ObamaCare Replacement Plan: “CARE” Act Facts

Get the facts on the ObamaCare replacement plan by Burr, Hatch, and Upton: the Patient Choice, Affordability, Responsibility, and Empowerment (CARE) Act.

Below we present a summary, some quick facts, a pros and cons chart, a complete section-by-section breakdown, and finally we compare the CARE Act proposal to ObamaCare. Keep in mind this is an older replacement bill, see the update below for the newest plan.

Quick Summary of the “CARE” Act Proposal

The new proposal reinstates the insurance company’s ability to discriminate based on preexisting conditions and impose annual limits. It takes children off their parent’s plan. It also raises the rates older Americans can be charged. The Republican plan also eliminates subsidies for many (including all out-of-pocket cost assistance), lowers subsidy amounts for most private plans, and lowers subsidy amounts for Medicaid. It restricts Medicaid eligibility, eliminates tax credits for the middle class (300% – 400% of the Federal Poverty Level) and eliminates the parts of the law that help Native Americans and immigrants. It also eliminates most of the other protections in ObamaCare, including new rules for insurers and the prevention of gender discrimination.

Read the latest version of The Patient Choice, Affordability, Responsibility, and Empowerment (CARE) Act. Compare it to our Summary of Provisions of the Patient Protection and Affordable Care Act to get an idea of the disparity. It ignores about 900 pages of the 1000 page law, partially because the “CARE” Act proposal is a 9-page PDF.

Quick ObamaCare Replacement Facts

Go to the benefits, rights, and protections page. It eliminates almost all of the new benefits, rights, and protections.

- All of the cost-curbing measures and consumer protections are repealed.

- All Medicare reform remains in place.

- It reinstates preexisting conditions and annual dollar limits.

- You CAN be charged more based on gender or if you were sick in the past.

- Tax credits amounts are lowered, eligibility is restricted, and credits can’t be used to purchase health plans that cover abortions in any circumstances other than those codified by the long-standing Hyde protections (rape, incest, and life of the mother), therefore respecting rights of conscience.

- It eliminates subsidies.

- It makes Medicaid eligibility more narrow.

- It gives tax breaks to businesses.

- It sets up a “debt panel” (a tribunal that handles medical malpractice litigation).

- It oddly enacts a for profit single payer system with automatic inclusion and an opt-out option.

ObamaCare Replacement Pros and Cons

Next, let’s look at some quick pros and cons.

| CARE Pros | CARE Cons |

| Tens of millions of will get tax credits, based on age and income, to help lower the cost of their health coverage. | Tax credits have more narrow eligibility. Fewer people have access to affordable coverage. Out of pocket-cost-assistance is eliminated. Tax credit amounts are reduced for many, especially low-income young people. |

| You must be allowed to renew your plan. | Unless you automatically renew, your only option is a high-risk pool if you’ve been sick in the past. To renew your plan, you must keep a plan for the rest of your life. One missed payment could put you in the high-risk pool and raise your rates for life. |

| Children under 26 are covered for now | The proposal aims to phase out under 26 coverage. |

| Medicaid expansion is eliminated saving tax payers money. | Tens of millions are left without affordable care. Instead of Medicaid being free, those who qualify under the new rules get a credit towards their care. |

| No benefits, rights, or protections from insurers means less spending and lower rates. | Insurance companies don’t have to cover sick people, can cap annual dollar limits, and don’t have limits on profits. If they want, they can lower insurance rates for healthy people. Or they could not. There’s no way to know. |

| No rules for what health insurance must offer, or who they can sell to, means lower rates for some. | Since women can be charged more than men and sick people can be rejected from plans, “junk insurance” and unequal rates will be the name of the game. |

| Medicare subsidies and new Medicare reforms remain in place. | It was wise to hide the fact that Medicare reforms would remain in place in a footnote on page 2 (allowing for a repeal, without an actual full repeal). Other changes are short-sighted; they seem to do away with most of the cost-curbing provisions beyond Medicare. |

What is The Patient Choice, Affordability, Responsibility, and Empowerment (CARE) Act?

The Patient Choice, Affordability, Responsibility, and Empowerment (CARE) Act (or “GOPCare”) is the Republican proposal to repeal and replace ObamaCare. It’s not legislation; it’s a 9 page PDF that outlines what legislation might look like.

