ObamaCare Rate Review & the 80/20 Rule

Protecting You Against Unfair Premium Increases

ObamaCare’s rate review provision and the 80/20 rule help keep curb premium growth and keep insurance affordable. Before the ACA premiums had been increasing at unsustainable rates on a yearly basis, the ACA’s new provisions help to curb that. There are two ways insurers are now held more accountable for rate increases, the rate review provision and the “80/20 rule”.

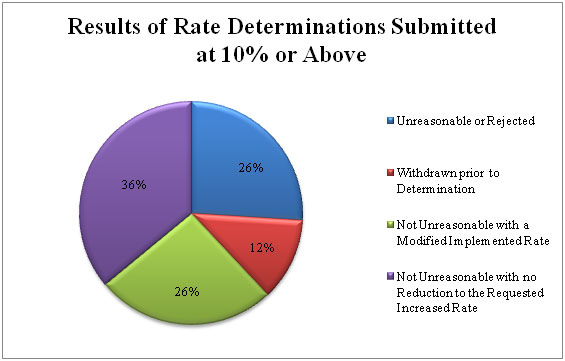

Rate Review Provision – Insurance companies have to justify rate hikes of over 10% to the state or federal government and post them publicly (currently on HealthCare.Gov). Here is the complete list of 2016 rate hikes.

Medical Loss Ratio / 80/20 Rule – Insurance companies have to spend at least 80 percent of premium dollars on claims and activities to improve health care quality. 85% in large group markets.

Learn more about the Rate Review & the 80/20 Rule at HealthCare.Gov. For insight into how these rules are working, see: Medical loss ratio forced carriers to devote more premium dollars to care. The proof of its impact? $3.24 billion refunded to consumers over the last six years from HealthInsurance.org.

The Facts on ObamaCare Insurance Premiums and the Medical Loss Ratio (80/20 Rule)

The medical loss ratio, or 80/20 rule, helps to decrease the growth in premium rates. Since insurance companies have stricter regulations on what they can spend your premiums on there is less incentive for them to inflate rates.

The 80/20 Rule generally requires insurance companies to spend at least 80% of the money they take in on premiums on your health care and quality improvement activities instead of administrative, overhead, and marketing costs.

The 80/20 rule is sometimes known as Medical Loss Ratio, or MLR. If an insurance company uses 80 cents out of every premium dollar to pay for your medical claims and activities that improve the quality of care, the company has a Medical Loss Ratio of 80%.

Insurance companies selling to large groups (usually more than 50 employees) must spend at least 85% of premiums on care and quality improvement.

If your insurance company doesn’t meet these requirements, you’ll get a rebate from your premiums.

Many insurance companies spend a substantial portion of consumers’ premium dollars on administrative costs and profits, including executive salaries, overhead, and marketing.

The Affordable Care Act requires health insurance issuers to submit data on the proportion of premium revenues spent on clinical services and quality improvement.

ObamaCare Rebates

If your insurance company spends more than 20% (15% in large markets) of premium dollars on expenses other than health care costs they will have to send out rebates for the difference. You may see the rebate in a number of ways:

- A rebate check in the mail

- A lump-sum deposit into the same account that was used to pay the premium, if you paid by credit card or debit card

- A direct reduction in your future premium

- Your employer may also use one of the above rebate methods, or apply the rebate in a way that benefits employees

An estimated 8.5 million Americans will receive rebates from their health insurers this summer thanks to the Affordable Care Act, which says companies that fail to spend at least 80 percent of premiums on health care must refund the difference to consumers.

ObamaCare Insurance Reform: The Rate Review Provision

ObamaCare does not increase insurance premiums directly. In fact, ObamaCare’s rate review provision states that as of 2011, insurance companies are no longer be able to raise insurance premiums solely for the sake of profit. If health insurance companies do raise premiums, they will have to justify rate hikes of over 10% to the State they operate in and then disclose this information immediately on both their website and healthcare.gov.

If the State does not have an effective rate review program, the Federal Government will step in. This has already prevented many unjustified rate hikes.

