ObamaCare Special Enrollment Period

Qualifying for Coverage Outside of Open Enrollment

A special enrollment period is a period outside of open enrollment in which you can get coverage due to qualifying life events.

You may qualify for special enrollment if you have certain “qualifying life events” like a change in family status (having a baby, getting married, adoption, etc), losing your plan for any reason other than non-payment (this includes employer coverage and private coverage), losing COBRA, losing eligibility for Medicaid or Medicare, or having one of many hardships (See the full list of Qualifying Life Events at HealthCare.gov and/ or see the full list of hardships at HealthCare.Gov).

On this page, we will discuss what qualifying life events will allow you to qualify for a special enrollment period in the health insurance marketplace, how other insurance types deal with special enrollment periods, and more.

FACT: If you qualify for a Special Enrollment Period (SEP), you typically have 60 days following the event to enroll in a plan. If you miss your window to enroll, you’ll miss your chance to get coverage and will have to wait until the next open enrollment period. Please note in some cases the window to enroll is different and in some cases, people may have other options like Medicaid, COBRA, or short-term coverage.

TIP: In some cases, qualifying events include trying to sign up before the end of open enrollment but not having time to complete enrollment.

TIP: In general, you’ll have to prove that you had a qualifying life event to qualify for special enrollment. Go to HealthCare.Gov to apply for special enrollment.

Quick List of Qualifying Life Events

Below is a more detailed list, but in short here is a quick list of qualifying life events from HealthCare.Gov:

- Loss of health coverage

- Losing existing health coverage, including job-based, individual, and student plans

- Losing eligibility for Medicare, Medicaid, or CHIP

- Turning 26 and losing coverage through a parent’s plan

- Changes in household

- Getting married or divorced

- Having a baby or adopting a child

- Death in the family

- Changes in residence

- Moving to a different ZIP code or county

- A student moving to or from the place they attend school

- A seasonal worker moving to or from the place they both live and work

- Moving to or from a shelter or other transitional housing

- Other qualifying events

- Changes in your income that affect the coverage you qualify for

- Gaining membership in a federally recognized tribe or status as an Alaska Native Claims Settlement Act (ANCSA) Corporation shareholder

- Becoming a U.S. citizen

- Leaving incarceration (jail or prison)

- AmeriCorps members starting or ending their service

If you had one of the above happen, your life is simple, go to HealthCare.Gov and fill out the screener. If you didn’t have one of the above happen, keep reading to find out more about other qualifying life events and hardship exemptions.

ObamaCare Special Enrollment Period Key Facts

A special enrollment period is a time outside of open enrollment when you and your family can sign up for health insurance in the health insurance marketplace. Here are some key facts about special enrollment to keep in mind:

- To be eligible for special enrollment, you’ll need to have a qualifying life event that qualifies you for special enrollment in the Healthcare Marketplace (HealthCare.Gov or your state marketplace). You generally also need to have been previously covered under a coverage type that counts as Minimum Essential Coverage (although some life events don’t require this).

- Qualifying life events include but aren’t limited to: Changes in household size (for example if you get married, have a baby, or a child turns 26), a move to a new home in a new ZIP code or county, losing job-based coverage, losing COBRA coverage, losing individual health coverage for a plan or policy you bought yourself, losing employer coverage, losing eligibility for Medicaid or CHIP, losing eligibility for Medicare, and losing coverage through a family member. TIP: See a full list of qualifying life events below.

- You may qualify for a special enrollment period of (typically) 60 days following certain life events that involve a change in family status (for example, marriage or birth of a child) or loss of other health coverage.

- Job-based plans must allow special enrollment periods of 30 days (giving you no less than 30 days to switch to an employer plan from a non-employer plan). If you lose your job you get 60 days to enroll in marketplace coverage.

- Many special enrollment periods start before you lose coverage, thus giving you time to enroll in a plan and avoid a coverage gap.

- IMPORTANT: Even though an enrollment period starts 60 days following the day of the event, in most cases you can enroll up to 60 days before the event. This allows your coverage to start on the day of the event and allows people to avoid any gaps in coverage.

- If you don’t have a special enrollment period, you can’t buy insurance inside or outside the Marketplace until the next open enrollment period.