GOPCare: The ObamaCare Alternative Explained

We break down the CARE Act piece by piece below.

The GOP plan consists of:

1. Repeal ObamaCare (the Patient Protection and Affordable Care Act (PPACA) and the Health Care and Education Reconciliation Act (HCERA))

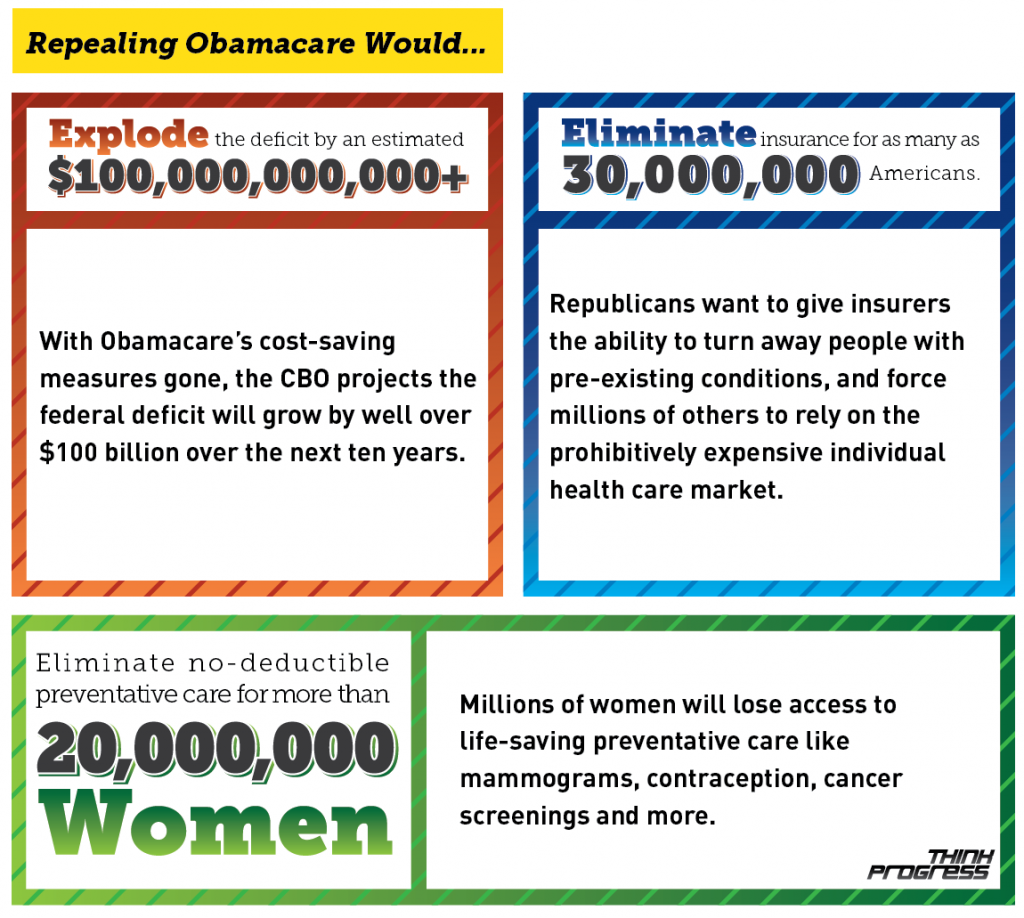

The repeal part strips away 90% or more of the law, including almost all benefits, rights, and protections. It also repeals cost assistance for tens of millions of Americans. The main issue, as you’ll see below, is that they try to replace 1000 pages of smart reforms with a 9 page PDF. Most of the PPACA is filled with obscure fixes for the healthcare industry, that along with Medicare reform have helped bring federal health spending down to the lowest rate since 1960

FACT: The proposal calls for all provisions of PPACA and HCERA to be repealed, except for the changes to Medicare.

According to the Congressional Budget Office (CBO) Eliminating the ACA’s coverage provisions ($1,350 billion in spending over the 2016–2025 period) and cutting taxes meant to help balance that spending out ($643 billion in revenue for 2015–2025) would add $6.2 Trillion to the deficit. Keeping Medicare reforms, and a few other solutions below, help to offset this. However, new subsidies for employers curb costs back up arguably adding to our nation’s “health care crisis.”

