Section 9010 a Tax On Large Insurers

Section 9010 of the Affordable Care Act includes a tax on America’s largest insurers, the one’s who profit the most off of ObamaCare.

How Much Is the Tax Under Section 9010?

The tax started at $6.7 billion in 2010, was $7 billion in 2014, and raised to $18 billion by 2024. The exact amounts are subject to change. The current IRS page on section 9010 shows this:

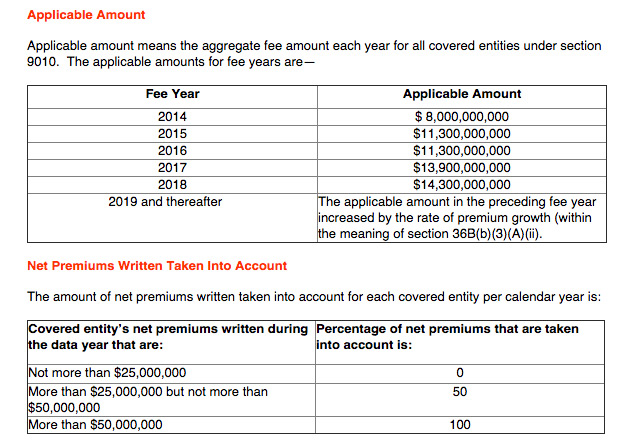

Applicable Amount

Applicable amount means the aggregate fee amount each year for all covered entities under section 9010. The applicable amounts for fee years are—

| Fee Year | Applicable Amount |

| 2014 | $ 8,000,000,000 |

| 2015 | $11,300,000,000 |

| 2016 | $11,300,000,000 |

| 2017 | $13,900,000,000 |

| 2018 | $14,300,000,000 |

| 2019 and thereafter | The applicable amount in the preceding fee year increased by the rate of premium growth (within the meaning of section 36B(b)(3)(A)(ii). |

Net Premiums Written Taken Into Account

The amount of net premiums written taken into account for each covered entity per calendar year is:

| Covered entity’s net premiums written during the data year that are: | Percentage of net premiums that are taken into account is: |

| Not more than $25,000,000 | 0 |

| More than $25,000,000 but not more than $50,000,000 | 50 |

| More than $50,000,000 | 100 |

Why Is There An Excise Tax?

This fee, sometimes called an excise tax, is meant to help fund the law by taxing insurers who profit the most off of the expansion of coverage under the ACA. It’s actually one of the larger funding mechanisms in the ACA.

This tax is one of many excise taxes that targets industries that profit off of America. Other major excise taxes include highway taxes, tobacco and alcohol taxes, aviation taxes, and a tax on high end health plans. See this CBO report on excise taxes.

Which Insurers Must Pay the Tax Under Section 9010

Large insurers who write more than $25 million in premiums or whose fees are more than $5 million from administration of employer self-insured plans must pay the fee under section 9010. Those who write more than $50 million in premiums pay the full amount.

Insurers who have to pay the fee include those who operate in public and private markets. Private markets include all plans sold inside and outside of the Marketplace and those who furnish group plans and Medicare Part C and D plans. Public markets include Nonprofit insurers that receive more than 80% of their premium revenue from Medicare, Medicaid, SCHIP, and dual eligible plans are exempt from the fee. Certain other nonprofit insurers can exclude 50% of their premium revenue from the health insurer fee calculation. Learn more here.

Do Individuals Have to Pay the Tax Under Section 9010?

In a perfect world individuals aren’t paying the tax, rather insurers are paying the non-deductible tax out of their profits.

However, some fear that the tax may lead to inflated premiums due to insurers passing the cost onto consumers. Those who wrote the law saw it as a compromise with insurers who would profit the most off of the ACA. Insurers can’t pass the tax off directly, but of course they are allowed to raise premiums as privately run businesses.

Is the Tax Hidden in the Affordable Care Act?

Some anti-ObamaCare folks have claimed the tax is hidden in the ACA. The truth is that it is the 9th item in TITLE IX – REVENUE PROVISIONS Subtitle A – Revenue Offset Provisions. If you want to call the 9th tax in the tax section “hidden” then it’s a matter of semantics.

Certainly we can agree this tax was referred to as a fee, and we do know that since it didn’t affect Americans directly few made a big deal out of it.

Logically though, it’s hard to see this as “hidden”. The tax under section 9010 is literally sandwiched in between the very publicized medical device tax and studies to improve VA healthcare. So, arguably, a politician overlooking the tax says more about the politician than the law.

Learn more about the fee at healthlawyers.org.

Will The 9010 Tax Be Repealed?

There is an effort to repeal this tax. While it may seem attractive on the surface we have to remember that this is one of the attempts to get insurers to pay their fair share and not foot America with the healthcare bill while insurers profit. Repealing the tax is probably a bad idea unless it is replaced with a smart solution that does a better job at tackling the issue of who foots the bill and how does health care become more affordable in America.

Remember the repeal of this tax is being pushed by house GOP members who want to see the law dismantled and defund piece by piece. If we take out billions in taxes on insurers the price of the ACA goes up for sure, but premiums don’t necessarily go down. This does a lot for the stance of a repealer politician, but does little to help the average American back here in reality land trying to ensure their families have access to health insurance and health care.

Of course repealers are going to go after TITLE 9, that is where one would start if they wanted to defund the law, but it doesn’t make it smart.

carol albright

I am insured under the ACA in Ohio with Medical Mutual. My money statement shows my premium and the federal Mandated fee. Can they pass this fee on to me?