT: The 400% Federal Poverty Level (FPL) Subsidy Cliff was temporarily removed by the American Rescue Plan and extended through 2025 by the Inflation Reduction Act. Through 2025, if you make over 400% FPL tax credits gradually decrease as your taxable income rises. This impacts repayment limits, but please note if you take more credits in advance than you end up qualifying for, you will still need to repay them.

This page is updated for 2023 – 2024.

What Are the Advanced Premium Tax Credit Repayment Limits?

Advanced Premium Tax Credit repayment limits are the maximum amount you have to repay if your income turns out to be higher than you initially estimated when you received Premium Tax Credits for health insurance.

ObamaCare Tax Credit Repayment Thresholds

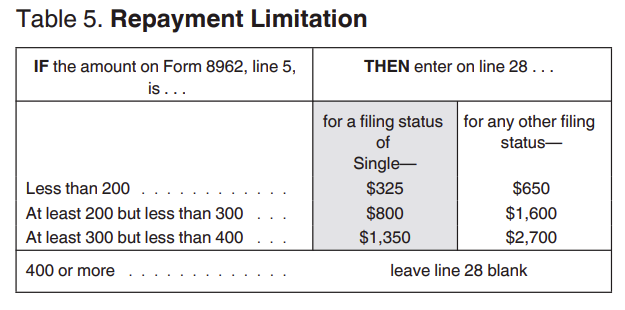

The following Advanced Tax Credit Repayment limit table is from form 8692 below (updated for 2022 tax filing). This table shows the maximum amount of tax credits you have to repay based on income as a percent of the Federal Poverty Level (FPL).

Form 8962: Line 28. Repayment Limitation. The amount is limited to certain amounts helping to ensure you won’t owe more than you can afford if you received an excess of Advanced Premium Tax Credits. Please note that you’ll owe back all tax credits if you make over 400% and could owe back nothing if you make less than 100% of the poverty level.

Table 5. Repayment Limitation (ObamaCare Repayment Limits)

| Income % of Federal Poverty Level (FPL) | Filing Status: Single |

Filing Status: All Other |

|---|---|---|

| Less than 200% FPL | $325 | $650 |

| At least 200% FPL but less than 300% |

$800 | $1,600 |

| At least 300% FPL but less than 400% |

$1,350 | $2,700 |

| More than 400% FPL | Full Amount Received | Full Amount Received |

| If your year-end income exceeds 400% FPL, you will have to return the total amount of Advanced Premium Tax Credits you received. If you make too little to qualify for subsidies (less 100% FPL), then you should owe NOTHING (per the directions of form 8962 from which this table comes). That being said, if you know you are going to price out-of-cost assistance, make sure to update your Marketplace account. You might become eligible for a free or low-cost Medicaid plan if your state expanded Medicaid. | ||

TIP: “Income” refers to household income calculated as MAGI. Once you know your household income, you can compare it to the Federal Poverty Level guidelines for the year you had coverage.

TIP: The numbers above represent the maximum amount you will may to repay, not the exact amount. Repayment limits cap the amount you can owe based on your family size and percentage of the Federal Poverty Level, though you may owe less. For example, if you earned 201% FPL as a family of two, your repayment is capped at $1,650 for 2021 plans filed in 2022. These amounts can change yearly, so always double-check the current year’s repayment limits.

TIP: The American Rescue plan Act expanded cost assistance under the Affordable Care Act and made changes to tax credit repayment limits. The Act granted a repayment holiday for 2020, which may reduce what you need to repay for that plan year. It also provides subsidies beyond the 400% FPL level for 2021-2022. For those years, individuals making over 400% FPL won’t pay more than 8.5% of household income, meaning exceeding 400% FPL won’t necessarily result in repaying the full amount of tax credits received.

TIP: This page is updated annually to reflect the current Advanced Premium Tax Credit repayment limits. Some years may not see changes. For accurate verification of repayment limits, consult the official IRS 8962 form instructions. Be sure to use the current 8962 form for each year’s tax calculations (you can use last year’s numbers for a general estimate).

What Cost Assistance Must be Paid Back?

You don’t need to repay Cost Sharing Reduction Subsidies or Medicaid. However, you may owe back Advanced Premium Tax Credits, up to the repayment limit based on your income level. To avoid this, it’s important to double-check your application and report any changes in income throughout the year so your credits can be adjusted accordingly. If you’re unsure about your income for the year, consider taking only a portion of the credit upfront to minimize potential repayment.

How Do you Calculate Repayment of Tax Credits?

You’ll calculate your repayment when you file the Premium Tax Credit Form 8962. This form helps reconcile any differences between the tax credits you received in advance and the amount you were actually eligible for based on your final income.