TIP: In past years open enrollment was extended for those who signed up but had trouble enrolling. This may be true moving forward, or it may not. Learn more about what happens if you miss the deadline.

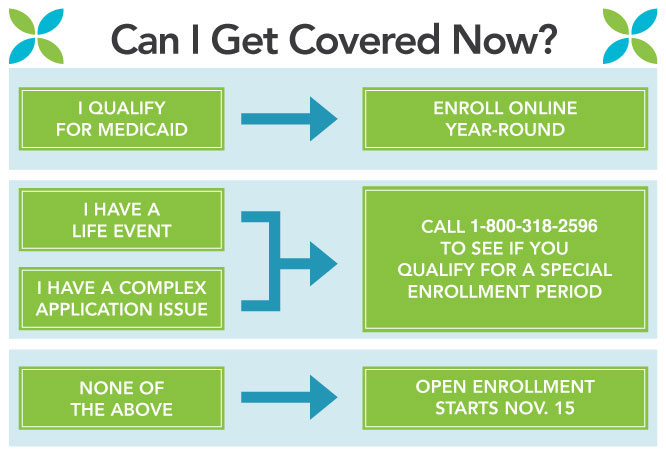

This special enrollment infographic is from the Maryland Health Connection, but the phone number has been updated to the official healthcare.gov marketplace hotline.

Common Special Enrollment Periods (SEP) Enrollment Windows

Not all special enrollment periods are the same length. Some life events trigger a 120 special enrollment period (60 days before to 60 days after the event), some trigger a hardship exemption, some trigger shorter periods with no exemption, and some only trigger the ability to purchase coverage outside of open enrollment (in that they don’t apply during open enrollment).

Below are common qualifying life events and enrollment windows. See full lists of qualifying events below.

NOTE: You can apply early to ensure your coverage starts on the day you would lose coverage. Even though you can enroll before the Special Enrollment window, your coverage won’t start until the day of the event or denial.

- Losing health coverage. From 60 days before to 60 days after losing your other coverage

- Being Denied Medicaid or CHIP. Up to 60 days after the denial.

- Getting Married. Up to 60 days after the event.

- Having a baby, adopting a child, or placing a child for adoption. Up to 60 days after the event.

- Having a change in income or household status that affects eligibility for premium tax credits or cost-sharing reductions (if already enrolled in coverage). Only triggers special enrollment if it’s not open enrollment. Up to 60 days after the event.

- Moving, gaining citizenship, leaving incarceration. Only triggers special enrollment if it’s not open enrollment. Up to 60 days after the event.

- Employer special enrollment. Employer special enrollment periods typically last 30 days. If moving from a Marketplace plan to an employer plan, make sure to avoid gaps in coverage or overlapping coverage.

- Hardship Exemptions and Enrolling in the Marketplace. Most hardship exemptions and even the act of simply enrolling in the Health Insurance Marketplace trigger a 60-day special enrollment window. Even more incentive to sign up during open enrollment or apply for a hardship exemption, even if you don’t have time to enroll properly.

Full List of Qualifying Life Events For Special Enrollment

Above we covered the basics and some common windows of opportunity for special enrollment. Below is a more robust list of every life event that counts as a qualifying life event.

The first list takes a look at common qualifying life events, next we discuss complex situations that may qualify someone for special enrollment.

The following life events will generally qualify you for a special enrollment period (ultimately HealthCare.Gov will make the call on a qualifying life event and may request proof, some qualifying events listed below are subject to change year-to-year):

- Having trouble enrolling up during open enrollment. If you signed up for the marketplace, but you were unable to complete the enrollment process for any reason, it may trigger a short special enrollment opportunity (this was true in past years, but may not be true moving forward).

- Getting married.

- Birth, adoption, or placement of a child.

- Leaving incarceration.

- Being rejected from Medicaid/CHIP (in some situations).

- Permanently moving to a new area that offers different health plan options. Life events related to moving include: moving to a new home in a new ZIP code or county, moving to the U.S. from a foreign country or United States territory, a student moving to or from the place they attend school, a seasonal worker moving to or from the place they both live and work, or moving to or from a shelter or other transitional housing. Note: You must prove you had qualifying health coverage for one or more days during the 60 days before your move. You don’t need to provide proof if you’re moving from a foreign country or United States territory.

