Laid off, Pregnant, ObamaCare Saved Me and My Unborn Son – Story

Thank you so much to our wonderful President and the all who have contributed to this act. It absolutely has saved the lives of me and my unborn son.

Thank you so much to our wonderful President and the all who have contributed to this act. It absolutely has saved the lives of me and my unborn son.

When I first enrolled in the Marketplace I was able to get a Silver PPO that I could afford with the subsidy, that offered what I needed. The second year that plan went up

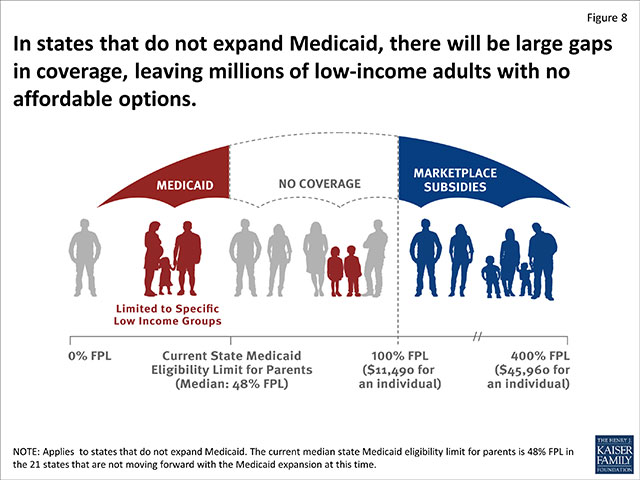

For 2016 Millions will get coverage, and cost assistance will help ease the impact of rate hikes, yet millions will be left uncovered due to the Medicaid gap.

A quick overview of everything you need to know about getting coverage, switching plans, and cost assistance during ObamaCare’s 2016 open enrollment period.

The new ObamaCare lawsuit is based on the Constitution’s Origination Clause, which requires that the House be the first to pass a bill “for raising revenue.”