2. Annual limits come back; Children under 26 can’t stay on their Parent’s Plan, and penalties for Preexisting Conditions are phased back in too.

…Or as the proposal titles it, “To adopt common-sense consumer protections.” All of these sections tweak existing ObamaCare provisions preparing to phase them out.

- No lifetime limits. However, annual limits are reinstated.

- A 1-5 ratio for health insurance premiums. Under ObamaCare, it’s a 1-3 ratio of health insurance premiums based on age. As in, insurers can charge older Americans up to 5 times what younger American pay instead of 3.

- Children can still stay on their parent’s plan until 26 during the transition, but states can opt-out. After the transition, children will not be able to stay on their parent’s plan.

- Keep the requirement for guaranteed renewal of coverage. This means anyone, even if they are sick, can renew coverage and can’t be charged more as long as they never let their coverage lapse. However, you can be denied coverage due to preexisting condition under the new plan. You might not catch this at first, but there is no plan to allow people with preexisting conditions to buy insurance after the one-time initial enrollment period. This is meant to essentially reinstate preexisting conditions for those who don’t maintain health insurance. If you miss one payment or can’t afford coverage, you will have to buy any insurance you get through a high-risk pool and pay higher payments for life, or you will not have health insurance.

3. Individual Mandate and Employer Mandates phases out

- The individual mandate and employer mandate are replaced with limited availability of coverage. There will be a one-time initial enrollment period to transition out of ACA coverage. After that you’ll have to maintain your plan, for no less than 18 months, to be guaranteed renewable coverage. Any gap in coverage could leave you paying more for life due to your health status. As an economic plus, this makes the market more predictable and stable. As an economic con, we lose about half a trillion in tax dollars by eliminating the individual and employer mandates. However, the insurance companies make a larger profit because they do not have to cover sick individuals unless they get paid extra.

4. Employer subsidies expanded, Individual Subsidies Cut

- Expand Employer subsidies to 100 Full-time equivalent employees. They don’t say at what amount, but this obviously adds to healthcare spending.

- Cut subsidies for 25% of Americans by limiting subsidy levels to those making less than 300% of the Federal Poverty Level.

- Subsidies (at the new lower value) are offered to everyone, including those with employee plans. Subsidies wouldn’t just be offered through Marketplaces (since there are no Marketplaces anymore). Expanding tax credits to employees is a smart move; later in the proposal, they expand tax credits to employers too. This doesn’t help federal spending, but it’s good for businesses.

- Lower subsidy amounts, based on age, for those making 200% of the Federal Poverty Level. This would be a substantial decrease in subsidies for many.

| New Subsidies Eligibility Under GOP Care | ||

| Age | Individual | Families |

|---|---|---|

| 18-34 | $1,970 | $4,290 |

| 35-49 | $3,190 | $8,330 |

| 50-64 | $4,690 | $11,110 |

- Eliminate cost sharing reduction assistance and Medicaid Expansion. Since cost sharing reduction subsidies aren’t offered, out-of-pocket costs could become a big problem for those with lower incomes.

- Create a federal healthcare financing office to administer subsidies. Just so we are clear, the guys who think federal subsidies should be illegal want to create a federal financing office to give out subsidies.

5. Give states “tools” to help reduce costs

Single Payer? The proposal seems to expand a one-size-fits-all health plan to everyone (they seem to imply Medicaid), by allowing states to implement an automatic baseline plan that everyone is automatically enrolled in (with an opt-out). The caveat is that the baseline plan has a price-tag, so lower income folks may have no choice but to opt-out and therefore risk being denied coverage for the rest of their life.

High-Risk Pools. The very costly high-risk pools will be coming back. States can take all those “sick people” out of the market and put them in their own high-risk pool. This helps keep health insurance costs for the rest of down. This pool uses federal funding.

Small Businesses lose the shop but gain the ability to band together to buy plans. We go back to large firms being to negotiate better deals. Small firms would be allowed to band together to create groups with more “buying power.”

Interstate Insurance. As a plus, interstate insurance will finally be allowed. This means companies could sell health plans across state lines.