Health insurance premiums have risen rapidly, straining the pocketbooks of American families and businesses for more than a decade. Many times, insurance companies have been able to raise rates without explaining their actions to regulators or the public or justifying the reasons for their high premiums. In most cases, consumers receive little or no information about proposed premium increases, and aren’t told why companies want to raise rates.

The Affordable Care Act brings an unprecedented level of scrutiny and transparency to health insurance rate increases.

The Rate Review Provision Protects Against “Price Gouging”

What is “Price gouging”? When a seller prices goods or commodities much higher than is considered reasonable or fair, due to a a demand or supply shock it is called “price gouging”.

Since tens of millions of Americans will now have to be covered and can’t be charged more based on health status or gender many insurance companies wanted to raise their rates. ObamaCare’s rate review provision makes sure these rate increases are fair and not for the purposes of “price gouging”.

How the Rate Review Process Works

When a health insurance company proposes a rate increase of 10% or more it must be gone over a group of independent experts.

If the reviewers feel insurance price increases are unreasonable, they can try to decrease the proposed increases or deny them outright. For instance, Connecticut reduced a proposed Anthem Blue Cross Blue Shield increase from 12.9 percent to 3.9 percent.

When a rate increase does occur, the health insurance provider must post the insurance rate hikes and a justification on their website and on healthcare.gov.

The disclosure process associated with the “rate review” is intended to help consumers to “shop” for private insurance particularly on the health insurance exchanges.

As of Sept. 2012, the rate review provision has saved Americans $1 billion, in States that are enforcing the law.

Total Savings in the Individual and Small Group Markets from Modified, Rejected or Withdrawn Rate Increase Requests of 10% or above, by State From HHS Annual Rate Review Report 2012

| Individual Market | Small Group Market | Total | ||||

|---|---|---|---|---|---|---|

| State | Number of Affected Enrollees | Estimated Savings | Number of Affected Enrollees | Estimated Savings | Number of Affected Enrollees | Estimated Savings |

