Health Insurance Exchange Guide

The Health Insurance Exchanges Explained: A Complete Unbiased Guide to the ObamaCare Health Insurance Marketplace.

Our Health Insurance Exchange Guide makes using ObamaCare’s Health Insurance Marketplace easy. Get how-to’s, tips and tricks on using the marketplace.

Our guide covers everything from applying for premium tax credits and out-of-pocket cost assistance, to comparing qualifying health plans, to rules for small businesses.

What Are the Health Insurance Exchanges?

The Health Insurance Exchanges (AKA marketplaces) are state and federal online marketplaces where individuals and small businesses can shop for federally regulated, subsidized health insurance using side-by-side price and benefit comparisons.

Customers will also be able to access the exchanges using the phone, by mail or at certain locations in person.

Which marketplace you use depends on if your state created its own exchange. You can find out which exchange you should use by going to the federal website HealthCare.Gov.

FACTS: The “Health Insurance Exchanges” are often referred to as “Health Insurance Marketplaces.” The terms are used interchangeably throughout our site. Your state’s health insurance website may have it’s own unique name, for example California’s health insurance marketplace/exchange is called Covered California. State’s that didn’t set up their own marketplace, like Texas, will use the Federal Health Insurance Marketplace (HealthCare.Gov).

If you are ready to start shopping for insurance now either go to healthcare.gov or find your state’s health insurance marketplace here.

Marketplace Open Enrollment

Your State’s marketplace is only open during each years annual open enrollment period. You won’t be able to get coverage that qualifies for cost assistance outside of open enrollment unless you qualify for a special enrollment period. The marketplace is also the only way to get cost assistance.

Insurance is only sold during open enrollment. Don’t wait to sign up for the marketplace! Find your state’s marketplace now.

Key Facts about open enrollment:

- Open enrollment starts each year on November 1st and ends December 15th unless otherwise noted.

- You can obtain coverage, apply for cost assistance, or switch plans at anytime during open enrollment.

- Insurance purchased before the 15th of each month starts on the first of month following the next month after you have paid your premium.

How the Health Insurance Exchange Marketplace Saves You Money

The Health Insurance Exchange Marketplace’s create a “pool” of consumers. This “pool” decreases the cost of health insurance by “pooling” together buying power of individual buyers and small businesses to get reduced costs on health insurance, like larger employers have been able to do for a long time. Ideally the pooled buying power pairs with marketplace competition to bring down prices for everyone (although some regions of some state’s lack this competition currently), beyond that many Americans making less than 400% of the Federal Poverty Level will be eligible for cost assistance. Cost assistance includes reduced premiums via tax credits and out-of-pocket subsidies. Small businesses can also get tax breaks through the marketplace.

6 in 10 uninsured Americans could qualify for health insurance costing less than $100 a month due to cost assistance.

FACT: From 2014 – 2019 you either had to enroll in health insurance or pay a fee. From 2019 forward, there is no federal fee for not having coverage (although some states have their own “mandate.”).

Quick Facts

Some quick Health Insurance Exchange Guide facts before we get started:

- A private broker can help you sign up for marketplace insurance.

- The only place to get cost assistance is on marketplace plans.

- Starting in 2019 the fee for not getting covered reduced to zero, in past years there was a fee for not obtaining and maintaining coverage.

- Everyone can use the marketplace. If you don’t like your current plan or don’t have insurance you should apply for the marketplace today to see your options. Applying doesn’t mean you have to enroll.

- If you have work based coverage you can apply, but you won’t be able to get subsidies.

- If you have Medicare, Medicaid, CHIP, any job-based plan, any plan you bought yourself, COBRA, retiree coverage, TRICARE, VA health coverage, you don’t have to worry about shopping on the health insurance marketplace.

- If you qualify for Medicare, are a large firm or are illegal or incarcerated you cannot use the exchanges to purchase health insurance (other limitations may apply).

Why use the ObamaCare Facts Health Insurance Exchange Guide?

ObamaCare Facts is a non-biased website. We receive no funding and exist only to present facts on the Affordable Care Act. In keeping with our mission, our ObamaCare health insurance exchange guide contains no ulterior motive. Our interest is only in helping you to understand your states exchange and to help you get the best insurance your dollar can buy.

How to Sign Up For The Health Insurance Marketplace

There are four ways to sign up for your State’s Health Insurance Marketplace.

- Find your State’s marketplace website.

- Get in person help. You can find in person help by going to LocalHelp.Healthcare.gov.