- Losing other health coverage (including job loss for any reason, divorce, loss of eligibility for Medicare, Medicaid, or CHIP, expiration of COBRA coverage or employer coverage, aging out of a family plan at 26, or a health plan being decertified). Note: Loss of coverage does not include voluntarily quitting other health coverage or being terminated for not paying your premiums. Losing coverage that is not minimum essential coverage also fails to qualify as loss of coverage.

- For people already enrolled in Marketplace coverage, having a change in income or household status that affects eligibility for tax credits or cost-sharing reductions

- An individual who was not previously a citizen, national, or lawfully present individual gaining such status.

- AmeriCorps VISTA members starting or ending their service.

- A qualified individual’s enrollment or non-enrollment in a QHP is unintentional, inadvertent, or erroneous and is the result of the error, misrepresentation, or inaction of an officer, employee, or agent of the Exchange, HHS, or its instrumentalities as evaluated and determined by the Exchange.

- An enrollee adequately demonstrates to the Exchange that the QHP in which he or she is enrolled substantially violated a material provision of its contract in relation to the enrollee.

- An individual is determined to be newly eligible or newly ineligible for advance payments of the premium tax credit or has a change in eligibility for cost-sharing reductions, regardless of whether such individual is already enrolled in a QHP. The Exchange must permit individuals whose existing coverage through an eligible employer-sponsored plan will no longer be affordable or provide minimum value for his or her employer’s upcoming plan year to access this special enrollment period prior to the end of his or her coverage through such an eligible employer-sponsored plan.

- An Indian, as defined by section 4 of the Indian Health Care Improvement Act, may enroll in a QHP or change from one QHP to another one time per month.

- Gaining membership in a federally recognized tribe or status as an Alaska Native Claims Settlement Act (ANCSA) Corporation shareholder.

- A qualified individual or enrollee demonstrates to the Exchange, in accordance with guidelines issued by HHS, that the individual meets other exceptional circumstances as the Exchange may provide.

Above information compiled from healthcare.gov and section 155.420 gpo.gov Federal Register. The above is subject to change, so make sure to see HealthCare.Gov for the latest rules.

Other Life Changes to Report

Not all life changes will trigger special enrollment – some may only trigger an exemption, and some may simply qualify you to change your marketplace options for coverage and cost assistance.

You should report a change if you:

- Have a change in income

- Become pregnant

- Get health coverage through a job or a program like Medicare or Medicaid

- Change your place of residence

- Have a change in disability status

- Gain or lose a dependent

- Experience other changes that may affect your income and household size

- Other changes to report: change in tax filing status; change of citizenship or immigration status; incarceration or release from incarceration; change in status as an American Indian/Alaska Native or tribal status; correction to name, date of birth, or Social Security number.

Complex Situations and Special Enrollment

While most qualifying life events are pretty standard qualifiers for special enrollment, some folks may find themselves with less common and more complex situations. Below is a list of other factors that can qualify you from special enrollment. You can see HealthCare.Gov’s complex situation’s list here.

Exceptional circumstance

You faced a serious medical condition or natural disaster that kept you from enrolling. For example:

- An unexpected hospitalization or temporary cognitive disability

- A natural disaster, such as an earthquake, massive flooding, or hurricane

Misinformation or misrepresentation

Misconduct by a non-Marketplace enrollment assister (like an insurance company, navigator, certified application counselor, or agent or broker) resulted in you:

- Not getting enrolled in a plan

- Being enrolled in the wrong plan

- Not getting the premium tax credit or cost-sharing reduction you were eligible for

Enrollment error

The insurance company was unable to process your enrollment because of a technical error between the Marketplace and the insurance company.

System errors related to immigration status

An error in the processing of applications or system caused you to get an incorrect immigration eligibility result when you tried to apply for coverage.

Display errors on HealthCare.gov

Incorrect plan data, such as inaccurate benefit or cost-sharing information, was displayed at the time that you selected your health plan. This includes issues where some consumers were allowed to enroll in plans offered in a different area or to enroll in plans that don’t allow certain categories of family relationships to enroll together.

