ObamaCare Cost Assistance For 2017 Plans

Updated Cost Assistance Information for 2017

For 2017, shoppers can get three types of health insurance cost assistance under the ACA: Premium Tax Credits, Cost Sharing Reduction Subsides, and Medicaid/CHIP.

Below is updated cost assistance information for 2017 plans, including all plans purchased during 2017 open enrollment Nov 1. 2016 – Jan. 31. 2017.

TIP: Seniors can get Medicare assistance and employees, employer assistance. Neither of these is directly through the Affordable Care Act, although the ACA does affect it.

TIP: The following cost assistance only applies to qualifying ACA plans that count as “Minimum Essential Coverage” (MEC).

The Federal Poverty Level and MAGI For 2017 Plans

Assistance for 2017 plans is based on the Federal Poverty Level (FPL) and MAGI (real income for 2017 after deductions). If your income changes, you could gain or lose assistance. This is true even if you gain or lose employment mid-year. This means you end up owing money or being owed money back. Given that fact, it’s vital to understand FPL and MAGI before taking Advanced Premium Tax Credits.

Below is a simple version of the 2016 guidelines (used for 2017 cost assistance; note Medicaid uses 2017 numbers after 2017 guidelines are printed on Jan. 20, 2017 by HHS).

Simplified 2016 FPL Guidelines for the 48 Contiguous States and DC (not Alaska and Hawaii). You’ll use these guidelines for 2017 cost assistance, and taxes filed April 15, 2018

| Persons in Household |

2016 100% Federal Poverty Level |

|---|---|

| 1 | $11,880 |

| 2 | $16,020 |

| 3 | $20,160 |

| 4 | $24,300 |

| 5 | $28,440 |

| 6 | $32,580 |

| 7 | $36,730 |

| 8 | $40,890 |

| *Medicaid eligibility is different in states that did not expand Medicaid. Federal Poverty Guidelines are different in Hawaii and Alaska. | |

NOTE: If your family contained more than 8 people, add $4,160 for each additional person. Note that Hawaii and Alaska use different guidelines. This is unchanged from 2015.

Medicaid and CHIP For 2017

Anyone below 138% of the poverty level can get Medicaid (if their state expanded it). Otherwise, Medicaid eligibility differs by state.

Most low-income children and parents will have CHIP options, and eligibility can be much higher than 138%. If you are low-or-middle income and have children under 18, CHIP may be an option for them. In some cases, Medicaid/CHIP is available to the whole family. Check with HealthCare.Gov or your state Medicaid department.

Premium Tax Credits For 2017 Plans

Premium Tax Credits (PTC) can be taken whole or in part in advance. Taking some tax credits in advance may lower your premium today. You can take any remaining credits at tax time. Either way, you’ll need to file form 8962 if you use the Premium Tax Credits.

The credit can only be taken by those whose actual MAGI for 2017 will be between 100%-400% of the poverty level. If your actual MAGI is lower or higher, then you’ll face repayment or reimbursement.

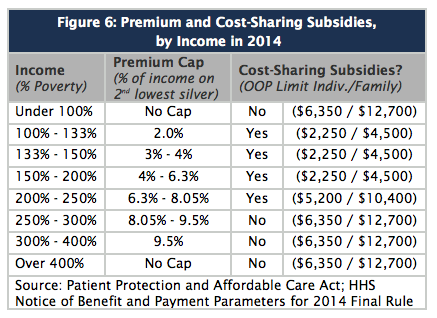

The credit is based on the cost of the Second Lowest Cost Silver Plan in your marketplace but is capped as a percentage of income.

TIP: 2017 caps and repayment limits aren’t out yet. It will probably be very similar to past years (shown below). The methodology is the same, but specifics numbers may change. See our page on 8962 and its instructions for more details.

| Income % of FPL | Filing Status: Single |

Filing Status: All Other |

|---|---|---|

| Less than 200% FPL | $300 | $600 |

| At least 200% FPL but less than 300% |

$750 | $1,500 |

| At least 300% FPL but less than 400% |

$1,250 | $2,500 |

| If your year end income exceeds 400% FPL, you will have to return the total amount of Advanced Premium Tax Credits you received. | ||

TIP: The methodology is essentially the same for 2017, but the exact OOP limit in the graphic above is updated for 2017.

Cost Sharing Reduction Subsidies (CSR) For 2017 Plans

Cost Sharing Reduction Subsidies (CSR) subsidies reduce your out-of-pocket expenses by raising the actuarial value of your plan (the average out-of-pocket costs an insurer pays on a plan). Specifically, they lower the coinsurance, and lower copays, deductibles, and maximum out-of-pocket costs you will pay in a policy period by raising the amount the insurer pays via subsidies. This means that some people will not only qualify for lower premiums on a Silver plan through tax credits but may also get the out-of-pocket costs similar to a Gold or Platinum plan.

There are three levels of CSR subsidies: CSR 73, CSR 87, and CSR 94. The numbers refer to the actuarial value (AV). Benefits sheets will include different summaries for various CSR levels.

Income Level Actuarial Value (the amount that a Silver plan will cover due to cost sharing reduction subsidies for % of the Poverty Level).

100-150% FPL = 94% Actuarial Value (CSR 94)

150-200% FPL = 87% Actuarial Value (CSR 87)

200-250% FPL = 73% Actuarial Value (CSR 73)

More than 250% FPL = 70% Actuarial Value

Out-of-pocket maximum limits for 2017 plans (equal to deductible limits):

- More than 250% percent of FPL,

- Your out-of-pocket limit won’t be more than $7,150 for an individual.

- Your out-of-pocket limit won’t be more than $14,300 for a family.

- For 100-250% both the FPL out-of-pocket limit and maximum deductible are reduced by the percentage noted above. This will be calculated for you when you enroll.