The Distant Future of June 5th 2015

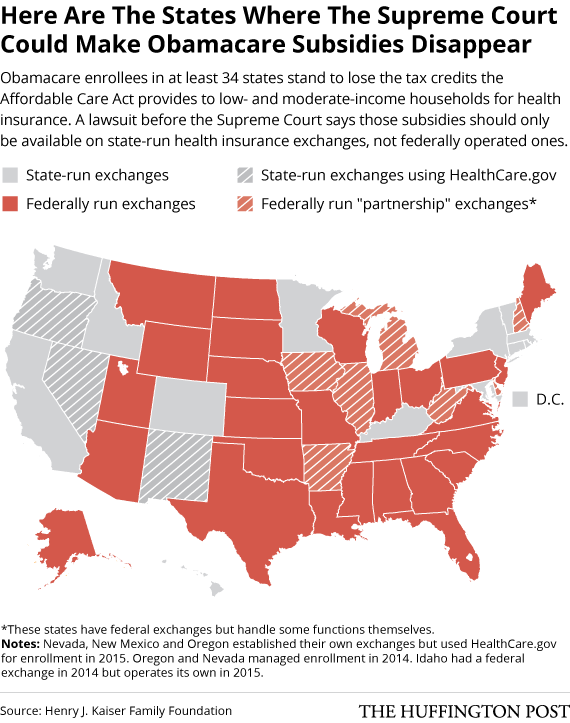

Far in the distance, a long time from now, on June 5th 2015 the GOP will be expected to have a solution in place for the potential repeal of ACA subsidies. What is that you say? “June 5th isn’t the distant future, it’s actually less than a month away?… And the GOP have no solid agreed upon… Read More