Individual Shared Responsibility Payment

The Individual Shared Responsibility Payment is the fee for not having Minimum Essential Coverage. Follow our guide to make calculating your payment easy.

UPDATE 2019: For 2019 forward there is no fee for not having health insurance in most states. In this sense, the Individual Shared Responsibility Provision has been effectively repealed as the federal Individual Shared Responsibility Payment has been reduced to zero. However, you may still owe the fee for past years or may live in a state that has a fee, and thus this page is potentially relevant moving forward.

The forms you need to calculate the fee for not having health insurance: You’ll use the Shared Responsibility Payment Worksheet found in the instructions of form 8965 to calculate your Shared Responsibility Payment. You’ll then file a 1040 schedule 4 along with your 1040 to account for the fee.

NOTE: The Individual Shared Responsibility Payment is also sometimes called the Individual Mandate fee or tax penalty. For information on the Employer Shared Responsibility Payment see Employer Mandate.

Although last year the IRS accepted tax returns that did not include health insurance information for 2016, the current Internal Revenue Service ruling is that it will not accept returns for the 2017 tax year (which will be filed in 2018) without health coverage information. The IRS will also not accept silent returns for the 2018 tax year either. For more detailed information, see IRS Changes Position, Will Not Accept Tax Returns Which Are silent On Healthcare Coverage.[1]

What is Shared Responsibility?

Shared Responsibility is part of the ACA’s Title I. Subtitle F—Shared Responsibility for Health Care that says:

“The federal government, state governments, insurers, employer, and individuals are given shared responsibility to reform and improve the availability, quality and affordability of health insurance coverage in the United States.”

What is a Shared Responsibility Payment?

Starting in 2014, The Individual Shared Responsibility Provision called for each individual to have minimum essential health coverage (also known as Minimum Essential Coverage) for each month, qualify for an exemption, or make a payment when filing his or her federal income tax return. This payment is called a Shared Responsibility Payment.

Do I Have to Make a Shared Responsibility Payment?

If you, or a dependent, went without coverage for 3 full months or more in a calendar year you should make the Shared Responsibility Payment.

The fee is owed for each month you, or another family member in your tax family, went without coverage or an exemption (explained below).

You’ll use the Shared Responsibility Payment Worksheet (instructions found below; see form 8965 for worksheet) to calculate your Shared Responsibility Payment to report on your 1040.

You’ll report your coverage based on the honor system unless you are issued a 1095 form showing what months you had coverage.

If you owe a payment and don’t make the payment, the only way for the IRS to collect the fee is for them to withhold the money from your Federal Income Tax Refund. The IRS cannot enforce the Individual Shared Responsibility provision with jail time, liens, or any other typical methods of collection.

How Much is the Individual Shared Responsibility Payment?

The payment for 2016 – 2018 is $695 per adult and $347.50 per child (up to $2,085 for a family), or it’s 2.5% of your household income above the tax return filing threshold for your filing status – whichever was greater. You would have paid 1/12 of the total fee for each full month in which a family member went without coverage or an exemption.

TIP: One should expect rate increases each year, although this isn’t always the case. See individual mandate (the unofficial name of Shared Responsibility) page for details on the fee and lots of details, tips, and tricks about Individual Shared Responsibility.

What you Need to Know to Calculate the Payment

Before you calculate your payment, you should fill out Form 1040, U.S. Individual Income Tax Return and Form 8965, Health Coverage Exemptions, and have a 1095-A on hand if you had marketplace coverage.

You’ll also need your household income, which is your Modified Adjusted Gross Income for you and each family member and your Filing Thresholds.

For 2017 and beyond the payment is made on a 1040 Schedule 4.

In short, you’ll use the worksheet found on form 8965 to make the payment on Schedule 4 if you can’t check the “I had coverage” box on your 1040.

How to Calculate the Shared Responsibility Payment

Below is a line-by-line breakdown of how to calculate the Obamacare fee (with a screenshot of the Shared Responsibility Payment worksheet and flat dollar amount worksheet).