Medicaid/Marketplace transfers

- If you applied for Medicaid through your state or were sent to Medicaid from the Marketplace, but you weren’t eligible for Medicaid.

- Your state transferred your information to the Marketplace, but you didn’t get an answer about your eligibility and/or didn’t get enrolled before March 31.

Error messages

Your application was stopped due to specific error messages. For example, you received a “data sources down” error message or another error message that didn’t allow you to enroll.

Unresolved casework

You’re working with a caseworker on an enrollment issue that didn’t get resolved before March 31.

Victims of domestic abuse

You’re a victim of domestic abuse and weren’t previously allowed to enroll and receive advance payments of the premium tax credit separately from your spouse. You’ll be able to do so now.

Other system errors

Other system errors that kept you from enrolling, as determined by the Centers for Medicare & Medicaid Services.

Find Out if You Qualify

If you think you qualify for special enrollment for any of the reasons above, contact the Marketplace Call Center at 1-800-318-2596 (TTY: 1-855-889-4325)

When you call the healthcare.gov call center, a representative will ask for information about your situation to determine if your circumstances qualify you for a special enrollment period. The representative will help you apply and enroll in coverage.

If you’re already enrolled in a plan and you get a special enrollment period, you can stay in your current plan (in most cases) or you can switch plans. In some limited cases, you may qualify for an earlier effective date of coverage. Remember: you must make the first premium payment before your coverage becomes effective.

Filing an appeal

If your request for a special enrollment period is denied, you can file an appeal. If the denial is found incorrect, you can get coverage back to the date your special enrollment period was denied.

How to file an appeal:

- Select your state’s appeal form, download it, and fill it out

- Mail your appeal to: Health Insurance Marketplace

465 Industrial Blvd.

London, KY 40750-0061

When possible, include a copy of any eligibility determination notice or other official notice you received. This isn’t required, but it will help them process your appeal.

When mailing the appeal request to the Health Insurance Marketplace, be sure to include the last 4 digits of the London, KY Zipcode (40750-0061). This will help your appeal arrive faster.

Hardship Exemptions

Most qualifying life events that trigger a special enrollment period also trigger a hardship exemption. This can qualify you to enroll in the Marketplace or even grant you access to catastrophic coverage. Hardship exemptions are also important to consider in states that still have a mandate for getting coverage.

Job-Based Special Enrollment Periods

Just like special enrollment periods in the marketplace, employer coverage usually has special enrollment periods as well. In regards to job-based coverage, a special enrollment period is a time outside of the open enrollment period during which you and your family have a right to sign up for job-based health coverage. Job-based plans must provide a special enrollment period of 30 days following certain life events that involve a change in family status–for example, marriage or birth of a child–or loss of other job-based health coverage.

Medicaid and CHIP Enrollment Periods

Medicaid and CHIP don’t have enrollment periods. However, you can only use the marketplace to sign up for Medicaid and CHIP during open enrollment. If you qualify for Medicaid or CHIP, you can sign up at any time, but you’ll have to use alternative sign up methods for Medicaid and CHIP as you won’t be able to sign up through the marketplace outside of open enrollment.

Medicare Enrollment Periods

Medicare has its own complex web of enrollment periods. You can find out more about specific enrollment periods for Medicare here.

I Don’t Qualify For Special Enrollment, What Other Health Insurance Options Do I Have?

If you don’t qualify for special enrollment, you still have health insurance options. If you don’t qualify for subsidized insurance or public health options, your best course of action will be to simply speak to an agent or provider and purchase private insurance outside of the marketplace. While many insurance options outside of open enrollment aren’t ACA compliant and won’t qualify for cost assistance, they can help you cover your medical costs and needs.

What If I Don’t Obtain Health Insurance?

You no longer have to pay a fee if you don’t get covered in most states. However, if you don’t get covered you won’t have access to health insurance with cost assistance and will have limited options for coverage. So make sure to shop around during open enrollment each year and to take advantage of special enrollment periods.

What Happens If I Miss the Deadline to Enroll in ObamaCare?![]()