Obamacare Helped Lower Personal Bankruptcies By Nearly 50%

The Affordable Care Act (ObamaCare) helped lower personal bankruptcies by nearly 50% according to a study by Consumer Reports.

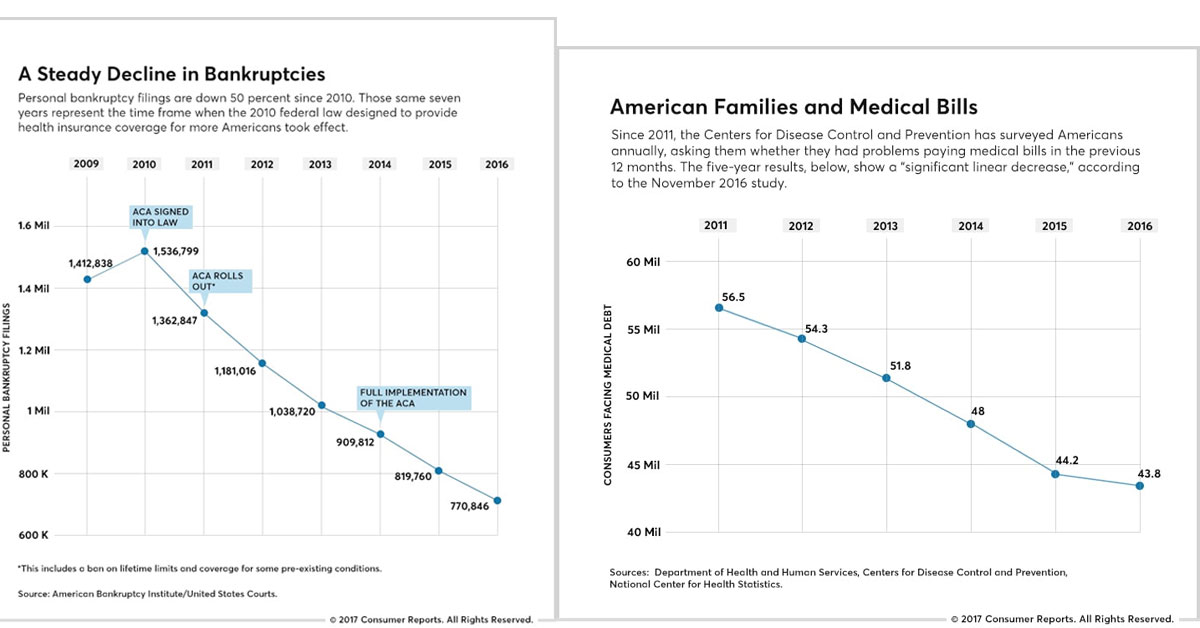

The ACA’s provisions, including caps on lifetime and annual limits, the new essential health benefits, mandated coverage for pre-existing conditions (in conjunction with other factors like tighter credit requirements, job growth, and new bankruptcy laws) resulted in bankruptcy filings dropping from 1.54 million in 2010 to 770,846 in 2016 according to the study.

Courts don’t ask people why they are filing for bankruptcy, so we can’t know exactly how much of this was a result of the ACA, but according to Consumer Reports

Many bankruptcy and legal experts agree that medical bills had been a leading cause of personal bankruptcy before public healthcare coverage expanded under the ACA. Unlike other causes of debt, medical bills are often unexpected, involuntary, and large.

Bankruptcy due to Medical related debt was the number one cause of bankruptcy before the ACA, it was part of the healthcare crisis that ObamaCare was trying to fix.

This is just one of many studies that show that, while the ACA still has some sticking points, it IS working.

FACT: A 2007 study by the American Journal of Medicine found approximately 62% of all personal bankruptcies in the United States were related to medical bills. 78% of those involved had health insurance, although many were bankrupted anyway due to gaps in coverage such as co-payments, deductibles, and uncovered services. Other people had private insurance but got so sick that they lost their job and lost their insurance. The ACA contains measures that prevent many of these problems. This study did not take into account other debts owed at the time of bankruptcy. Learn more about bankruptcy from Medical bills.