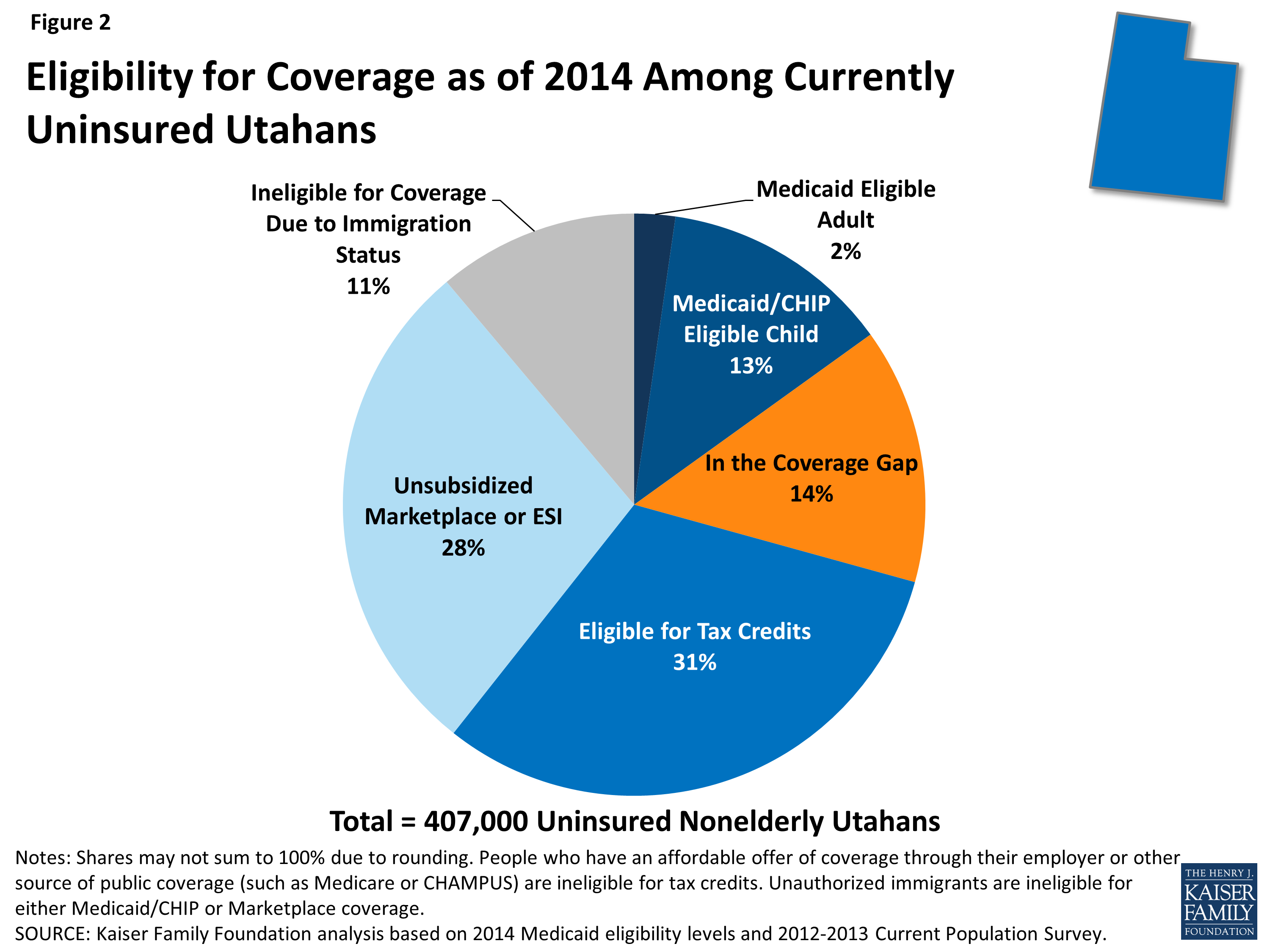

An effort in Utah to expand Medicaid has been rejected after Republicans in the state House of Representatives rejected a compromise proposal.

Obama signed in the 14th and most recent change to ObamaCare since the law was passed in 2010, this notably included a few breaks for small business.

I don’t care what I read from this site or opposing sites. I care about what actually is happening. What actually has happened with my insurance is the cost has gone up every year since this bill was passed. the coverage has gotten worse every year, while the deductibles and premiums have gone up. Every… Read More

As of September 2015 an estimated 17.6 million are enrolled in ObamaCare including 15.3 million in the Marketplace and Medicaid and 2.3 million young adults.

But I had to say it, Obamacare is not realistic! We are going to be in trouble, and soon.

If it were not for Obamacare, when I turned 26, I would have lost access to OBGYN care and the prescription which deeply improves my quality of life.

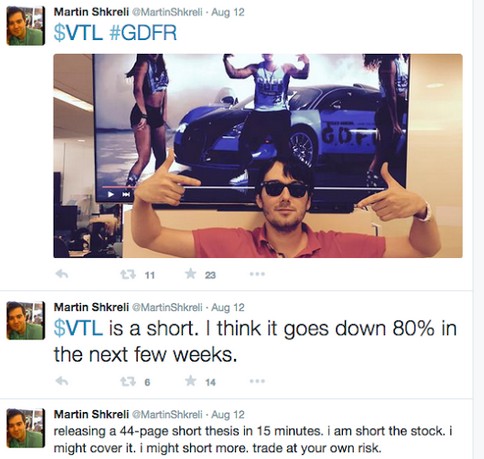

Profit creates competition on a good day, on a bad day a 32 year old ex hedge fund guy under investigation hikes an AIDS drug from $13.50 to $750 to profit off the sick and taxpayers. This event raises the question: How do we avoid price-gouging on taxpayer subsidized items and how much profit and regulation belongs in drugs and treatments that treat chronic illness?