IMPORTANT: The guide below was originally created in 2014. not much has changed, but some specifics are subject to change. Please see the official instructions, but feel free to use the information below as reference.

Name. The household members name.

Month. You’ll add an “X” in each box for any month each month in which you or another member of your tax household had neither minimum essential coverage nor a coverage exemption. (There are lots of exemptions, so make sure you understand which exemptions you have a right to, namely coverage gap exemptions).

Line 1. Tally up the Xs for each month. If it’s more than 5, put the number 5 on line 1.

Line 2. Total Xs for each month for over 18.

Line 3. Total Xs for each month under 18.

Line 4. Total up lines 3 and 4.

Line 5. Multiply the line 4 total by $95 for each month. If that number is higher than the family max of $285, then enter that. ADVICE: Don’t worry, we will be applying the deductions for under 18 and dividing this total by 12. The fee is per month, per person, not per year.

Line 6. Total of all X’s from line 1.

Line 7. Enter your household income. Your household income is your household Modified Adjusted Gross Income (click for calculations and info). Adjusted Gross Income, which is needed to calculated Modified Adjusted Gross Income, can be found on your 1040.

Line 8. Filing threshold. This is a number based on your family size and age. It can be found on the IRS tax filing threshold page. You only owe the percentage fee (if you don’t pay the flat dollar amount) on income above the filing threshold.

Line 9. Subtract line 8 from line 7. This is deducting the filing threshold from your MAGI, to ensure you don’t pay the fee on income below the filing threshold.

Line 10. Multiply line 9 by 1% (.01). This figure represents 1% of your income. It is, so we have a correct dollar amount to work with. This should result in a fee of $285 or less for most low-to-middle income Americans, and higher for those making more.

Line 11. Is it more than $285? You’ll either answer yes multiply line 10 by the number of months you had coverage (number of months line 1 says zero); or answer no and write in the “flat dollar amount” from line 14 of the flat dollar amount worksheet (see below) on line 11.

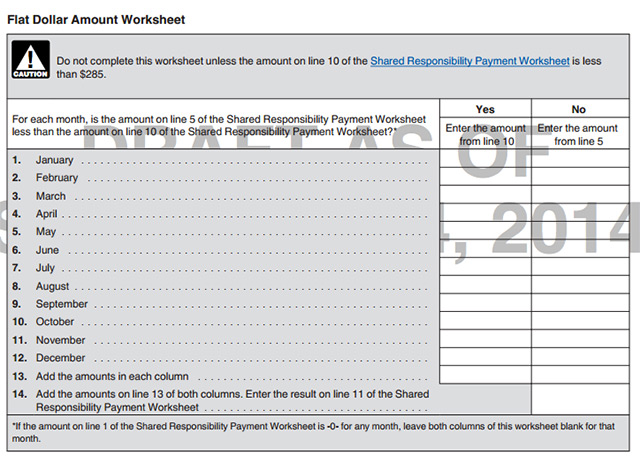

How the Flat Dollar Amount Worksheet Works. This worksheet is pretty easy. For each month enter the lesser amount of line 5 or line 10 from the Shared Responsibility Payment Worksheet. This determines which flat dollar amount you pay per month. On the Flat Dollar Amount Worksheet, add up the columns from Line 1-12 on line 13, add those together, then write the total in line 14. $285 is the family max flat dollar amount for 2014.

Line 12. If you answered yes to line 11, you would be paying a percentage fee instead of a flat amount. If you answered no, and completed the flat amount worksheet, you’ll pay that. Time to divide your line 11 number by 12.0. That represents the 12 months in a year. The calculation takes 1% of your income and divides it by 12, to see if you pay this amount or the amount in line 13 for those who answered yes to 11. And we are or taking that flat dollar amount and diving it by 12 to get your total flat dollar fee if you answered no to 11.