- Call the 24/7 marketplace helpline 1-800-318-2596.

- Mail in a paper application. bit.ly/PaperApplication. (read these instructions first)

Information You Need For Signing Up for the Health Insurance Marketplace

Make sure you have the following information about your and your family before visiting your State’s Health Insurance Market Place

• Last years tax information for you and your family

• Projected incomes for this year

• Medical history – ObamaCare does away with pre-existing conditions and gender discrimination so these factors will no longer affect the cost of your insurance. Smoking, weight and age still all affect cost.

• Social Security Numbers (or document numbers for legal immigrants)

• Employer and income information for every member of your household who needs coverage (for example, from pay stubs or W-2 forms—Wage and Tax Statements)

• Policy numbers for any current health insurance plans covering members of your household.

• A completed Employer Coverage Tool for every job-based plan you or someone in your household is eligible for. (You’ll need to fill out this form even for coverage you’re eligible for but don’t enroll in.)

• Any other important information that could affect your health insurance premium or coverage options. Better safe than sorry!

Here is an example of the health insurance exchange application form for individuals.

Here is an example of the health insurance exchange application form for families.

The Health Insurance Exchange Guide Part 1: How ObamaCare’s Health Insurance Marketplace Works With Enrollment

Many aspects of the health insurance exchanges apply to every State’s exchange, let’s start with how enrollment works.

When Does Enrollment Start?

The health insurance marketplaces first opened on October 1st, 2013. Each year enrollment starts on November 1st and ends December 15th unless otherwise noted.

Special Enrollment

Typically you must obtain health insurance during a year’s annual open-enrollment period. Major medical plans are not sold in the individual and families market outside of open enrollment, unless you qualify for a special enrollment. If you have a life-changing event such as the loss of a job, death of a spouse or birth of a child, you may be eligible for special enrollment within 60 days of the event allowing to obtain insurance outside of open enrollment.

Exemptions

You won’t have to pay the fee for not having insurance if you meet certain exemptions. This doesn’t matter since 2019 in most states, but it is still good to know about in states with their own fee. Please see our exemptions page for a full list.

Who Can Enroll in the Health Insurance Exchange Marketplaces?

If you don’t have insurance or don’t like your current plan you can enroll. However, only those who don’t have access to Medicare or work based coverage can apply for cost-assistance. You are not required to wait until your plans renewal date to buy health insurance through the marketplace if you don’t like your current plan.

Open Enrollment: What happens under ObamaCare if I have a lapse in coverage?

If you are eligible for the marketplaces a lapse in coverage won’t affect your ability enroll in the marketplace, but it may be limited outside of enrollment.

The Health Insurance Exchange Guide Part 2: Plans and Benefits

After you sign up for an account, its time to shop for plans before you pick a plan to enroll in.

Shopping for health insurance on the exchanges is easy. Using the Online Health Insurance Marketplace works pretty much like car insurance price comparison websites work now. The first step is to go to your State’s insurance exchange website, in most cases this is referred to as a “Health Insurance Marketplace”. Once on the site you will sign up by putting in some basic information including your family size, tax information, income and medical history. Be open and honest, purchasing health insurance is a tax and you may be eligible for premium tax credits!

How the Insurance Exchanges Work: Choosing an Insurance Plan

After filling out your information you will be able to start shopping for health insurance. Like a car insurance website you will be able to compare plans, premium rates and benefits. Although all plans must include the 10 essential health benefits (see below), not all plans are created equal. Further down in the guide you will learn about the types of plans, their additional benefits, costs and your out of pocket costs.

The 10 Essential Health Benefits Required for All Plans Sold on the Exchange

Regardless of what tier of plan you purchase all plans must cover:

1. Ambulatory patient services

2. Emergency services

3. Hospitalization

4. Maternity and newborn care

5. Mental health and substance use disorder services, including behavioral health treatment

6. Prescription drugs

7. Rehabilitative and rehabilitative services and devices

8. Laboratory services

9. Preventive and wellness services and chronic disease management

10. Pediatric services, including oral and vision care

Get a detailed explanation of the Ten Essential Health Benefits.

Learn more about the official health insurance regulations on our ObamaCare health insurance rules page.

