Switching on or off a Marketplace Plan?

Ads by +HealthNetwork

If you are switching on or off a Marketplace plan, because you lost or gained income, you should be aware cost assistance is based on annual income.

A few of our readers have been confused about how ObamaCare’s cost assistance works when getting or losing a job. We break down how cost assistance works with changes to income in detail here, but here is the quick version.

- Cost assistance is based on annual household income, not monthly. (That is your Modified Adjusted Gross Income or MAGI plus your families Adjusted Gross Income or AGI for the entire upcoming year).

- If you lose a job, you can enroll in the Marketplace via special enrollment.

- If you think you will get a job later in the year you can enroll in a Marketplace plan now.

- You can get cost assistance when you enroll in a Marketplace plan, but don’t project income based on upcoming months alone, use total annual household income including money you already made.

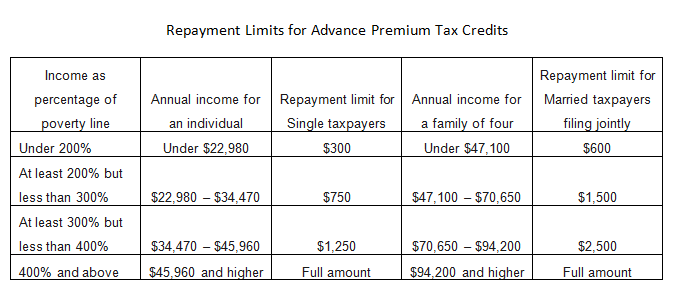

- If you take too many tax credits up front you could end up having to repay them.

- You can choose not to take tax credits up-front, or to only take part up front. You can then claim net tax credits at the end of the year using IRS form 8962.

- Silver plans are super flexible and qualify for all types of cost assistance, you can adjust assistance amounts on a monthly basis.

- Medicaid can help people who don’t have income now, but think that will change over the year.

- You don’t have to pay back cost sharing subsidies or Medicaid, but you do have to pay back tax credits. So don’t worry about getting cost sharing or Medicaid assistance.

Remember you can contact the Marketplace today and adjust cost assistance amounts. Don’t wait to pay it back at the end of the year. If you do, remember that you are simply repaying amounts you should have owed.