Line 13. Multiply line 6 by $204. Here you are figuring out what the national average premium for a bronze plan ($204 a month for 2014) would be for the number of months your family went without coverage. It’s not a per-person amount; it’s a per family fee. This is the maximum anyone can owe for going without coverage. This won’t matter for those paying the flat dollar amount.

Line 14. If you answered yes to line 11, add the smaller of Line 12 or 13 to line 14. In short, you’ll either pay 1% of your income for each month without coverage, or $204 as a family. If you answered no, then just write in the lowest amount, which will be $285 or less.

Shared Responsibility Payment (Examples)

Below are examples of how to calculate the Shared Responsibly Payment from IRS.Gov.

The examples below are used only to represent the mechanics of calculating the payment and are not estimates of current or future health insurance premium costs. For information on the cost of bronze level plans, visit HealthCare.gov.

NOTE: These examples are from 2014. All the logic stays the same each year, the specific numbers change. We will update this for 2018 when the new forms are released.

Example 1: Single individual with $40,000 income

Jim, an unmarried individual with no dependents, does not have minimum essential coverage for any month during 2014 and does not qualify for an exemption. For 2014, Jim’s household income is $40,000, and his filing threshold is $10,150.

- To determine his payment using the income formula, subtract $10,150 (filing threshold) from $40,000 (2014 household income). The result is $29,850. One percent of $29,850 equals $298.50.

- Jim’s flat dollar amount is $95.

Jim’s annual national average premium for bronze level coverage for 2014 is $2,448. Because $298.50 is greater than $95 and is less than $2,448, Jim’s shared responsibility payment for 2014 is $298.50, or $24.87 for each month he is uninsured (1/12 of $298.50 equals $24.87).

Jim will make his shared responsibility payment for the months he was uninsured when he files his 2014 income tax return, which is due in April 2015.

Example 2: Married couple with 2 children, $70,000 income

Eduardo and Julia are married and have two children under 18. They do not have minimum essential coverage for any family member for any month during 2014, and no one in the family qualifies for an exemption. For 2014, their household income is $70,000, and their filing threshold is $20,300.

- To determine their payment using the income formula, subtract $20,300 (filing threshold) from $70,000 (2014 household income). The result is $49,700. One percent of $49,700 equals $497.

- Eduardo and Julia’s flat dollar amount is $285, or $95 per adult and $47.50 per child. The total of $285 is the flat dollar amount in 2014.

The family’s annual national average premium for bronze level coverage for 2014 is $9,792 ($2,448 x 4). Because $497 is greater than $285 and is less than $9,792, Eduardo and Julia’s shared responsibility payment is $497 for 2014 or $41.41 per month for each month the family is uninsured (1/12 of $497 equals $41.41).

Eduardo and Julia will make their shared responsibility payment for the months they and their children were uninsured when they file their 2014 income tax return, which is due in April 2015.

More Details on Calculating the Shared Responsibility Payment

Many of us have complex situations that aren’t covered by the examples above (such as getting divorced or married). Not everyone will have a family that either did or didn’t have coverage for every month. The bigger the family, the more you earn, and the more sporadic your coverage, the more complicated calculating the payment gets. If you still have unanswered questions or can’t figure out something on the form, you have two options.

Either see detailed calculations of the Shared Responsibility Payment from the Federal Register Vol. 78 NO. 169, give our how to file taxes for ObamaCare page another look, or get help from an accountant. The more complex your situation, the greater chance you’ll save money by using a tax professional.

NOTE: You can use the ObamaCare Fee Calculator from the TaxPolicyCenter.Org to get a quick estimate on your total annual fee for 2014 – 2016 (not sure if they will update this for 2017 and 2018, but since the fee has generally stayed the same since 2016, using the 2016 numbers shouldn’t be much of a problem). Of course, with that said, alway use a tax professional or the worksheets in the official IRS instructions when filing taxes! Online information can be helpful to improve your understanding and answer questions, but official documents and professional assistance should always be the final stop!