Types of Health Insurance Plans

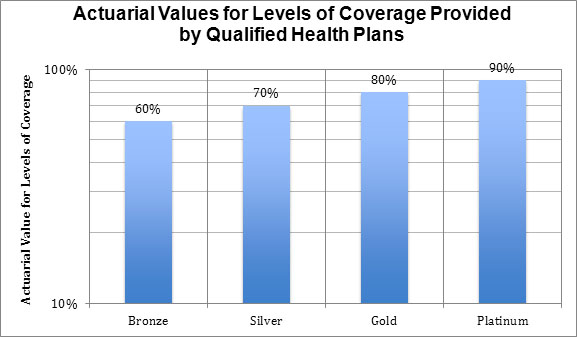

There are a number of different tiers of plans available on your health insurance exchange. These are known as “metal plans“, due to their names being based off of metals. As a rule of thumb, the more valuable the metal the better the plan.

Plans range from bare bones “bronze” plans which cover 60% of pocket medical costs on average, to “platinum” plans which have greater coverage but come with higher premiums. In general higher premiums mean lower out-of-pocket costs and a wider insurer network of doctors and hospitals. The plans are as listed below:

NOTE: All cost sharing is of out of pocket costs. Please see ObamaCare health benefits for services that are covered at no out of pocket charge on all plans.

1. Bronze plans split covered expenses 60-40 on average.

Bronze plans are the cheapest plans. All employer plans and non-catastrophic marketplace plans must provide at least the value of a bronze plan.

For a Bronze plan with 60% actuarial the insurer will, on average, pay 60 % of covered health expenses while the policy holder must come up with the other 40%. In other words a plan with 60% actuarial value covers 60% of out-of-pocket costs on average for all policy holders, not just you.

Bronze plans have the most basic benefits and most limited networks of doctors and hospitals. The actuarial value reflects this since that percentage is determined by the average expenses your insurer will have.

A Bronze plan is a good choice for those who don’t plan on using many medical services. Many low-income Americans may qualify for free or very low-cost Bronze plans. That being said in many cases a Silver plan will provide better value as Bronze plans won’t qualify for Cost Sharing Reduction subsidies (CSR). You will be getting a low premium in exchange for the fact that you will pay more out-of-pocket and have a more narrow network.

More than 50% of all medical costs are incurred by a very few unfortunate people. Since your deductible will be high and all plans have the same maximum limits on the amount you can pay in a year, most of the costs you pay for a Bronze plan will go to the unfortunate people who get cancer or have a bad accident and reach their cost sharing limit.

2. Silver plans split covered expenses 70-30 on average.

Silver plans are “the marketplace standard” meaning that premium caps are based on the cost of Silver plans. A Silver plan on the marketplace can’t cost more than 9.5% of your income if you make less than 400% of the Federal Poverty Level (FPL) due to Advanced Premium Tax Credits. The less you make, the lower your premium cap is.

Like Bronze Plans, the actual value of Silver plans can range. They simply must have at least a 70% actuarial value.

Silver plans are the only plans eligible for Cost Sharing Reduction subsidies (CSR)

A Silver level plan is a good choice for individuals and families who have access to marketplace subsidies, especially CSR subsidies. If you make below 250% FPL the chances you won’t find your best plan to be a marketplace Silver plan is slim. Go with an HMO when in doubt, you’ll need referrals, but this will be your cheapest option. Like with any other plan, make sure your medical needs are covered in-network.

3. Gold plans split covered expenses 80-20 on average.

Gold plans cost a little more, but the lower deductibles and better out-of-pocket cost sharing coverage means that families won’t have to worry about health care costs stopping them from their families getting the care they need. Even if your premium is capped you’ll have to pay more to make up the difference if you want a gold plan.

Gold plans are smart for those who don’t get CSR subsidies and need the low deductible and robust networks some gold plans provide.

4. Platinum plans split covered expenses 90-10 on average.

Platinum plans have the lowest out-of-pocket costs and the highest monthly premiums. This is the right choice for anyone who wants “the best coverage” for them and their family and is a smart buy for those who are sick or who have dependents who are likely to use costly health services. Even if your premium is capped you’ll have to pay more to make up the difference if you want a Platinum plan.

Platinum plans only make sense if your total medical spending will exceed the amount you will pay in premiums or if you need very specific treatments.

5. Catastrophic Coverage

Catastrophic coverage is available to some people under 30 and those with hardship exemptions. Catastrophic plans only cover the bare minimum health benefits and has a very limited network. You’ll have high out-of-pocket costs and a high deductible but this type of plan will protect you in a worst case scenario and will ensure that you avoid paying the shared responsibly fee for not having health coverage. If you get a catastrophic plan you should assume most of your medical costs will be out-of-pocket.