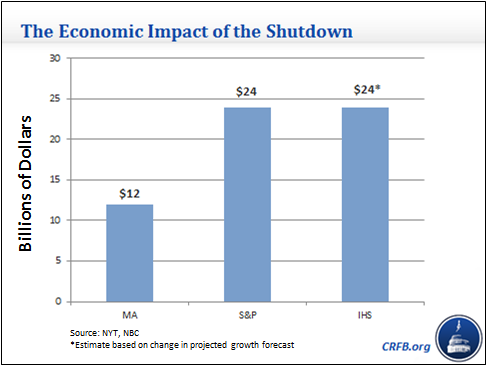

The new 2016 house GOP budget includes a full repeal of ObamaCare, this mirrors the 2013 budget that shutdown the government cost tax payers billions.

According to CMS 9.9 million are enrolled and paid for Marketplace coverage. This is on track with the HHS estimate of 9.1 million for the end of 2015 and the CBO’s previous estimate of an average of 12 million for the year.

ObamaCare is a law, the law contains cost assistance based on income and tax filing status. Whether this is a handout depends upon your definition of handout.

A series of unfortunate events out of my control have resulted in my current inability to function as a hard working American. I’m not victimizing myself intentionally, yet I am so isolated from my old life due to a slip and fall injury last January that I am the first to excuse myself as being… Read More

A woman put a public facebook post up about a BCBS plan in Alabama. Is this an ObamaCare problem or an Alabama problem?

According to CMS Accountable Care Organizations (ACOs) generated more than $411 million in total savings in 2014, which includes all ACOs’ savings and losses.

After three years without insurance I was grateful for the opportunity to get coverage. It didn’t take long to realize that there were very few doctors that took my insurance. I pay more for insurance per month than my mortgage, can’t save any money because it all goes to that and I can’t find a… Read More

Yesterday I went in for my annual physical, my second since I first enrolled in Obamacare in 2014. What a pleasure it was to go to my doctor’s office, be greeted by the friendly staff, be well taken care of by my doctor, get basic wellness tests lined up, and walk out the door without… Read More

My husband and I are both self employed. Thanks to these new laws we purchased health inusrance this year. We now pay $651.00 a month for our family of four to have health insurance. Now when we go to the dentist or doctor we pay the insurance fee instead of the cash price. All of… Read More

We explain Scott Walker’s plan to repeal and replace ObamaCare. We compare it to the ACA and examine what it gets right and wrong.

I have not benefited from the ACA. In fact I only clear 900.00 from social security a month but because I file with my husband I do not qualify for any assistance. We are being penalized for having to use money from his 401 k to help pay my $689. a month health insurance policy… Read More

My husband and I are both disabled. He is on Medicare and has a supplemental drug plan. I on the other hand do not have Medicare yet. I have several medical issues and struggled before ObamaCare to find an insurance that would even insure me. I found one, but it didn’t cover much at all… Read More

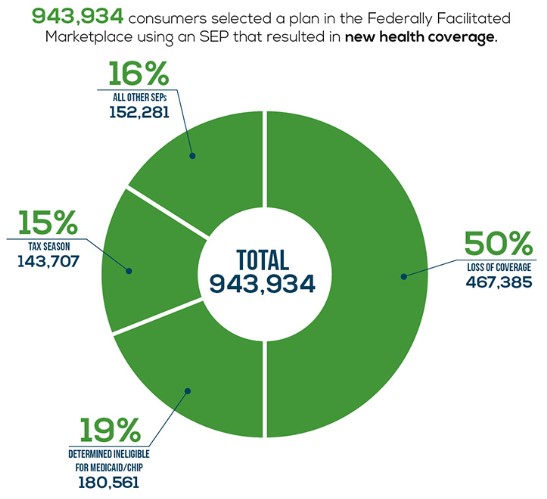

According to CMS nearly 950,000 Americans selected a plan through the HealthCare.gov via Special Enrollment between February 23 and June 30, 2015. What Is Special Enrollment? A Special Enrollment Period (SEP) is a time outside of open enrollment where people can get a Marketplace plan that is eligible for cost assistance and protects them from the fee. There are a number… Read More