| Alabama | — | — | * | * | * | * |

| Alaska | * | * | * | * | * | * |

| Arizona | 2,204 | $396,000 | * | * | 2,204 | $396,000 |

| Arkansas | 266 | $23,000 | — | — | 266 | $23,000 |

| California | 166,652 | $34,295,000 | 377 | $255,000 | 167,029 | $34,550,000 |

| Colorado | 30,466 | $11,304,000 | — | — | 30,466 | $11,304,000 |

| Connecticut | — | — | 32,223 | $2,369,000 | 32,223 | $2,369,000 |

| Delaware | — | — | 27 | $6,000 | 27 | $6,000 |

| District of Columbia | — | — | — | — | — | — |

| Florida | 55 | $7,000 | * | * | 55 | $22,000 |

| Georgia | — | — | * | * | * | * |

| Hawaii | — | — | — | — | — | — |

| Idaho | * | * | * | * | * | * |

| Illinois | * | * | * | * | * | * |

| Indiana | 3,304 | $1,569,000 | 2,633 | $460,000 | 5,937 | $2,028,000 |

| Iowa | — | — | 6,929 | $1,125,000 | 6,929 | $1,125,000 |

| Kansas | — | — | * | * | * | * |

| Kentucky | * | * | — | — | * | * |

| Louisiana | * | * | * | * | * | * |

| Maine | 1,105 | $399,000 | * | * | 1,105 | $399,000 |

| Maryland | — | — | — | — | — | — |

| Massachusetts | — | — | — | — | — | — |

| Michigan | 20,503 | $3,741,000 | 72,533 | $11,770,000 | 93,036 | $15,511,000 |

| Minnesota | — | — | — | — | — | — |

| Mississippi | — | — | 207 | $0 | 207 | $0 |

| Missouri | * | * | 120 | $4,000 | 120 | $4,000 |

| Montana | * | * | * | * | * | * |

| Nebraska | 1,302 | $0 | 1,909 | $0 | 3,211 | $0 |

| Nevada | 4,372 | $0 | — | — | 4,372 | $0 |

| New Hampshire | — | — | — | — | — | — |

| New Jersey | — | — | * | * | * | * |

| New Mexico | — | — | — | — | — | — |

| New York | — | — | 87,037 | $20,242,000 | 87,037 | $20,242,000 |

| North Carolina | — | — | 2,174 | $69,000 | 2,174 | $69,000 |

| North Dakota | — | — | 1,416 | $484,000 | 1,416 | $484,000 |

| Ohio | * | * | * | * | * | * |

| Oklahoma | — | — | * | * | * | * |

| Oregon | 15,554 | $1,352,000 | — | — | 15,554 | $1,352,000 |

| Pennsylvania | — | — | * | * | * | * |

| Puerto Rico | — | — | 5,300 | $2,623,000 | 5,300 | $2,623,000 |

| Rhode Island | — | — | — | — | — | — |

| South Carolina | 6,942 | $1,461,000 | 1,421 | $339,000 | 8,363 | $1,800,000 |

| South Dakota | * | * | 499 | $232,000 | 499 | $232,000 |

| Tennessee | — | — | — | — | — | — |

| Texas | — | — | 2 | $2,000 | 2 | $2,000 |

| Utah | — | — | * | * | * | * |

| Vermont | 600 | $362,000 | — | — | 600 | $362,000 |

| Virginia | — | — | * | * | * | * |

| Washington | 293,053 | $49,035,000 | 21,360 | $85,000 | 314,413 | $49,121,000 |

| West Virginia | — | — | 221 | $201,000 | 221 | $201,000 |

| Wisconsin | 286 | $104,000 | 5,886 | $4,078,000 | 6,172 | $4,182,000 |

| Wyoming | * | * | * | * | * | * |

| Overall | 546,664 | $104,050,000 | 242,274 | $44,342,000 | 788,938 | $148,407,000 |

ObamaCare Insurance Premium Rate Hikes Facts

• Many people are finding their Premiums rising at alarming rates. People with high-end plans may continue to see higher prices on their plans moving forward, while low to middle income Americans and employees will see an Average savings of 60% of their premiums due to subsidies, tax credits and up-front assistance. Customers in States utilizing rate review provisions who purchase marketplace insurance using premium tax credits will see the highest reduction in rates.

• Holding insurance companies accountable, the rate review provision and the 80/20 rule yielded an estimated $2.1 billion in savings in 2012 alone. However, this is very disproportionately from one State to the next, with many saving nothing and others saving tens of millions.

• The rate review provision has led to less requests for premium increases over 10% since the provision went into effect.

• In 2012 States like Washington and California have saved their constituents tens of millions of dollars by blocking or lowering rate increases, while others like Texas have saved only $2k via the Rate Review provision.

• 44 States and Washington D.C. have effective Rate Review programs. Montana, Wyoming, Arizona, Missouri, Arizona, Louisiana and Alabama do not. Virginia has a partial effective program.

• Some rate increases have made insurance unaffordable for Americans. Many of ObamaCare’s provisions associated with premium costs don’t start until 2014.

• Insurance companies have to disclose how funds are being spent. They must spend a minimum of 80% on healthcare or give consumers a rebate for the difference. This is known of the 80/20 rule and has saved Americans $1.1 Billion as of Sept., 2012.

• The rapid appeals provision lets you repeal any claim from insurance companies within days, giving customers legal standing to fight the appeal and helping to curb insurance premium costs.

• The Rate Review rules applies to new plans in the individual and small group markets. (If you are in a health plan that existed on March 23, 2010, your plan may be a grandfathered plan, which is exempt from the Rate Review rules.)

• Each state may have its own minimum premium increase that requires a review, based on the state’s unique premium trends, health care cost trends, and other factors.

• If your state doesn’t have a Rate Review program, or has a Rate Review program that is ineffective, the federal government will conduct Rate Reviews in your state.

• An estimated 13 million Americans have received rebates due to the 80/20 rule.

Know the Law: Medical Loss Ratio and Rate Review Provision

You can learn more about the Medical Loss Ratio and Rate Review Provision from CMS.gov.

Check out our Summary of Provisions of the Patient Protection and Affordable Care Act for a plain English summary of each provision pertaining to the new protections against health insurance premium increases.

Protections Against Insurance Rate Increases![]()