NOTE: You can also get covered through Medicaid on the marketplace. As a rule of thumb if you make less than 250% FPL a Silver plan is the way to go, if you make less than 138% and your state expanded Medicaid then you’ll go with Medicaid.

Not every healthcare provider has to offer each tier of plan, however, all health insurance companies must offer at least one silver plan and one gold plan to consumers.

The Health Insurance Exchange Guide Part 2: Getting Cost Assistance

Applying for Subsidies, Tax Credits and Cost Assistance

In order to get subsidies all you need to do is sign up with the insurance exchange. Once you input your families medical and tax information the system will automatically calculate your subsidies. Subsidies determine the limit of what percentage of your taxable income you can spend per month on a “Silver” plan, which is the second least expensive health care plan.

Subsidies are given in the form of tax credits based on your income and are paid by the health insurance companies toward your premium on a monthly basis. Keep in mind that you may lose or gain cost assistance as your income fluctuates throughout the year. If your income increases the difference will be reflected on your tax returns.

TIP: The guidelines below use 2014 as an example, see cost assistance amounts for 2020 for more recent figures.

| Income % of federal poverty level | Premium Cap as a Share of Income | Income $ (family of 4) | Max Annual Out-of-Pocket Premium | Premium Savings | Additional Cost-Sharing Subsidy |

|---|---|---|---|---|---|

| 133% | 3% of income | $31,900 | $992 | $10,345 | $5,040 |

| 150% | 4% of income | $33,075 | $1,323 | $9,918 | $5,040 |

| 200% | 6.3% of income | $44,100 | $2,778 | $8,366 | $4,000 |

| 250% | 8.05% of income | $55,125 | $4,438 | $6,597 | $1,930 |

| 300% | 9.5% of income | $66,150 | $6,284 | $4,628 | $1,480 |

| 350% | 9.5% of income | $77,175 | $7,332 | $3,512 | $1,480 |

| 400% | 9.5% of income | $88,200 | $8,379 | $2,395 | $1,480 |

| In 2016, the FPL is projected to equal about $11,800 for a single person and about $24,000 for family of four. Use the Kaiser ObamaCare Cost Calculator for more information. DHHS and CBO estimate the average annual premium cost in 2014 to be $11,328 for family of 4 without the reform. Source: Wikipedia | |||||

Determine if you are above the poverty level to get a better idea of what subsidies you may be eligible for through the Health Insurance Marketplace.

| Federal Poverty Guidelines 2014 – for Continental U.S. | |||||

| Persons in Household | 2014 Federal Poverty Level (100% FPL) | Medicaid Eligibility* (138% of FPL) | Cost Sharing Reduction and Premium cap guideline (150% FPL) | Cost Sharing Reduction subsidy threshold (250% FPL) |

Premium subsidy threshold (400% of FPL) |

|---|---|---|---|---|---|

| 1 | $11,670 | $16,105 | $17,505 | $29,175 | $46,680 |

| 2 | $15,730 | $21,707 | $23,595 | $39,325 | $62,920 |

| 3 | $19,790 | $27,310 | $29,685 | $49,475 | $79,160 |

| 4 | $23,850 | $32,913 | $35,775 | $59,625 | $95,400 |

| 5 | $27,910 | $38,516 | $41,865 | $69,775 | $111,640 |

| 6 | $31,970 | $44,119 | $47,955 | $79,925 | $127,880 |

| 7 | $36,030 | $49,721 | $54,045 | $90,075 | $144,120 |

| 8 | $40,090 | $55,324 | $60,135 | $100,225 | $160,360 |

| *Medicaid eligibility is different in states that did not expand Medicaid. Federal Poverty Guidelines are different in Hawaii and Alaska. | |||||

• If you make between $11,505 to $46,021 you can buy subsidized private insurance in the state-based online marketplaces. If you make less than $15,302 you may qualify for Medicaid.• You may be eligible for subsidies if you make between 100% and 400% of the federal poverty level.

• You may qualify for discounts to help pay for premiums if your income is from $15,302 to $46,021 for an individual and $31,155 to $93,700 for a family of four.

Here are some more quick ObamaCare facts about Premium Health Insurance Tax Credits:

• Tax credits lower the cost of your premium.

• Tax credits reduce the amount of the premium you will pay for insurance.

• Tax credits help low-income and middle-income individuals and families making between 133% – 400% of the federal poverty level.

• Tax credits are available to individuals and families who meet certain income requirements.