6. Incentive Medical Savings Accounts

Without being specific, it seems HSA’s will have higher caps and other Medical savings programs may be extended as well.

7. Reform Medicaid

Expansion of Medicaid is eliminated leaving tens of millions of adults without coverage options. We will go back to the old way of narrow eligibility if a state chooses. This doesn’t pair well with the automatic enrollment of plans. An adult male with a low income could be automatically enrolled in a plan they couldn’t afford and thus lose their right to renew coverage. Since the under 26 rule is removed, we could be talking about a 19-year-old trying to find health insurance themselves if they realize they need it.

8. Alternative Medicaid Program

Instead of free or low-cost health coverage, Medicaid recipients might get tax payer a funded savings account under Health Opportunity Accounts (HOA). Health Opportunity Accounts (HOA) was part of a pilot program tested in 2005 by the Deficit Reduction Act (DRA). The state and federal government could fund the accounts with up to $2,500 annually for an eligible adult and $1,000 for a child.

9. No more Unnecessary Tests and Lawsuits

This part would eliminate “unnecessary tests” like that unnecessary mammogram. “Jeez lady, you just had one of these, said the proposal.”

It also does away with “junk lawsuits.” It will limit appeal rights for medical malpractice.

It also creates a tribunal of health judges that determine if your lawsuit is valid. “Debt Panel?”

To be fair, America does waste a lot of money on healthcare litigation. However, the problem isn’t only patient lawsuits; it’s also insurers and hospitals fighting over claims. If we are going to address this problem, let’s address all of it.

10. Transparency

Essentially this calls for more transparency. More transparency is always good. On that note, they shouldn’t be cutting out the transparency measures already in the law. Hopefully, if this is turned into legislation, the person who writes this reads the PPACA first.

11. Reform the Tax Code to give breaks to Businesses offering health plans.

Instead of a fee for not offering coverage, employers get bigger tax breaks for offering coverage. This also replaces an excise tax on high-end plans.

How Does the “CARE” Act Compare to ObamaCare?

Without repeating all the points above the “CARE” Act puts the focus on the consumer taking responsibility, rather than sharing responsibility with everyone.

Under the new act, if you get sick you’ll have to keep health insurance coverage for the rest of your life. If your plan is discontinued, or you miss a payment, you’ll spend the rest of your life in a high-risk pool.

You can be charged more for coverage, and fewer people get cost assistance. On the plus side, businesses get more tax breaks to incentivize insuring workers, and workers can get tax credits too.

The malpractice litigation and automatic enrollment with an opt-out would work better as reforms to the current law rather than as replacements.

And of course, the footnote about leaving in Medicare reform was very important.

What it gets right:

- Better tax breaks for businesses

- Automatic enrollment in Medicaid type plan with opt-out

- Malpractice reform (and the idea of looking at the billing and litigation middlemen and their effect on spending and health care costs).

- More flexibility for HSA’s.

- Employee tax credits

- Not messing with Medicare reform

And those are the positive aspects of the new proposal. Everything else is poison and will result in little-to-no savings as well as tens of millions without affordable coverage. The Republican plan leaves a lot of people in poor situations because it lacks all the regulations and protections that are in the other 900 pages of ObamaCare.

Addressing Federal HealthCare Spending

The biggest flaw here is that healthcare spending is not addressed in a responsible way. Instead of repealing subsidies which, if you discount the value of human life, might help the economy, they also repeal taxes which offset spending. They then give subsidies to businesses instead of individuals, which makes them more profitable. This creates, at best, a net-zero economic effect leaving us in the same place were are under the PPACA in regards to healthcare spending.

Along with the elimination of many cost-curbing measures, we expect that this proposal will create a bigger spending problem and thus result in more publicly held debt and a higher uninsured rate.

Our strong feeling is that this is proposal is a watered-down version of past reform attempts including Nixon’s HealthCare plan and the PPACA itself. Instead of reading the current law, researching it’s impact, and fixing its problems, the entire program is being scrapped. It appears that the Republicans endorsing this plan focused on making good on their repeal promise and are then trying to reinstate the tired ideas they have been trying to stick in healthcare laws over the past decade.

The bottom line is that some of this proposal is good, but despite the repeal battle, the answer is the adoption of smart reforms and dismissal of this short-sighted proposal as a whole.