• Tax credits can be applied to the cost of your health plan when you enroll – you do not need to wait until you file a tax return at the end of the year.

• Tax credits are only available through the Health Insurance Exchanges. You must enroll in a health plan through the Health Insurance Exchange Marketplaces if you want to use your tax credits.

• Tax credits are paid directly to your health plan. These tax credits are paid by the Health Insurance Marketplace to your health plan to keep your out-of-pocket costs low.

• Tax credits will be adjusted at the end of the year based on your actual income. At the end of the year, the tax credits may be adjusted if your income is different than you anticipated. This means you will want to notify your State’s Health Insurance Marketplace if your income changes.

Learn more about Premium Tax Credits.

Qualifying for Medicaid Expansion

If you make under 139% (in State’s that have expanded Medicaid, 133% in others) you may qualify for Medicaid under Medicaid expansion under ObamaCare. You will automatically apply for Medicaid when filling out your State’s insurance exchange marketplace application form.

Qualifying for CHIP

CHIP (Children’s Health Insurance Program) provides low-cost health coverage to children in families that earn too much money to qualify for Medicaid. CHIP also covers parents and pregnant women in some States. You will automatically apply for CHIP when filling out your State’s insurance exchange marketplace application form.

Factors that Affect Premium Rates

ObamaCare does away with pre-existing conditions and gender discrimination so these factors will no longer affect the cost of your insurance. Please be aware location, income, smoking status, family size and age all affect the cost of your health insurance premium. So the cost of any their of plan will fluctuate from person to person and from family to family. Please keep this in mind when shopping for insurance on the health insurance exchange.

Using Customer Assistance Tools to Help You Shop for Insurance on the Exchange

The Affordable Insurance Exchange provides consumers with a number of customer assistance tools for shopping on the exchange. Tools to access affordability and quality include comparisons of prices, quality, and physicians and hospital networks.

How to Calculate the Cost of Health Insurance

To get started you’ll want to figure out what your budget is for health care this year. Affordable health insurance is defined as 8% of your income. Take your income for last year and find out if you can afford to pay 8%, if not find a number that you feel you can pay. Although insurance costs differ from State to State you can use this official cost calculator from the Cover California health insurance exchange to get an idea of what your costs may be. Keep in mind that health, age and other factors can increase or decrease the cost of your insurance.

For More Information on the Cost of Health Insurance Please see our Cost of ObamaCare page.

Also see our page on Calculating Premium Tax Credits for detailed information on how the process of calculating credits works.

What if I Choose Not to Buy Insurance?

If you choose not to purchase insurance, not just through the exchanges but in general, you will be subject to a penalty tax on that years taxable income. Find out more about the ObamaCare penalty tax.

Buying and Comparing Health Plans

See our page on Buying and Comparing Health Insurance Plans for more information on buying and comparing types of health plans both on and off of the Health Insurance Exchange Marketplace.

For more information on using the online health insurance marketplace please visitor our “using the health insurance marketplace guide“. This guide focuses on navigating the exchange as an individual or family.

Using the Small Business SHOP Exchange to Purchase Insurance for Your Employees

Employers with up to 100 employees will be able to use the health insurance exchanges to purchase insurance for their employees starting at open enrollment Nov. 2014. For now small businesses can use an agent to help them get tax breaks on health insurance. Tax breaks are available retroactivity for all years since the Affordable Care Act was signed into law. Learn more about the SHOP exchanges on our ObamaCare SHOP Exchange Guide. This guide focuses on navigating the exchange as a small business employer.

Finding Your State’s Health Insurance Exchange

Below is a complete list of State specific health insurance exchange guides. States not listed below will use healthcare.gov to find coverage:

NOTE: Which states operate their own exchanges and what services those exchanges offer is subject to change.

California

Colorado

Connecticut

District of Columbia

Hawaii

Idaho

Kentucky

Maryland

Massachusetts

Minnesota

Nevada

New Mexico

New York

Oregon

Rhode Island

Vermont

Washington

If you don’t see your state listed above your state uses healthcare.gov, get more information on your state’s health insurance marketplace here to find out how to sign up for health insurance now.

Moving Forward with the Health Insurance Exchanges

The ObamaCare Exchange Health Insurance Marketplaces first opened October 1st, 2013 and are open during each years annual open enrollment period. Make sure to sign up for our newsletter and keep checking our guide for updates. As more people enroll in health insurance marketplace plans we will have new reviews, tips and tricks to help you navigate the exchange!

The Complete Health Insurance Exchange Guide

![]()